Today we are going to look at the stock charts for Nvidia Corp. (NVDA:NASDAQ) not because we want to buy it, but because it is a stock that has gripped the investing public's imagination in the recent past and provides us with a classic example of a spectacular parabolic blowoff top in the making.

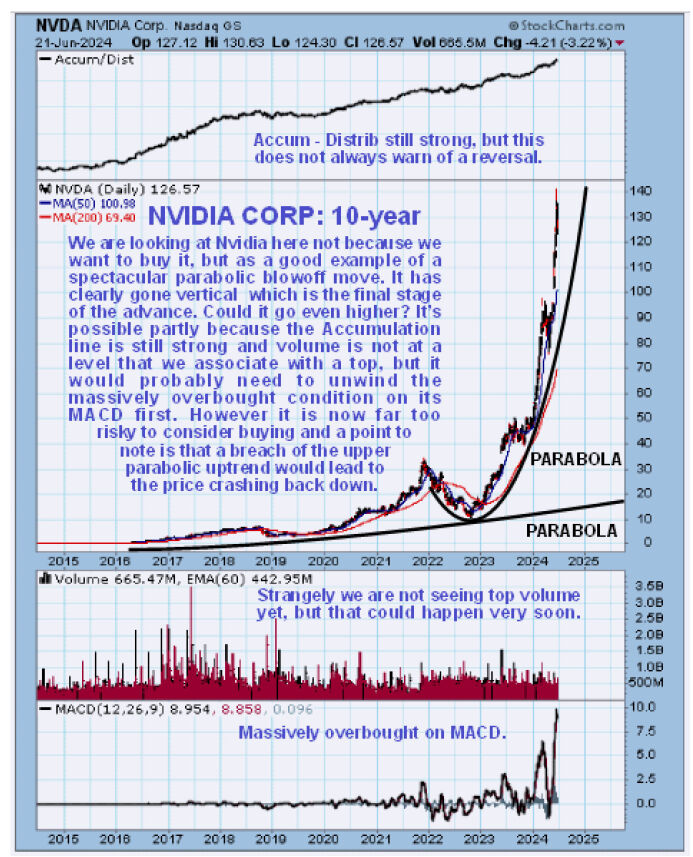

On its 10-year chart, we can see that Nvidia has made staggering gains over the past 8 years. Interestingly, after the big runup in 2020 and 2021, it reacted back to touch the lower, more shallow parabolic uptrend, which would have been a great point to buy it had we seen it at the time, and this is easy to say now, of course with the benefit of hindsight.

After this reaction, it took off higher above a much more dynamic parabolic uptrend that it recently ran way ahead of to become insanely overbought on its MACD indicator, and we will now look at this uptrend in more detail on a 2-year chart.

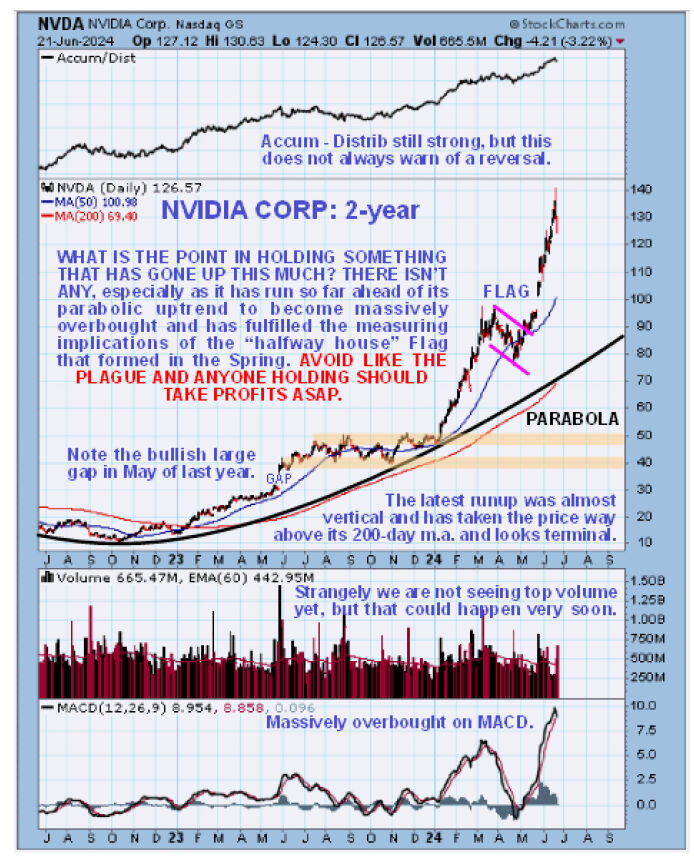

The 2-year chart captures the much more dynamic parabolic uptrend in its entirety from its humble beginnings at the October low in 2022. A worthwhile point to note is that the high volume gap higher in May of last year that was soon followed by a lengthy rectangular trading range consolidation until the parabolic uptrend had caught up was very bullish and a sign that the stock was destined to rise to much higher levels, as it has.

Another interesting technical pattern to observe is that the "halfway house" bull Flag that formed this Spring was a sign that another strong upleg was "in the works." This was followed by the price rising almost vertically to open up a huge gap with its 200-day moving average and become massively overbought on its MACD indicator as it ascended to fulfill the measuring requirements of the Flag.

This action looks like the final vertical blowoff move to end the parabolic bull market, and if so, it furnishes us with a perfect example of how such a bull market ends. However, that said, the recent volume does not look terminal as it has not (yet) risen to become climactic, and the Accumulation line remains strong. This implies that rather than "turning on a dime" and plunging back towards where it came from a large top pattern may now form in Nvidia, perhaps for some months, and we cannot rule out that it doesn't creep somewhat higher in the process.

Apart from it being an interesting example of a giant and spectacular parabolic blowoff, the main takeaways for us are that Nvidia should be "avoided like the plague" simply because it has gone up so much and is massively overbought and anyone holding should of course take profits soon.

Nvidia Corp. (NVDA:NASDAQ) closed at US$118.11 on June 24, 2024

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.