When I was in my 20s, starting out in the securities industry, I was put through a rigorous training program by the senior staff at the old and highly venerable McLeod, Young, Weir Limited, a Bay Street blueblood bond house that specialized in placing Canadian federal and provincial bond issues with their institutional and high-net-worth retail clients. One of my stints was a one-month tour of the corporate bond desk where each morning, I would arrive at 8:00 am. and watch half a dozen traders sip coffee and smoke cigarettes and communicate with one another in sign language and phrases completely foreign to me. Despite graduating with a double major in finance and marketing from one of the top 10 undergraduate businesses in the U.S. (St. Louis U.), I knew absolutely nothing about the relationship between economic growth, inflation, and bond prices.

Now, this was 1977, and the North American economy was suffering from a bout of "stagflation" where the abandonment of the Bretton Woods Agreement had removed the gold-backed status of the world's reserve currency (the U.S. greenback), allowing the inflation rate to exceed 10% amidst energy shortages creating long lines of angry consumer awaiting the arrival of fuel at local pumps.

I recall one especially grumpy, pipe-smoking senior trader saying that bond prices had only one direction to go, and that was "DOWN," and after I asked him "WHY?" he simply rolled his eyes and went about reading the newspaper.

After a month of derision and heckling by this pompous gathering of interest rate "bookies," I really had only one "friend" (more like "non-insulter") on that desk, and his name was Gord Cheesebrough. "Cheese" loved hockey and played right wing on the Upper Canada College club. He was also one of the organizers of the Bay Street Hockey League, where all the bankers and brokers would field squads of players for heated contests at Ted Reeve Arena.

Once "Cheese" found out that I had just finished a season playing semi-pro hockey in Richmond, Va., he pounced upon me (and threatened under penalty of banishment to the mail room), demanding that I join the McLeod team that evening. You see, the team needed a "ringer" because the charlatans over at Wood Gundy had hired an ex-NHL-er named John Wright as their "ringer." After the game, the teams would all gather at a pub familiar to all of these UCC grads but only once was I invited to join. The fact that I had placed a few strategic elbows in the direction of Wright's melon might have had something to do with it.

Before I left the bond desk of that blueblood bond house, I asked "Cheese" whether I should apply for a permanent position on the desk, and keeping in mind that the Bay Street hockey season was rapidly coming to a close, he replied with a punctuative "NO!" citing the "intricacies of the job" as his excuse for rejection.

"You should go into retail sales and become a water cooler analyst." he extolled with feigned enthusiasm. "Forget the research department. Some of the best ideas you will ever get will come from those water cooler gatherings."

Mortified at the stereotyping to which I had just been subjected, I never returned to that desk and went on to a career in "retail sales," which, to a bond trader, was one very shallow step up from the mail room. As for "Cheese," he went on the run McLeod after literally saving the entire firm in the days immediately following the October 1987 stock market crash, where his massive buying of long-term Canada bonds generated such enormous profits that it offset the equity market hemorrhaging that would have buried the firm. For decades after 1987, the name "Cheesebrough" was held as a legend by staff and shareholders alike. (He was a pathetic right-winger though.)

As it would turn out in a great twist of fate and dollop of irony, "Cheese's" words were spot on as it turned out that "water cooler analysis" turned out to be of far greater use to me than any of my university diplomas ever were. Registering a 94% on the CSC exam, which was simply a repeat of my university finance courses, meant absolutely nothing when it came to actually making money in either the stock or bond markets.

Over the years, I wrote dozens of more exams and papers and "refreshers" demanded by the useless compliance officers at all of the big banks and brokers who needed to provide work for their overpaid legal staff. Regardless of the subject, it was all completely useless "make-work" nonsense that, once completed, gave one an embellished C.V. that would allow one to impress high-net-worth individuals and hand over their millions of inherited dollars.

No better example of the futility of "Bay Street training" can be found in the one watershed event that sculpted my career. In the midst of the 1981-1982 bear market, after interest rates had been jacked up to 15% in the U.S. and over 19% in Canada, the managers of the retail staff were continually jamming new bond issues down our throats to stuff into the accounts of our poor, unsuspecting clients and after a number of healthy haircuts on issues that opened at severe discounts, many of us started to get our backs up.

Fed up with the corporate hypocrisy, I switched firms and arrived at a smaller boutique house noted for a more entrepreneurial flair than the big Bay St. bond houses, and in May of 1981, I was in their Toronto head office being introduced to some of the craziest men and women in the securities industry. They refined the art of "martini lunches" to afternoons of the same, which inevitably spilled over into dinners at Hy's or Winston's, ending in an expensive cab ride home.

This particular afternoon, I had just got out of a meeting with an ex-college hockey player when I wandered over to the water cooler where a bunch of nefarious-looking men in three-piece suits were smoking cigars and sipping water but immersed in what appeared to be "no good." Joining them, I introduced myself, at which point I recognized one of them as the legendary Dusty Graham, a former senior referee in the Metro Jr. B league who had given me a ten-minute misconduct in my rookie year for firing the puck at him for a really suspect tripping call. After the usual reminiscences, Dusty asked an institutional trader (name I forget) to tell me "the story".

In the next ten minutes, this chap proceeded to tell me of rumors he was hearing out of northwest Ontario via the Vancouver Stock Exchange of gold discovery and proceeded to name the players involved — Corona Gold, Golden Sceptre Resources, and Goliath Gold Mines. Corona had already gapped up on the rumor, but the two juniors were still trading below $1.00, making them "penny stocks" and anathema to everything I had learned at McLeod. Trained to "stay with quality" and "avoid the speculative juniors," I had become disenchanted with being forced to explain to the few clients I still had why Bell Telephone was down 15% after recommending it as a "safe" investment.

Taking a "damn the torpedoes" approach to managing my career, I stormed back to my office in western Ontario and started dialing. I called every person that had a pulse. I called schoolteachers; I called university administrators; I even called a bunch of senior citizens in the local Old Folks' Home. One such call plunked me directly on the phone with old Mrs. Grady, a widow who, as it turned out, was not only eighty-six years old but also hard of hearing.

After introducing myself and the reason for my call, she rasped into the phone, "You're not gonna try and sell me some of that boring Bell Canada sh*t, now, is ya?" After telling her about how I came across the rumor, she asked where it was, and after telling her it was in a little place called "Hemlo, near Marathon, up near T-Bay," she yelled excitedly into the phone. "Now that's a story! I'll take ten grand of Golden Sceptre!"

Over the next two weeks, I opened up more accounts, buying millions of shares of both Golden Sceptre and Goliath Gold Mines until the rumor morphed into the May 17 news release of Hole 76 confirming the Hemlo Gold discovery of May 1981 that launched all of those names into the ionosphere and catapulted my client's net worth (and my career) seriously northward.

Eventually, both companies were acquired for a massive dollar number by mining giant Noranda Inc., making the thousands of pages of research on blue-chip Canadian companies spewed out by the research departments totally irrelevant.

And all because of a conversation at a water cooler.

Stocks

The sole reason I keep trying to find the top of the U.S. equity market bubble is that it is sucking the air out of every room it enters, especially in the junior mining space. We all know that money moves to where it is best treated, and thus far, in 2024 — in fact, since October 2023 — money allocated to the "Mag Seven," specifically the "artificial intelligence" space, has been treated with great and loving tenderness. An entire generation of Millennial and Generation X traders are consumed with "anything AI" to the extent that structural shortages in copper and valuation discrepancies in the energy space are completely ignored by portfolio managers the world over.

It has gotten so extreme that in a recent earnings call by Hewlett-Packard Enterprise (HPE:NYSE), despite just reporting only 3% revenue growth for the period, company management used the term "artificial intelligence" something like 69 times in less than the one-hour call. Every major high-profile company is following Elon Musk's stock-pumping antics where he convinced the algobots that Tesla Inc. is actually "an AI company."

Unbelievable.

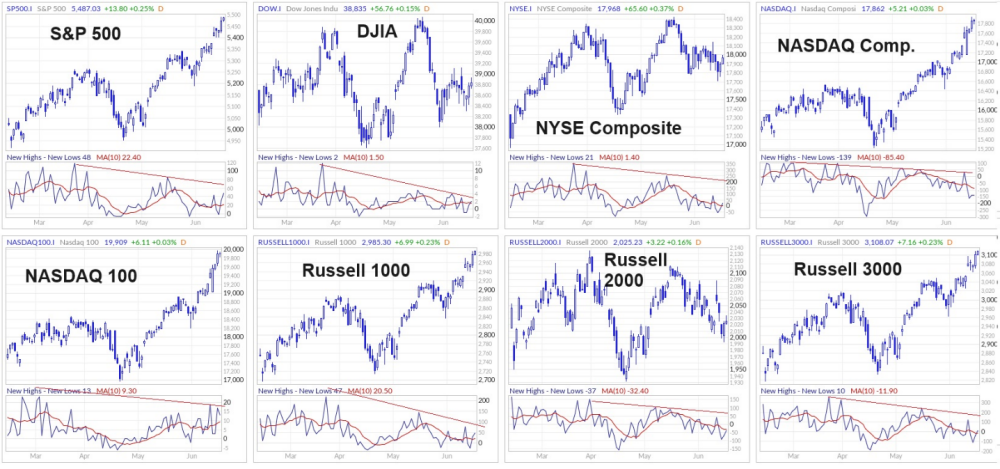

The U.S. economy is beginning to show signs of a slowdown, with recent numbers on retail sales and employment giving off recessionary signals. Despite that, we are seeing record highs in the NASDAQ and S&P based on their heavy weighting of "Mag Seven" stocks but not in the DJIA, where there is a far smaller concentration of those market leaders.

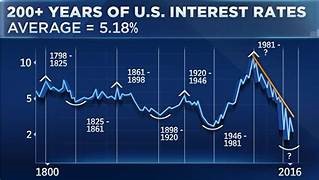

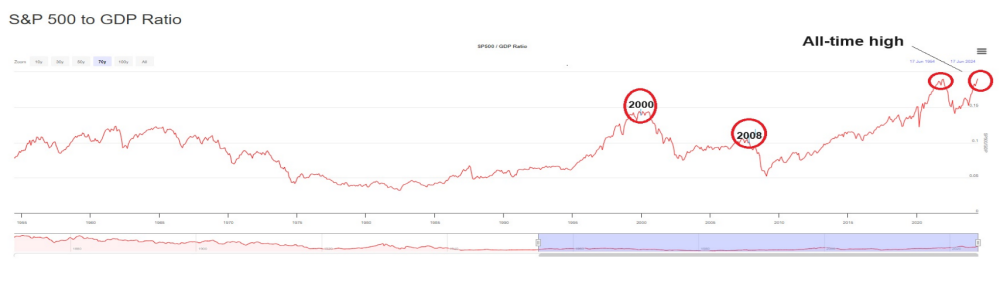

The chart below shows how the "Buffett ratio" is now at an all-time high, surpassing the pre-crash highs of 2000 and 2008. The next chart confirms that it is across literally every major index in the U.S. but none so glaring as in the S&P 500. The unweighted S&P is up 16.6% YTD versus the weighted S&P, where the Mag Seven comprise over 35% of the index, which is up 42.33% YTD.

Absurd.

Also, the number of new highs is not confirming the new highs in prices where, in fact, the new low list is expanding and the new high list is contracting even as the averages float into record-high "bubble" territory.

When fewer and fewer issues participate in any rally in the major averages, it is a sign that the troops are abandoning the general and it is exactly the point where Bob Farrell's Rule # 7 kicks in: "Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names." Which is exactly where were are now.

Gold

I remain a long-term bull on gold (and copper) but am currently flat all trading positions in copper but remain short the SPDR Gold Shares ETF (GLD:NYSE) via the August $215 put options, not so much because I am a gold bear but more because the Twitterverse remains inundated with newbies that continue to call for "$200 silver."

Until these silver bugs (gold bugs on steroids and crystal meth) throw in the towel like they did after the aborted "#SilverSqueeze" in March 2021, these precious metals markets will be challenged. The big breakout move to $2,454 brought in a whole new generation of late longs that have now memorized the money-printing mantra of the 1970s, throwing out buzzwords like "stagflation" and "debasement" as if they were first discovered last April. I need to see evidence that this group of newbies has left the building and moved on to "AI" or "bio-med," which will be the ultimate set-up for the resumption of the 2024 advance. It is coming, but not until I get a test of the 100-dma around $206.88 for GLD:NYSE or around $2,250 basis June futures.

The late-week action in gold was no surprise to me. It gave up the weekly gain and registered a red candle on the weekly chart, making this a continuation of the flag formation with the possibility of it filling the gap down to the breakout point of $202 (GLD:NYSE) or $2,150 basis June. I think that the 100-dma is the "line in the sand" and that gold rallies from there. In the interim, as a bull, I am fully prepared to chomp down on the bullet if it proves me wrong, which would not be a bad thing, given how many millions of shares of junior gold developers and explorers I own.

Copper

I issued a sell on copper back in the $5.15/lb. range in mid-May, and that has worked out well. However, a testimonial to the strength of the copper-gold markets, my favorite mining company in the world — Freeport-McMoRan Inc. (FCX:NYSE) — refused to crash in response to the 14.5% pullback in copper prices.

I exited my beloved FCX position with a superb gain above $52, but after getting down under $47 briefly on Monday, it closed out the week at a hair beneath $50, proving without doubt that it is headed much higher by the end of 2024.

Ideally, I am a buyer under $45 and preferably $43, but as you have seen printed many times before, "I am flat, and I am nervous."

A Junior copper to own "come hell or high water."

I leave you all with this suggestion. There are a few occasions where I start jumping up and down on the kitchen table, knocking beer and wine bottles and glasses asunder with breathless admonishment for those not yet in possession of a substantial position in Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), but that is exactly what I am doing now.

All I am able to report is that the water cooler system of equity research is alive and well, and those of you who remain believers in the bullish copper narrative are advised to own this name.

Management is making all of the right moves, and once the money flow shifts to the junior copper space, FTZ/FTZFF will be at the forefront of portfolio manager's lists.

| Want to be the first to know about interesting Silver, Base Metals, Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. and Freeport-McMoRan Inc. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.