In May, the U.S. Department of Justice (DoJ) accused Boeing Co (BA:NYSE) of violating a 2021 deferred prosecution agreement (DPA) related to fraud conspiracy charges. The violation stemmed from a mid-air blowout of a panel aboard Alaska Airlines Flight 1282 — 737 MAX 9 jet — in January. Though the door plug, which served as the ultimate source of the blowout, was manufactured by supplier Spirit Aerosystems, the extra door assembly is only "semi-rigged", meaning Boeing completes the installation of most door plugs on its planes and is supposed to conduct testing under pressurization to ensure all pieces of the craft are properly fastened.

The National Transportation Safety Board (NTSB) found that Boeing was, in fact, behind the mis-installation of the door plug. According to the DoJ, the Alaska Airlines incident was evidence that Boeing had failed to meet the terms of its DPA, which required the company to set up and maintain a program to detect and prevent violations of U.S. anti-fraud laws.

Boeing's ongoing woes, which have shattered the reputation and financial health of the American aviation giant over the past five years, began with its withholding of information during the certification process for its Maneuvering Characteristics Augmentation System (MCAS). This software system, which proved to be faulty, was the root cause of two separate 737 MAX 8 crashes within a five-month span in 2018-2019 and led to the death of 346 passengers and crew aboard the doomed jets. At the outset of a subsequent global grounding of all 737 MAX planes in March 2019, Boeing led investors and airlines to believe that a fix for the MCAS software, along with re-certification, would come as soon as mid-May of that year.

When no progress on re-certification was present by that June, MRP expressed skepticism about the simplicity of the repairs that would be needed, noting that, in addition to software problems, almost 150 parts inside the wings of 312 Boeing 737 jets were potentially defective and had to be replaced. On June 4, 2019, we initiated SHORT Aviation and Airlines themes (closed on January 8, 2020, and March 30, 2020, respectively), largely focused on Boeing and the fallout that would be felt by suppliers and commercial airline operators.

It would ultimately take 20 months before the 737 MAX could be re-certified in the U.S. in November 2020. As part of its DoJ settlement, Boeing submitted to a fine of $243.6 million, as well as payment of $1.77 billion in compensation to its airline customers and $500 million to the victims' beneficiaries. Boeing also paid $200 million to resolve 2022 allegations from the Securities and Exchange Commission (SEC) that the company and its former CEO, Dennis Muilenburg, made misleading statements but were not required to admit any wrongdoing.

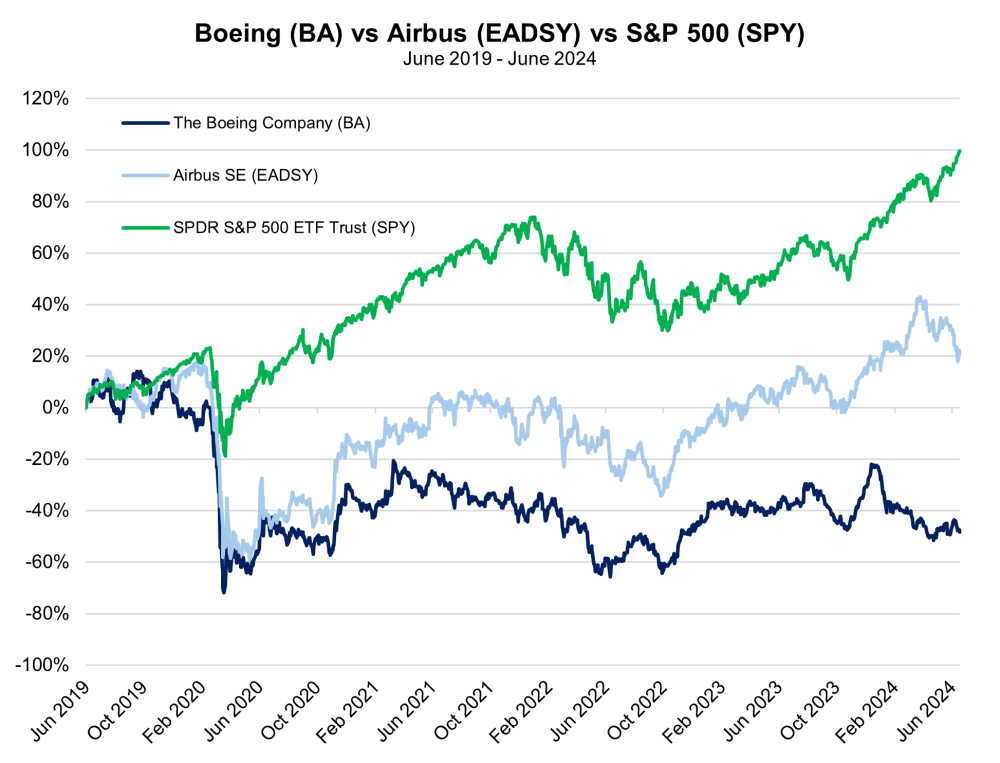

Total direct costs to Boeing as a result of the MAX disasters are thus far equivalent to more than $20 billion, but external costs – in the form of evaporated trust and heightened scrutiny by business partners and regulators — are still accruing to this day. As of Tuesday's close, the aviation manufacturer's share price remained nearly -50% below its price at the start of June 2019. That ongoing downtrend has weakened Boeing's market capitalization to less than $107 billion.

Under the current framework of the DPA, federal prosecutors have until July 7 to decide how to proceed in regard to prosecution, but it is possible that the DoJ could extend the probation period by another year. Despite the alleged violation of a provision of the settlement, prosecutors have not yet accused Boeing of committing another crime. This is a difficult process for the government, and politics could play a role, as the company is a massive supplier of defense goods to the Pentagon. Per Defense and Security Monitor, Boeing was the fourth-largest defense contractor in 2023, earning awards worth nearly $21.8 billion from the Department of Defense. Per the Wall Street Journal, companies with a felony conviction may face the prospect of being suspended or barred from working as defense contractors.

Additionally, a conviction on the pending charges from 2021 could open Boeing to further demands from the families of 737 MAX crash victims. When the DPA was offered to Boeing, it was done so without the consultation of these parties, who later claimed this action violated the Crime Victims' Rights Act (CVRA). In 2022, U.S. District Court Judge Reed O'Connor in Fort Worth, Texas, legitimized those accusations, ruling the families have standing to question and continue challenging the DPA because they have rights as "crime victims" under federal law. Judge O'Connor said in his ruling that the lies Boeing told the Federal Aviation Administration (FAA) helped the company avoid additional pilot training that otherwise would have been required, and may have saved lives, if Boeing employees had not been untruthful in their dealings with regulators. "In sum, but for Boeing's criminal conspiracy to defraud the FAA, 346 people would not have lost their lives in the crashes," the judge wrote.

Though the DoJ disagrees with the characterization of the families as "crime victims," Attorney General Merrick Garland met with them, and the department has apologized in a court filing for not conferring with them in regard to the creation of the DPA. In a letter outlining the position of the families as to how the DoJ's prosecution of Boeing should proceed, attorney Paul Cassel noted that a "maximum possible fine" is "legally justified and clearly appropriate," a sum that surpasses $24.7 billion.

Further, the families have requested that "if the Department seems likely to reach a tentative agreement with Boeing on plea concessions, they should be allowed to exercise their right under the CVRA to confer with the Department about any possible concessions." Whether this will be taken into serious consideration remains to be seen, but it is likely that the families of 737 MAX crash victims will remain determined to seek substantial monetary damages from Boeing.

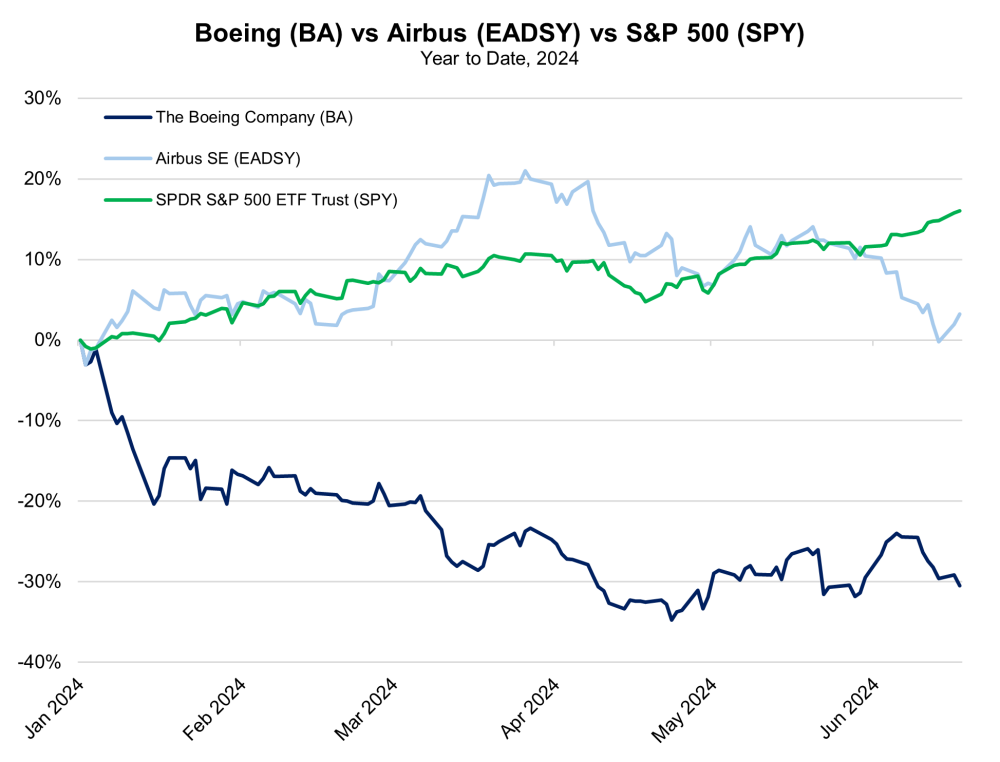

Since 2019, Boeing has endured $31.9 billion in core operating losses and that figure looks likely to continue growing this year. A month after announcing a $3.9 billion cash burn in Q1, finance chief Brian West warned investors in May that the company is on track for an even wider hole in net cash flow for the second quarter. The FAA in February froze the production rates of Boeing's 737 planes at 38 per month until controls are assessed. That is -27% lower than its 737 output rate of 52 per month in 2018.

Three weeks ago, FAA Administrator Mike Whitaker said he did not expect Boeing to win approval to increase production of the MAX "in the next few months" and has had no discussions with Boeing yet about the issue. For the month of May, the company delivered just 24 commercial planes, less than half of the 50 jets it handed over to customers during the same month a year earlier. Boeing received orders for only four new planes throughout the month and, for the second straight month, none for its 737 MAX.

Prior to a $10 billion debt issuance in late April, attempting to fill the gap left by its ongoing cash burn, Boeing suffered a cut to its credit rating from multiple agencies, with S&P assigning the latest issue of unsecured notes a BBB- rating. Moody's assigned an equivalent Baa3 rating. The value of Boeing's cash and marketable securities at the end of the first quarter was worth just $7.5 billion, down by more than half from the prior quarter's $16 billion.

The new bonds will pile on to outstanding debt remaining from other large raises of $25 billion and $10 billion in 2020 and 2021, respectively. Adding the latest raise onto of the near $48 billion in consolidated debt disclosed in its most recent earnings report puts the aviation giant's total debt load close to $58 billion. More than $12 billion of this will come due in 2025 and 2026. Boeing may find it difficult to avoid further downgrades that would shift its debt into "junk" territory, thereby making further borrowing even more expensive. Earlier this month, the Financial Times noted that yields on 30-year bonds issued by Boeing in 2020 are worth roughly 6.5%, well-above the average for all BBB rated bonds at 5.7%, and approaching the average yield of 6.7% for all BB rated bonds. This suggests investor sentiment may be tilting toward continued deterioration of Boeing's financials in coming quarters.

Charts

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.