The drone industry is very much a growth market and looks set to remain so for the rest of this decade, with the primary drivers being expanding military conflict, surveillance, and increasingly, in the case of U.S.-based drone and drone component manufacturers such as Unusual Machines Inc. (UMAC:NYSE), what is called "onshoring" which means production returning from overseas places like China back to the homeland in large part due to security concerns and this is a process that is likely to be assisted and expedited by the government.

While Unusual Machines is positioned to benefit, possibly greatly, from all the above, it is important to keep in mind that it is already an established player in the consumer drone space with its e-commerce platform "Rotor Riot" and generates US$5 million revenue a year with 20 – 30% year on year growth that is expected to continue so downside at the current stock price is considered to be very limited.

The company thus caters to all segments of the drone market — drone racing, which involves the use of fast and agile drones in competitive events; freestyle flying, where drones are for hobby use and aerial acrobatics; cinematic filming, in which drones are used to provide high-quality videos often for the tourism industry and as mentioned already, for defense applications.

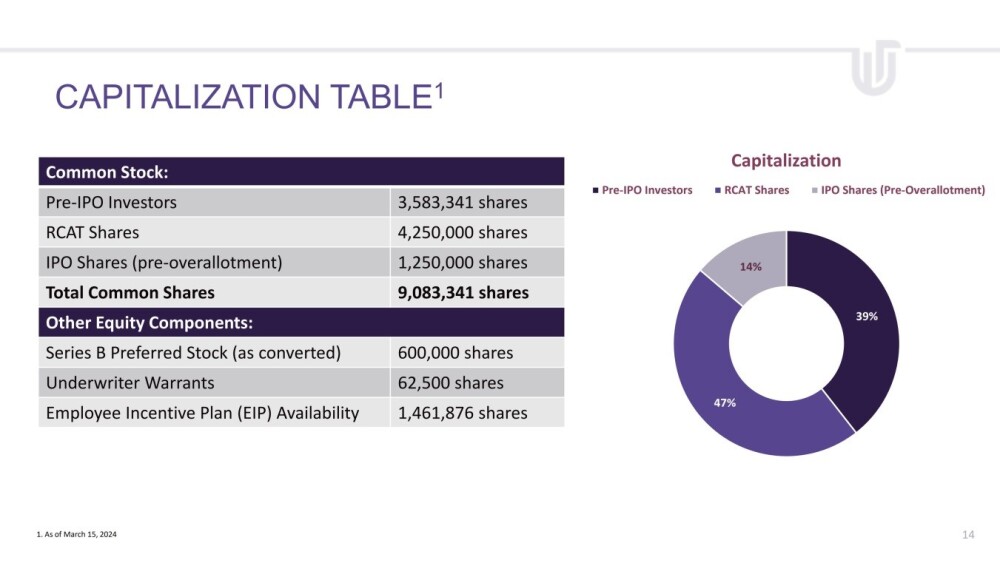

In February, the company successfully closed an IPO (Initial Public Offering) of 1.25 million shares at a price of US$4.00 a share, and a part of the proceeds was used to buy the strong brands Fat Shark and Rotor Riot via a purchase agreement with their creator, Red Cat Holdings Inc. (RCAT:NASDAQ) and as a result of the transaction Red Cat became a big shareholder of the company with approximately 47% of the stock.

This is believed to be a very good point for investors to take positions in the stock, not just because of its recent basing action following the severe downtrend in the Spring but because there are important catalysts that will be coming into play over the next several months and starting as early as next month.

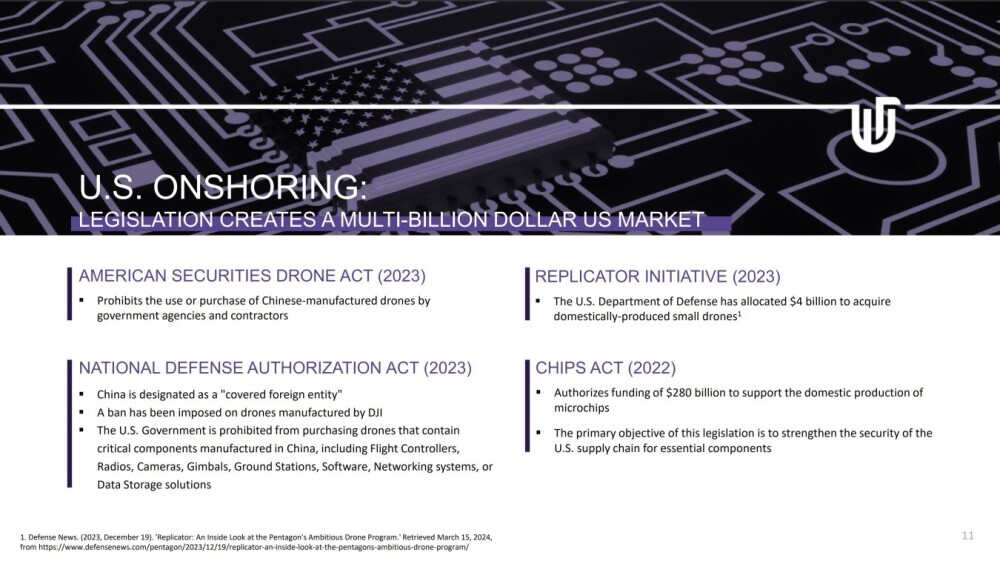

The will be the seasonal round of government buying contracts starting toward the end of July and continuing through September, intensified this year by a backlog holdover due to budgets being passed late last year and by orders being ramped up in anticipation of the American Securities Drone Act coming into effect in Jan 2026, which could see the company win major orders that would "light a fire" under the stock, but as mentioned above, even without this, the company is on a dynamic growth path with its consumer-driven business. Lastly, the CCCP (Chinese Communist Party) Drone Act might increase the company's sales of Fat Shark products, video transmitter products, and FPV (First Person View) goggles by excluding the main Chinese competitors from the market.

Before we examine Unusual Machines' increasingly positive-looking stock chart, we will use slides from the company's latest investor deck to overview the outlook for the drone business and Unusual Machines, in particular.

The first slide provides an overview, and its main point is that growing global conflict and polarization are going to shift a significant segment of demand back from China to domestic production in the West.

The second slide provides a sense of how the company is evolving from its established position in the market to take advantage of the new opportunities being afforded by new legislation and the increasing "onshoring" of drone and drone part production with an eye to potential acquisitions that are cash flow positive.

The next slide sets out the business model.

Note, in particular, the company's strong growth last year in the FPV (first person view) market and the plan to transition component manufacturing back to the U.S.

Components were a big part of the company's business for a long time before it was spun out of Red Cat, and they still are, with robust sales in 2023.

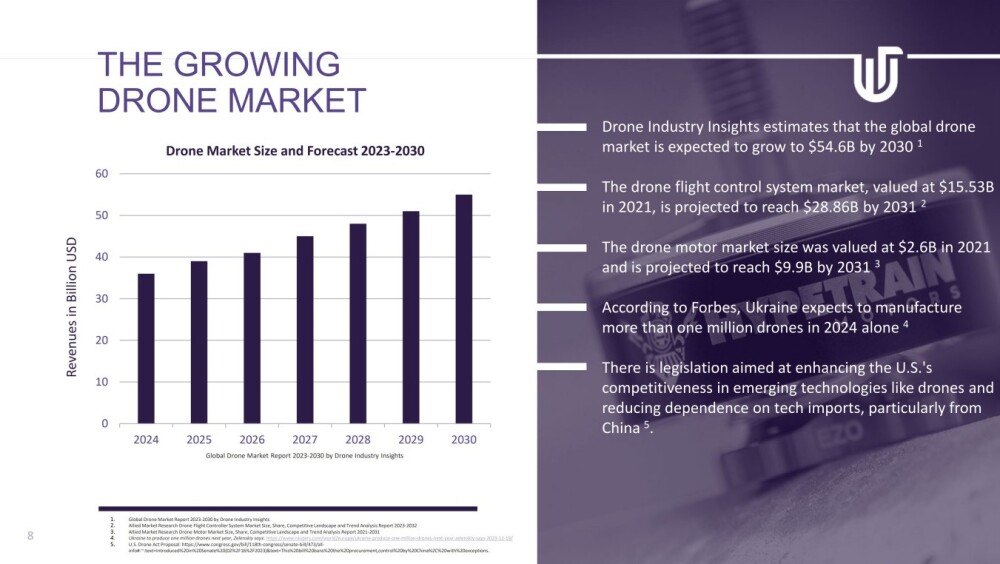

The drone market should see strong growth through the end of this decade, as the graph on this next slide makes clear.

One of the biggest drivers of demand for drones is, of course, the defense industry. With conflict around the world looking set to expand, so will the demand for drones and associated support and technology. The company is set to benefit from the shift away from Chinese-produced drones and components in Western countries.

At present, China dominates the drone market with 70% of the business, and even drones made elsewhere usually contain key components made in China.

We can thus expect to see a movement toward domestic suppliers of components, which will, of course, benefit companies like Unusual Machines.

After decades of offshoring production to the point that the U.S. has become a service economy, geopolitical factors are promoting a shift back toward domestic production, especially in militarily sensitive industries like defense equipment and drone manufacture, which will work to the advantage of Unusual Machines.

This next slide shows companies involved in the U.S. drone marketplace.

Lastly, this slide shows the company's capitalization. On it, we see that there are only just over 9 million shares in issue, although this is believed to now be nearer to 10 million.

Of these, almost half, or 47%, are owned by Red Cat Holdings, which was the parent company of Fat Shark and Rotor Riot that the company acquired in February, so there are only about 3 million shares in the float.

Turning now to the stock chart for Unusual Machines, we see that after coming to market as recently as February, the stock went into the customary bear market, which happens to many stocks after the initial excitement of starting trading. This steady bear market downtrend erased most of the stock's value by the time it hit bottom early in May.

Even though it hit bottom in May, it is now apparent that a Head-and-Shoulders bottom had started to form as far back as late March, and this potential bottoming action has allowed time both for the falling 50-day moving average to drop down close to the price and flatten out and for downside momentum as shown by the MACD indicator to drop out which we can see it has completely with momentum on the verge of turning positive.

The recent volume pattern looks positive, especially the high-volume run at resistance early this month, which is why the On-balance Volume line has been and is strong, all of which indicates that a valid Head-and-Shoulders bottom is completing that will soon lead to a new bull market. The Accumulation line (not shown) is still weak and we will want to see that improve — sometimes it takes this indicator a while to "get with the plot."

An important point worth mentioning is that the company intends to pursue non-dilutive financing through research and development (R&D) awards to help cover the cost of developing compliant components, so funding exercises should not prove to be such a limiting factor.

Buyers and owners of the stock may also like to keep in mind that the February IPO-created stock is locked up (or cannot be sold) until late August. It is also worth repeating that there are plenty of potential catalysts over the next several months with the seasonal round of government contracts being announced.

With the price now very close to what is believed to be the Right Shoulder of the Head-and-Shoulders bottom, this looks like an excellent point to buy the stock which is therefore rated an Immediate Strong Buy.

Unusual Machines' website.

Unusual Machines Inc. (UMAC:NYSE) closed at US$1.40 on June 19, 2024.

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Red Cat Holdings Inc. and Unusual Machines.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.