A supercycle in the copper market is emerging, experts say. Such an event, a prolonged duration of rising prices, would be a boon to copper explorer-developers and those invested in them.

"Investing in juniors has historically been a good way to leverage rising metals prices," Ahead of the Herd's Richard Mills wrote in a June 16 article. "Juniors own the world's future mines."

Soaring Demand, Constrained Supply

Copper is critical to the green energy transition, specifically its use in the clean energy, artificial intelligence (AI), and cryptocurrency industries. It stands out for its conductivity, corrosion resistance, longevity, and ductility. As such, the red metal is as essential to meeting the world's future power needs as natural gas is, U.S. Global Investors purported in a June 3 article.

Thus, demand for copper is soaring, driven in large part by the growing need for electric vehicle charging stations and AI data centers, according to Seeking Alpha's Erik Norland. Countries looking to secure vital materials are another contributor.

Growth in copper production has been "extremely slow" and has lagged that of all other ferrous and base metals, Nordik added.

Several factors, including "years of underdevelopment, expanding protectionist policy measures, and a continued preference among copper producers to grow by mergers and acquisitions rather than greenfield development," have led to copper's currently constrained supply, Sprott asserted in a June 11 Energy Transition Materials Monthly article. Today, copper supply is facing numerous challenges, including technical mining difficulties, decreasing ore quality (leading to increasing capital and operating costs), particularly in the copper-rich locales of Latin America and Africa, geopolitical tensions, and restrictive environmental mandates.

Given the rising demand, 115% more copper than has ever been mined needs to be produced in the next three decades, U.S. Global pointed out.

"The International Energy Forum warns that under current policy settings, it's unlikely there will be sufficient new mines to achieve 100% EV adoption by 2035," the investment manager wrote.

Evidence A Supercycle Has Begun

Since the start of 2024, the copper price has increased about 25% and hit its highest peak ever of US$5.20 per pound in May, resulting from long-term demand forecasts and supply constraints, wrote U.S. Global Investors. This has made copper "a highly attractive commodity."

As well, reported Sprott, copper mining stocks moved with the copper price, gaining 5.15% and reaching all-time highs last month, for a year-to-date increase of 33.79%. Copper junior mining stocks also did well in May, gaining 3.91%.

Haywood Securities pointed out in a June 13 report that over the past 12 months, equity stocks benefited from rising copper prices more than the metal did. During that period, whereas the copper price rose 17.5%, copper stocks rose 27.6% per the Copper Miner Exchange Traded Fund.

Since copper hit its peak in early June, it experienced a now completed short and sharp correction that reversed the previous heavily overbought condition entirely and returned the price to its rising 50-day moving average, reported Technical Analyst Clive Maund in a June 6 report.

Looking forward, he added, "the larger uptrend looks set to resume. This will result in many copper stocks and polymetallic stocks advancing too."

Newsletter Publisher Mills asserted that copper (and other commodities) will strengthen once the U.S. Federal Reserve begins cutting real interest rates, and the U.S. dollar weakens as a result. Like Sprott, he too believes copper is entering a supercycle, supported by the demand surge, the supply crunch, resource nationalism, environmental concerns, and inflation. He wrote that these factors "can only mean one thing: higher prices."

Here's a look at three junior mining companies, all headquartered in Vancouver, British Columbia (B.C.), that might benefit from a copper supercycle:

Blackwolf Copper & Gold Ltd.

Explorer-developer Blackwolf Copper & Gold Ltd. (TSXV.BWCG;OTC:BWCGF) owns base and precious metals projects, Niblack and the Hyder properties.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Blackwolf Copper & Gold Ltd. (TSXV.BWCG;OTC:BWCGF)

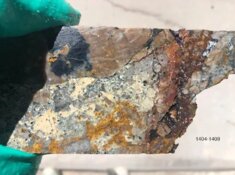

Niblack, a volcanogenic massive sulfide project in southeast Alaska, is the most advanced and has a current resource of 5.851 million tons of 1.83 grams per ton (1.83 g/t) gold, 29 g/t silver, 0.94% copper, and 1.73% zinc.

As announced in early May, Blackwolf is merging with Treasury Metals, another Canadian mining junior. Treasury Metals' flagship asset, which it is moving toward production, is the Goliath gold complex project, a trio of projects in Ontario.

"We view this transaction favorably as it provides Blackwolf shareholders access to an advanced development-stage asset in a tier one jurisdiction within a larger combined vehicle," Red Cloud Securities Analyst Taylor Combaluzier wrote in a May 3 research report.

As for the ownership of Blackwolf, according to the company, management and insiders hold 16.25% of Blackwolf Copper & Gold.

Strategic investors hold 37.03% of the company. The rest is with retail.

Blackwolf currently has a market cap of approximately CA$15 million, trading within a 52-week price range of CA$0.09 to CA$0.37.

Its share structure consists of 131M outstanding shares and 108.4M free float traded shares.

Granite Creek Copper Ltd.

Granite Creek Copper Ltd. (GCX:TSX.V; GCXXF:OTCQB), part of the Metallic Group of Companies, is advancing its cornerstone Carmacks copper-gold-silver project in the Minto Copper Belt of Canada's Yukon Territory toward a feasibility study, noted Couloir Capital.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Granite Creek Copper Ltd. (GCX:TSX.V; GCXXF:OTCQB)

A 2023 preliminary economic assessment (PEA) on the asset indicated a CA$321M pretax net present value discounted at 5% and a 36% internal rate of return.

"The PEA demonstrates attractive project economics with significant opportunities for additional mine life expansion, reinforcing the potential of Carmacks to become a top-tier global copper project," Couloir Capital wrote. Granite Creek has suggested they may update the PEA based on improved metallurgical recoveries announced in January. Drilling is slated to start at Carmacks this summer, according to a May news release.

Management is looking to attract a major company to consolidate the Minto Copper district, including its CA$220M Carmacks project and the past-producing Minto mine to the north, into "a local copper giant," reported Echelon Capital Markets Analyst Ryan Walker last year.

Granite Creek also owns the Lucky Ship molybdenum project and the Star copper-nickel-platinum group metals project, both in B.C.

According to Reuters, insiders own 5.74% or 9.23 million shares of Granite Creek Copper.

One of the five insiders is the Chairman of the Board, President and CEO Timothy Johnson, with 2.54% or 4.08 million shares.

The other four, all directors, are Robert Sennott with 1.87% or 3.01 million shares, Michael Rowley with 1.06% or 1.71 million shares, John Cumming with 0.26% or 0.42 million shares, and Loy Chunpongtong with 0% or 0.01 million shares.

The company does not have any institutional investors.

Retail investors own the remaining 94.26%.

Granite Creek has 161 million shares outstanding and 151.77 million free-float traded shares.

The company's market cap is CA$7.23 million, and it trades in a 52-week range of CA$0.03 to CA$0.08 per share.

World Copper Ltd.

World Copper Ltd. (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA) is working to increase shareholder value through acquiring and advancing copper oxide projects, reported Steven Ralston with Zacks Small-Cap Research.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

World Copper Ltd. (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA)

World Copper has two assets: Zonia in Arizona and Escalones in Chile. Last month, management announced its decision to prioritize its U.S.-based assets, reported Red Cloud's Combaluzier in a May 2024 corporate update.

Thus, the explorer now is concentrating solely on advancing Zonia and targeting a production start there in three to five years. It is executing its plan for moving forward, for taking Zonia to a feasibility study then to construction.

"With a new management team and technical committee, along with a current cash balance of about CA$4.9M, we believe the company is well positioned to execute on its refined U.S. strategy," the analyst wrote.

Red Cloud has a Buy rating on World Copper as well as a price target implying a 129% potential return.

World Copper outperformed the TSX Venture Exchange benchmark in at least the past four months, according to Fundamental Research Corp. (FRC), which covers and considers the stock a Top Pick.

In May, for instance, WCU was up 195.7% month over month.

Earlier this month, Technical Analyst Clive Maund wrote that World Copper is a Buy.

With respect to ownership of World Copper, Wealth Minerals Ltd. (WML:TSX.V; WMLLF:OTCQB) owns about 11.51% of World Copper.

About 27% is owned by management and insiders, including Director Robert Kopple with 8.37% and Board Chairman Hendrik van Alphen with 0.13%. CEO Neal holds about 0.96%. The rest is retail.

Its market cap is CA$41.84 million. It has 178 million shares outstanding, including 127.86 million free-floating. It trades in a 52-week range of CA$0.35 and CA$0.06.

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Blackwolf Copper & Gold Ltd., World Copper Ltd., and Granite Creek Copper Ltd. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blackwolf Copper & Gold Ltd. and World Copper Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.