Throughout history, silver has been recognized as a valuable commodity across the globe. The Chinese language itself reflects the metal's significance, with the term for "bank" (银行) directly translating to "silver trading depot," highlighting its historical use as a standard currency in China.

Silver's versatility sets it apart, as it is prized not only as a financial asset but also for its decorative properties and industrial applications. The metal plays a crucial role in clean energy technologies, particularly in the manufacturing of solar panels. The solar industry is currently experiencing rapid growth, driven by increasing environmental awareness, technological advancements, and supportive government policies. In 2024, silver has emerged as one of the top-performing commodities, surging by more than 30% and outpacing even gold. The month of May witnessed a significant milestone as silver prices surpassed the US$32/oz mark, reaching an impressive 11-year high. Several factors have contributed to this remarkable performance:

- Silver's safe-haven characteristics, serving as a hedge against inflation and geopolitical uncertainties.

- The weakening of the U.S. dollar.

- Persistently growing demand for industrial applications, especially photovoltaics (PV) in the solar panel industry.

Industry experts suggest that this silver rally is just the beginning, citing minimal technical resistance between the US$30/oz and US$50/oz price levels. Based on these observations, I anticipate that silver will surpass the US$50/oz threshold during this cycle and subsequently stabilize within the US$30-US$50/oz range for the foreseeable future.

Industry experts suggest that this silver rally is just the beginning, citing minimal technical resistance between the US$30/oz and US$50/oz price levels. Based on these observations, I anticipate that silver will surpass the US$50/oz threshold during this cycle and subsequently stabilize within the US$30-US$50/oz range for the foreseeable future.

In the years leading up to 2024, the silver market experienced its most significant deficit in 2022, amounting to 263.5 million ounces. Projections for 2024 indicate that the silver market will face the second-largest deficit on record, estimated at 215.3 million ounces. Over the past six years, the solar panel industry has consistently emerged as a notable driver of increased silver demand through the use of photovoltaics. In 2023 alone, the industry consumed 193.5 million ounces of silver, representing a remarkable 64% increase from the previous year.

The demand for solar panels continues to surge year after year, fueled by factors such as declining prices for this alternative clean energy source and an increase in climate-related energy disruptions. As solar panel technology and efficiency advance, future models are expected to require up to 150% more silver, further intensifying the demand for this precious metal. Several factors contribute to the increasing use of silver in emerging solar panel technology:

- Tunnel oxide passivated contact (TOPCon), considered the new standard in PV module technology, is expected to increase the silver load in solar panels by at least 25%. By the end of 2024, more than half of all solar panels are projected to incorporate TOPCon technology.

- Heterojunction technology (HJT), another groundbreaking development in the solar industry, is anticipated to double the silver load in solar panels in the coming years.

Past its current applications and growing role in the energy transition, silver is poised to become a critical component in the artificial intelligence (AI) sector, encompassing various fields such as transportation, nanotechnology, biotechnology, healthcare, consumer wearables, computing, and data center energy storage.

These compounding factors point towards a structural shortage of silver that could persist for decades.

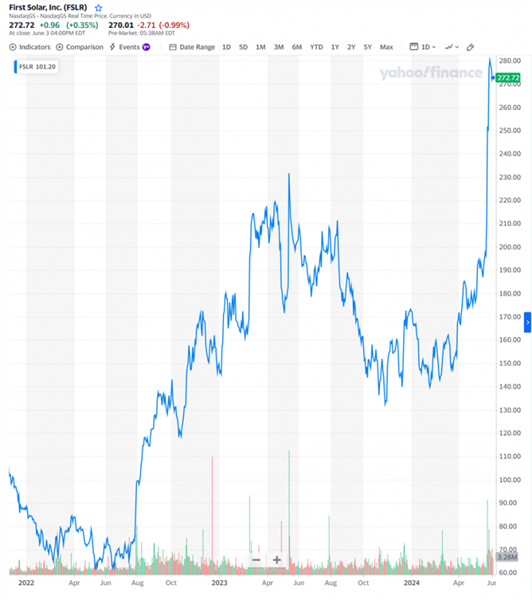

Recently, the rapid advancement of Artificial Intelligence (AI) has led to a significant power shortage in the United States. Microsoft Corp. (MSFT:NASDAQ), a leading AI company, has turned to solar power as the solution for future AI data centers. Investors have embraced this new idea, with solar stocks like First Solar Inc. (FSLR:NYSE) adding US$10 billion in market valuation following Microsoft's announcement.

The bright future of solar power is evident, as other leading technology companies such as Google, Meta, and Apple are likely to follow suit, not only in the U.S. but also in the E.U. and Asian countries like China. Currently, Chinese solar panel production capacity is underutilized, operating at less than 50%. If these factories were to run at full capacity in 2025, PV production would double, resulting in a silver supply and demand gap of 500 million oz/year or more — an unprecedented occurrence in human history. This potentially historic run of silver presents a compelling opportunity that investors should not overlook.

Currently, silver is primarily obtained as a by-product of mining other primary metals. To ensure that production keeps up with the ever-increasing demand, the industry will need to construct several new primary silver mines. The success of this endeavor is contingent upon maintaining elevated silver prices over an extended period.

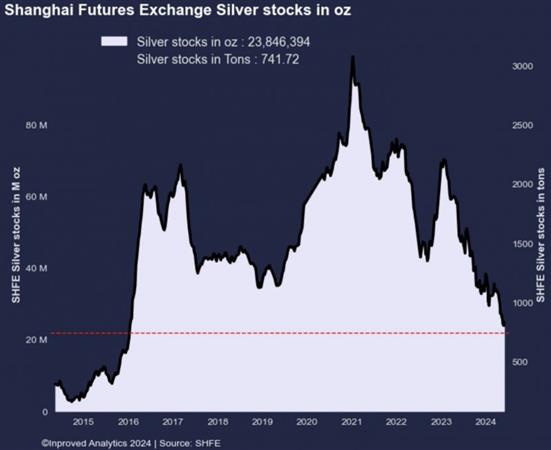

Since my previous report, the fundamentals supporting a growing silver market have continued to strengthen, and the long-term outlook is truly captivating. Although some silver stocks have experienced rallies in the past six months, there remains significant potential for further growth. Chinese investors, in particular, are flocking to silver as they are more attuned to the impending silver shortage driven by the metal's extensive use in solar panels. In fact, the silver stockpile at the Shanghai Futures Exchange is on the verge of depletion and is expected to reach zero before the end of 2024.

As someone who has been investing in silver for a considerable time, I have significantly increased my holdings in stocks, futures, and ETFs, reflecting my strong conviction in the bright future that lies ahead for this highly sought-after precious metal.

For investors looking to seize this long-term opportunity, I suggest focusing on silver production companies that exhibit substantial growth potential. Two companies worth considering in the current market landscape are:

- Silvercorp Metals Inc. (SVM:TSX; SVM:NYSE): This Canadian pure-play silver mining company operates several cost-effective, long-life mines in China. In its most recent fiscal year, Silvercorp achieved an impressive production of 6.2 million ounces of silver at an all-in sustaining cost of just US$11.38 per ounce, net of by-products. Notably, silver accounted for an impressive 58% of the company's total revenue, setting it apart from its peers in the silver mining industry. Silvercorp boasts a robust balance sheet with USUS$185 million in cash and no debt, allowing it to actively engage in share buybacks and dividend payments. This strong financial position also enables the company to fund a wide array of growth projects at its operations and pursue strategic M&A opportunities for enhanced diversification. The company is led by mining entrepreneur Dr. Rui Feng, who serves as the founder, chairman, and chief executive officer.

- Cerro de Pasco Resources Inc. (CNSX:CDPR; OTCMKTS:GPPRF; N8HP:FRA): This Canadian mining company owns several polymetallic mining assets in Peru. CDPR recently secured a long-awaited easement, paving the way for the development of its Quiulacocha Project. The project involves the reprocessing of 75 million tons of tailings extracted from the iconic Cerro de Pasco mine between 1902 and 1992. Historical reports and metallurgical balances obtained by CDPR indicate that the tailings contain approximately 458M ounces of silver equivalent across Ag, Cu, Zn, and Pb. Moreover, there is evidence suggesting a significant presence of critical metals such as germanium, tellurium, indium, and gallium. The mining cost per unit is expected to be among the lowest in the industry, as the material is readily accessible on the surface. Studies will assume reprocessing at nearby processing plants that currently have the capacity to treat at least 17.5K tons per day. The Quiulaococha Project is one of six mining projects prioritized by the Peruvian government.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Chen Lin: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Chen Lin Disclaimer: This publication is for entertainment and education purpose only. It contains no recommendation to buy or sell any stocks or any other financial instruments. It includes certain “forward-looking statements” within the meaning of applicable securities laws. All statements, other than statements of historical fact, included herein including, without limitation, statements relating to future financial performance, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “plans”, “expects”, “anticipates”, “budgets”, “believes”, “intends”, “estimates”, “potential”, “possible” and similar expressions, or statements that events, conditions or results “will”, “may”, “could”, or “should” occur or be achieved. These forward-looking statements may include statements regarding perceived merit of properties; anticipated production; exploration results and budgets; mineral reserves and resource estimates; work programs; capital expenditures; timelines; strategic plans; completion of transactions; market price of precious base metals; or other statements that are not statements of fact. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from our expectations include the uncertainties involving [risks of construction and mining projects such as accidents, equipment breakdowns, bad weather, non-compliance with environmental and permit requirements, unanticipated variation in geological structures, ore grades or recovery rates; unexpected cost increases; fluctuations in metal prices and currency exchange rates; the need for additional financing to explore and develop properties and availability of financing in the debt and capital markets; uncertainties involved in the interpretation of drilling results and geological tests and the estimation of reserves and resources; the need for cooperation of government agencies in the development and operation of properties; the need to obtain permits and governmental approvals;] and other risk and uncertainties disclosed in reports and documents filed to applicable securities regulatory authorities from time to time. The forward-looking statements made herein reflect our beliefs, opinions and projections on the date the statements are made. Except as required by law, we assume no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change.