Barksdale Resources Corp. (BRO:TSX.V; BRKCF:OTCQB), an advanced-stage base and precious metals explorer focused on world-class mining jurisdictions in the United States, has announced an increase to its previously reported non-brokered private placement financing.

This adjustment, driven by substantial demand, will yield gross proceeds of CA$5,625,000 for the company.

The structure of the offering remains unchanged, with each unit comprising one common share of Barksdale and one common share purchase warrant, which entitles the holder to acquire an additional common share at CA$0.23 within three years of issuance.

Initially set at 26,666,667 units, the financing has been upsized to 37.5 million units at a price of CA$0.15 cents per unit.

This adjustment, driven by substantial demand, will yield gross proceeds of CA$5,625,000 for the company.

The structure of the offering remains unchanged, with each unit comprising one common share of Barksdale and one common share purchase warrant, which entitles the holder to acquire an additional common share at CA$0.23 within three years of issuance.

The proceeds from this offering are earmarked for exploration activities at Barksdale's properties in Arizona, as well as for working capital and general corporate purposes. The closing of the offering is anticipated to occur on or about June 25, 2024. Securities issued through this offering will be subject to a mandatory hold period of four months and one day from the issuance date, with completion contingent upon customary closing conditions, including approval from the TSX Venture Exchange. Additionally, finders' fees may apply.

Mining Sector Growth

The advanced-stage base and precious metals exploration sector has shown significant potential and growth in recent months. In March, S&P Global reported that the Pipeline Activity Index (PAI) metrics were mixed. Significant drill results and positive milestones increased, while initial resource announcements dropped by one, and financings rebounded after a poor January.

Technical Analyst Clive Maund asserted, "Barksdale Resources is rated an Immediate Strong Buy for all timeframes."

Despite slight declines in most metals tracked in the Exploration Price Index, the overall activity in the commodity supply pipeline remained strong.

The PAI measures the level and direction of activity by incorporating significant drill results, initial resource announcements, significant financings, and positive project development milestones into a single index.

Significant financings increased to 38 from 31, with three transactions valued at over US$30 million, compared to none in January. Gold financings nearly tripled to US$198 million, while the base/other metals group saw a fivefold increase to US$352 million.

These developments underscore the sector's robust growth potential, especially in geopolitically stable regions like Quebec, as reported on Investing News in May 2024.

Companies are increasingly prioritizing sustainable and responsible exploration practices. This trend is indicative of a broader industry shift toward environmental and social governance (ESG) considerations, as INN reported in March.

Company Catalysts

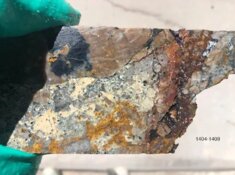

The upsizing of Barksdale's private placement represents a notable milestone, highlighting the investor interest and confidence in the company's prospects. This financing initiative will bolster Barksdale's ability to advance its strategic exploration projects. The company's flagship Sunnyside project in the Patagonia mining district of southern Arizona is of particular note. This region is renowned for hosting several significant porphyry copper deposits and is adjacent to the world-class Hermosa carbonate replacement lead-zinc-silver deposit, currently under construction by a major mining company.

In the company news release, Rick Trotman, President and Chief Executive Officer of Barksdale, stated, "With the backing of our largest shareholders, we are excited to begin the next phase of drilling at Sunnyside. The focus over the next few months will be on solidifying our ownership stake in the Sunnyside project as the drill program demonstrates the potential of this substantial mineral system."

Participation by insiders in the offering, a related party transaction, demonstrates internal confidence in the company's direction and potential. The offering has been unanimously approved by Barksdale's board of directors, reflecting a unified commitment to the company's growth and development. As Barksdale continues to advance its projects and secure the necessary funding, it positions itself solidly within the base metal exploration sector, particularly in North America.

An Immediate Strong Buy

In his June 13 analysis, Technical Analyst Clive Maund provides a highly positive outlook on Barksdale Resources, emphasizing the potential for significant gains based on recent chart patterns and volume activity.

Maund stated, "A very interesting and positive chart pattern has formed in Barksdale Resources over the past several months, which the powerfully bullish volume pattern and Accumulation line this month suggests is now at the point of completion with an upside breakout looking imminent."

Maund detailed the formation of a "fine Cup & Handle base" on the three-month chart, noting that despite a "rather 'droopy' Handle," this presents an opportunity to purchase the stock at an attractive price. He highlighted the significance of the volume build-up, indicating strong upward momentum: "The big buildup in upside volume this month to date that has driven the Accumulation steeply higher — this is a clear sign that it is powering up to break out of the pattern."

Examining the 18-month chart, Maund observed that the Cup and Handle base follows a severe bear market that had "erased most of the stock's value." He underscored the bullish indicators, stating, "The powerfully bullish recent volume pattern and Accumulation line coupled with the very positive Cup & Handle base . . . are compelling indications that a new bull market is set to begin soon, or even immediately."

On a broader 10-year scale, Maund pointed out the stock's historical volatility but notes that it has now reached a strong support zone. He concluded, "The severe bear market from mid-2023 has brought the price back to a zone of quite strong support above the low base pattern that continued until mid-2016, which is a good place for it to reverse to the upside."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Barksdale Resources Corp. (BRO:TSX.V; BRKCF:OTCQB)

Overall, Clive Maund rated Barksdale Resources as an Immediate Strong Buy, asserting, "Barksdale Resources is rated an Immediate Strong Buy for all timeframes."

Ownership and Share Structure

According to Reuters, 4.14% of Barksdale Resources Corp. is held by management and insiders. The largest shareholder in this category is CEO Richard Trotman, holding 1.619% with 1.48 million shares. Other significant insider holdings include Jeffrey Morgan O'Neill with 1.092% (1.00 million shares).

Institutional investors hold 15.44%. Crescat Capital LLC has 10.12%, with 9.27 million shares, and U.S. Global Investors Inc. has 5.32%, with 4.88 million.

The remaining of the shares are held by retail investors.

Barksdale Resources Corp.'s market capitalization is approximately CA$13.74 million, with about 91.61 million shares outstanding. The company trades in a 52-week range from CA$0.15 to CA$0.41

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.