All of the pieces are now in place after long preparation for Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) to become a highly productive and profitable precious metals mining company. The three main planks of the company's impending success are the ongoing advancement of its properties towards production in the not too distant future, the backing of one of the most important silver producers in the world, First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE), and the accelerating major bull market in gold and silver that will see their prices ascend to much higher levels which will result in vastly improved profitability for mining companies such as Sierra Madre whose costs are relatively fixed.

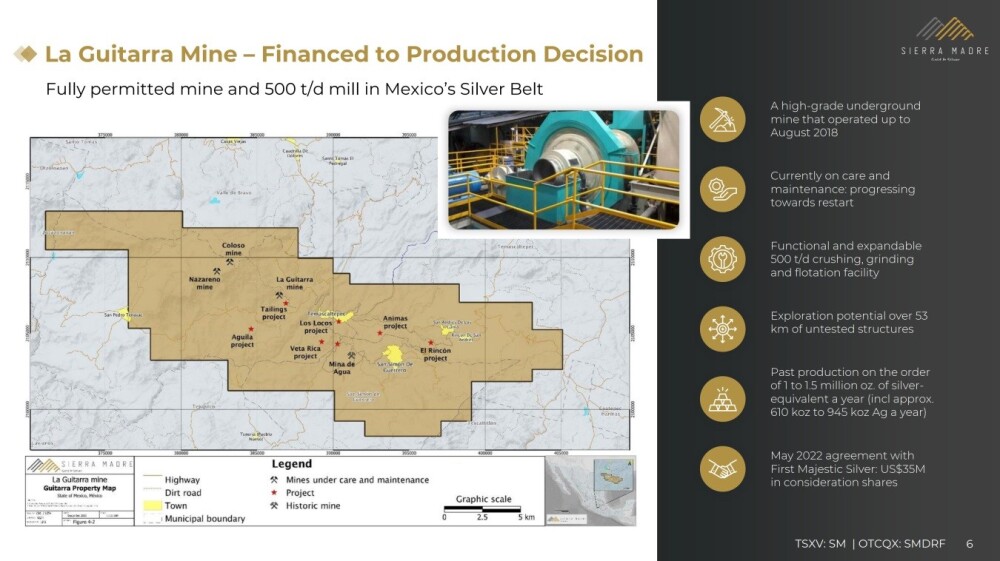

The company has two properties in central Mexico, by far the largest of which is the La Guitarra Project, not very far from Mexico City, which was purchased from First Majestic Silver in March of last year. The other property, the Tepic Project, is a 2,600-hectare exploration stage property not far from the west coast of Mexico.

The La Guitarra Project is expected to go into production in the third quarter of this year, and because it contains several important developed mines that have been in care and maintenance, the path to production is greatly expedited and much faster and less costly than would otherwise be the case. La Guitarra is a very large property with a lot of potential for further discovery and extension of operations, as the following slide lifted from the company's latest investor deck makes plain.

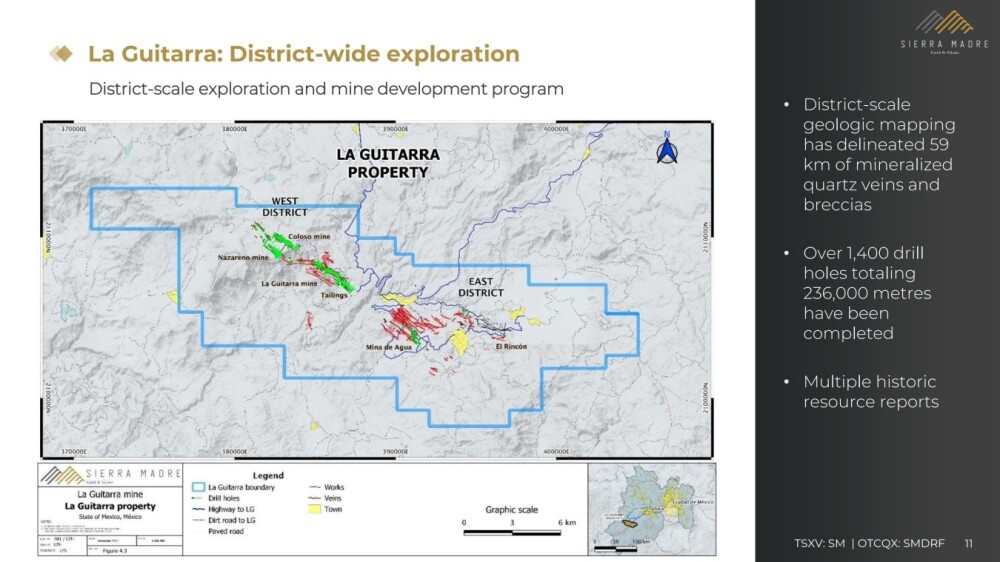

There has been a district-wide exploration of La Guitarra that has delineated 59 km of mineralized quartz veins and breccias with over 1,400 drill holes totaling 236,000 meters completed — now that's what you call exploration.

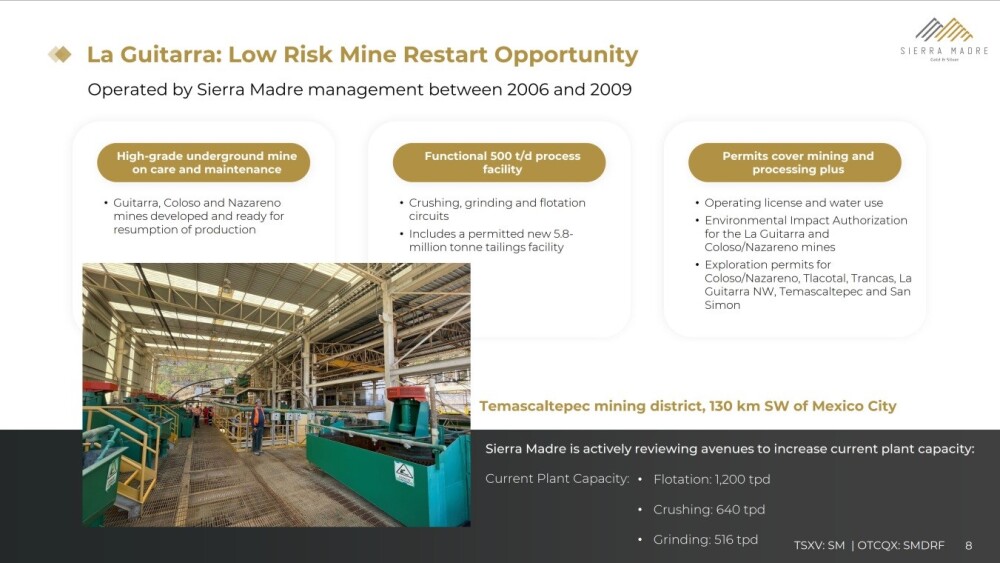

A huge advantage of La Guitarra is that it is already at an advanced stage of development with a high-grade underground mine on care and maintenance, a functional 500-ton / day process facility already in situ, and a wide range of licenses and permits already secured as the following important slide makes clear.

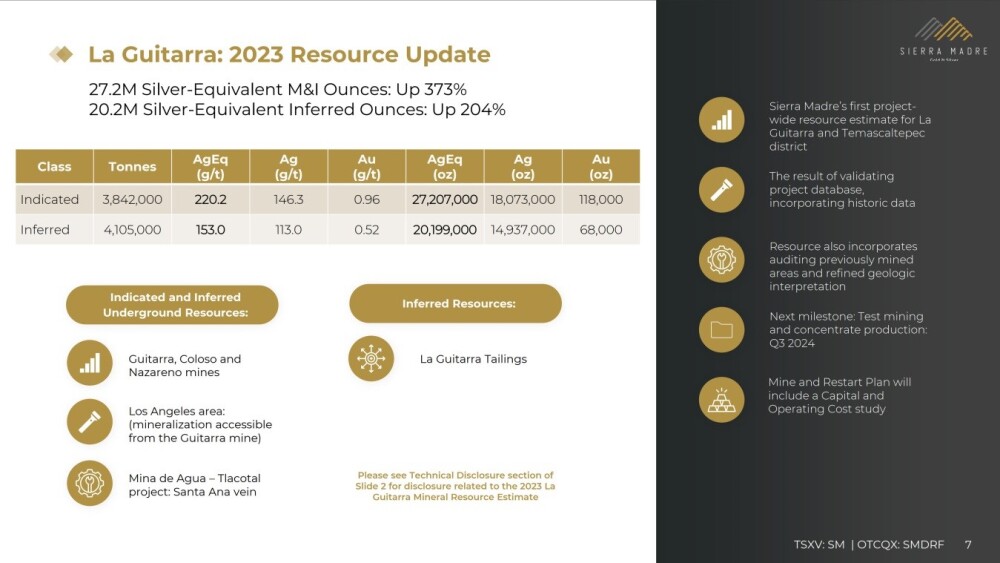

2023 saw a huge increase in Indicated and Inferred resources.

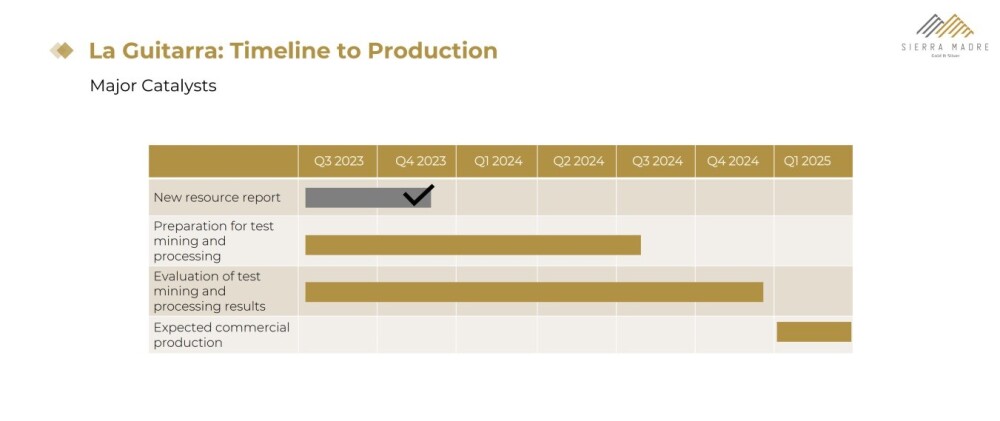

NOT LONG NOW — this chart shows that production is expected to start early next year.

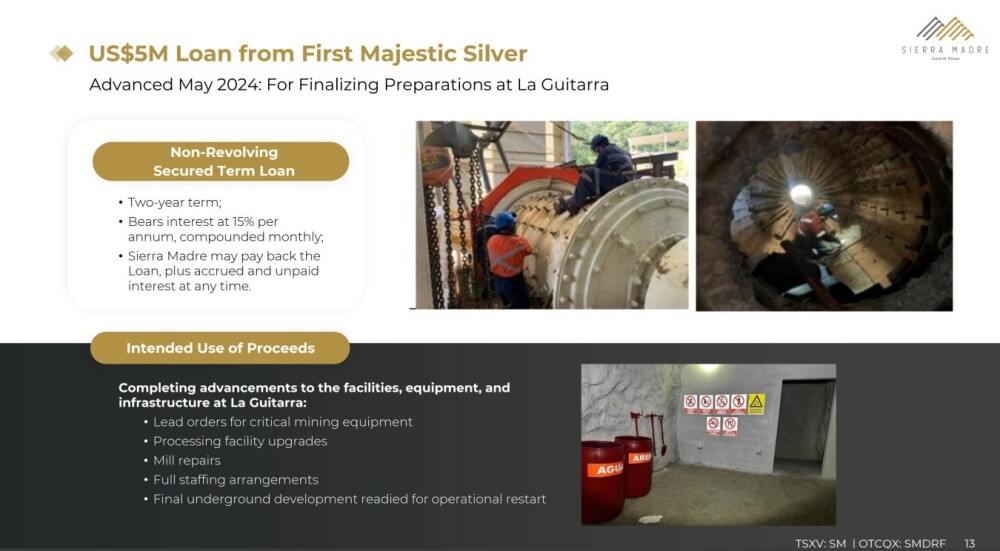

The following slide details the US$5 million loan from First Majestic Silver and what it will be used for.

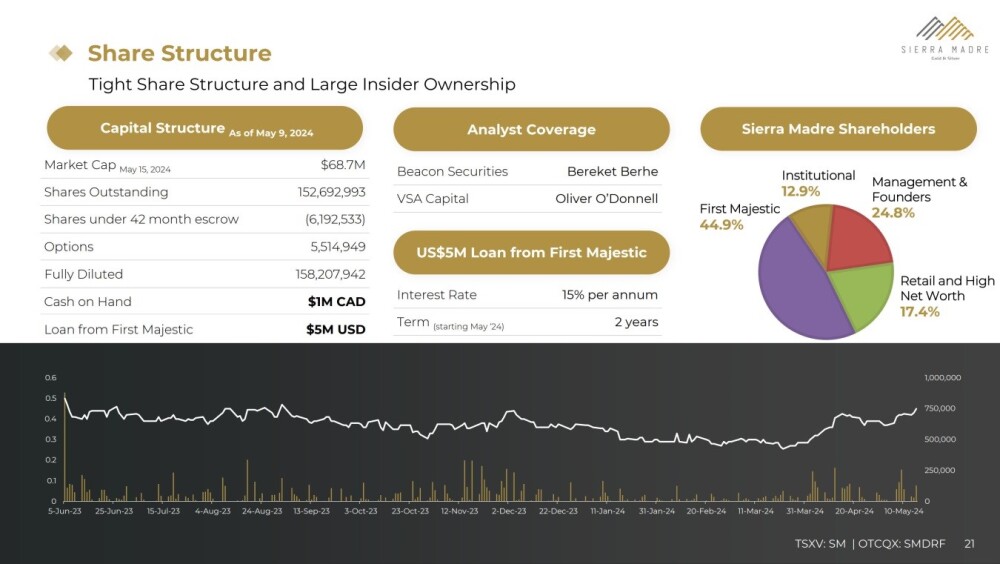

The last slide details the share structure and reveals that with First Majestic owning almost 45% of the stock, management and founders almost 25% and institutions almost 13%, only just under 17.5% of the 152.7 million shares in issue are available to retail investors, or well under 30 million and this limitation will enhance the stock's capacity to appreciate in value.

Turning now to the charts, we will quickly see that the rapidly improving outlook for the company against the background of an improving outlook for the sector has already translated into the vigorous uptrend that we can see to advantage in the 3-month chart below.

This chart requires little explanation — everything about it is bullish — the fine steady uptrend, the strong upside volume driving the advance resulting in a climbing Accumulation line, the positive momentum (MACD), and the cross of the moving averages into bullish alignment last month. The "cherry on the cake" for investors here is that the price has just reacted back across the channel to its lower rail, where it put in a bullish "dragonfly doji" candle on the 11th, which is a sign that it is reversing back to the upside. The larger uptrend shown on this chart remains very much in force and is expected to reassert itself soon and very possibly accelerate for reasons that will become clear when we look at the 1-year chart.

The 1-year chart shows nearly all of the action since Sierra Madre started trading again in early June of last year. The persistent downtrend from where it resumed trading through the balance of last year and into the Spring of this year was largely due to the sector remaining stuck "in the doldrums" and continuing to drift gently lower overall until late February of this year. Then it came to life early in April about a month after the sector started strongly higher and made up for lost time with a vigorous advance that has been followed by a normal reaction back across the channel to support. A catalyst that led to the stock briefly breaking above the important resistance in the CA$0.48 – CA$0.50 zone a couple of weeks ago was the news that the company has been granted some important environmental permitting.

Although there was some profit taking on the minor spike resulting from this news that beat it back below this zone, this initial foray above this resistance is viewed as a bullish development, and it is expected to break above this resistance again and stay above it in due course. Before leaving this chart, observe how the strongly uptrending On-balance Volume line over the past year "gave the game way" as it presaged the breakout into a new bull market.

We will end by taking a brief look at the 52-month (4-year 6-month) chart, which, although technically of little use because Sierra Madre evidently went through some sort of major restructuring during roughly the second half of 2022 and the first half of 2023, at least gives us an idea of the history of the stock. Because of this restructuring and associated changes of share ownership the trading that took place at higher levels in 2021 is thought unlikely to generate any significant resistance to impede the stock's advance, so that for practical purposes it should have little trouble getting above and staying above its highs of the past year, especially because, as mentioned above, its recent volume pattern has been so strong.

The conclusion is that Sierra Madre Gold & Silver is in a vigorous bull market that is set to continue and accelerate for the reasons set out here, and it is therefore rated a Strong Buy.

Sierra Madre Gold & Silver's website.

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) closed for trading at CA$0.43, US$0.3494 on June 12, 2024

Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Sierra Madre Gold and Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sierra Madre Gold and Silver Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.