Arizona Gold & Silver Inc. (AZS:TSX; AZASF:OTC)

The charts for Arizona Gold & Silver Inc. (AZS:TSX; AZASF:OTC) present a most encouraging picture of a stock that is building up to a major bull market yet still at a most attractive price here.

Before we look at them, we will overview the fundamentals of the company using first a company Fact Sheet and follow this up with slides (pages) lifted from the company's latest investor deck.

As its name indicates, Arizona Gold & Silver is primarily a gold and silver explorer that is looking for major deposits in highly prospective territory in Arizona and Nevada.

The following page from the company's Fact Sheet lists the highlights of the company's projects.

The location of the company's projects is shown more clearly in the next picture, in which we see that its flagship Project, the Philadelphia Project, is in Arizona, very close to the border with Nevada.

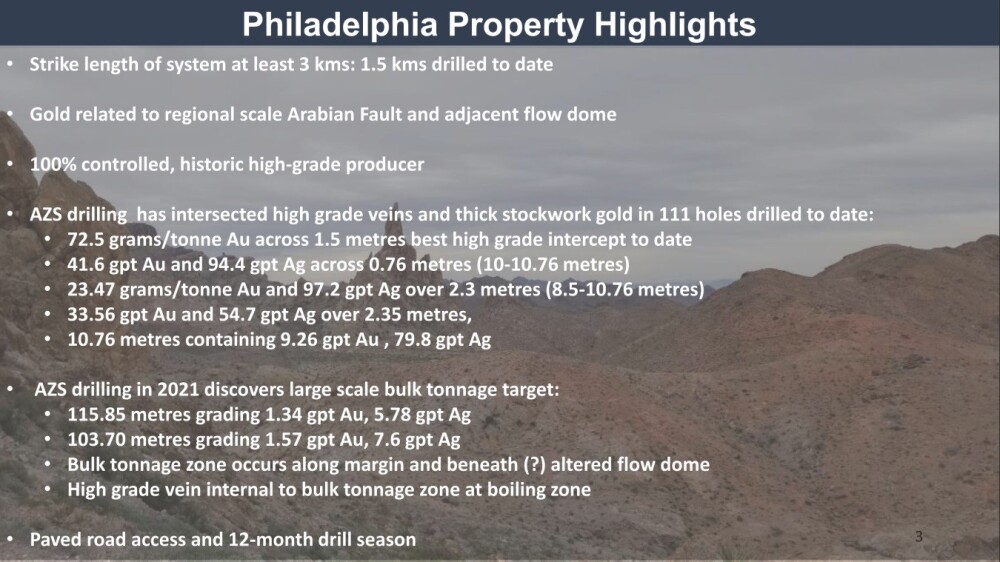

The second slide shows the highlights of the Philadelphia Property and makes clear that a lot of work has already been done on it that has discovered significant resources.

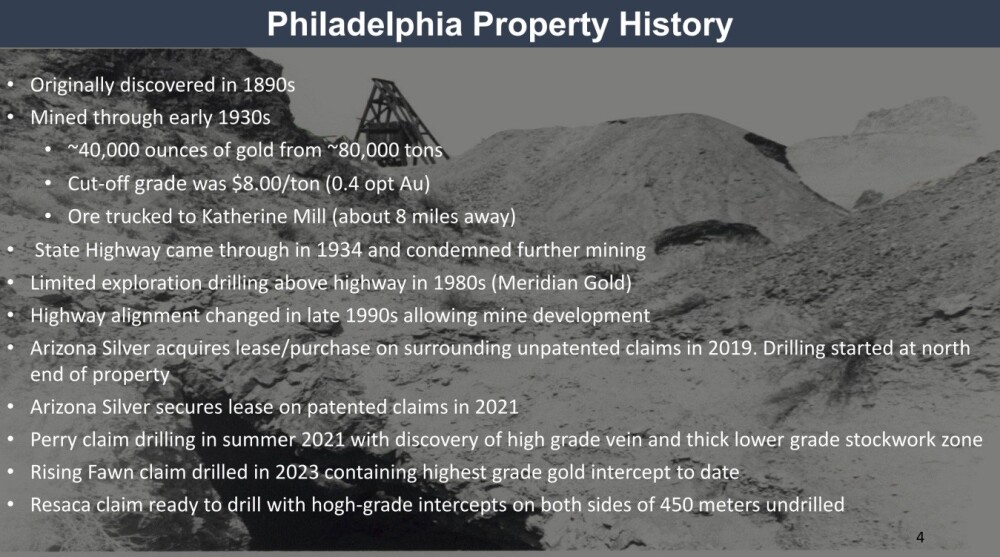

The next slide provides an interesting perspective on the historical development of the Philadelphia Property to date.

The Philadelphia Property lies in the Oatman Gold Mining District in NW Arizona.

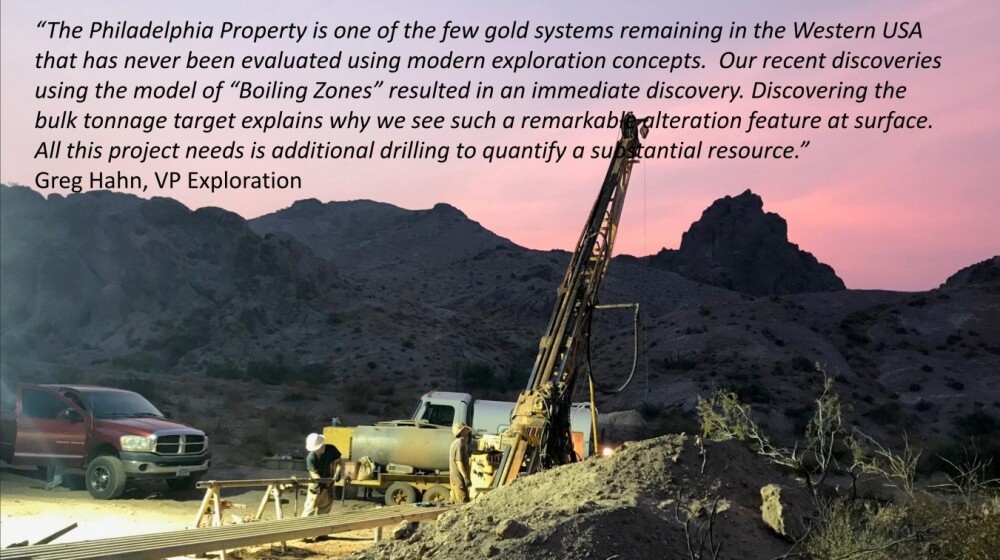

This slide makes clear in one paragraph from the VP of Exploration Greg Hahn the potential of the Philadelphia Property.

This slide makes clear in one paragraph from the VP of Exploration Greg Hahn the potential of the Philadelphia Property.

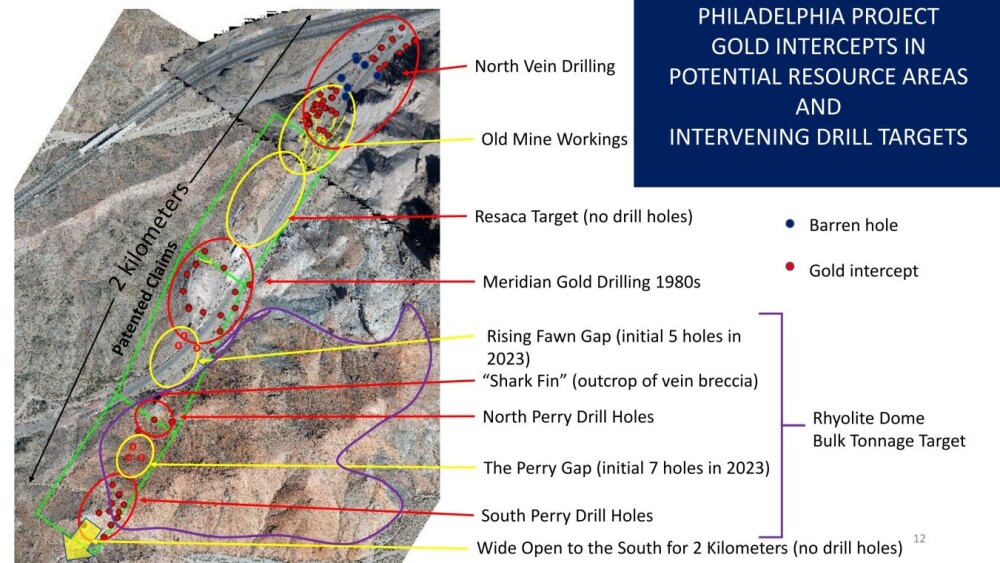

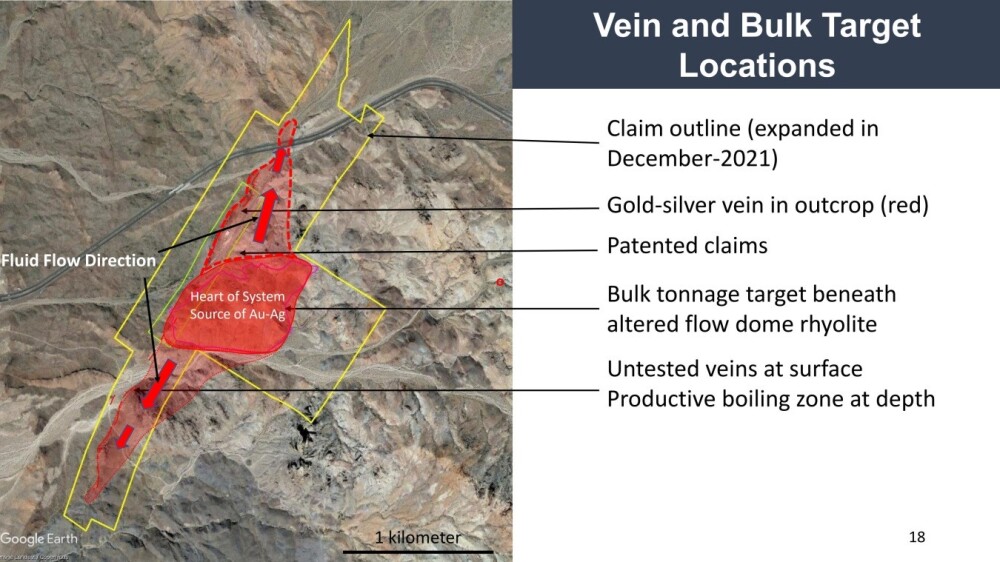

This slide gives the vein and bulk target locations at Philadelphia and shows the heart of the gold-silver bearing system.

For more details on the geology of the Philadelphia Property, go to the company's latest investor deck.

We will end our look at the company's fundamentals with a page from the company's fact sheet, which gives details of company highlights, the share structure, and information on the management and directors.

The company has seen some very positive developments this year, with it reporting exceptional gold extractions (90 – 99%) from leach tests on the Philadelphia Gold – Silver Project in Arizona in May and BLM (US Bureau of Land Management) Issuing Exploration Drilling Permit for The Red Hills Target at The Philadelphia Gold-Silver Project, Arizona this month (June) and it is noteworthy that management has never sold a share, ever.

Also, this morning, Monday, June 17, the company reported that Philip Yee joined the team as a special advisor to the CEO. Yee has an extensive history of working with successful precious metals companies, including Eldorado Gold (BC) Corp., Kirkland Lake Gold Corp., and Patagonia Gold Plc., among others.

Turning now to the stock charts for Arizona Gold & Silver we soon find that they make a clear and unequivocal case for buying the stock here that can be set out in short order.

After Arizona Gold & Silver started trading late in 2016, it trended higher into 2017 before spiking vertically toward the middle of that year, which we can reasonably presume was due to the company announcing a significant or even a major discovery, but as so often happens after such a spike, a long post-discovery hangover set in that led to its losing all the gains garnered during the spike.

Then, after the stubborn downtrend into late 2018 erased all of the earlier gains, it tentatively entered a much slower measured bull market that we can now see has slowly gathered pace right up to the present, with the price being gradually shepherded higher by the parabolic uptrend shown.

This parabolic uptrend is driving the price towards a breakout above the key resistance shown in the CA$0.50 – CA$0.60 zone and it has already had three goes at it already, the first being early in 2022 and the robust Accumulation line that continues to make new highs indicates a high probability that it will succeed in doing so in due course that only increases with the passage of time.

With the benefit of having learned the Big Picture perspective using the long-term chart, we will now zoom in via the 3-year chart to see how it is shaping up.

This chart shows that after dropping back to a support level late in February against the background of a sector retreat it started higher again and it is clear that it is now gathering itself to mount another assault on the key resistance level with the chances of its breaking above it improving all the time, and it may be aided in this by a general advance across the sector.

Lastly, we will look at recent action in more detail in the 9-month chart. This chart shows the drop into the late February low and the reversal into a new uptrend that followed. Superficially, this uptrend looks like it may be a bearish Rising Wedge, but we must factor in that it is being constrained temporarily by the nearby resistance in the CA$0.44 – CA$0.46 zone and that the volume pattern is strongly bullish with predominant upside volume driving the Accumulation line steeply higher which certainly augurs well for continued advance and the bullish cross of the moving averages that is occurring now indicates that the time is certainly right for it.

Lastly, with the price now at or very near to the lower rail of the uptrend channel shown, this is viewed as an opportune time to buy the stock ahead of renewed advance.

Arizona Gold & Silver is therefore rated an Immediate Strong Buy for all time horizons. The stock trades in acceptable volumes on the US OTC market, and there are just over 77 million shares in issue.

Arizona Gold & Silver's website.

Arizona Gold & Silver Inc. (AZS:TSX; AZASF:OTC) closed for trading at CA$0.41, US$0.29672 on June 14, 2024.

Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Arizona Gold & Silver Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.