Gold bounced from Friday's downdraft. US$ is strong. T Bonds give another (false?) rally in yield.

Key Points

Gold

- Pull back in gold has not breached parabolas

- Still in good support.

- Big falls take out selling energy

- Should recover and go on to new highs

Gold Stocks

- Still in symmetry box

- Good support beneath market

- Still in consolidation zone

Bonds

- Last gasp rally again

- Yields heading lower

- Market will be leading Fed lower

Currencies

- Euro heading lower

- Yen at lows again

Gold had a big sell off on Friday night that didn't seem to cause much technical damage although the ascending triangle has been negated for now.

It was a big move, all right, just not in the anticipated direction. The Elliott Wave count is also difficult to read. Selloffs like these take out considerable selling energy, so short covering should take gold higher again.

Perhaps the most interesting development in the past week has been the change in the political scene in Europe with big swings away from the globalist and left wing woke governments.

Macron in France reacted to strong swings against him and followed similar developments in the Netherlands, Germany, Belgium, and Italy.

It seems the days of control by the centralized and unrepresentative European Union might be coming to an end. The Euro was weaker and that concept of the Euro not being around by the end of 2025 doesn't seem so silly. The major issues seem to be immigration and Green Energy policies.

It seems that many governments and administrations around the world are likely to also react to this, and incumbents will be feeling uneasy, particularly those in coalitions with green parties and with small majorities.

But, heed the markets.

Gold

This is a very difficult market to analyse technically so we just need to let the market to tell us what it wants to do.

Gold in most currencies is continuing the parabolic arcs higher. Maybe only 1-2% corrections left from here.

The long term issues haven't changed and the political changes are more likely to direct us to a return to a gold standard. A bounce is to be expected and we need to just keep watching.

Supporting here and did not go low enough to test that low in early May.

The longer term looks OK.

Gold in US$ is still running in a parabola with <2% downside from here.

Gold in Yen made a new high in May.

Currency is still very weak.

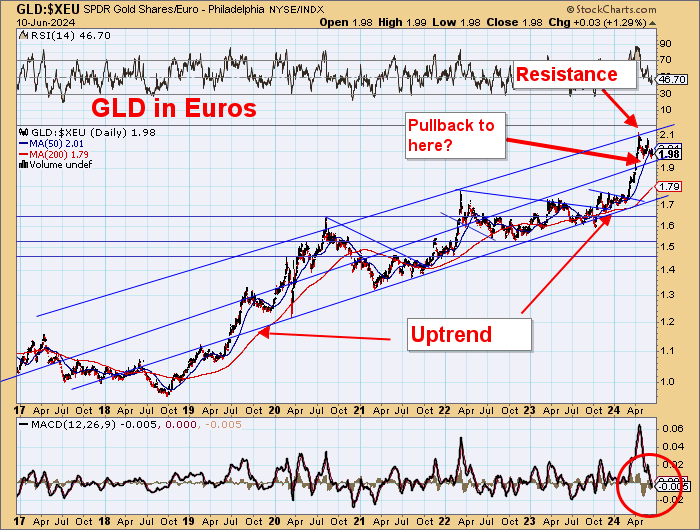

Gold in Euros looks to be in support.

Euro weakening again.

Gold in AU$.

Maybe 2-3% weaker to hit parabola.

Gold Stocks

Still in the symmetry box, although this is ageing.

Big support at 130.

Considerable support within this consolidation band.

Bonds

Reaction rally only.

Another 'goodbye kiss?'

The market will lead the Fed lower.

Head the markets, not the commentators.

Gold Companies to Watch

Liberty Gold Corp. LGD:TSX; LGDTF:OTCQX

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Learn More

MAG Silver Corp. MAG:TSX; MAG:NYSE American

MAG Silver Corp. is a growth-oriented Canadian development and exploration company focused on becoming a top-tier primary silver mining company by exploring and advancing high-grade, district scale, precious metals projects in the Americas. Its principal focus and asset is the Juanicipio Project (44%), being developed with Fresnillo Plc (56%), the operator. The project is located in the Fresnillo Silver Trend in Mexico, the world's premier silver mining camp, where the operator is currently advancing underground mine development and commissioning a 4,000 tonnes per day processing plant. Underground mine production of mineralized development material commenced in Q3 2020, and an expanded exploration program is in place targeting multiple highly prospective targets at Juanicipio. MAG is also executing multi-phase exploration programs at the Deer Trail 100% earn-in Project in Utah and the recently acquired Larder Project, located in the historically prolific Abitibi region of Canada. Learn More

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry's highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon's high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon's Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry's leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges. Learn More

Seabridge Gold Inc. SEA:TSX; SA:NYSE.MKT

Seabridge Gold Inc. is designed to provide its shareholders with exceptional leverage to a rising gold price. From 1999 through 2002, when the gold price was lower, Seabridge acquired nine North American projects with substantial gold resources, including Courageous Lake and KSM. Subsequent exploration by Seabridge has significantly expanded its acquired gold resource base. Seabridge considers each of its common shares to represent an indirect ownership interest in its reserves and resources. Our aim is to increase the value of this ownership interest by growing reserves and resources faster than shares outstanding. Project acquisitions, exploration and engineering programs are carefully designed and monitored to ensure that equity dilution required to fund these activities is more than offset by additional reserves and resources. Seabridge is pursuing three value-enhancing strategies. First, the Company continues to search for gold projects in North America which would be accretive in terms of gold resources. Second, Seabridge funds exploration and engineering work considered likely to expand resources and upgrade them to reserves. Third, Seabridge sells or partners its projects when they reach the production stage, to limit risk and share dilution. Seabridge Gold recently completed an updated Preliminary Feasibility Study for its 100% owned KSM Project located in British Columbia, Canada capturing 47.3 million ounces of gold, 7.3 billion pounds of copper and 160 million ounces of silver in proven and probable reserves. The study projects a 33 year open-pit only mine life generating an after tax net present value (at 5%) of US$7.9 billion and a life of mine total cost (including all capital, reclamation and closure costs) of US$601 per ounce of gold produced after base metal credits. Over the 33 year mine life, average annual metal production is estimated at 1.0 million ounces of gold, 178 million pounds of copper and 3.0 million ounces of silver. Learn More

Stillwater Critical Minerals PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE

Stillwater Critical Minerals Corp. ("Stillwater CM") is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt, and gold exploration assets in top North American mining jurisdictions. The Company's core asset is the Stillwater West PGE-Ni-Cu-Co + Au project adjacent to Sibanye-Stillwater's high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals' development-stage Goliath Gold Complex in northwest Ontario, which is currently under an earn-in agreement with an option to joint venture whereby Heritage Mining may earn up to a 90% interest in the project by completing payments and work on the project. Stillwater CM also holds the Kluane PGE-Ni-Cu-Co project on trend with Nickel Creek Platinum's Wellgreen deposit in Canada's Yukon Territory. Learn More

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.