The technical condition of Fobi AI Inc.'s (FOBI:TSX;FOBIF:OTCMKTS) stock has continued to improve since we last looked at it on April 11, with the original article about it being posted on February 20, and there has been important positive news out of the company, in particular this news that came out about three weeks ago on the May 15 that FOBI AI LAUNCHED NEW INTEGRATED EVENT REGISTRATION AND DIGITAL TICKETING PLATFORM, EXPANDING REVENUE OPPORTUNITIES AND ENHANCING USER EXPERIENCE.

This new platform promises to greatly expedite and simplify event registration and ticketing both for event organizers and attendees, and clearly, if it really catches on, which seems very possible, it could be a BIG earner for the company, especially as Fobi is introducing an innovative aspect to the event registration and purchase experience with the integration of pass bundling. This feature allows for the bundling of event tickets with additional purchase offerings such as merchandise, food and beverage, parking, raffle tickets, and more, all within the same user-friendly platform. By consolidating these purchases, the platform provides a more streamlined and enjoyable event experience, saving time and effort for attendees.

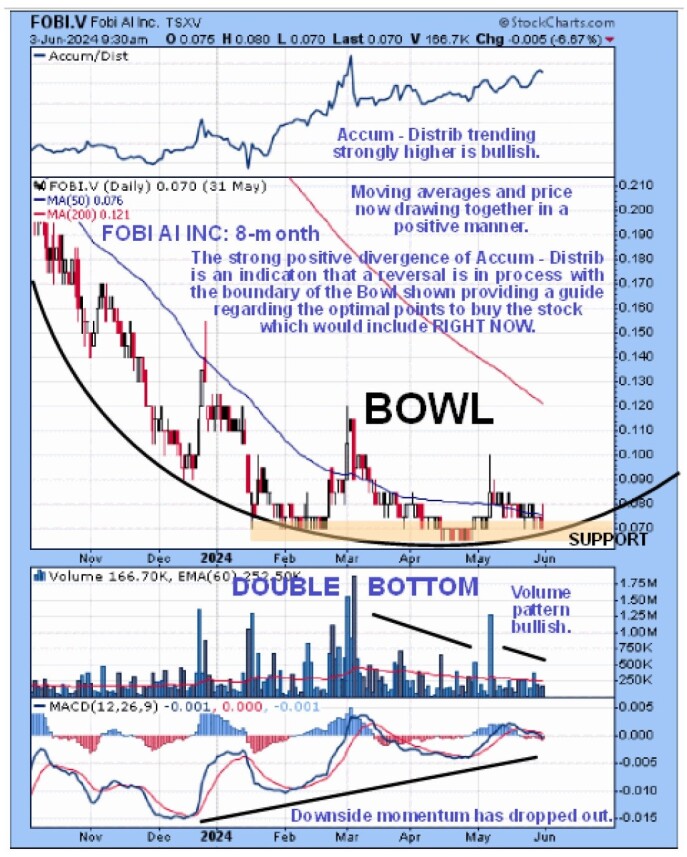

Turning now to the stock charts for Fobi, we see on its 8-month chart something that we had not previously observed, which is that the stock appears to be bottoming within a giant Bowl pattern, and the time that it has spent doing this from January to the present has allowed the 200-day moving average to drop down and narrow the gap with the price which is normally a necessary prerequisite for a new bull market to begin, and for downside momentum to drop out which is also positive. That this Bowl pattern is likely to project the price higher into a new bull market is made much more likely by the positive volume pattern with strong upside volume in recent months that has driven an uptrend in the Accumulation line since January.

It is worth taking another look at the 5-year chart to remind ourselves that Fobi AI is still languishing at a cyclical low that is about coincident with the major lows of 2020.

What this means is that, given the very positive fundamental and technical aspects that we have just considered, it is at an excellent entry point for buyers here, with the price still touching the Bowl boundary that we observed on the 8-month chart.

Holders should, therefore, stay long, and Fobi AI is rated an Immediate Strong Buy here.

Fobi AI Inc.'s website.

Fobi AI Inc. (FOBI:TSX;FOBIF:OTCMKTS) closed for trading at CA$0.07, US$0.51 on June 3, 2024.

| Want to be the first to know about interesting Special Situations and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Fobi AI Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fobi AI Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.