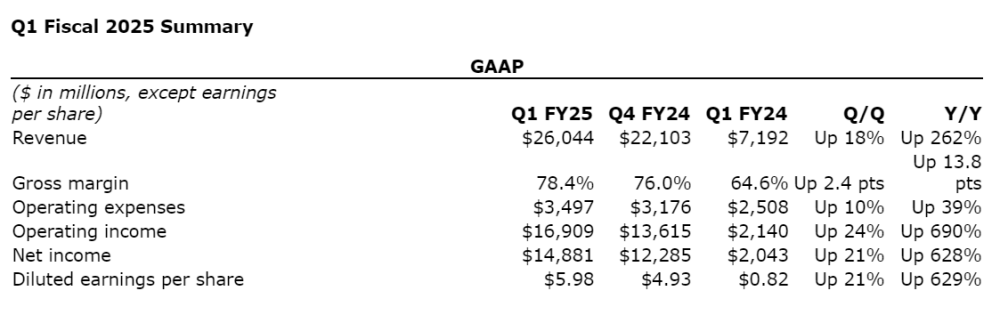

Nvidia Corp.'s (NVDA:NASDAQ) just-announced financial results for quarter one of fiscal year 2025 (Q1 FY25) were notable for record total and Data Center revenues along with quarter-over-quarter (QOQ) and year-over-year (YOY) improvements, the company announced in a news release.

"Revenues topped a record $26 billion ($26B), more than triple the amount from the same period a year earlier, while profits were up a staggering sevenfold, Frank Holmes, chief executive officer (CEO) and chief investment officer of U.S. Global Investors, wrote in Frank Talk on May 28. He described the earnings as "phenomenal."

Specifically, NVIDIA's total revenue for the quarter, ended April 28, 2024, was up 262% YOY and 18% QOQ. Its Data Center revenue also was the best to date at $22.6B, up 427% YOY and 23% QOQ.

"Our data center growth was fueled by strong and accelerating demand for generative artificial intelligence (AI) training and inference on the Hopper platform," NVIDIA Founder, President and CEO Jensen Huang said in the release. "Beyond cloud service providers, generative AI has expanded to consumer internet companies, and enterprise, sovereign AI, automotive and healthcare customers, creating multiple multibillion-dollar vertical markets."

Newsletter Writer Ron Struthers explained the impetus behind this trend, in his Struthers Resource Stock Report in March. "AI has already been around for a long time but is just now getting wings because of the advancement in computer power," he wrote.

Also in Q1 FY25, NVIDIA's GAAP (generally accepted accounting principles) gross margin was 78.4%. GAAP diluted earnings per share was $5.98, 629% higher YOY and 21% higher QOQ.

In other news covered in the release, NVIDIA announced a 10-for-1 stock split to take effect in early June. Each record holder of common stock as of market close on June 6, 2024 will receive nine additional shares of common stock, to be distributed after market close on June 7, 2024.

The split makes the stock "infinitely buyable for the smaller retail investor," wrote Michael Ballanger of GGM Advisory Inc. on May 28.

Further, according to the news release, NVIDIA raised its cash dividend 150%, equivalent to $0.01 per share on a post-split basis. The first dividend at this new rate will be paid on June 28, 2024.

"That's still not anything impressive, but it's the foundation for a much larger payment," opined Keithen Drury in a May 28 Motley Fool article. "Many investments are being made to produce the most powerful graphics processing unit (GPU) possible right now. Eventually, this demand will decrease, and NVIDIA can increase its dividend to a meaningful amount when it diverts its cash flows to return capital to shareholders."

Operationally during Q1 FY25, NVIDIA achieved numerous developments in each of its business segments. Regarding its Data Center business, for instance, the firm unveiled its NVIDIA Blackwell platform.

GPUs On Center Stage

Headquartered in Santa Clara, Calif., NVIDIA is a full-stack computing company with data center-scale offerings and is the "world's engine of AI," according to its website. Services from Alibaba, Amazon, Google, Meta, Microsoft, Snap, Spotify, Tencent and 40,000 other companies are built and run on NVIDIA AI technologies.

"Founded in 1993, the company has surpassed Microsoft and Amazon in market cap and replaced Apple as the darling of the current bull market in 'story stocks,'" Ballanger pointed out.

The information technology firm specializes in products and platforms for various industries, including robotics, healthcare, gaming, automotive, AI factories and digital twins. It is the NVIDIA DGX AI supercomputer that powers ChatGPT, for example.

"NVIDIA's primary products are GPUs, which handle intense computing workloads," Drury noted. "Because GPUs process many calculations in parallel, they are great choices for complex tasks like training AI models."

The tech company boasts more than 27,000 employees in about 50 locations and 7,500 patents, pending and granted, worldwide. It garnered the No. 1 spot on the 2024 Axios Harris Poll 100, ranking the reputations of companies most on the minds of tens of thousands of responding Americans, Holmes reported.

AI Helping Fuel This Tech Sector

NVIDIA's sector, information technology, is forecasted to expand in value at a compound annual growth rate of 15% by 2030, according to Exactitude Consultancy, a market research and consulting services firm. The market is projected to increase in value, to $28.99 trillion ($28.99T) by 2030 from $10.9T in 2023.

Driving the growth, as well as demand and innovation, is accelerated advancement in artificial intelligence, cloud computing, the Internet of Things and cybersecurity.

"AI will bring significant productivity gains to nearly every industry and help companies be more cost and energy efficient, while expanding revenue opportunities," NVIDIA's Huang said in the news release.

Exactitude, in its May 2024 report, highlights NVIDIA as one of the sector's major players and reveals that North America, accounting for 38%, is information technology's largest market.

The Catalyst: "Next Wave Of Growth"

NVIDIA aims to continue expanding its revenue in Q2 FY25, targeting about a 7% QOQ jump.

"The company expects sales to hit $28B in the current quarter as demand for its GPUs, ideal for use in AI applications, continues to accelerate," wrote Holmes.

Looking forward, NVIDIA's Huang said in the release, "We are poised for our next wave of growth. The Blackwell platform is in full production and forms the foundation for trillion-parameter-scale generative AI. Spectrum-X opens a brand-new market for us to bring large-scale AI to Ethernet-only data centers. And NVIDIA NIM is our new software offering that delivers enterprise-grade, optimized generative AI to run on CUDA everywhere, from the cloud to on-prem data centers and RTX AI PCs, through our expansive network of ecosystem partners."

Analyst: Time To Buy Is Now

A number of financial experts believe NVIDIA's stock will keep going up. U.S. Global Investors' Holmes is among them.

"NVIDIA is just getting started," he wrote. "They already control a huge portion of the market, and they've built an entire ecosystem around their AI tools, locking in customers and driving sales. It's like the Gold Rush, but instead of pickaxes, they're slinging GPUs, purchased by everyone from Amazon to Dell to Tesla."

Three facts support the notion that NVIDIA's share price will "continue to rise," Howard Smith purported in a May 28 article. The IT firm's sales pipeline keeps getting bigger and bigger. NVIDIA just landed another huge customer, Elon Musk's xAI. This AI startup just raised $6B in capital, much of which, it is believed, will be spent on NVIDIA's processing chips.

According to Drury, the time to buy NVDA is before the announced stock split takes effect in early June. As for the firm, its Data Center revenue keeps increasing, its dividend is growing and its stock is less expensive that people generally think it is.

By the way, noted Drury, the last time NVIDIA split its stock, back in 2021, its price climbed 20% in the two months between the announcement of the split and the start date.

Ownership and Share Structure

According to Reuters, regarding ownership of NVIDIA, 34 strategic entities hold 4.32%, or 106.29 million (106.29M), shares of NVIDIA. The three strategic investors with the greatest stakes, all insiders, are Founder, President and CEO Jensen Huang with 3.8% or 93.46M shares, Director Mark Stevens with 0.17% or 4.19M shares and Director Tench Coxe with 0.15% or 3.79M shares.

Institutional ownership comprises 5,525 such entities owning 67.49% or 1,660.56M shares. The Top 3 are The Vanguard Group Inc. with 8.63% or 212.29M shares, BlackRock Institutional Trust Co. N.A. with 4.82% or 118.64M shares and Fidelity Management & Research Co. LLC with 4.51% or 110.92M shares.

Retail investors own the remaining 28.19% of NVIDIA.

The company's share structure consists of 2.459 billion (2,459B) outstanding shares and 2.353B free float traded shares.

The IT firm has a market cap of $2.619T.

"NVIDIA's market cap now tops a mind-boggling $2.5T, larger than the entire German stock market and making it the world's third most valuable company after Microsoft and Apple," commented Holmes.

Over the past 52 weeks, NVIDIA's stock has traded between $373.56 and $1,064.75 per share.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |