The reasons why Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) looks set to do very well going forward can be simply stated. They include a successful restart of operations last September and the ramping up of production, and this, combined with the implementation of effective cost-reduction measures and the streamlining of operations, should all lead to a steady improvement in performance as 2024 unfolds — and this is without any mention of the fact that the company's principal product, silver, has just begun a vigorous bull market that is set to accelerate, resulting in much higher prices that will go straight through to the bottom line of companies like Silver X as the costs of mining are relatively fixed. All this will, of course, lead to greatly increased interest in the company and especially in its stock as an investment.

Before we proceed to examine the latest charts for the stock to see what they portend, we will quickly overview the fundamentals of the company, using slides taken from the company's latest investor deck.

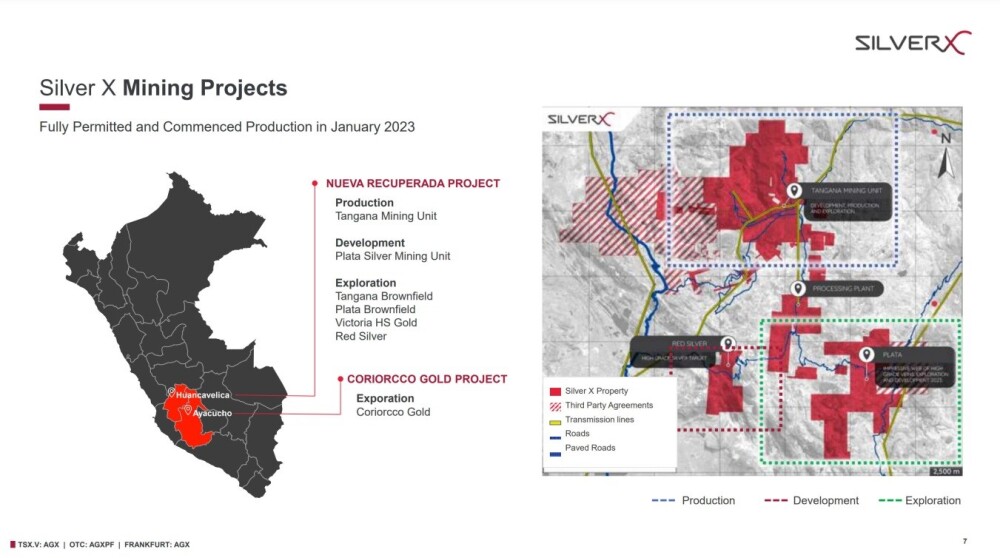

The company's two properties are in Peru and their location is shown on the following slide. By far the biggest is the Nueva Recuperada silver project part of which is already in production with production set to continue ramping up.

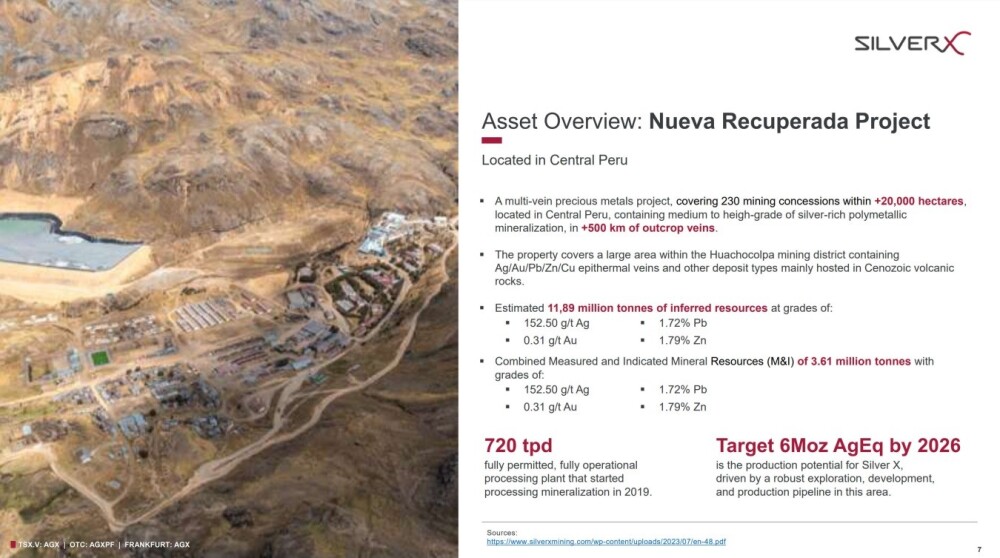

Nueva Recuperada is a massive 20,000-hectare district-scale property with enormous potential — here is an overview of it.

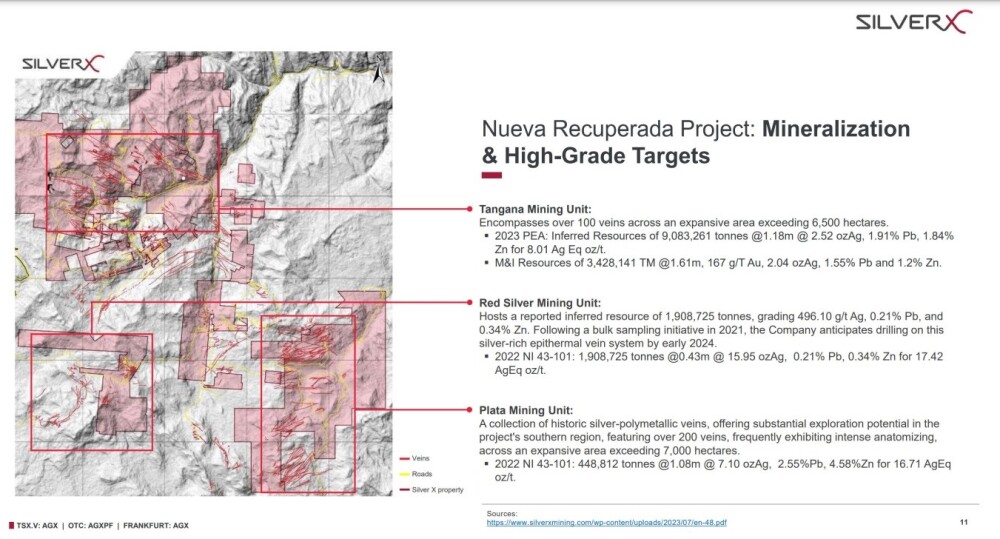

The Nueva Recuperada property is subdivided as shown on the following map which shows the resources already delineated.

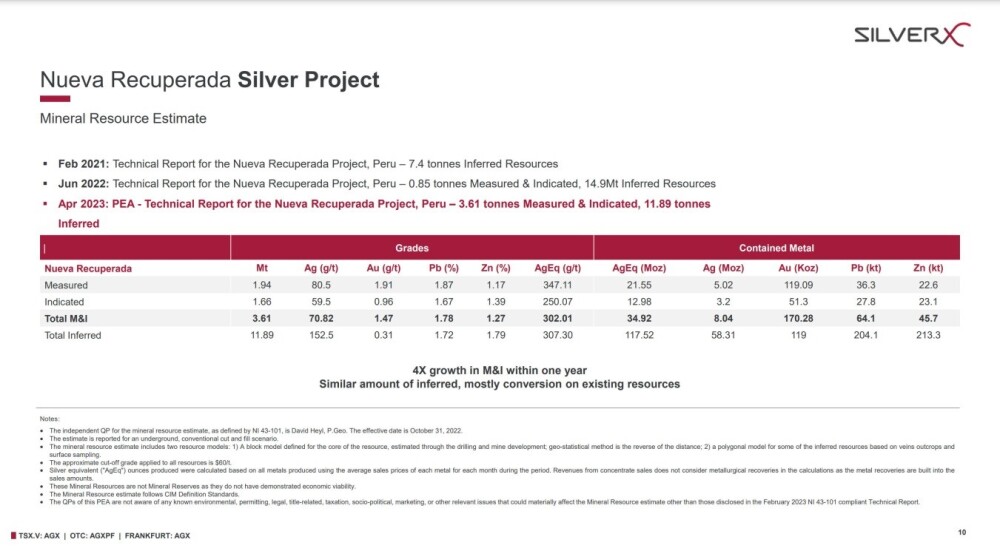

The Mineral Resource Estimate is shown on the following slide — note the 4X growth in Measured and Inferred resources within the year.

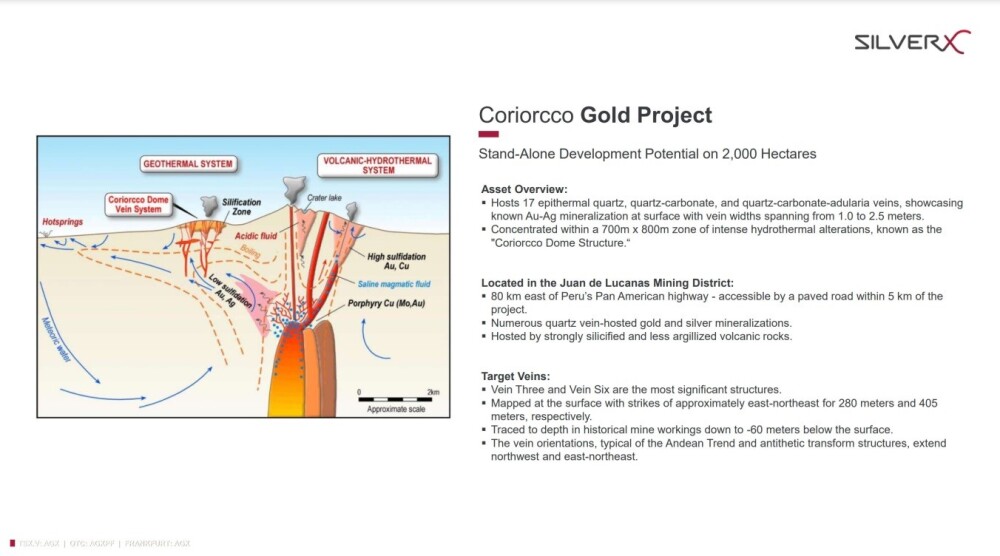

The following slide gives information on Silver X's lesser property, the Coriorcco Gold Project which at this point is still in the exploration phase.

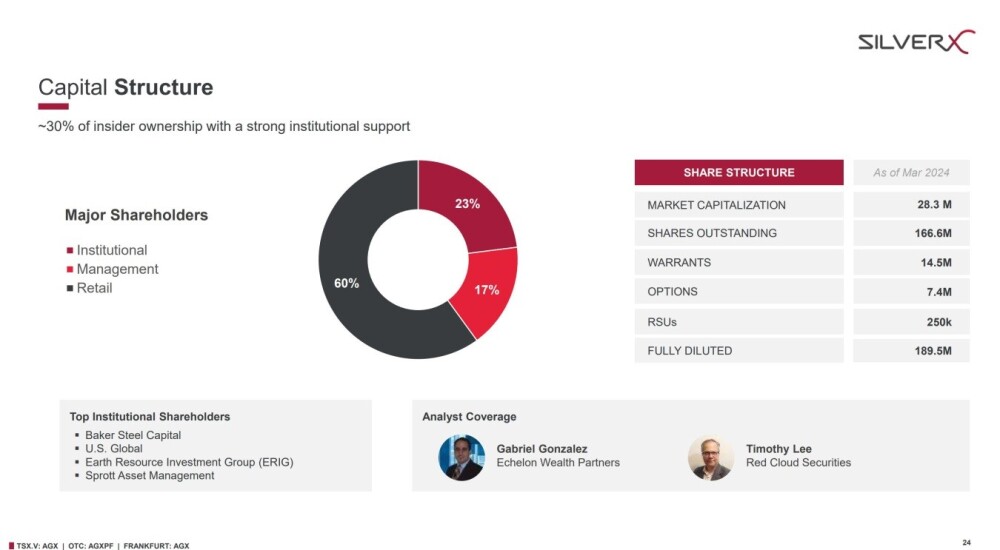

Institutional investors and management own a considerable percentage of the company's stock, leaving 60% available for Retail investors.

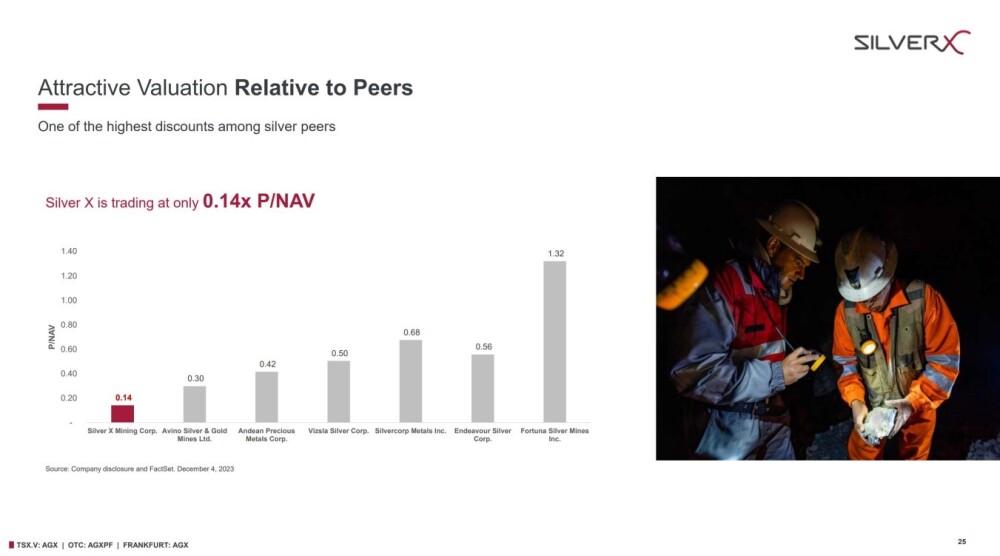

Silver X is attractively valued relative to its peers, which clearly creates more upside if the company does as well as it looks set to.

Silver X Mining stock has done well since it was recommended on February 12 at CA$0.21 and again later at a more optimal price / time entry point at CA$0.20 on April 4 at the Right Shoulder low of a Head-and-Shoulders bottom, for it has since broken out of this base pattern to commence a major bull market and the main purpose of this update is emphasize that this bull market is still in its infancy with the stock is expected to head much, much higher and if you grasp the reasons why this should be, you will understand that this is no exaggeration.

In the April 4 update, it had been determined that the stock was in the late stages of a Head-and-Shoulders bottom, a determination that proved to be prescient as almost immediately it broke out of the H&S bottom on massive record volume, which was clearly a very bullish development.

Looking at the latest 6-month chart, it is clear that the downsloping "neckline" of the pattern is valid because after breaking out, it has reacted to find support at this neckline repeatedly until its now rising 50-day moving average came into play to drive the company higher in another upleg.

The upleg this month has seen the price make significant gains as it rallied up to band of resistance whose origins we can see on the 2-year chart.

Zooming out using a 2-year chart, we see that the Head-and-Shoulders bottom that we delineated on the 6-month chart constitutes the second low of a larger Double Bottom and that the resistance which the price is now arriving at marks the upper boundary of this Double Bottom base pattern.

So, a breakout above this resistance will be a significant technical development that will lead to the stock targeting the next serious resistance at the 2022 and 2023 highs in the CA$0.45 – CA$0.48 zone that we can see towards the top of this chart.

The Double Bottom that formed from late last year into this year constitutes the second low of a much larger Double Bottom whose first low can just be seen on the extreme left of this chart that we will now proceed to look at in its entirety on a 54-month (4-year 6-month) chart.

The 54-month (4-year 6-month) chart shows the giant Double Bottom that formed from 2022 to the present advantage, and the great value of this chart is that it shows that as the price is still relatively close to the second low of this Double Bottom, this bull market is still at its earliest stages with much more to go for.

This is why the stock continues to be rated a Strong Buy here despite its worthwhile gains since we first looked at it.

In conclusion, holders of Silver X Mining should stay long, and it is rated as a Strong Buy for all time horizons.

The first target for an advance is the CA$0.48 area.

Silver X Mining's website.

Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) closed at CA$0.285, US$0.1982 on May 27, 2024.

Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Silver X Mining Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- For this article, the Company has paid Street Smart US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver X Mining Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.