Since the article on Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS; LLJA:FSE) was posted on April 5, it has taken off strongly higher with a move that is believed to mark the start of a major bull market in the stock.

A crucial point for investors to grasp with Emerita Resources is that, as a polymetallic resource company, it is exploring and delineating a wide range of base and Precious Metal deposits, and that is definitely the right place to be at this time with a massive broad-based commodities and especially metals bull market in prospect that has already begun.

The fundamental case for buying Emerita was set out in that original article, and it was illustrated with a selection of interesting slides from the company's investor deck. You are referred back to that article to see them. Included in this update will be different slides from the new May investor deck to give us some additional fundamental insights.

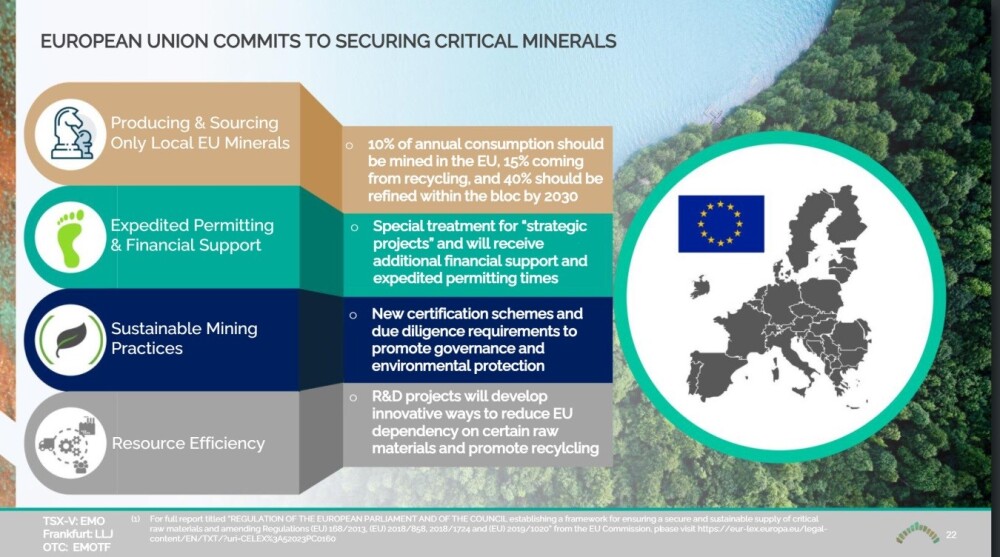

It is a big positive that the business environment for resource companies in Europe is improving, as set out on our first slide.

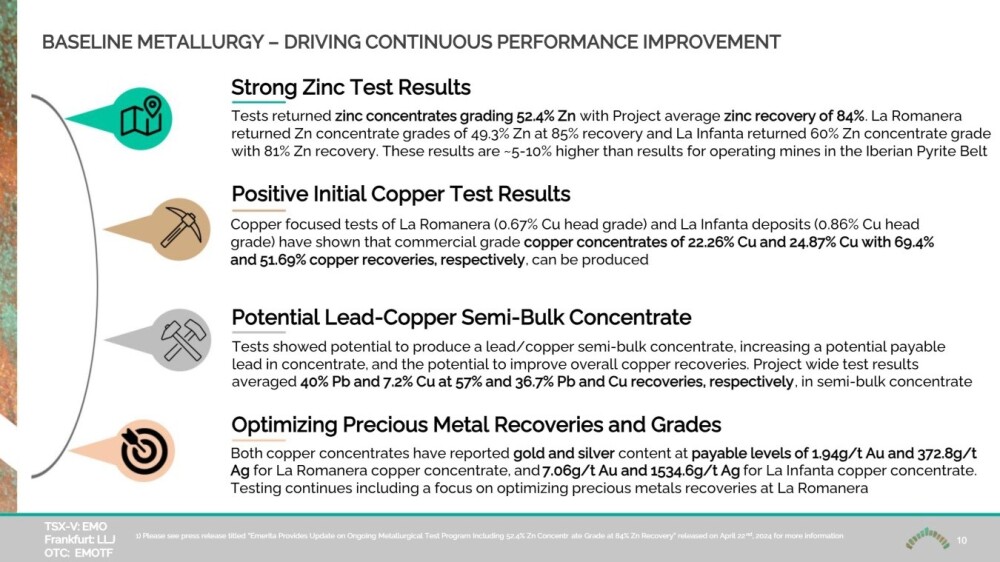

As a polymetallic resource stock Emerita will be producing a wide range of metals once up and running as set out on the following slide which also makes clear that significant discoveries have already been made on the company's properties.

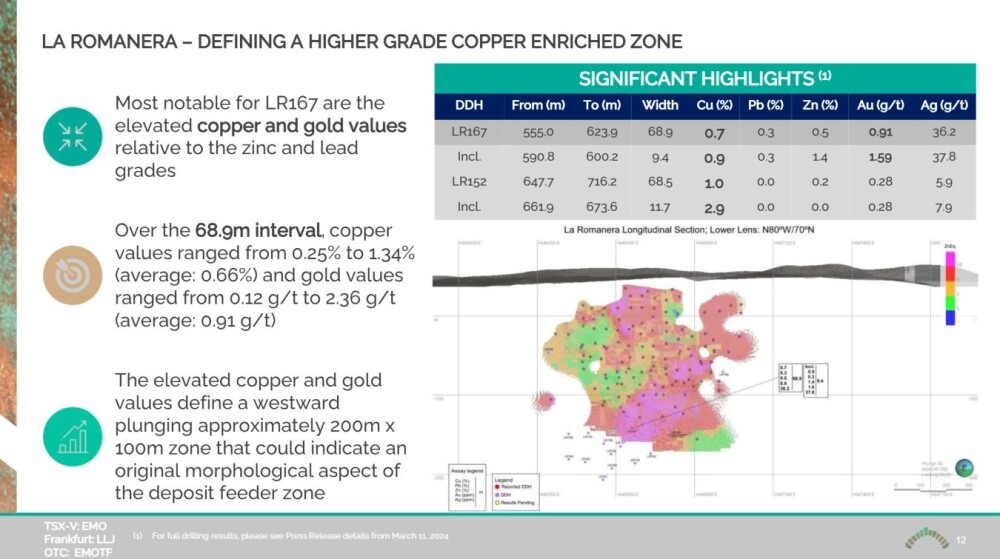

Getting down to some specifics, we see on the next slide that elevated copper and gold grades have been discovered at the La Romanera property, which is good to know given that copper is entering probably its biggest bull market ever with impending massive supply shortages on the horizon and gold is also embarking on a massive bull market due to the current fiat money system reaching its nemesis.

The La Romanera deposit is a part of the Nuevo Tintillo property and its location and position can be seen either on the appropriate slide included in the original article or on page five of the new May investor deck.

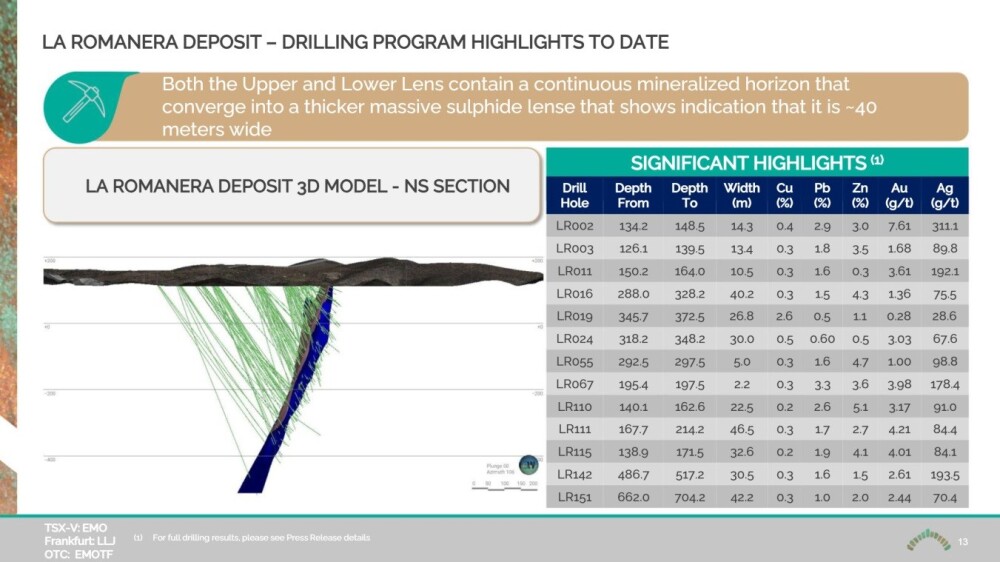

The next slide highlights the drilling program at La Romanera and shows the grades of a wide range of metals found by different drill holes at the deposit.

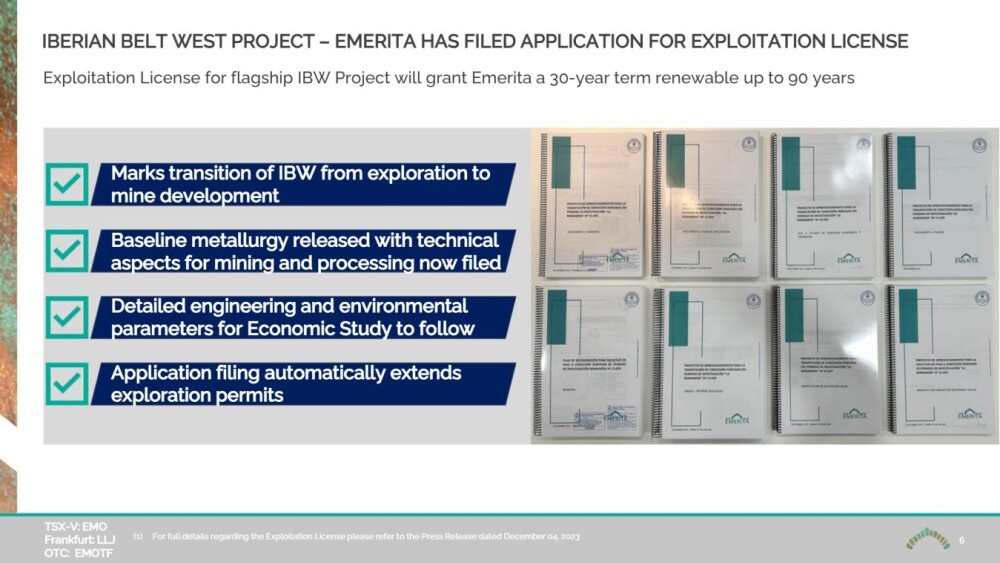

Lastly, Emerita has filed an application for an exploitation license for its westernmost IBW (Iberian Belt West) property, that once granted will confer a 30-year term renewable term for up 90 years.

Turning now to the stock charts for Emerita, we see that the assessment made in the article of April 3 that Emerita Resources was at or very close to the Right Shoulder low of a Head-and-Shoulders bottom has been proven correct, and although we were a little early as it did nothing for a month it was better to be early than late as this month it blasted higher so that we were up 95% by the time it peaked on May 17 at CA$0.78, as can be seen on its 3-month chart below.

After such a move, it is normal for a stock to pause to consolidate or react back somewhat, which is what it has done in recent days, and the reason why the rally ended where it did can be clearly seen on its 2-year chart below.

On this chart, we can see that the rally brought it up to the upper boundary or "neckline" of the Head-and-Shoulders bottom, and since it is unlikely to break out of the pattern when it is in an overbought state, it was natural for it to pause to consolidate here, especially as it had also arrived at the band of quite strong resistance shown arising from earlier trading in this price area.

The purpose of this update at this time is to point out that the strong rally this month has the characteristics of an "impulse wave," i.e., a move in the direction of the primary trend, and thus marks the start of a major bull market. What this means is that after due consolidation in this area to work off some of the overhanging supply from the resistance zone shown, it should then forge ahead in another upleg against the background of a robust advance by the sector as its bull market continues to gather pace. The target for the next upleg is the CA$1.25 area.

The conclusion is that Emerita Resources continues to be rated a Strong Buy despite its considerable percentage gains this month, especially if we should see a minor near-term correction. The first target for an advance is the CA$0.95 area.

Emerita Resources website.

Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS; LLJA:FSE) closed at CA$0.72, US$0.526 on May 28, 2024.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Emerita Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- For this article, the company has paid Street Smart US$1,500 in addition to its monthly sponsorship fee.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.