Since the article on Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS; LLJA:FSE) was posted on April 5, it has taken off strongly higher with a move that is believed to mark the start of a major bull market in the stock.

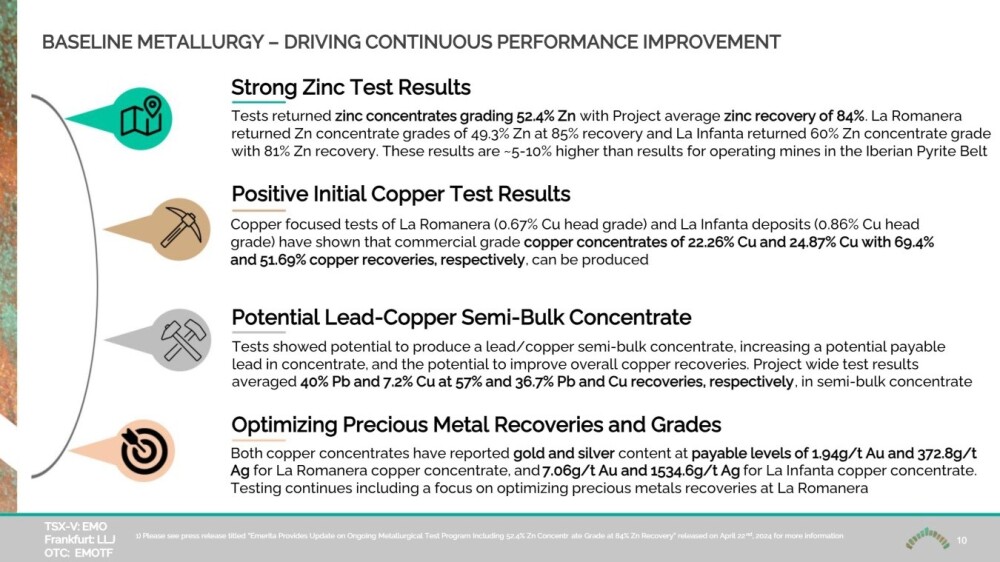

A crucial point for investors to grasp with Emerita Resources is that, as a polymetallic resource company, it is exploring and delineating a wide range of base and Precious Metal deposits, and that is definitely the right place to be at this time with a massive broad-based commodities and especially metals bull market in prospect that has already begun.

The fundamental case for buying Emerita was set out in that original article, and it was illustrated with a selection of interesting slides from the company's investor deck. You are referred back to that article to see them. Included in this update will be different slides from the new May investor deck to give us some additional fundamental insights.

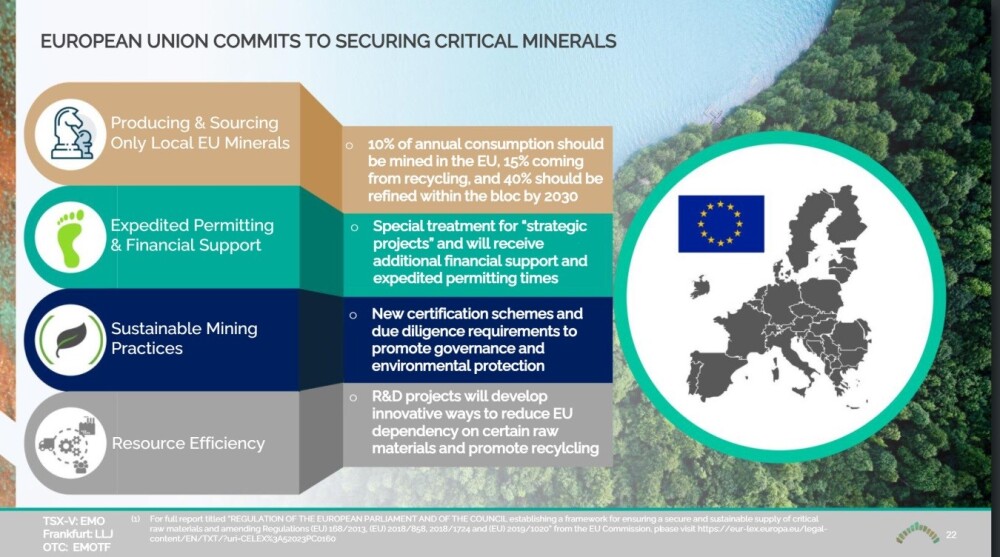

It is a big positive that the business environment for resource companies in Europe is improving, as set out on our first slide.

As a polymetallic resource stock Emerita will be producing a wide range of metals once up and running as set out on the following slide which also makes clear that significant discoveries have already been made on the company's properties.

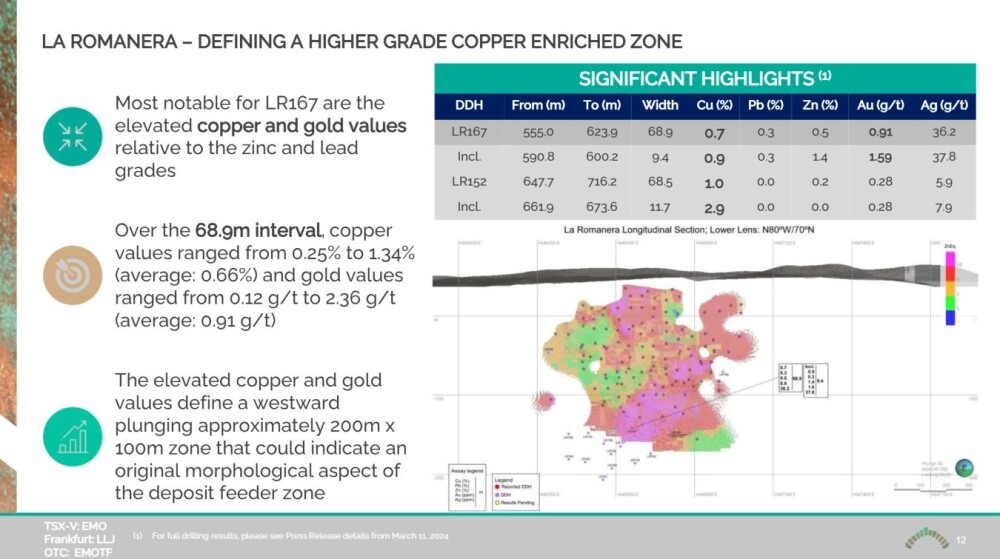

Getting down to some specifics, we see on the next slide that elevated copper and gold grades have been discovered at the La Romanera property, which is good to know given that copper is entering probably its biggest bull market ever with impending massive supply shortages on the horizon and gold is also embarking on a massive bull market due to the current fiat money system reaching its nemesis.

The La Romanera deposit is a part of the Nuevo Tintillo property and its location and position can be seen either on the appropriate slide included in the original article or on page five of the new May investor deck.

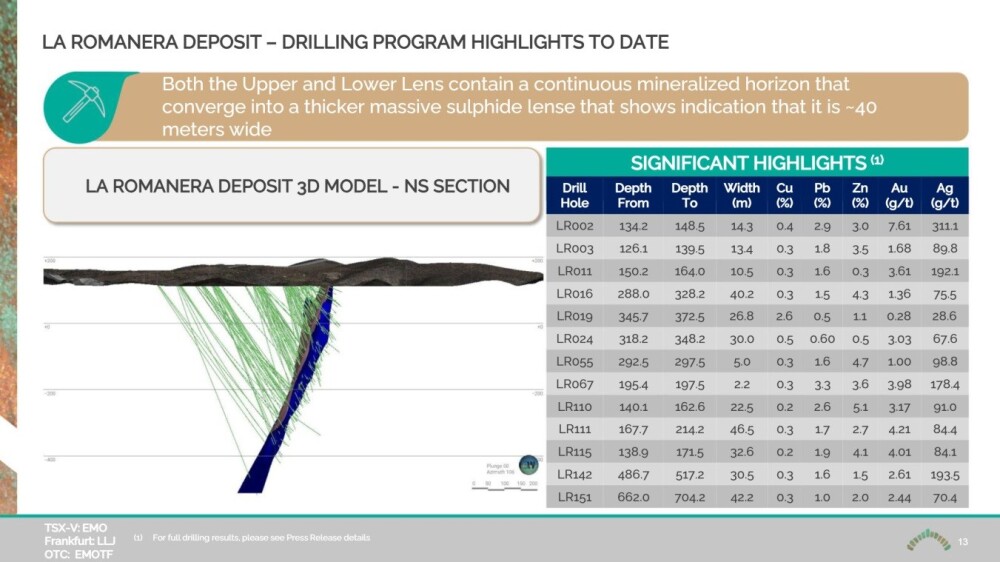

The next slide highlights the drilling program at La Romanera and shows the grades of a wide range of metals found by different drill holes at the deposit.

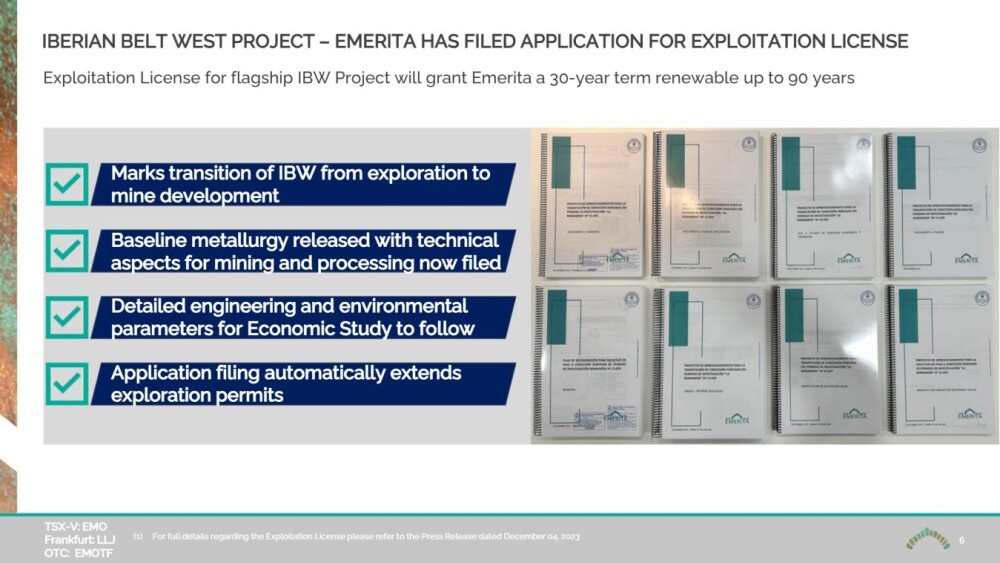

Lastly, Emerita has filed an application for an exploitation license for its westernmost IBW (Iberian Belt West) property, that once granted will confer a 30-year term renewable term for up 90 years.

Turning now to the stock charts for Emerita, we see that the assessment made in the article of April 3 that Emerita Resources was at or very close to the Right Shoulder low of a Head-and-Shoulders bottom has been proven correct, and although we were a little early as it did nothing for a month it was better to be early than late as this month it blasted higher so that we were up 95% by the time it peaked on May 17 at CA$0.78, as can be seen on its 3-month chart below.

After such a move, it is normal for a stock to pause to consolidate or react back somewhat, which is what it has done in recent days, and the reason why the rally ended where it did can be clearly seen on its 2-year chart below.

On this chart, we can see that the rally brought it up to the upper boundary or "neckline" of the Head-and-Shoulders bottom, and since it is unlikely to break out of the pattern when it is in an overbought state, it was natural for it to pause to consolidate here, especially as it had also arrived at the band of quite strong resistance shown arising from earlier trading in this price area.

The purpose of this update at this time is to point out that the strong rally this month has the characteristics of an "impulse wave," i.e., a move in the direction of the primary trend, and thus marks the start of a major bull market. What this means is that after due consolidation in this area to work off some of the overhanging supply from the resistance zone shown, it should then forge ahead in another upleg against the background of a robust advance by the sector as its bull market continues to gather pace. The target for the next upleg is the CA$1.25 area.

Emerita Resources website.

Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS; LLJA:FSE) closed at CA$0.67, US$0.486 on May 23, 2024.

[NLINSERT}