The world is on the cusp of a significant financial shift as global digital currencies, also known as Central Bank Digital Currencies (CBDCs), are poised to make their debut. While they haven't taken center stage just yet, their introduction is expected to be subtle but impactful.

In a March newsletter, we discussed the numerous developments surrounding CBDCs that have taken place in the last few months. With this context in mind, it's hardly surprising that central banks have been the most significant purchasers of gold in recent years.

Since 2010, central banks have consistently been net buyers of gold, accumulating more than 7,800 tonnes of the precious metal. Remarkably, over a quarter of this amount was acquired in just the last two years.

As with the development of CBDCs, it's worth noting which countries have been at the forefront of this gold-buying trend.

In 2023, the People's Bank of China once again became the world's top gold purchaser among individual countries. The central bank reported adding an impressive 225 tonnes to its gold reserves, the largest annual increase for China since at least 1977.

However, China is not alone in this trend. Central banks worldwide have been buying gold at unprecedented levels, with 2022 seeing record-high purchases. This buying frenzy shows no signs of abating.

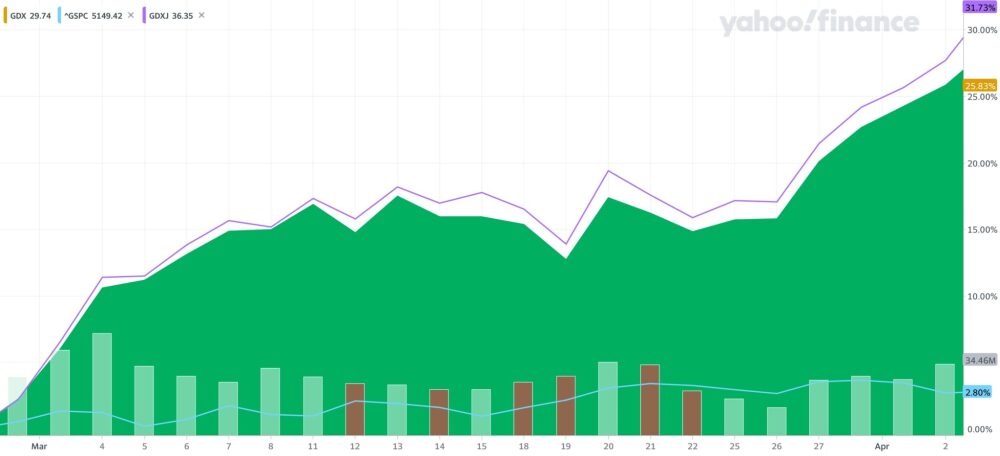

As a result, mining stocks are beginning to follow suit. Since February 28, the price of gold has risen by 12%, while the VanEck Gold Miners ETF (GDX:NYSEARCA:) has surged by nearly 26%. During the same period, the VanEck Junior Gold Miner ETF (GDXJ:NYSEArca) has performed even better, climbing by more than 31%.

In comparison to the impressive gains seen in gold and mining stocks, the S&P 500 has only managed to rise by less than 3% during the same period.

We have repeatedly emphasized that mining companies, particularly junior miners, offer one of the most effective ways to capitalize on gold's rising price trends.

As metal prices increase, it translates into better profit margins and higher share prices for the larger mining companies.

When these two factors coincide — higher metal prices and increased share prices of major mining companies — the industry giants tend to go on an acquisition spree, seeking to expand their operations and resources.

Acquisitions Spree

Major mining corporations rarely prioritize making new discoveries, as the process is often lengthy and fraught with risk. Instead, they allow smaller companies to take on this task.

However, when these smaller players yield promising results, the big companies are more than willing to pay a premium, particularly during periods of increasing prices and profit margins.

Last year provided a textbook example of this phenomenon.

For investors, especially those in Canada, mining discoveries are the ultimate dream come true. Such discoveries have transformed ordinary individuals into multi-millionaires and have given rise to some of the world's wealthiest people.

As more discoveries are made, however, the pool of potential new finds diminishes. In reality, most of the significant discoveries have already been uncovered.

This scarcity is precisely why the mining industry goes into a frenzy whenever a new discovery is announced.

And that's exactly the scenario that unfolded last October.

The Hercules Discovery

In October of last year, Hercules Silver (BADEF:OTCMKTS;BIG:TSXV), a small junior exploration company based in Idaho, made a groundbreaking announcement: they had discovered the first significant porphyry copper system in the state.

Copper porphyry deposits are the world's most important source of copper, accounting for over 60% of all copper mined globally. Although these deposits typically have a relatively low grade, they are often enormous, containing between 100 million and 10 billion tonnes of ore.

The reason for their immense size is that copper mineralization in these systems can extend vertically for several kilometers beyond the primary open pit base. This extensive vertical scale usually results in mines that operate for decades.

Moreover, the metallurgical properties of copper porphyry orebodies make them well-suited for cost-effective, large-scale resource extraction.

The combination of favorable metallurgical characteristics, the high tonnage of mineralized rock, and the potential for decades-long mine life makes copper porphyries incredibly attractive to major mining companies.

Therefore, it's no surprise that within a month of Hercules' discovery announcement, Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), one of the world's largest gold producers, invested nearly CA$23.5 million in Hercules' stock at CA$1.32 per share.

Less than two years prior, Hercules shares were trading at under US$0.06 per share. After the discovery announcement and Barrick's investment last year, Hercules shares skyrocketed to as high as US$1.62, representing a potential gain of over 2845%!

My purpose here is not to discuss a past event or to make anyone feel like they missed out on an opportunity. Instead, I want to share another potential way to capitalize on this same discovery.

How, you might ask?

Porphyry Clusters

One of the key principles regarding copper porphyries is that they rarely occur in isolation; where one exists, others are likely to be found nearby.

Copper porphyry systems often form in clusters or groups within specific geological regions. These clusters can contain multiple individual copper porphyry orebodies or deposits, frequently situated in close proximity to one another.

This clustering pattern highlights how exceptional geological processes influenced localized regions of the lithosphere during the mineralization process, resulting in the formation of distinct geographic clusters that are evenly spaced and aligned within orogen-parallel belts.

The central Andes, for example, is renowned for its giant porphyry copper deposits of similar ages that are grouped into these clusters within orogen-parallel belts. It's no surprise that the world's largest mining companies, such as Glencore International Plc (GLNCY:OTCMKTS) and Freeport-McMoRan Inc. (FCX:NYSE), have a presence in this region.

Consequently, exploration efforts often prioritize known copper porphyry clusters or districts where the probability of discovering additional deposits is higher.

Interestingly, not only does the Hercules copper porphyry discovery appear to be the first large-scale copper porphyry found in Idaho, but it also lies within the same Cordilleran orogenic belt as the porphyries of the central Andes.

In other words, just as with the copper porphyries in the Andes, a single discovery suggests the potential for many more!

As expected, mining companies have been rushing to stake claims within the same area as Hercules. However, most have yet to achieve success.

But there is one company — one that many of you may already be familiar with through our newsletter — that has been actively operating in Idaho. In fact, alongside Hercules, THIS company was one of the only other operators in Washington County, Idaho, at the time of the discovery.

Consequently, their technical team already possessed a deep understanding of regional geology. They recognized its potential and were among the first to make key strategic claims while consolidating some of the most strategic ground in this emerging copper belt.

This company is. . .

NevGold Corp.

You can see the last report we did on NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) by clicking here.

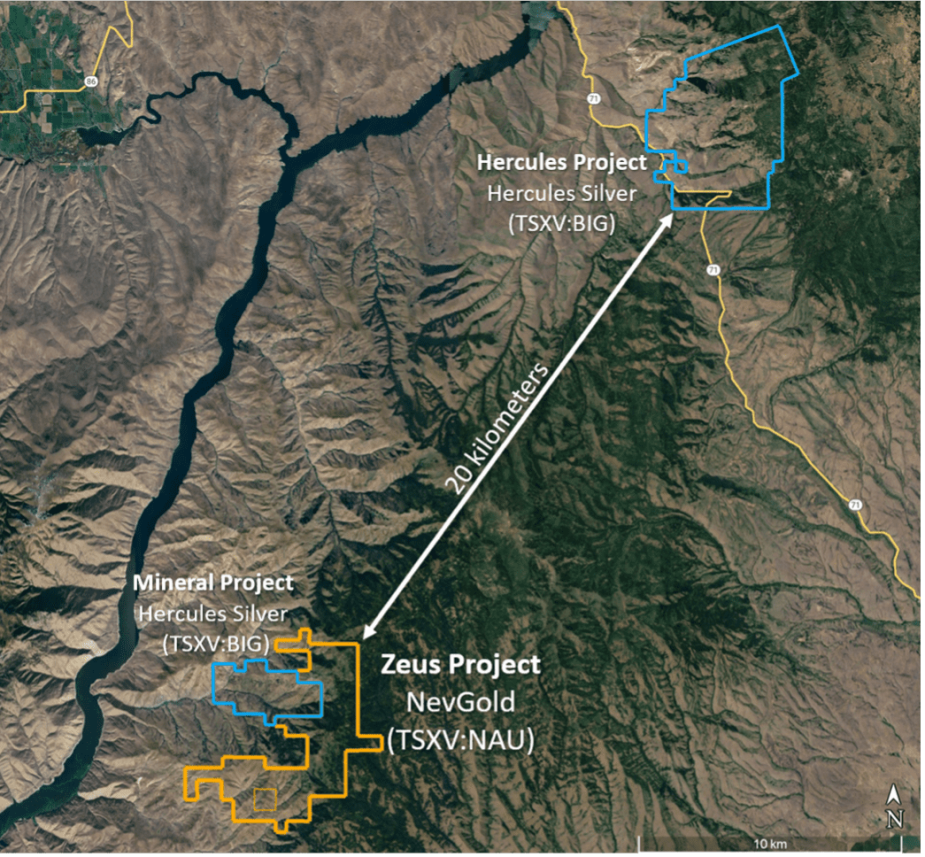

Around April, NevGold Corp. announced that it had staked roughly 20 square kilometers of land adjacent to the mineral claims owned by Hercules Silver Corp., the company responsible for the discovery of Hercules copper porphyry.

NevGold has named this new venture the Zeus Copper Project ("Zeus" or the "Project"), a name that seems quite appropriate given the potential scale of the discovery.

The Zeus project is situated 120 km northwest of Boise, Idaho, and 40 km northwest of NevGold's own Nutmeg Mountain gold project (for more information, click here). Additionally, Zeus is located approximately 20 kilometers southwest of Hercules's groundbreaking copper porphyry discovery.

The Zeus Copper Project benefits from a robust infrastructure, including excellent road access, ample water resources, and readily available power. The area boasts numerous nearby sources of both water and power, as well as an extensive network of roads leading directly to the Project site, making it easily accessible.

The recently staked claims cover some of the most promising land within the Hercules Copper Trend, hinting at the immense potential of the area.

But just how prospective is it?

Hercules themselves can attest to the region's potential. On October 2, 2023, Hercules entered into a lease option agreement to acquire the Mineral Project, which is located a mere 14 miles southwest of their flagship property. This strategic move underscores the company's confidence in the area's geological potential and its commitment to securing key assets within the trend.

Courtesy of Hercules Silver:

"Chris Paul, CEO and Director of the Company, noted: “We’ve entered into a lease option agreement to secure another key piece of ground in the Hercules mining district, which the Company believes shows strong potential to emerge into a significant copper porphyry belt. The Hercules Copper Belt, as it’s referred to internally, represents a trend of underexplored copper porphyry targets with excellent discovery potential. Relative to Hercules, the Mineral Project appears to be the next best developed prospect in the district and adds another compelling copper-gold porphyry target to the portfolio. We are highly encouraged by Mineral’s historical drilling, strong soil geochemistry and similar geological setting to the Hercules project."

You can see what NevGold was able to stake in the yellow outline below.

According to the geological mapping data compiled by the United States Geological Survey, the Zeus Project shares the same underlying geology as the Hercules Project.

Moreover, during the recent staking campaign, NevGold's geologists made several significant observations. They discovered numerous instances of copper mineralization and identified alteration signatures that are characteristic of copper porphyry systems throughout the newly acquired claims.

These findings further support the notion that the Zeus Project has the potential to host mineralization similar to that found at the Hercules Project, bolstering the area's prospectivity and increasing the likelihood of additional copper porphyry discoveries within the trend.

Here is what NevGold's geologist, Derick Unger, had to say:

"The Hercules copper porphyry discovery is one of the most exciting recent discoveries in the Western USA. Along with Hercules, NevGold was one of the only other operators in Washington County, Idaho.

Since acquiring Nutmeg Mountain two years ago, we have established strong infrastructure and local relationships while building a very good understanding of the local geology. This allowed us to move quickly to secure some of the most prospective ground on the entire Hercules Copper Trend, which saw a significant increase in land acquisition and exploration activity after the Hercules discovery was announced last October.

We have spent significant time in the field completing the staking process, and our team has been encouraged by the numerous indications of a large copper porphyry system at Zeus. The work now begins to target the best part of the system while we also continue to systematically advance Nutmeg Mountain and Limousine Butte."

Hercules' pursuit of the Mineral Project, represented by the blue lines on the map, is a clear indication that they perceive significant potential in the area. Interestingly, NevGold's recently staked claims now surround this highly prospective ground, placing the company in a strategically advantageous position.

The Juniors' Time To Shine

The current market conditions are particularly favorable for junior mining stocks, which haven't performed this well in a considerable amount of time. As mining companies reap the benefits of record-high gold prices, it is highly likely that this will lead to an increase in acquisitions and investments by larger industry players.

Moreover, from both macroeconomic and geopolitical standpoints, there are no compelling reasons to suggest that gold prices will not continue to climb higher.

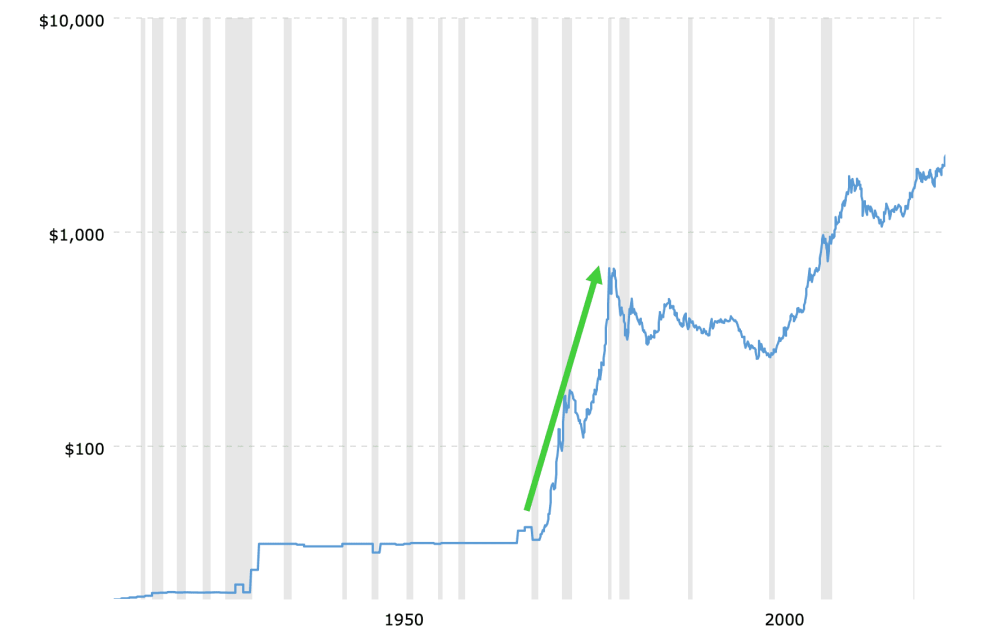

When the world transitioned from a gold-backed system to a purely fiat-based system, the price of gold skyrocketed from US$35/oz to nearly US$650/oz (not adjusted for inflation) in less than a decade. This historical precedent underscores the potential for gold prices to experience significant growth during periods of economic and geopolitical uncertainty.

The price increase from US$35/oz to nearly US$650/oz represents a staggering gain of more than 1740%.

Over the past month, we've seen clear evidence that junior gold stocks can deliver returns that far exceed the performance of gold itself.

As the global economy faces the prospect of shifting from traditional fiat currencies to Central Bank Digital Currencies (CBDCs), it begs the question: what impact will this transition have on the gold market and the performance of junior gold mining stocks?

[NLINSERT}

Important Disclosures:

- NevGold Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp. and Barrick Gold Corp.

- Ivan Lo: I, or members of my immediate household or family, own securities of: [COMPANY]. I personally am, or members of my immediate household or family are, paid by [COMPANY]. My company has a financial relationship with [COMPANY]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

The Equedia Weekly Letter Disclosures

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Nevgold (NAU) because the Company is an advertiser on www.equedia.com. We currently own shares of NAU. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in NAU or trading in NAU securities. NAU and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from NAU, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.