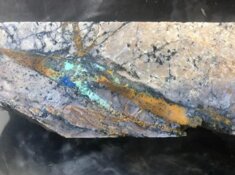

Giant Mining Corp. (BFG:CSE; BFGFF:OTC; YW5:FWB) highlighted progress at its flagship Majuba Hill Porphyry Copper Deposit in Nevada, underscoring a period of significant advancements from 2020 to 2023. The company's intensified exploration efforts have paid off with the discovery of new high-grade copper, silver, and gold mineralization zones, as well as the expansion of existing ones.

Result Highlights from the latest company release:

MHB-27: 1136 ft (346.3 m) at 0.25% copper equivalent (CuEQ) starting at 710 ft (216.4 m) including:

834 ft (254.2 m) at 0.31% CuEQ from 750 to 1584 (228.6-482.8 m)

119 ft (36.3 m) at 0.14% CuEQ from 1727-1846 ft (526.4-562.7m)

MHB-28: 1287 ft (392 m) at 0.30% CuEQ starting at 245 ft (74.7 m), including:

652 ft (198.7 m) at 0.33% CuEQ from 595 to 1247 ft

192 ft (58.5 m) at 0.21% CuEQ from 1340 to 1532 ft

105 ft (32 m) at 0.18% CuEQ from 1542 to 1647 ft

MHB-29: Intersected granodiorite porphyry at 3403 ft (1037 m). The entire hole is mineralized with 3607 ft (1099.4 m) at 0.05% CuEQ from 0 to 3607 ft.

- Strong potassic alteration that is overprinted by pervasive propylitization.

- Zoning within the Majuba Target Zone indicates MHB-29 is southwest of the main mineralized zone.

- Intersected 26 intervals greater than 0.20% CuEQ.

MHB-27 is mineralized throughout the entire hole with 3500 feet (1066.8 m) at 0.18% CuEQ1 from 0-3500 feet (0-1066.8 m).

CEO David Greenway remarked on the strategic exploration initiatives over the past years at Majuba Hill, "These efforts are bearing fruit, as demonstrated by our impressive drilling results and the expansion of mineralized zones. This success underpins our confidence in Majuba Hill's potential to become a cornerstone of America’s copper supply, essential for the burgeoning renewable energy sector."

There's hope for copper, mostly due to its dependable quality. As Katusa Research explained in April, it's even garnered a nickname because of that, "Of all the commodities, however, one that's particularly important to focus on is copper.

Dubbed "Doctor Copper" for its ability to gauge economic health . . . As one of the key building blocks of our modern society, if there's any commodity you'd expect to lead the way in a commodity rally, it'd be copper."

"Such a bullmarket is made all the more likely by the strongly bullish volume pattern of recent months that has driven a strong uptrend in the Accumulation line shown at the top of the chart, and momentum (MACD) is set to turn positive too," Technical Analyst Clive Maund wrote.

As Shad Marquitz of Excelsior Prosperity wrote on May 11, "2 months ago we had postulated that Dr. Copper had finally put on his dancing shoes, and proceeding action the last two months has further confirmed that thesis; with a solid close to end last week at (US)$4.66. We need to point out here that not only has the good doctor now definitively cleared last year's January peak at (US)$4.355, but it has cleared that whole slew of prior peaks back from 2021 and 2022 at (US)$4.628, (US)$4.471, (US)$4.511, (US)$4.601, and (US)$4.577. Yes, things are getting a bit overbought now on copper futures, with the RSI up to 74.52 on Friday's close (a level not seen since mid-2021), but still, this has been an impressive rally in copper any way one slices it. Even copper bears would have to admit this move has been strong with the force."

Malcolm Shaw of Hydra Capital also expressed interest in the copper market in a May article, writing, "In March, I expressed my desire for copper prices to surpass (US)$4 per pound, and my wish was promptly granted. As I write this, copper is trading at (US)$4.65, and while it may be exhibiting some frothiness, numerous thematic factors are working in its favor. The intersection of electrification and AI trends, coupled with a lack of investment in new mines, is occurring at a time when the process of discovering, planning, permitting, and constructing new mines has become more time-consuming and capital-intensive than ever before."

He continued, "Copper prices could skyrocket to (US)$6 tomorrow, and no one could do anything about it. The physical market is tight, copper is often irreplaceable, and (US)$6 is not exceptionally high in the grand scheme of things."

At the time of this article, the price of copper is US$5.14.

Catalysts

The successful closure of this financing represents a strategic bolstering of Giant Mining's financial resources, primarily aimed at advancing its projects.

CEO David Greenway highlighted the direct application of the net proceeds, stating, "The net proceeds from the private placement will be allocated toward further exploration activities on the company's Nevada project and for general corporate purposes."

He further expressed optimism about the company's trajectory, emphasizing the timing with copper prices peaking at US$4.59 per pound and the strategic positioning of their Majuba Hill project.

According to Greenway, "With our announced financing and our preparations to advance work at Majuba Hill, it's an optimal time for exploration. This project, hosting significant historical copper production and prospective new findings, positions us well for a transformative year in 2024."

This development is poised to catalyze the company's operations, particularly as it seeks to leverage the increasing demand for copper driven by global green initiatives and infrastructure projects.

Technical Experts

Technical analyst Clive Maund has shared a highly optimistic view of Giant Mining Corp., emphasizing the substantial potential for those looking to leverage capital in a high-opportunity, moderate-risk environment.

On May 6, 2024, Maund highlighted the dramatic transformation of the company, noting, "In its former incarnation as Majuba Hill Copper, the only things giant about the company were the potential of its Majuba Hill resource, which continues, and the magnitude of losses suffered by shareholders." He expressed enthusiasm for the company's future, especially with the recent restructuring and funding successes.

Maund pointed out the enticing investment appeal due to Giant Mining's current low stock price and a significantly reduced number of shares following a substantial rollback.

He stated, "There are only a tiny 3.4 million shares in issue, less than 2 million of which are in the float, so any tilt in the supply-demand balance will result in big gains in the stock." This situation, combined with the company's strategic position in a burgeoning copper market, presents a rare opportunity for speculative investors.

On May 14, Maund expressed optimism over Giant's 18-month future, writing, "The 18-month chart for Gladiator reveals that it is in the late stages of a basing pattern that has been building out since last July, so for 10 months now. This base pattern can be defined either as a Cup & Handle base with the Cup forming from September through December and the Handle of the pattern following, or as a Head-and-Shoulders bottom as shown, and since it is both at the same time, it can be thought of as a hybrid, as is often the case with chart patterns."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Giant Mining Corp. (BFG:CSE; BFGFF:OTC; YW5:FWB)

He continued, "The upper boundary or neckline of the H&S bottom is the band of resistance shown, so a breakout above this resistance will be what marks the start of the expected major bull market in the stock. Such a bullmarket is made all the more likely by the strongly bullish volume pattern of recent months that has driven a strong uptrend in the Accumulation line shown at the top of the chart, and momentum (MACD) is set to turn positive too."

Ownership and Share Structure

According to Giant Mining Corp., approximately 18.6% of its shares are held by insiders. The remaining shares are held by retail investors.

Giant Mining Corp. has a market capitalization of approximately CA$18.7 million. The company's shares are traded on the Canadian Securities Exchange (CSE) under the ticker BFG, on the Deutsche Boerse AG (DB) under the ticker YW5, and on the OTC Pink Sheets in the U.S. under the ticker BFGF.F, with these listings active since December 2017

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Giant Mining Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.