It's a good time to take another look at Silver North Resources Ltd. (SNAG:CVE;TARSF:OTCMKTS) because it is at another favorable buy spot. While the fundamentals of the company have been covered in previous articles, there has been one significant piece of news since we last looked at it a month ago, which is that SILVER NORTH OPTIONS GDR SILVER PROJECT.

Given the extraordinarily positive outlook for silver, it makes sense for the company to acquire more prospective ground, especially as it is close to their existing Tim property and is, therefore, logical from a logistical point of view.

Jason Weber, P.Geo., President and CEO of Silver North, commented, "The GDR acquisition represents a strategic move to acquire additional ground prospective for high-grade CRD silver mineralization in this under-explored district. "Despite the early-stage nature of these properties, all three have favorable characteristics for CRD mineralization. In particular, the Veronica claim group has a strong, unexplained multielement soil geochemical anomaly just west of our Tim Property. This complements the Tim Property nicely and gives Silver North access to more of the prospective stratigraphy in this district."

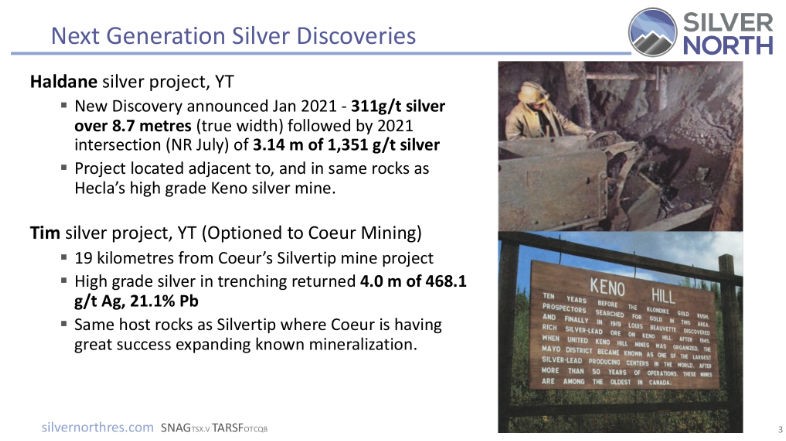

Before we move on to consider the all-important stock charts, it's worth grounding ourselves in the fundamental circumstances of the company by means of some interesting slides lifted from the company's latest Investor Deck.

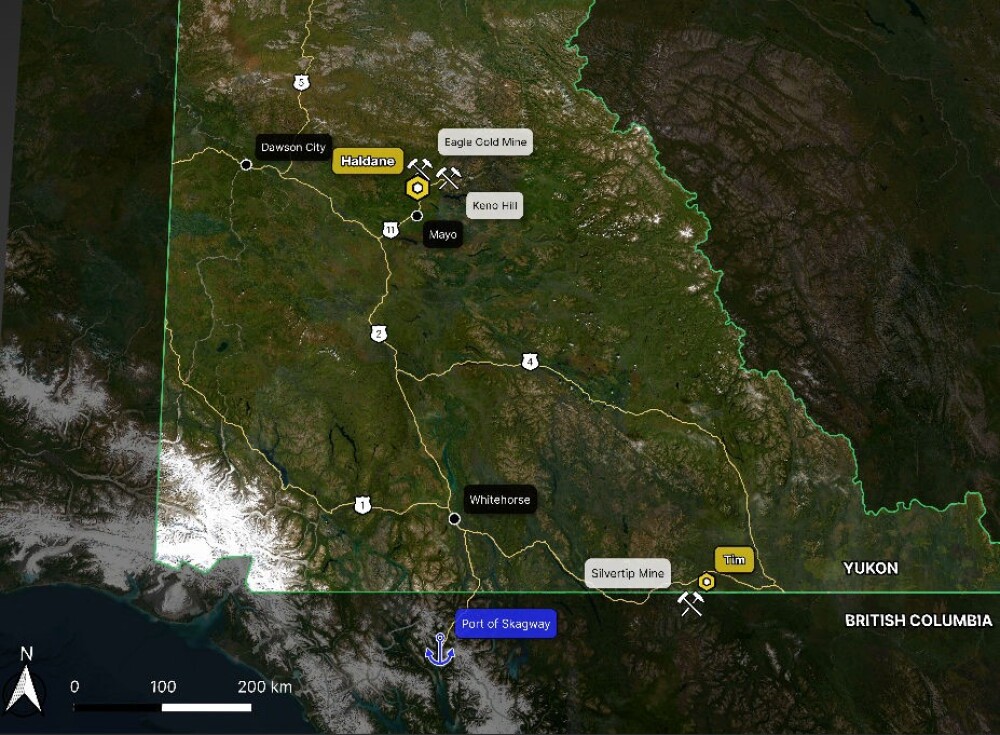

The company's two main properties are Haldane and Tim, both located in the Yukon Territory in Canada, some details of which are provided on the following slide.

The next slide shows the location of these two Yukon properties.

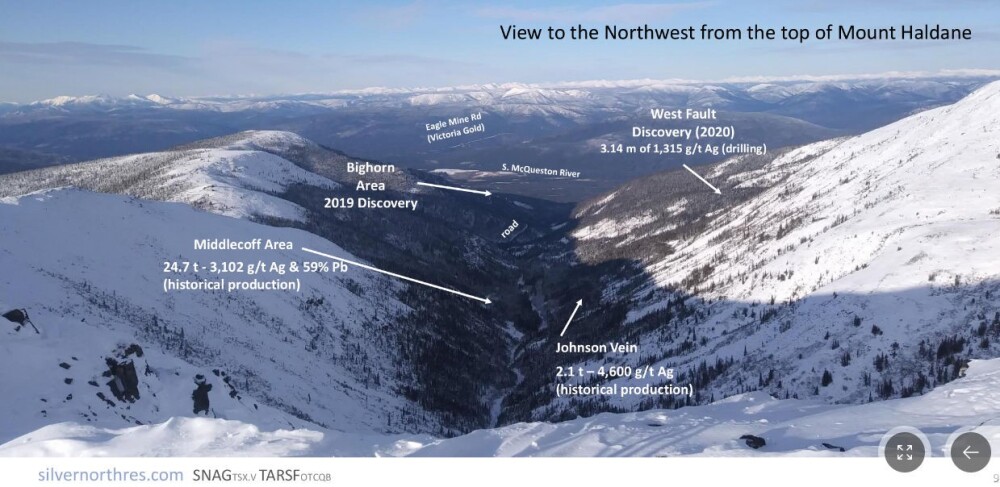

The following slide shows the view from Mt. Haldane and gives an idea of the local terrain.

The company's plans for the Haldane Project are summarized on this slide.

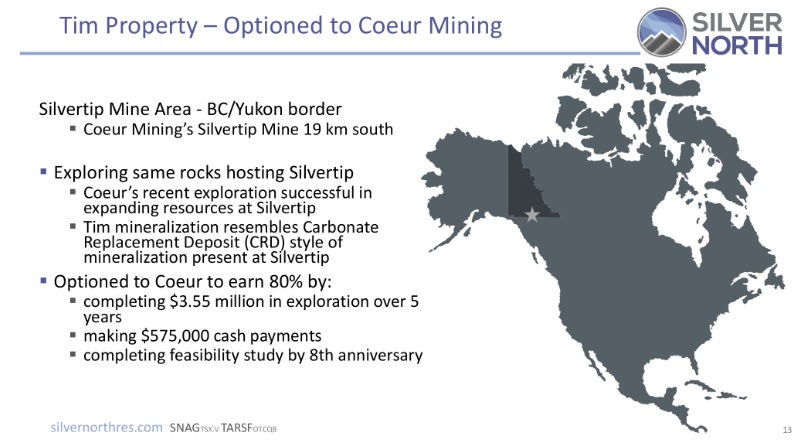

The company's other main project, the Tim property, is optioned to Coeur Mining, as detailed on this slide.

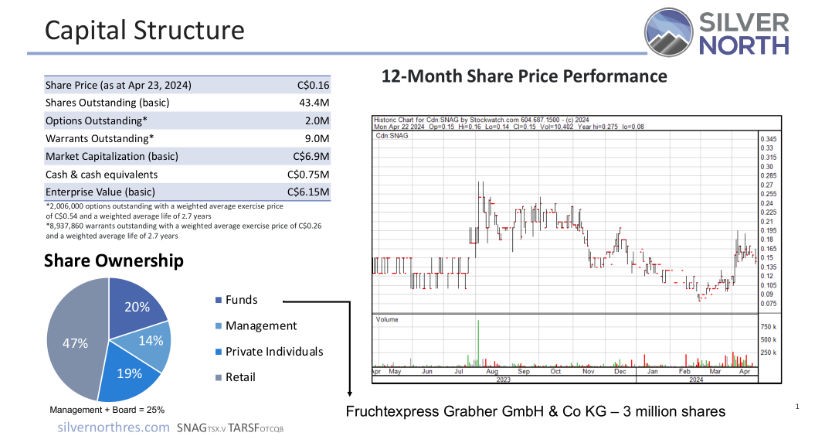

Lastly, this slide shows that of the 43.4 million shares is issue, more than half are owned by Management, Funds and Private Individuals, leaving 47% to Retail Investors.

If you want more information, especially regarding the company's properties and geology, go to the company's latest investor deck.

Turning now to the charts, we will soon see that we have another good entry point for Silver North Resources here following its dip this month back to the lower boundary of what can now be seen to be a rectangular trading range on its 6-month chart that is a "staging post" on its way to breaking out of the Triple Bottom base pattern that can clearly be seen on its longer-term charts.

The volume dieback on this dip is bullish, and the rising 50-day moving average is now coming into play beneath to drive an advance against the background of an increasingly strong silver price. If, as expected, it proceeds to break out the top of the rectangular trading range, it will soon lead to a bullish cross of the moving averages, which will mark the start of a major bull market.

On the 2-year chart, we can see in some detail the Triple Bottom that has formed since last October, how the price is now advancing away from the third low of the pattern, and a breakout from the entire base pattern will be signaled by the price breaking above the band of resistance that marks its upper boundary, which as we can see is at CA$0.28 – CA$0.30, and while it is still some way from achieving this, the flip side of this is that the stock will have doubled in price from its current level by the time it gets to the breakout point.

The 5-year chart is most encouraging as it shows us the recent base pattern in the context of the severe bear market that preceded it. This chart makes plain that Silver North is at a most attractive price for buyers here as it is clear that once it breaks out of the base pattern by clearing the nearby resistance, a major bull market will be in prospect that will result in substantial gains from the current low price.

The Accumulation line at the top of this chart is trending strongly higher, indicating a high probability that this scenario will eventuate, and the MACD indicator shows plenty of upside potential from here.

We, therefore, stay long, and Silver North is rated an Immediate Strong Buy for an advance soon from the lower boundary of its current rectangular trading range that will result in significant percentage gains from the current price as it moves toward breaking out of the base pattern into a major bull market.

The immediate first target for the advance is the top of the current trading range at CA$0.19 – CA$0.20. Click on this link to learn the higher targets for the stock.

Silver North Resources Ltd. (SNAG:CVE;TARSF:OTCMKTS) closed at CA$0.15, US$0.12 on May 16, 2024.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.