Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA) expanded its initial, phase one, 10-hole Geoprobe drill program to test additional prospective targets at its Columbus lithium-boron project near Tonopah, Nevada, after receiving permits for this specific low-cost, low-impact work, the company announced in a news release.

"This program is delivering valuable subsurface data within the highly conductive upper layers across kilometers of strike length," Canter Chief Executive Officer (CEO) Joness Lang said in the release.

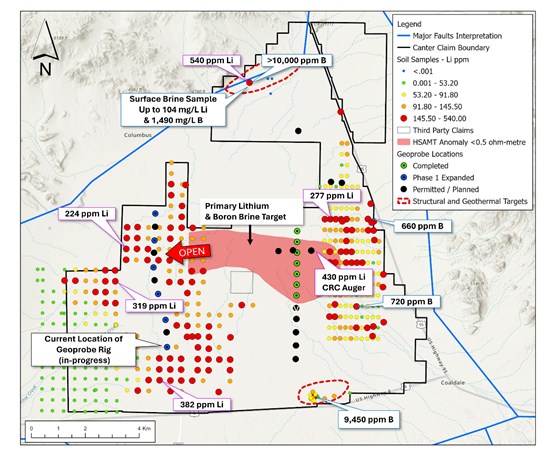

Now with permits for 22 locations, the explorer decided to Geoprobe drill another five to 10 holes in the upper 30 meters (30m) at Columbus. These further holes will be placed about 2 kilometers (2 km) to the west of the three-dimensional modeled HSAMT resistivity shells that remain open in that direction. This location is where surface sampling returned highly anomalous lithium values and where gaps exist in the current data.

In other news, the release noted that the gravel transport and stockpiling that began recently as part of the preparation work for drilling of the first well at Columbus is finished.

Before well drilling, though, Canter is looking to carry out a second phase of Geoprobe drilling, using a different type of rig that is low-cost, low-impact, and can reach depths as far down as 45 meters (45m), the company said. For this, Canter is preparing another 10 to 20 permit applications.

Plans for phase two are to Geoprobe drill two specific areas, south of the completed north-south grid and to the north of one of two known geothermal inputs.

"Geothermal activity is an important mechanism for liberating lithium and boron from sediments into brines, and the fact there are known geothermal inputs along structures at both ends of the basin provides additional support for enriched brine potential at Columbus," the release noted.

Standout Projects, People, Places

Based in Vancouver, British Columbia, Canter Resources is a junior lithium, boron, and critical metals explorer with three properties, now focused on advancing Columbus, its flagship asset.

"This project looks like it has world-class potential," wrote Chen Lin of What is Chen Buying? What is Chen Selling? on May 2. "They are not only exploring for lithium but boron as well."

Proof-of-concept drill holes and geophysical anomalies at Columbus outlined a target area highly prospective for lithium-boron brine, which Canter continues to explore. The potential for boron at this project is excellent, according to the company, given borax historically was produced there in the late 1800s and given Ioneer Ltd.'s feasibility-stage Rhyolite Ridge project, 17 miles away and sharing the same volcanic rocks boasts material boron concentrations.

"Significant historical boron values in sedimentary units from historical drilling at Columbus underpin the discovery potential," the company said.

The Columbus land package spans nearly 30,000 acres and comprises the largest claims position in Nevada's Columbus salt marsh, after which the project is named. It is a structurally and hydrologically closed basin surrounded by lithium-boron-bearing volcanics in Nevada.

The prospectivity of the large land package and the numerous lithium-boron targets there "reinforce what a strong speculation [Canter] is," wrote Jeff Clark, The Gold Advisor author, in April.

The Columbus project's location is notable. For one, it is in Nevada, a Tier 1 mining jurisdiction deemed the world's best by the Fraser Institute in 2022. Columbus is only a three-hour drive away from Tesla Inc.'s gigafactory, in the same state, which supplies lithium-ion batteries and components for Tesla's electric vehicles.

"Columbus is surrounded by other lithium discoveries in the area," Clark explained. "The geological team working on it, which this company bought into and hired, believes this particular piece of property is the most prospective of all the other lithium discoveries they've made in the area." Those discoveries include Ioneer, American Lithium Corp. (LIACF:US-OTC; LI:TSX.V; 5LA1:FSE), and American Battery Metals Corp. (ABC:CSE; FDVXF:OTCQB), the company said.

It also pointed out that exploration for lithium-boron brine mineralization requires less drilling and happens more rapidly than with hardrock mineralization. Whereas hardrock generally needs to be drilled at 25-meter centers to achieve a resource, lithium brine deposits can be drilled at 1-km centers. Therefore, assuming Canter has success drilling at Columbus, the path toward an initial resource estimate is straightforward and years faster than would be the case with a hardrock deposit.

"Lithium discoveries happen quickly, and market caps follow, meaning with success, stocks can move very quickly," the company added.

Canter's team, Clark described, is made up of "people that can be very aggressive, know how to move a project forward aggressively, and have had success in the past." This group, formerly of American Pacific Mining Corp. (USGD:CSE; USGDF:OTCQX), has a solid track record in navigating corporate and capital markets as well as mining exploration and discovery. American Pacific was named the world's top-performing gold stock globally in 2021 and was a finalist in the running for Deal of the Year in 2021 and 2022, part of the S&P Global Platts Metals Awards.

The junior mineral explorer also fully owns the Beaver Creek lithium property, covering a 1.3 km long by 0.3 km wide bed of lithium-rich outcrop near Lincoln, Montana. There, 99 surface samples returned lithium grades up to 1,500 parts per million (1,500 ppm) and averaged 500 ppm. The Canadian explorer plans to do additional sampling from and mapping of this prospective area to validate historical data and further investigate the potential of these lithium occurrences, according to its 2024 corporate presentation.

Looking forward, Canter has a catalyst-rich year ahead. According to an April 22 analysis by Capital Cube, the company has sufficient funds to finance its current exploration program and will not need to raise capital in the immediate future.

Sectors Critical to Green Energy

Both the lithium and boron sectors are growing around the world.

As for lithium, the need for the metal is constant, given its use in lithium-ion batteries that power a vast array of products, from remote controls and cellphones to large appliances and electric vehicles, according to Eco Lithium. Other applications include digital cameras, pacemakers, laptops, watches, power packs, mobility scooters, alarm systems, backup power systems, golf carts, and energy storage.

In the U.S., the Inflation Reduction Act is encouraging the discovery and development of a domestic lithium supply. This federal law passed in 2022, mandates that beginning in 2024, 40% of critical minerals found in electric vehicle batteries, such as lithium, be extracted or processed in the U.S. or in countries with which it has free trade agreements, a 2022 Forbes article explained. By the end of 2026, 80% must meet the requirement. Also, starting this year, 50% of battery components will have to be manufactured or assembled in North America, and by the end of 2028, 100% must be.

Global demand for lithium has been rising steadily since 2020 and is expected to continue this trend to at least 2035, Statista data show. By then, demand will have reached an estimated 3,829,000 metric tons of lithium carbonate equivalent, a 317.5% increase over demand last year of 917,000 metric tons.

As for the lithium market today, the bottom "is absolutely in," according to Gerardo del Real, editor of Resource Stock Digest. "We're definitely starting to see some of the equities respond," he wrote in an April 29 article.

Looking forward, the lithium market is projected to expand at a 20.4% compound annual growth rate (CAGR) to US$6.4 billion (US$6.4B) by 2028 from US$2.5B in 2023, according to Markets and Markets.

"Investors are going to need the best lithium stocks in their portfolio so that they can capitalize on the growing prices that growing demand is going to bring with it," Jason Williams, managing editor of Wealth Daily newsletter, wrote on May 2.

With respect to boron, Hallgarten + Co. called it the "low-flying tech metal" in a March 2 report.

"Boron has an enormous range of uses, from high-tech to the mundane, with one of the most talked about being neodymium-iron-boron permanent magnets in electric vehicle motors," the report said.

Boron/borates are used in applications in agriculture, metallurgy, nuclear energy, and advanced materials, Mordor Intelligence noted. The increasing use of fiberglass in various end-user industries is also boosting demand. According to the U.S. Geological Survey, borates are also used in abrasives, cleaning products, insecticides, insulation, ceramics, and semiconductors.

"The boron ("B") market is rapidly emerging as a critical mineral due to its use in numerous high-tech and clean energy applications, making the presence of boron mineralization at the Columbus project potentially significant," Canter said.

Demand for boron "is strong and growing with CAGR exceeding most forecasts of just a few years ago," Hallgarten + Co. also wrote. Further, demand is expected to outpace supply, thereby resulting in a fairly rapid widening of the gap between the two.

The Business Research Co. reports the global boron market has grown "exponentially in recent years" and forecasts it will reach US$7.99B this year, up from US$6.57B in 2023, reflecting a 21.7% CAGR. Rapid growth is expected to continue through 2028 by which time the market is projected to reach US$12.68B.

"Major trends in the forecast period include a focus on boron neutron capture therapy, boron in the aerospace industry, boron-based flame retardants, boron in nuclear power applications, sustainable mining practices," the report indicated.

Canter's Lang pointed out that two companies, Turkey's state-owned Eti Maden and Rio Tinto Plc's (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) U.S. Borax, are the primary sources of mined boron.

"So, scarcity of supply and challenging to find significant boron concentrations, and we believe we may have just that here at Columbus," the CEO added.

Near-Term Catalysts Aplenty

Canter expects to complete the expanded phase one Geoprobe drill program by the middle of this month. The results should be released about two to four weeks afterward.

After the conclusion of phase one and once it receives the necessary permits, Canter will likely embark on phase two of Geoprobe drilling, likely in late H1/24, followed by the announcement of the results sometime in H2/24.

Meanwhile, the company is looking to acquire additional property based on its target database, and this could happen any time this year.

Experts Like Canter, Its Prospects

Three newsletter writers with expertise in the mining space are bullish on Canter Resources.

David Morgan, metals/minerals analyst and founder/publisher of The Morgan Report, predicts that the Canadian explorer will outperform.

"The backers of Canter have brought good profits to us and founded such companies as USGD.cn [American Pacific Mining Corp.], UUSA.cn [Kraken Energy Corp.] and Silver Hammer Mining Corp. (HAMR:CSE; HAMRF:OTCQB)," Morgan wrote last November. "All these stocks had a huge run out of the gate, and I expect [Canter] to do the same."

The Gold Advisor's Clark pointed out recently that Canter's stock price right now, far below its one-year high, makes for a good entry point for new investors. Clark himself has a position in Canter, which he said he is holding, and he suggested that other shareholders maintain their investment as well.

According to What is Chen Buying?'s Lin, Canter's Columbus project "is a lithium discovery in the making in Nevada."

Ownership and Share Structure

Streetwise Ownership Overview*

Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA)

According to Reuters, six strategic investors own 9.6%, or 4.89 million (4.89M) shares, of Canter Resources. The five with the largest stake are all insiders. Listed from most to least shares owned, they are CEO and Director Joness Lang with 3.3% or 1.69M shares, Director and Strategic Adviser Warwick Smith with 2.16% or 1.1M shares, Director and Technical Adviser Kenneth Cunningham with 1.96% or 1M shares, Chief Financial Officer Alnesh Mohan with 0.98% or 0.5M shares and Director and Technical Adviser Eric Saderholm with 0.59% or 0.3M shares. Strategic Advisor, Michael Gentile, co-founder of Bastion Asset Management, owns 4.12% or 2.1M shares.

Four institutions or funds, including Euro Pacific Asset Management, collectively hold 3.33% or 1.7M shares.

Retail investors own the remaining.

The Canadian explorer has 50.99M outstanding shares, 46.15M free float traded shares, 3.7M warrants, and 580,000 options, said the company, with a CA$14.3 million market cap.

Over the past 52 weeks, Canter has traded between CA$0.07 and CA$0.99 per share.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Canter Resources Corp. and Silver Hammer Mining Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Canter Resources Corp., American Pacific Mining Corp., and Silver Hammer Mining Corp..

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.