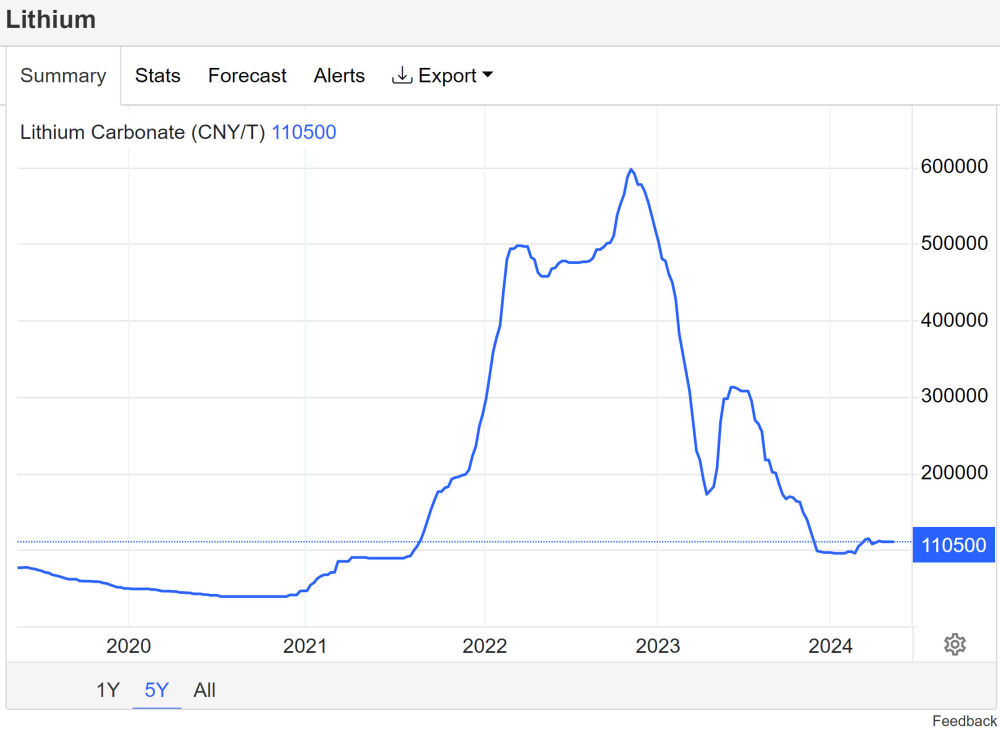

There are a number of reasons why lithium junior Xplore Resources Corp. (XPLR:TSX; XPRCF:OTC) looks attractive here. The first and perhaps most important is that, after a brutal bear market last year, lithium itself looks like it will soon begin a new bull market by breaking out of the low Cup and Handle base that has been forming in it since late last year and if this happens it will obviously rekindle interest in the sector.

The severity of the bear market can be seen on the 5-year lithium chart below, with the massive boom in lithium prices in 2021 and 2022 followed by a bust that is almost as big. This was a classic boom and bust cycle, with the price being driven higher by rampant speculation that eventually resulted in oversupply and a consequent bust.

However, the demand for lithium has not gone away and looks set to increase partly due to the huge demand associated with batteries, etc. So, it is in order for a new bullmarket to commence soon, especially as commodities in general are set to advance in the face of intense inflationary pressures.

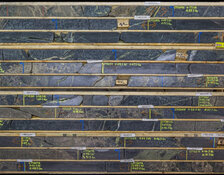

In addition to the prospects for a rising lithium price benefiting the company and its stock, other favorable factors more specific to the company include that it holds a key land position in the Root Bay lithium trend in Ontario, where it entered into an option agreement to acquire a 100% interest in 5 additional properties and it will be actively exploring a part of these properties with a drill program beginning about now, or soon — and this is hard rock lithium, not brine pool lithium where you have to hang around waiting for evaporation from the brine pools. The company just closed a financing, so this constraint on appreciation of the stock is no longer in play. Lastly, given the potential of its properties in Ontario, the company is considered to be a potential takeover candidate.

Now, we will review the stock charts for Xplore.

Starting with an 8-year chart, which shows the entire history of the stock, we see that it has been in a bear market since it started trading in 2017 until it hit bottom late in 2022. Then, after rallying sharply from that low, it dropped back again late in 2023 to form a Double Bottom with the 2022 low before suddenly breaking out of the entire base pattern and soaring up to CA$0.20, after which it went into a wide trading range that continued up to the present.

Now, we will zoom in via the 2-year chart, which is better for seeing the Double Bottom and subsequent action more clearly. On this chart, we can see the details of the Double Bottom that formed in 2022 and 2023 and how the breakout from this base pattern last October was dramatic with it making a big gap move higher, although this breakout was not on very much volume.

Since that move it continued higher for the next month or two before settling into a trading range that has formed above the support shown that was formerly the resistance marking the upper boundary of the base pattern. Now, we will attempt to define this trading range using an 8-month chart.

On the 8-month chart, we can see that the trading range has taken the form of a "Diamond." Diamonds are clear patterns, but rare, and in drawing this pattern, we have intentionally ignored the low volume freak move-up that occurred towards the end of December. Rather like Symmetrical Triangle patterns with which they are related, Diamonds can be either consolidation patterns or tops.

In the case of Xplore, this Diamond is thought to be the former, a consolidation pattern that will lead to renewed advance for the reasons set out above.

Given that Xplore is now rather oversold after the reaction back of the past couple of weeks and that it is close to the lower boundary of the Diamond and also close to its rising 200-day moving average with moving averages in quite strongly bullish alignment, this looks like a good place to buy the stock, which is rated a Strong Speculative Buy for all timeframes.

Xplore Resources Corp.'s website.

Xplore Resources Corp. (XPLR:TSX; XPRCF:OTC) closed at CA$0.115 on May 10, 2024

Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Xplore Resources Inc.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.