Cannabis shares soared last week on reports that the U.S. Drug Enforcement Agency (DEA) would reclassify cannabis, potentially opening up access to certain tax deductions that the industry was previously denied access to. The Wall Street Journal reports that restrictions related to cannabis businesses dealing in a product that is categorized as a Schedule I narcotic — which is legally defined as trafficking a controlled substance by Section 280E of the federal tax code — meant that these firms were often on the hook for an effective tax rate of 70% or more. Without the change in cannabis's scheduling at the DEA, Whitney Economics has forecast that licensed U.S. cannabis enterprises could pay $2.3 billion more in federal taxes in 2024 than they would under normal business tax rules.

MRP first covered the prospect of cannabis rescheduling last August after the U.S. Department of Health and Human Services (HHS) first recommended that the drug should be reclassified as a lower-priority Schedule III narcotic under the Controlled Substances Act. DEA drug scheduling runs from one to five, with drugs at the top end of that scale, like cannabis, supposedly having a high potential for abuse with no accepted medical use, along with a lack of accepted safety for use under medical supervision. This puts cannabis on par with narcotics like heroin and fentanyl. A reclassification down to Schedule III would imply that cannabis only has moderate to low potential for physical and psychological dependence and is comparative to certain anabolic steroids and ketamine.

Lowering cannabis firms' tax bills will take some pressure off of the industry, which has been receding under the weight of high interest rates, a glut of supply, and legislative deadlock. A survey of 224 businesses in the U.S. cannabis sector across 13 states, conducted by Whitney Economics, showed that only 24.4% were profitable enterprises in 2022. Total active licenses in regulated medicinal and recreational marijuana markets, tracked by CRB monitor, fell -6% QoQ in the first quarter of 2024, marking the fifth consecutive quarter of decline. Additionally, the count of active U.S. licenses fell on an annual basis for the first time ever, dropping by -10% YoY.

The cultivation category has experienced the largest decline in the number of active licenses, likely reflective of overflowing stockpiles of flower, concentrates, and extract supplies across some of the largest North American markets. In May 2023, MRP noted that California, Michigan, Oregon, and others have each felt the squeeze of massive supply overhang and, therefore, falling wholesale and retail prices. Meanwhile, the cost of virtually everything else has risen sharply with inflation.

With legal interstate commerce nearly impossible under the current prohibition, there is no way to move cannabis outside of the state where it was grown and stored. If a state produces a surplus above the demand within its own borders, it cannot export that surplus to other markets or countries that could be potential buyers of the excess product. According to Cannabis Benchmarks's U.S. spot index, the national cannabis price was gauged at $1,035 per pound in the week to May 3. That's roughly equivalent to this time last year but up almost 6% since our August 2023 report. The implied forward curve suggests prices will largely hold steady around current levels through November.

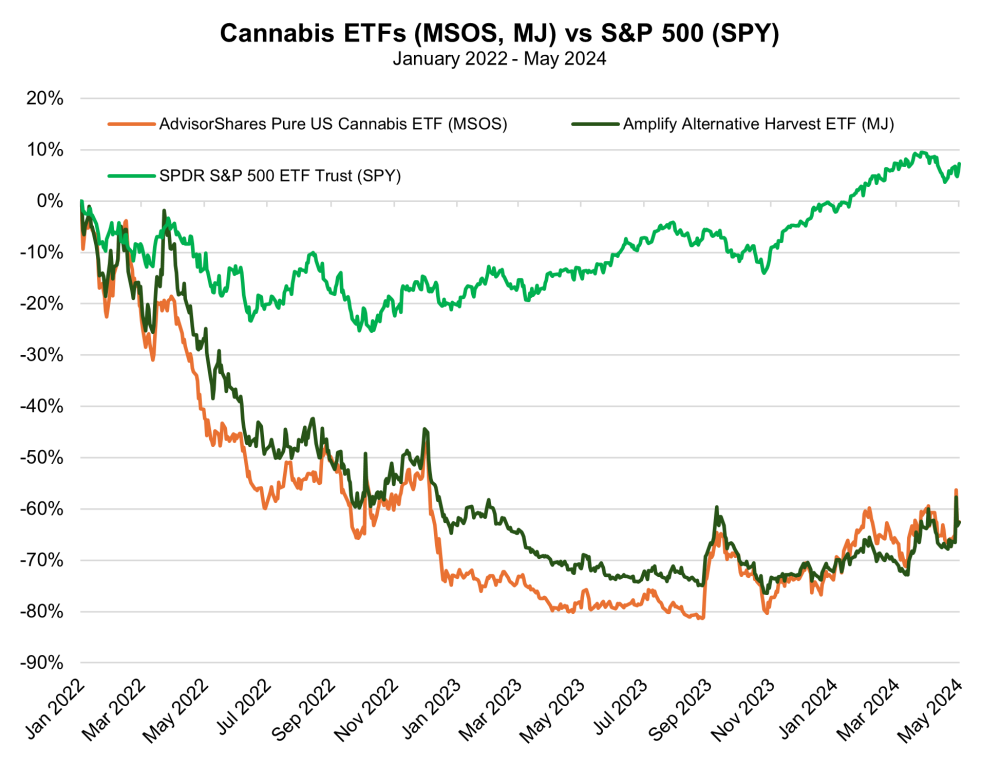

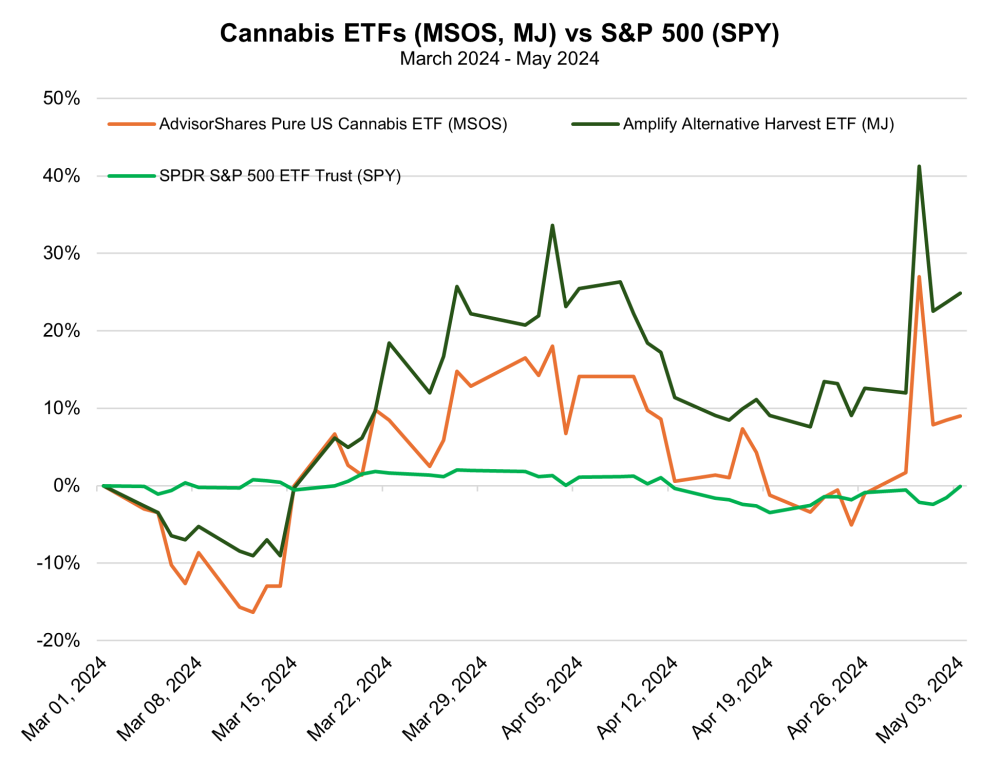

A large portion of the gains cannabis firms enjoyed last Tuesday have been given back in the days since, likely reflecting the realization that it will take some months for the DEA to change its rules. This effort will likely face legal challenges and a comment period before the President could sign off on a final version of cannabis's revised scheduling. Shares of AdvisorShares Pure U.S. Cannabis ETF (MSOS) swung by more than a quarter, from under $9.00 per share to almost $11.30, on April 30. However, as of this morning, MSOS was trading at roughly $9.70 – down about -14% from that high.

Next to an outright end to the prohibition of cannabis at the federal level, MRP has noted for years that sweeping reform addressing access to financial institutions is what has been most desperately needed by the U.S. cannabis industry for several years. Nearly 40 U.S. states have legalized marijuana use in some form, with 24 now allowing the use and regulated sale of marijuana for recreational use, but businesses working in this sector lack access to federally chartered banks or any framework for interstate commerce. Most banks in the U.S. are federally chartered and, therefore, have to do their business according to federal laws and regulations — particularly those regarding narcotics. Some state-chartered banks are more open to doing business with cannabis companies, but lack of access to financial infrastructure in the banking system has created a very cash-intensive industry, opening businesses up to a wave of robberies targeting dispensaries and other places that cannabis businesses might be stashing money they can't get into a bank. Those vulnerabilities raise the cost of doing business by forcing firms to hire extra security, pay for greater insurance, etc. Per Reuters, only about 10% of all U.S. Banks and about 5% of all credit unions provide cannabis-related businesses with accounts.

Multiple pieces of legislation, like the various forms of Secure and Fair Enforcement Regulation (SAFER, formerly known as SAFE) Banking Act, meant to increase cannabis firms' access to financial services, has been tossed around Congress for several years. Previous iterations of SAFER, specifically, have passed the House of Representatives numerous times, only to be stonewalled by the Senate. SAFER, which originated in the upper chamber, made it out of the Senate Banking Committee last September, putting it on track for an eventual floor vote by the entire Senate. That journey had been held up by broader federal budget negotiations that only wrapped up in late March. Senate Majority Leader Chuck Schumer (D-NY) had suggested that the chamber could"realistically" be expected to pass before November's Presidential election but also said it "won't be easy."

The SAFE Banking Act of 2023, which was introduced in the Senate but never made it through the Financial Services Committee, had eight Republican cosponsors and presumed unanimous support among the 51 Democrats and Independents in the chamber, leaving the Senate just one vote shy of a filibuster-proof majority of 60. The current SAFER bill, however, carries just four Republican cosponsors, suggesting that concessions made in the committee stage were not favorable among conservative Senators or the Republicans are determined to deny the Democratic incumbent, President Biden, a key legislative victory in the last mile of his re-election bid. Even if SAFER clears the Senate, the bill will need to be sent back to the House of Representatives for approval before reaching the President's desk. Recent guidance from the House Republican Policy Committee has advised Republican lawmakers in the House of Representatives to vote against SAFER.

Charts

| Want to be the first to know about interesting Cannabis investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.