North Shore Uranium Ltd. (NSU:TSX) President and Chief Executive Officer Brooke Clements is excited for assay results expected back soon from its maiden drilling program at the Falcon uranium project in Saskatchewan's Athabasca Basin.

In an earlier news release, Clements and the company noted that general results, which included elevated gamma probe readings at two targets, were "encouraging." The final assays should be released sometime this month.

"For a first program and a new area that we're just getting our feet wet (in), we feel really encouraged about the results from the field," Clements told Streetwise Reports.

The company is also planning for a field program to prospect and take samples at a number of potential drill targets for the element needed for green energy transition.

Technical Analyst Clive Maund noted this week that on the basis of the coming results and the company's charts, the case for buying the stock is "clear, simple, and STRONG."

"North Shore is a stock that we went for too soon," Maund wrote. But "of particular note for investors is that drill sample results (from the March drilling program) are expected very soon. This could move the stock and might help explain the strong Accumulation we are seeing on the stock chart."

Maund said he was staying long and rated North Shore a Strong Buy for all timeframes, "with the case for buying it here considerably improved than when we first looked at it."

Red Cloud Securities analyst David Talbot wrote in an updated research note in March that Falcon is "prospective for Athabasca-style and pegmatite-hosted mineralization."

Technical Analyst Clive Maund noted this week that on the basis of the coming results and the company's charts, the case for buying the stock is "clear, simple, and STRONG."

"The structures and alteration typical of basement hosted uranium mineralization was identified by this initial drill program," wrote Talbot, who did not rate the stock but noted that further exploration could warrant rerating.

"It confirmed the presence of sub-vertical, altered graphitic structures with associated graphite and radioactivity at predicted locations. We see the results as a positive first step, and plans are to continue to work at Falcon by testing other high-priority drill targets."

Three targets associated with EM conductors were drilled at Falcon: P03, P08 and P12, the company said. Drilling at P03 and P08 intersected the targeted subvertical EM conductors and encountered favorable structures very close to the depths predicted by previously created three-dimensional plate models.

In terms of radioactivity, total count gamma probe readings were elevated at P08 and P03, the maximum total count at the latter being 2,695 counts per second at P03.

The Catalyst: Prospects Are 'Clearly Very Good'

The Athabasca basin is a Tier 1 jurisdiction and "home to the world's highest-grade uranium deposits that provide over 20% of the world's uranium supply," Maund has noted. "New exploration methods and technical developments have yielded multiple significant discoveries on and near the perimeter of the basin, where there is the advantage of much less overburden than exists towards the center of the basin."

Also nearby are Cameco Corp.'s (CCO:TSX; CCJ:NYSE) and Orano Canada’s Key Lake uranium mill and former mine and the Cigar Lake and MacArthur River projects, along with Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT) and Orano Canada’s McClean Lake project. "Since they are in the same belt along the east side of the Athabasca basin, the prospects for significant discoveries on North Shore's claims are clearly very good," added Maund.

Headquartered in British Columbia, North Shore is an "early-stage explorer with significant upside potential in the Athabasca basin," Talbot wrote. The company is focused on the basin's eastern margin, where it is exploring for economic uranium deposits. It is also evaluating opportunities to add more properties in the region to its portfolio.

Red Cloud Securities analyst David Talbot wrote in an updated research note in March that Falcon is "prospective for Athabasca-style and pegmatite-hosted mineralization."

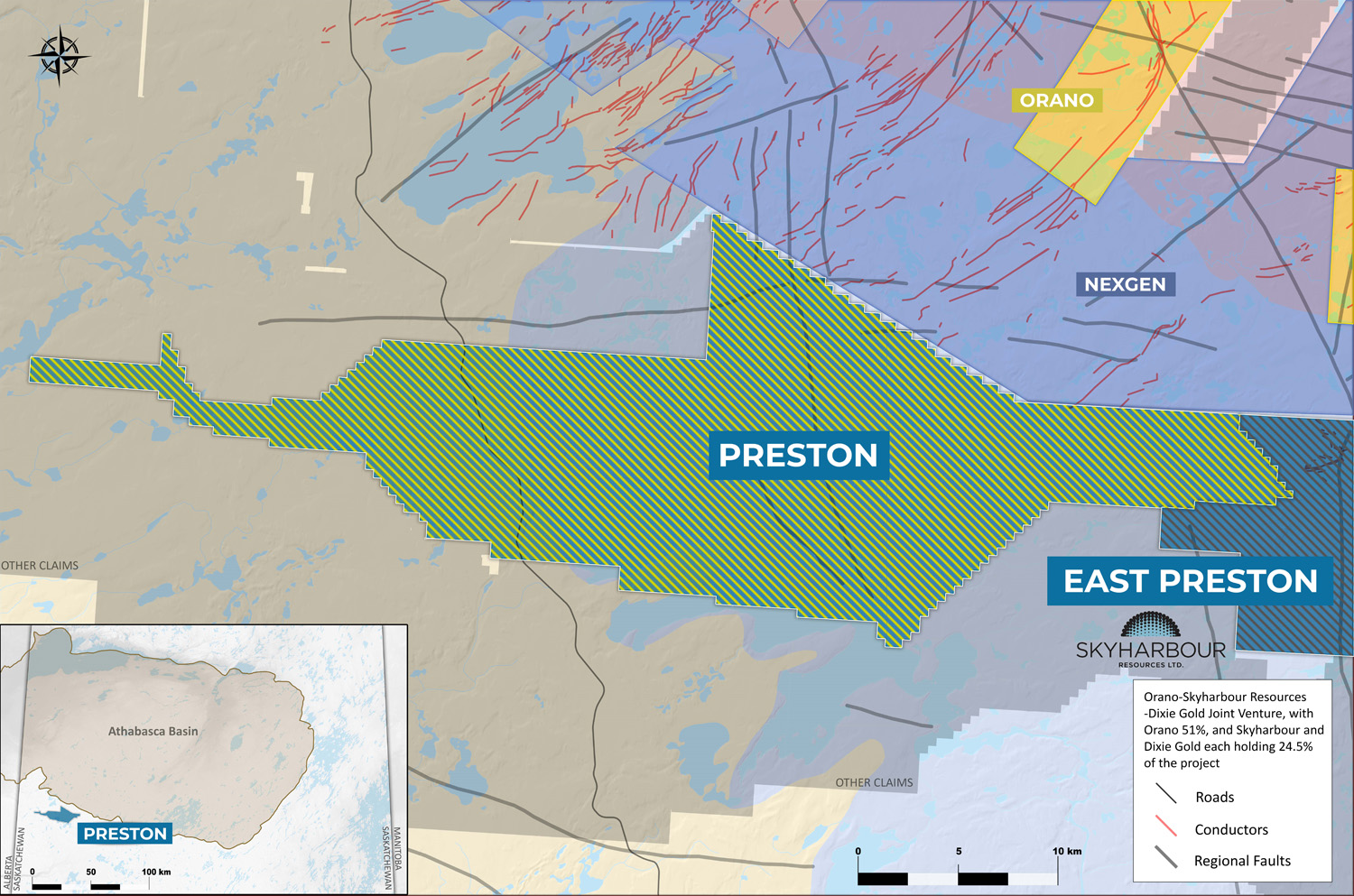

The Falcon project comprises 15 mineral claims. North Shore owns four, covering 12,791 hectares (12,791 ha), and Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) owns the rest, spanning 42,908 ha. However, North Share has the option to earn an initial 80% stake on the rest, which it is working toward now, and to purchase the remaining 20% interest after the initial earn-in.

Falcon has seen limited drilling, including 28 holes drilled in 2008 that returned up to 0.235% U308.

"Multiple high-priority untested targets on the property have the potential for basement-hosted uranium mineralization," the company said. "Using its proven exploration methods, the company will continue to prioritize these targets for future field evaluation and drilling."

'A Real, Solid Demand'

According to Talbot and Red Cloud Securities, the outlook for nuclear power and small modular reactors in the short and long term is positive. This is evidenced by "proactive government policies, public acceptance, better economics, climate change impacts and security of supply," he wrote.

This improved attitude, continued Talbot, has led to increased uranium demand and higher uranium prices. This bodes well for the uranium market and uranium companies looking for incentives to make discoveries and develop new mines.

In the fight against climate change, "the general public started to realize we need more nuclear power," Clements said. "But more importantly, they started to accept it."

There is a feeling in the industry that demand is going to keep increasing now, he said.

"Lots of places like Michigan (and) California that had had plans to decommission nuclear plants are now trying to extend their life," Clements noted. "So, there's a real, solid demand. … And that means we need a lot more uranium deposits. A new high-grade uranium discovery near an existing mill would be very valuable."

Stock Looks Ready to Break Out

Since the start of 2023, the U308 spot price jumped more than 100% to US$106 per pound in January and has since retreated; however, it still remains around US$90 per pound (up about 80% since January 2023) and Red Cloud sees significantly more upside.

Red Cloud's uranium spot price estimates are set to steadily increase over the next four years from US$120 per pound for 2024, to US$135 per pound for 2025, US$150 per pound for 2026, and US$175 per pound for 2027.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

North Shore Uranium Ltd. (NSU:TSX)

| Strike Price | Number | Expiry Date |

|---|---|---|

| $0.1 | 465,000 | 03/22/2024 |

| $0.3 | 210,014 | 10/26/2025 |

"Fortunately, we are starting to see the much-needed uranium price incentive, leading to exploration and mining projects being taken off the shelf, new exploration companies are emerging, and equity investment into uranium stocks continues at a torrid pace," Talbot wrote.

Maund noted that the nuclear power industry is in "growth mode and is deemed to be of critical importance in meeting carbon dioxide emission reduction goals with the recent COP28 declaration to triple nuclear power by 2050."

He also highlighted that the pending drill sample results should be a big catalyst for the company and said he is seeing increasing chances of an upside breakout soon.

Ownership and Share Structure

According to North Shore, there are 36,830,960 shares outstanding, and 45% of the shares are held by management, directors, and founding investors.

CEO Brooke Clements owns 3.34%, with 1.23 million shares.

The company told Streetwise, "Directors and founding investors took down 1.10 million of the 7.7 million shares in the initial financing, which closed on October 31, 2023, 14.3% of the offering. This is a sign of our commitment to building a strong company."

The company currently has a market cap of CA$4.4 million and trades in a 52-week range of CA$0.11 and CA$0.30.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- North Shore Uranium Ltd. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of North Shore Uranium Ltd. and Cameco Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Contributing Author Disclosures

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.