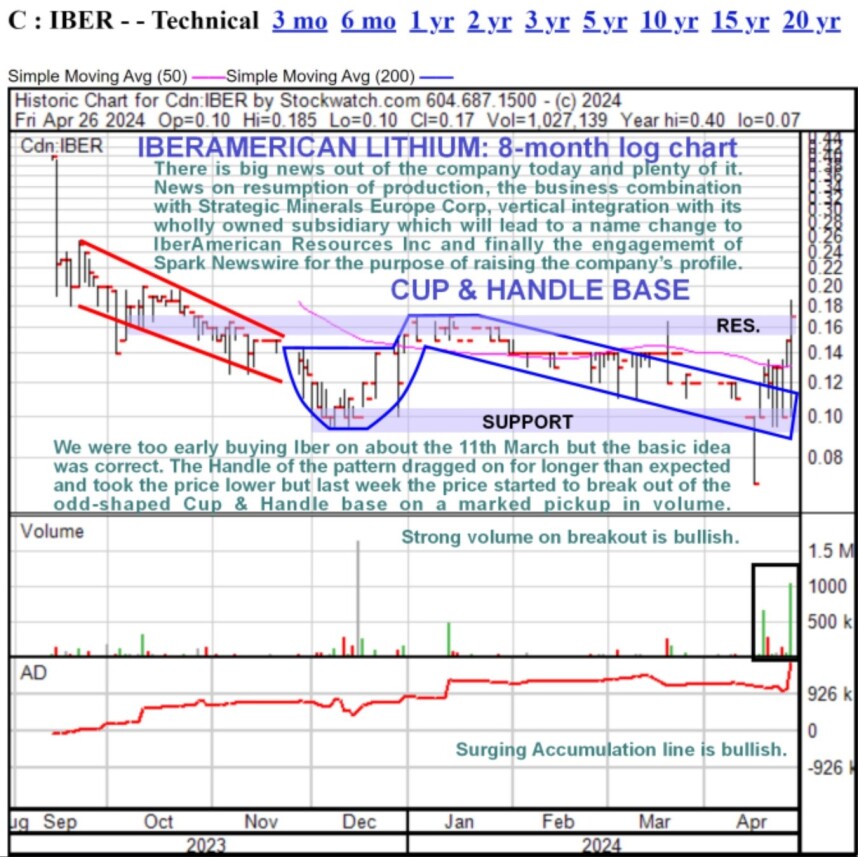

IberAmerican Lithium Corp. (IBER:CBOE; IBRLF:OTCQB) was the subject of an article posted on March 11, when the stock was recommended on both fundamental and technical grounds. In the event, the recommendation was rather too early as it went on to drop to a lower level before completing its odd-shaped Cup and Handle base.

Yet the basic idea was correct, for it has just last week broken out upside from the pattern due to the rapidly improving fundamental situation for the company so that we are now up on where we bought and the reason for this update is that the company came out with a range of positive news announcements early today that are thought like to drive the stock price higher still.

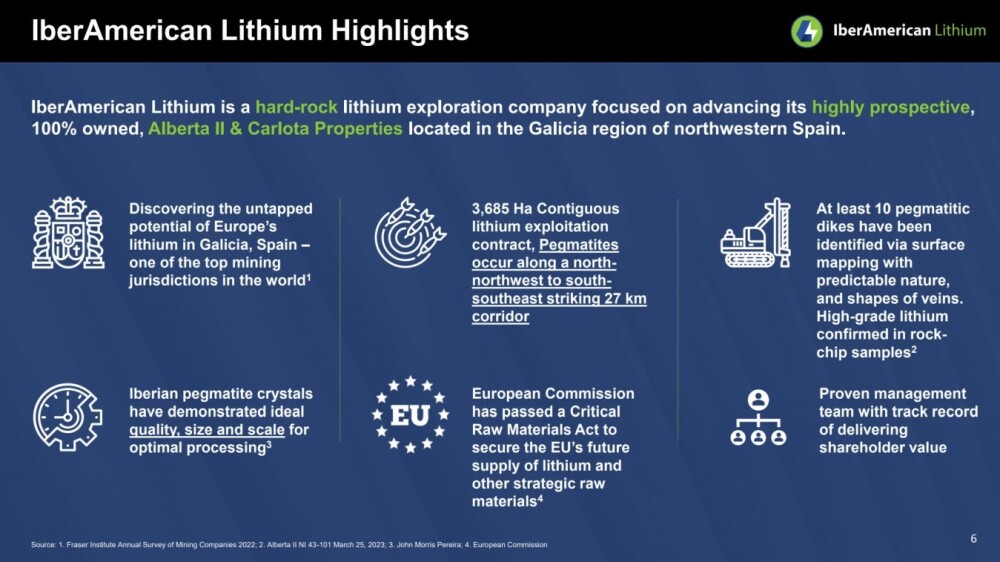

The news out today included a business combination with Strategic Minerals Europe Corp. Upon completion of this Proposed Transaction, the company intends to resume production at Strategic Minerals' flagship property, the Penouta Project. In addition, the company will vertically integrate with a wholly owned subsidiary and change its name to IberAmerican Resources Inc., which will lead to it not being associated solely with lithium. Lastly, the company will engage Spark Newswire to generate publicity and raise its profile.

Probably the most important points in the news release that are likely to impact the stock price, perhaps immediately, are these statements:

"After completion of the Proposed Transaction (the business combination with Strategic Minerals Europe), the Company is committed to implementing crucial capital improvements to optimize production efficiencies within the expansive hard rock resource located in Section C so that the company may restart its exploitation as soon as possible after the lifting of the provisional suspensión."

And the statement by CEO Campbell Becher:

"Upon completion of the Proposed Transaction, we intend to promptly resume production in Section B, generating immediate cash flow."

Now, we will turn our attention to the progress of the company's stock by looking at its latest 8-month stock chart. On this chart, we can see that after we bought on about March 11, the price continued to drift lower within an extended Handle of the odd-shaped Cup and Handle base.

Over a week ago, there was an alarming but short-lived drop to 7 cents, which may have been an "organized raid" designed to shake out weak holders of the stock ahead of the strong rally that followed. After this freak drop, the stock quickly recovered and then became much more active, breaking out of the Handle of the Cup and Handle base last week. The remaining Hurdle to clear before the stock is more free to advance is the resistance shown at the upper boundary of the entire pattern, and it is thought that the big news out this morning is likely to drive the stock above this resistance.

With the picture for IberAmerican now considerably clearer and brighter, we stay long, and this is thought to be a good point to buy or add to positions.

IberAmerican Lithium's website.

IberAmerican Lithium Corp. (IBER:CBOE; IBRLF:OTCQB) closed at CA$0.17 on April 26, 2024.

Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- IberAmerican Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of IberAmerican Lithium Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.