Tier One Silver Inc. (TSLV:TSX; TSLVF:OTCQB)

For reasons that we will not go into here, the bull market that has just started in silver (and gold, copper, and other metals) promises to be of massive, unprecedented proportions, and clearly, this will be beneficial for the entire precious metals sector and in particular for silver explorers like Tier One Silver Inc. (TSLV:TSX; TSLVF:OTCQB), especially as silver looks set to probably be the best-performing metal.

Silver's appeal as a safe haven investment is set to explode, but in addition to this, it has many other uses, most of which are set to expand rapidly, as this slide from the company's investor deck shows.

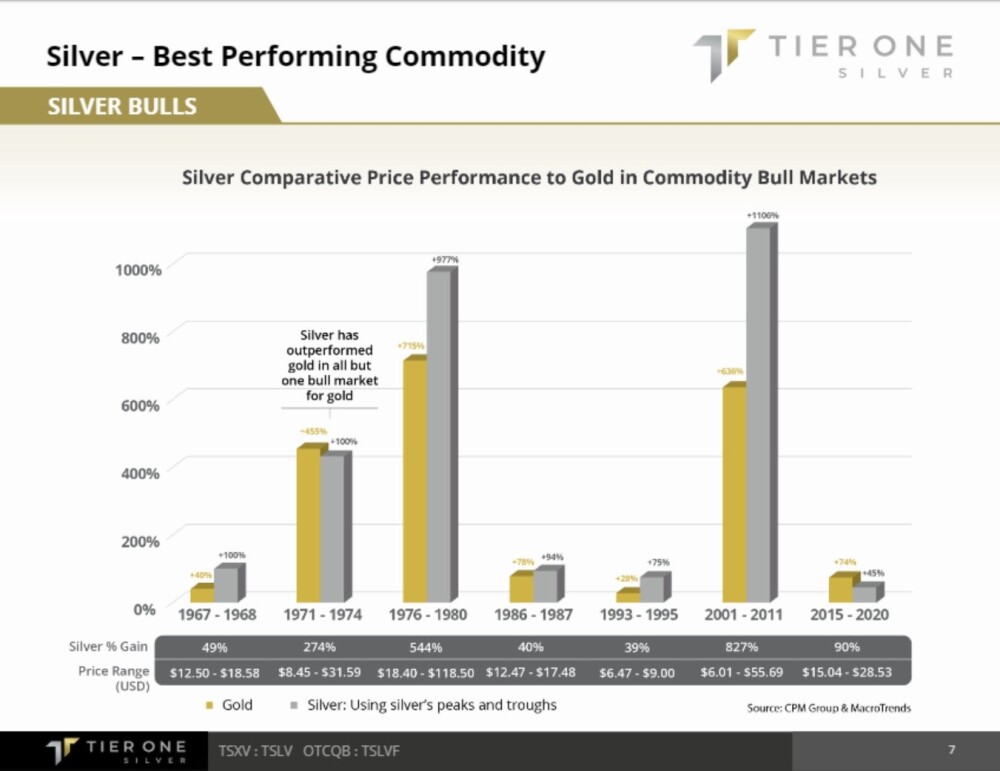

It is certainly worth noting that while silver has performed poorly in recent years as the metals sector has gone nowhere, during dynamic precious metals sector bull markets such as we have just begun, it greatly outperforms gold, as this slide shows.

Tier One Silver is an exploration company that was spun out from Auryn Resources on October 9, 2020. The company is focused on creating significant value for shareholders through the discovery of world-class silver, gold, and base metal deposits in Peru.

The company's exploration assets include Corisur and the flagship project, Curibaya. Of these, Curibaya is by far the largest, with active exploration of the property ongoing.

Why Peru?

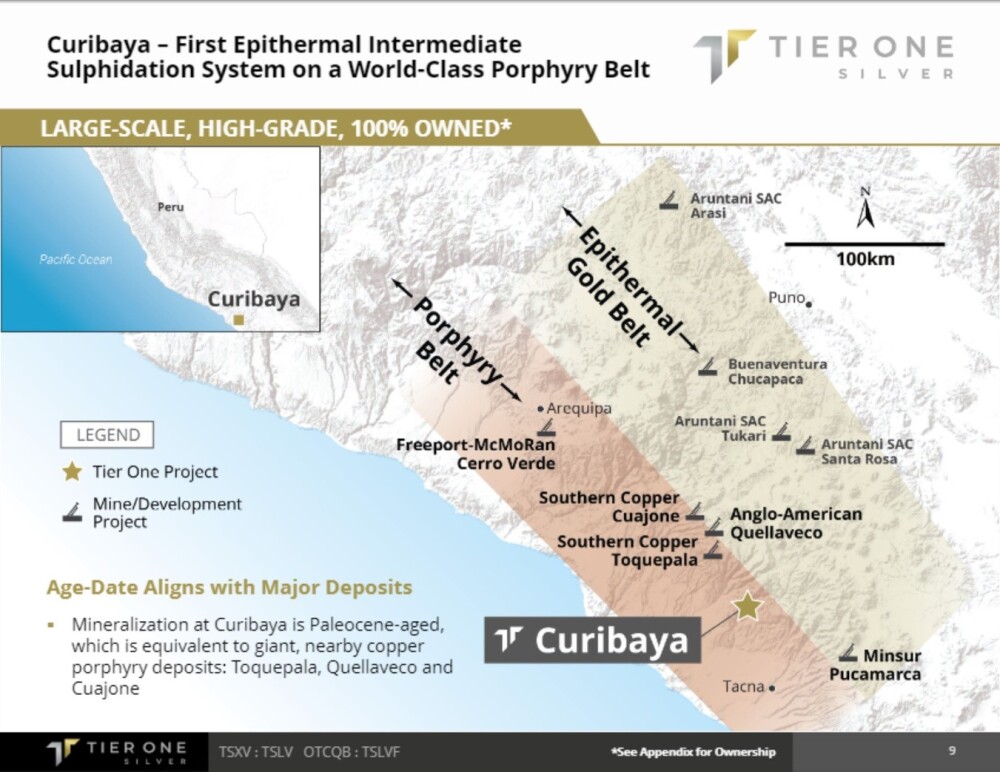

This slide from the company's investor deck makes it clear why Peru is a very good place to explore for silver.

The company's two properties are located in southern Peru, north of the city of Tacna, in the broad porphyry belt, as shown on the following slide.

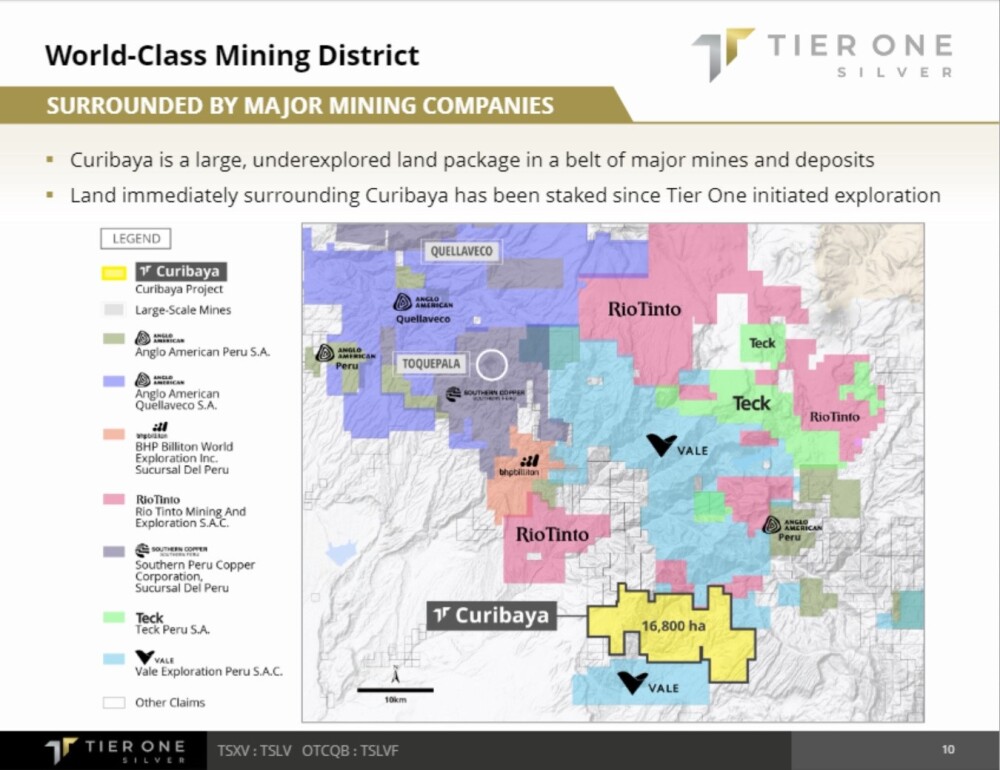

The Curibaya property is located in a belt of major mines and deposits, and it has some heavy-hitting neighbors nearby, and they wouldn't be there without good reason.

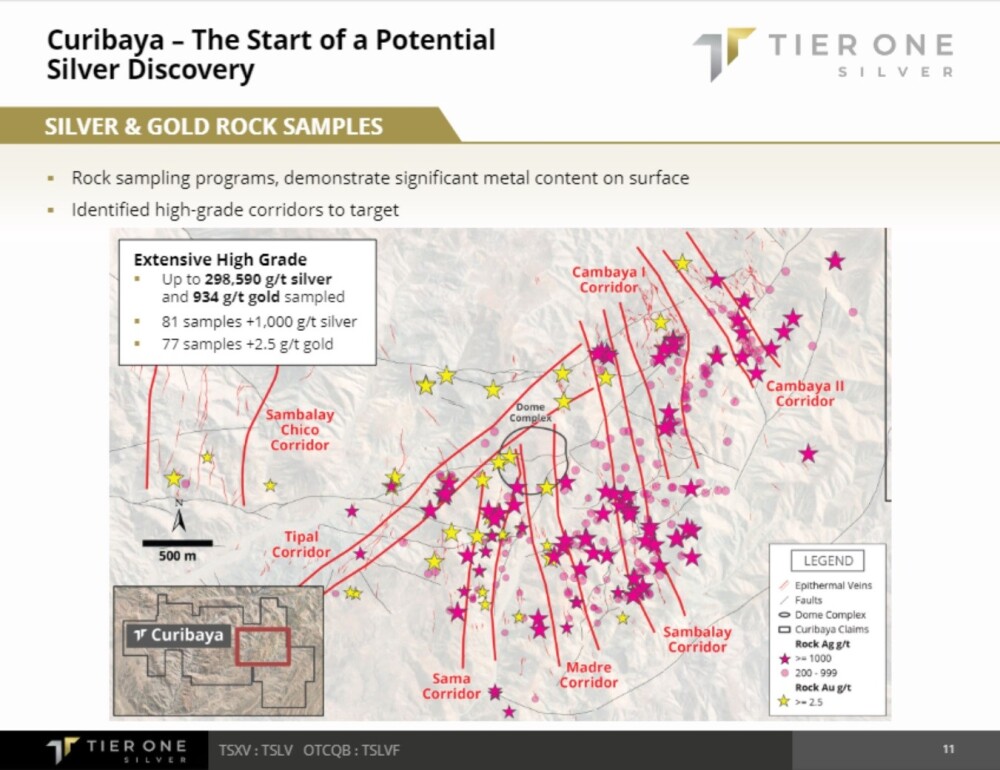

At Curibaya, the company has found some impressive silver and gold rock samples at surface, so it's not hard to see how Tier One could end up being a star performer.

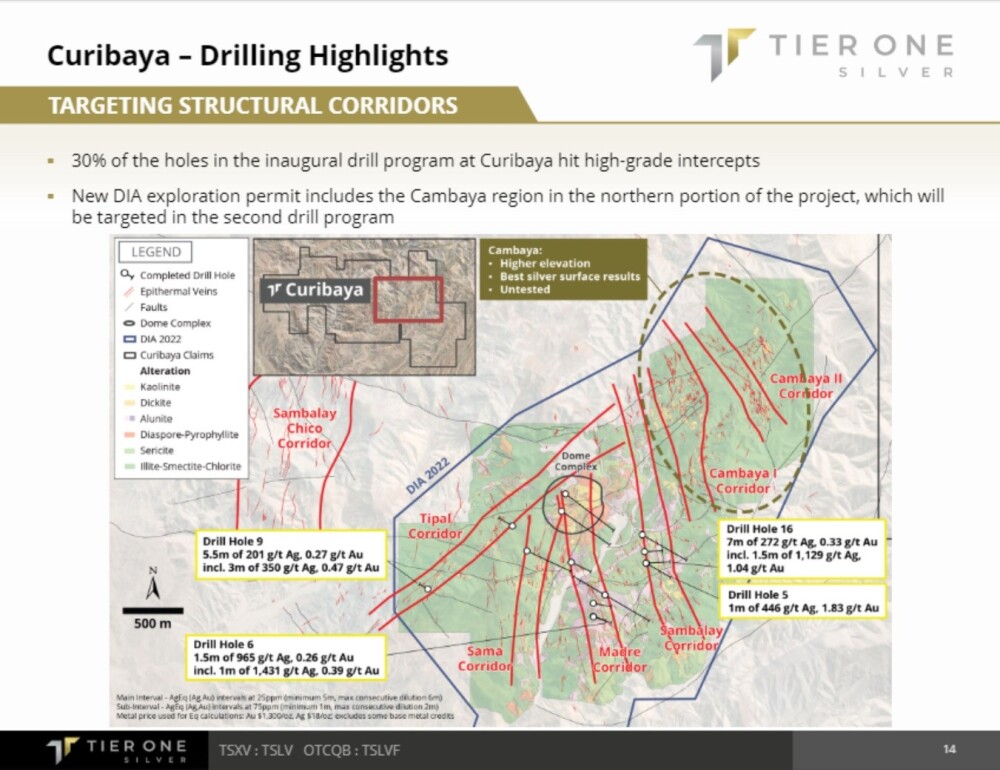

Here are highlights of the inaugural drilling program, and it is worth noting that 30% of the holes hit high-grade intercepts.

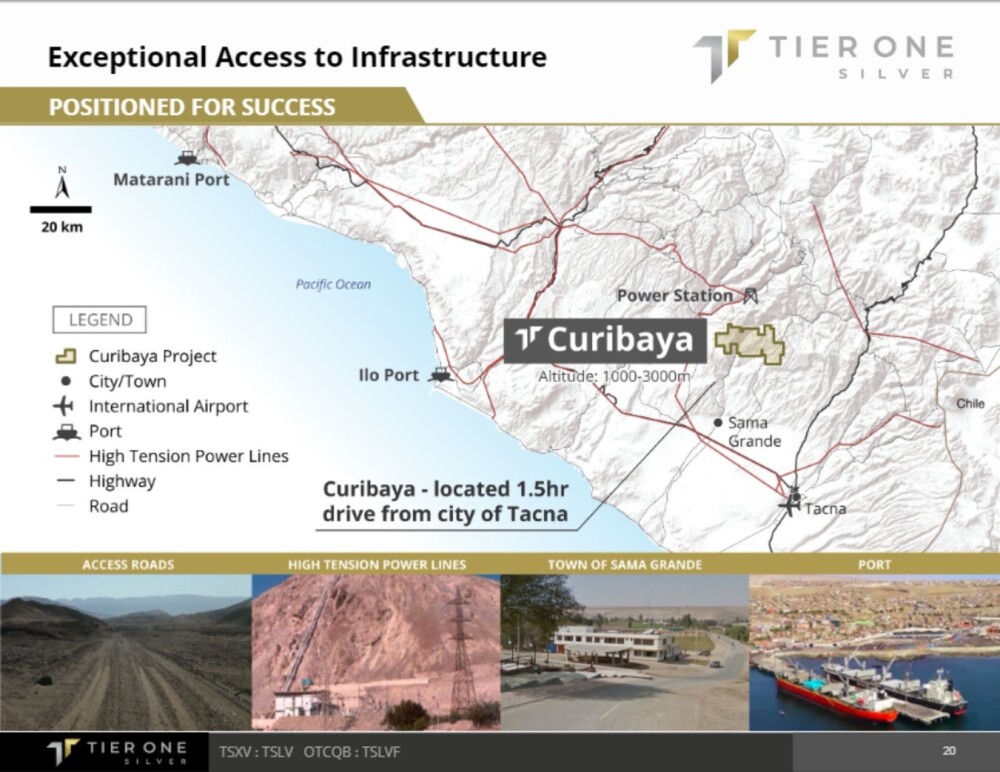

The Curibaya Project is well situated with respect to infrastructure, which is perhaps not surprising given how important mining is to the Peruvian economy.

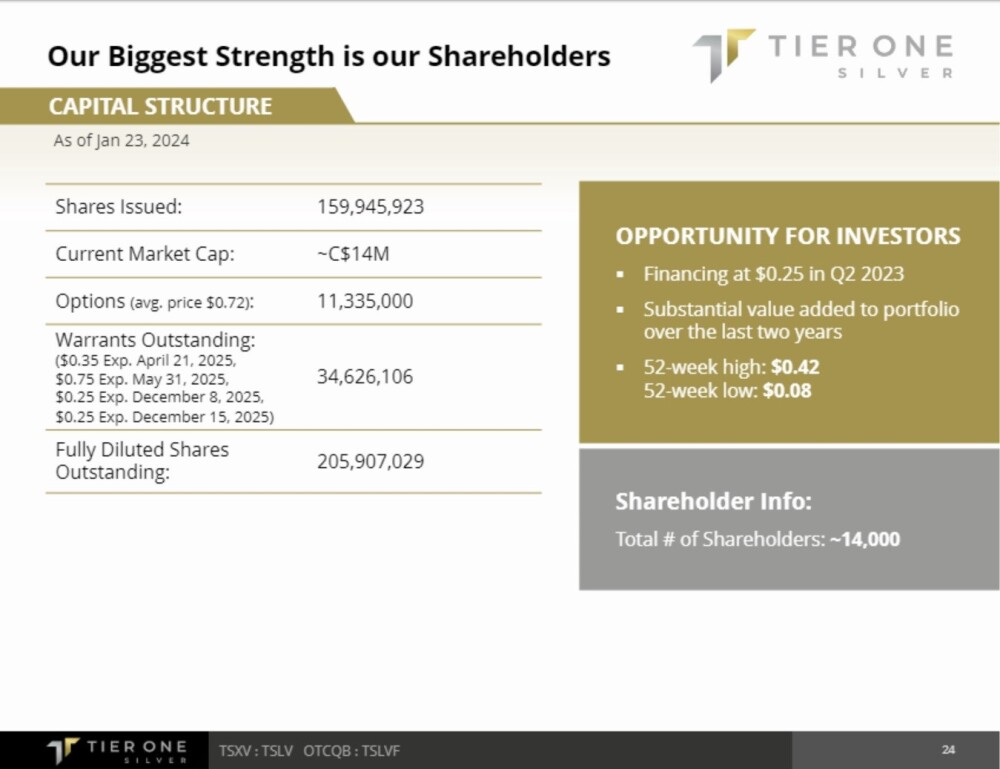

Lastly, the following slide shows the capital structure. While there are a high number of shares in issue, this is in the price of the stock, and with the most recent funding announced at 14 cents, it should not have a depressing effect on the stock price because it is currently at 14 cents and in the current environment for the sector this funding is likely to be completed swiftly, especially as there is a warrant thrown in, making the offer more attractive.

Turning now to the stock charts for Tier One, we see on its 3-month chart that the price responded in a very positive manner indeed to the strong gains in the silver price, especially this month, rising on very heavy volume, which is bullish.

This is most positive as it is an early sign that the stock will benefit in a big way from the expected continuation of the accelerating bull market in silver, which is hardly surprising as the company's projects will become much more economically viable and attract major investor interest.

On the 6-month chart, we can see technically why the stock reacted back as it did from the recent high at CA$0.19 — it had risen steeply higher to drive through not just the resistance level shown without a pause but then pushed past its still falling 200-day moving average to become heavily overbought, and with its moving averages still in unfavorable alignment this made a reaction back almost inevitable.

However, the volume pattern continues to be very bullish, with strong volume driving the vigorous upleg followed by a marked dieback as it reacted back. In addition, the Accumulation line, whose multi-month uptrend from December presaged a reversal, has held up well on the reaction all of which suggests that the price is unlikely to react back any further.

Instead, this is a good point from which to start another upleg, although it might wait a little until the current funding is completed, which the company anticipates will be by the end of the month.

The 4-year chart should be a source of good cheer to new investors here because it shows that you can pick the stock up now at less than 10% of its price at its June 2021 peak, thanks to the terrible bear market that persisted until late February of this year.

On this chart, we can see that it attempted a reversal in June of last year, with a deceptive high volume rally, but the time wasn't right because silver was still drifting lower, so down it went again.

This time is completely different, with the recent strong rally occurring against the background of a vigorous break higher by silver as it commences a bull market that should prove to be of historic proportions, and that means that Tier One has just commenced a bull market that is likely to be of historic proportions too, and the best news of all is that it's still at a great entry point.

Tier One Silver is therefore rated an Immediate Strong Buy for all timeframes. The initial price target for this bull market is in the CA$0.35 - CA$0.40 range. The next target is at CA$0.58 - CA$0.60.

Tier One Silver Inc. (TSLV:TSX; TSLVF:OTCQB) closed at CA$0.14, US$0.10 on April 19, 2024.

| Want to be the first to know about interesting Silver, Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tier One Silver Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.