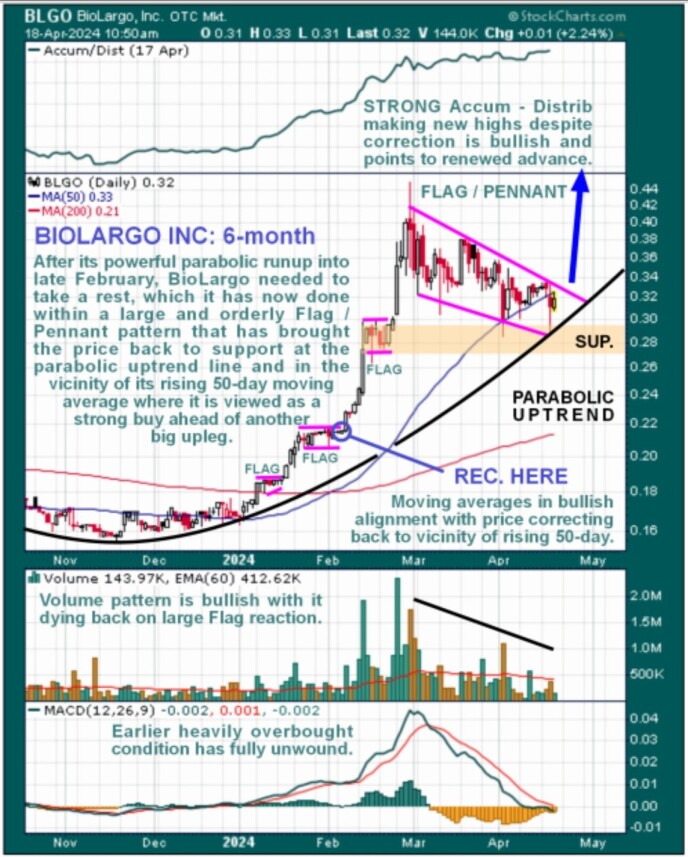

BioLargo Inc. (BLGO:OTCQB) was recommended at a good point early in February as it went on to about double in price by the end of the month as it moved to complete a parabolic slingshot uptrend that we can see delineated on the 6-month chart below.

By the end of this move, it had become extremely overbought, with volume building up to climactic levels. This situation naturally called for a lengthy period of consolidation or reaction before another significant upleg could take hold.

We have seen a large bull Flag / Pennant forming that has corrected the price back to the support at the parabola and in the vicinity of its rising 50-day moving average and, in the process, completely unwound its earlier heavily overbought condition. The way that volume has died back on this reaction is bullish as it indicates that speculative froth has cleared, paving the way for renewed advance, and it is thus most encouraging to see that the Accumulation line has remained strong during the reaction and is even making new highs which is a reliable indication that another sizeable upleg can be expected soon. With the price now cornered between the rising parabola and the descending upper rail of the Flag / Pennant channel, an upside breakout looks set to occur soon.

Note that interesting long-term charts for BioLargo's stock may be viewed in the original article.

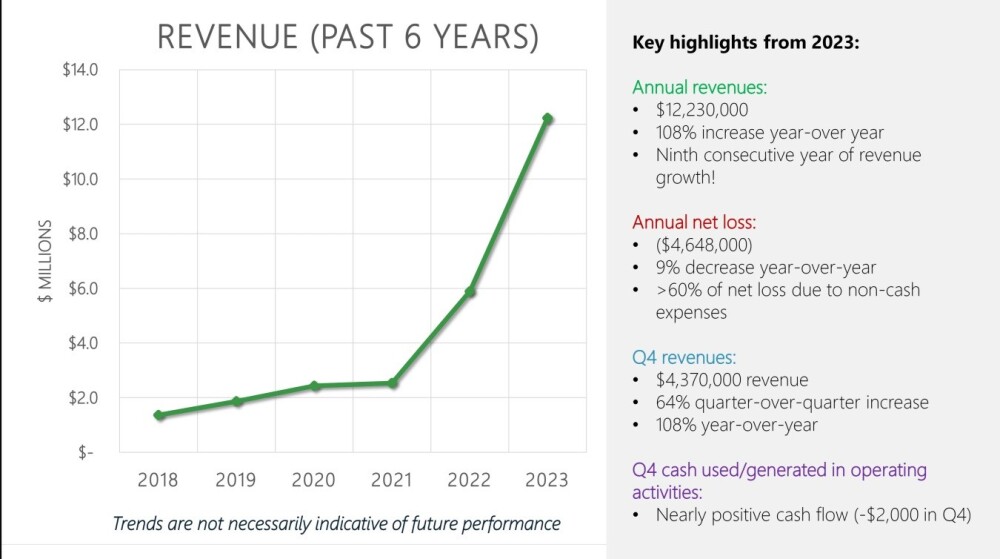

While BioLargo is advancing its business on many fronts, as set out in the original article, there have been a number of developments since then. In addition to some high-level management appointments, the company revealed that it had Achieved 108% Year-Over-Year Revenue Growth in 2023.

As President and CEO Dennis Calvart said, "Almost cash-flow positive in the fourth quarter of 2023, we continue to focus our business on leveraging our intellectual property and partnering with great companies to scale up sales and distribution while preserving capital and human resources."

In addition, just a few days ago, the news appeared that BioLargo PFAS Removal Technology Meets New US Drinking Water Standards. The full significance of this is grasped when you understand that until now drinking water providers were subject to a patchwork of regulations cobbled together in a piecemeal fashion by State and local regulators.

Now, however, they will be governed in a uniform manner by Federal Law understood to be coming into effect this month. The EPA (Environmental Protection Agency) estimates compliance with the new rules will cost approximately $1.5 billion annually; spending in other industry segments is not included in that estimate (e.g., treatment of groundwater, wastewater, industrial wastewater, or landfill leachate).

As BioLargo's Tonya Chandler explains, "These long-awaited drinking water regulations are a big win for our technology. Our AEC has an edge over the competition, as it can meet these new standards for all PFAS contaminants and generates far less PFAS-laden waste requiring disposal." With respect to this, an interesting report about BioLargo has been put out by Oak Ridge Financial on the 17th of this month.

BioLargo's new investor deck, presented in a webcast on April 2, contains some interesting slides, and a selection of these is shown below.

This first slide shows that revenues have accelerated dramatically since mid-2021 and look set to continue to do so.

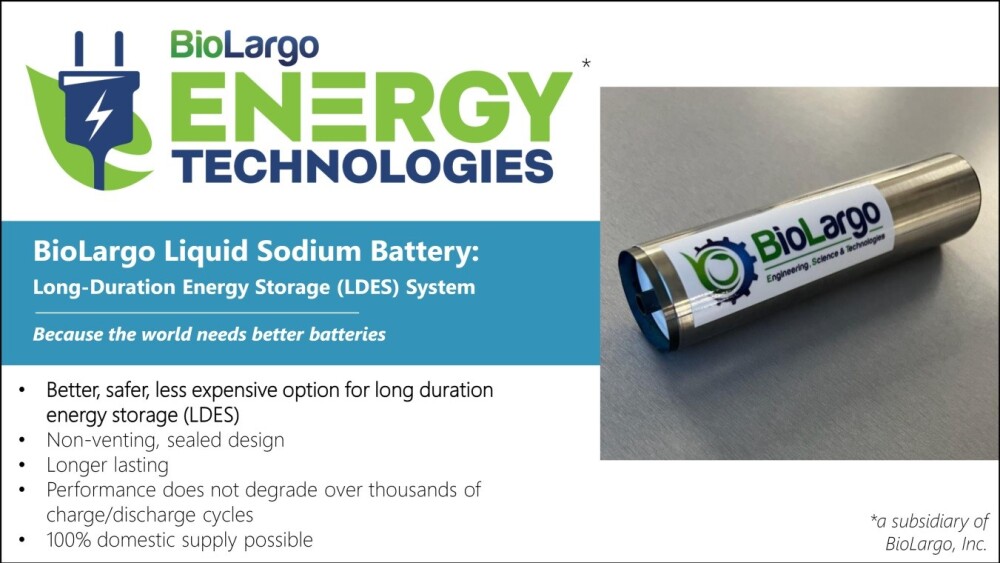

We covered many important aspects of BioLargo's businesses in the original article. Here, we are going to give some coverage to BioLargo's battery technology and power storage.

This slide lists the key advantages of BioLargo's battery technology.

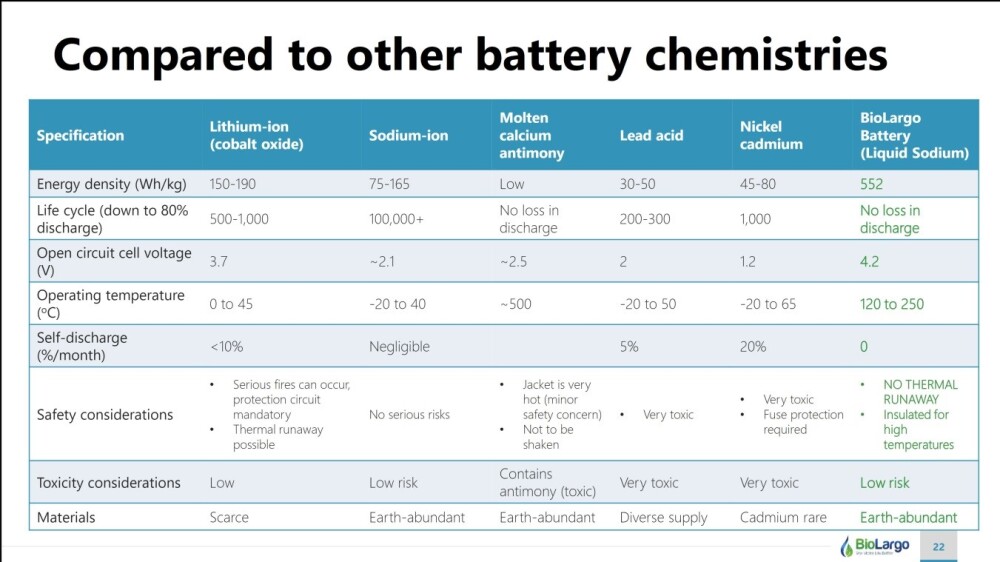

This one shows how they measure up against other battery chemistries.

Next, the following slide gives us a glimpse into the enormity of the battery / energy storage market.

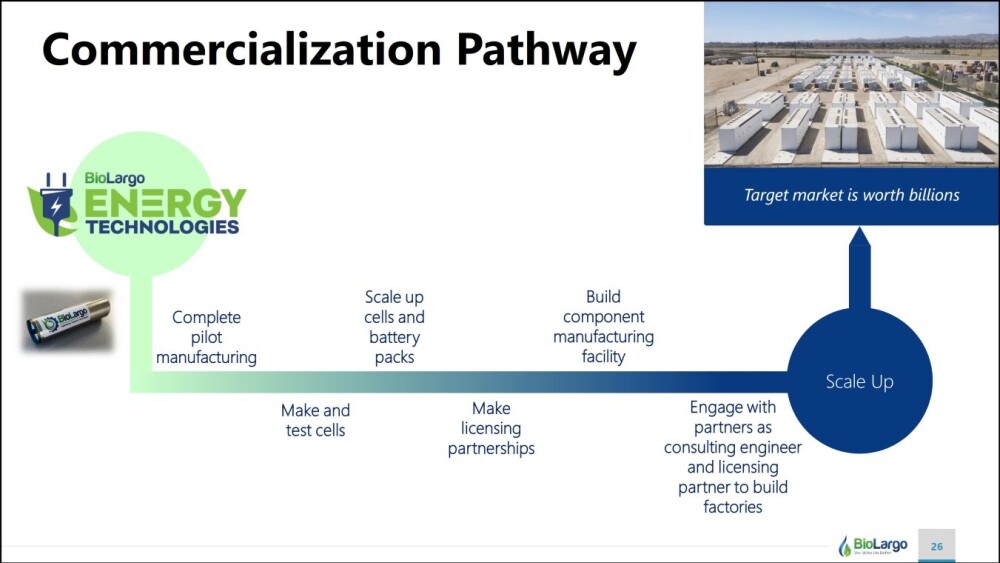

Here, we see how BioLargo is moving forward with the monetization of its battery technologies

And lastly, we see here in clear and simple terms the steps to monetization of the company's products and technologies on the path to scaling up to meet the needs of a target market worth billions.

To conclude, all the main segments of BioLargo's diverse businesses are doing well and heading in the right direction. BioLargo's stock is viewed as having completed a necessary correction over the past seven weeks or so that has set it up for another major upleg.

So we stay long, and BioLargo is rated as an Immediate Strong Buy here.

BioLargo Inc. (BLGO:OTCQB) closed at US$0.31 on April 18, 2024.

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- BioLargo Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of BioLargo Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.