NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) completed a geological review and 3D model update of its newly staked Zeus project in southwestern Idaho's emerging Hercules Copper District, results of which are favorable and encouraging, the company announced in a news release.

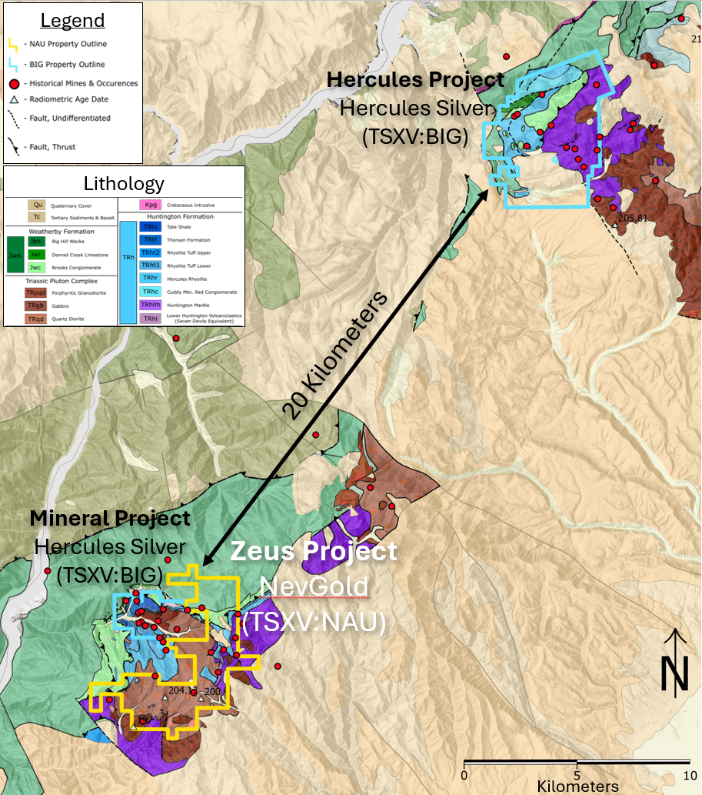

The results from the geographical review and 3D model showed significant copper porphyry potential at the Zeus Copper Project. The project is incredibly similar to the Hercules Silver Corp. (BADEF:OTCMKTS;BIG:TSXV) copper porphyry discovery at the Hercules Project (see Hercules Silver News Release dated October 10, 2023).

These similarities are highlighted in the press release:

- Both projects have Triassic age plutons, the likely source of the copper porphyry

- Both projects have Olds Ferry terrane rocks, including the Hercules Rhyolite

- Both projects have a cover sequence of Izee terrane rocks, including the Weatherby Formation

- Both projects are located along the Bayhorse Thrust Fault, a major structural corridor, which places Izee Terrane rocks (Weatherby Formation) overtop of Olds Ferry terrane rocks (Huntington Formation)

- Both projects have abundant mineral occurrences and historical mine workings.

- Both projects are erosional windows through the post-mineral Columbia River basalts that cover the vast majority of the Hercules Copper Trend

" All of the geological signatures that we encountered through our geological review and time in the field solidify our view that Zeus has very strong copper porphyry potential and is some of the most strategic ground in this emerging Hercules Copper Trend." President and Chief Executive Officer Brandon Bonifacio said in the release.

"One of the most important rules with copper porphyries is that where there is one, there are others," Carlisle Kane, editor/publisher of The Equedia Letter, wrote in an April 4 article on NevGold.

The company's recent dive into Zeus included detailed assessments of historical records, compilations and reinterpretation of numerous published geological maps, creation of a 3-D geological model, and analysis of rock chip samples collected by the NevGold Team while staking the mineral claims over the past six months.

"This has provided a major advantage in being able to rapidly advance the project," Vice President of Exploration Derick Unger said in the release.

Zeus is about 120 km northwest of its capital, Boise, in an area with existing road, water, and power infrastructure but limited modern exploration described Stephan Bogner of Rockstone Research in a March 18 initiation report.

The project is in a historically known copper-producing district in the top mining jurisdiction of Idaho, known for its geological potential, low geopolitical risk, and favorable mining regulation, taxation, and political support.

Strong Upside, Resource Growth Potential

NevGold is a mining explorer-developer targeting large-scale mineral systems in mining districts in Idaho, Nevada, and British Columbia. Along with Zeus, the company owns three "near-surface, heap-leachable gold projects with significant resource growth upside," Bogner wrote.

One of them, 40 kilometers southeast of Zeus, also in Idaho, is Nutmeg Mountain, a low-sulfidation epithermal gold deposit spanning 1,724 ha. It has a current mineral resource, updated last June, of 1,006,000 ounces of 0.61 grams per ton (0.61 g/t) gold in the Indicated category and 275,000 ounces of 0.48 g/t gold in the Inferred category. The company also said Nutmeg Mountain offers significant upside for exploration.

"The asset has attractive scale," Bogner wrote in an April 4 research report.

NevGold also owns 100% of Limousine Butte, a Carlin-style gold deposit in Nevada, another top-tier mining jurisdiction. The 6,650 ha project boasts historical resources and recent intercepts on drilling of 2.19 g/t gold oxide over 61.6 meters (61.6m) and 0.86 g/t gold oxide over 175.2m, Bogner reported. Last year, NevGold created a new geological model of the project and identified a series of high-priority drill targets, including Resurrection Ridge, Cadillac Valley, West Cadillac, and Coffee Mug.

About 300 km south-southeast of Limousine Butte is Cedar Wash, the company's other asset in Nevada. Spanning 3,904 ha, this high-potential project, as described by Bogner, hosts both Carlin-style gold and gold-bearing quartz-calcite veins.

Advancing all of these projects is a group of well-qualified and skilled professionals, the company said. Together, they have 175 years of broad experience and success in the mining industry, including progressing properties from exploration to construction.

Copper on Upward Trajectory

Copper is one of the metals that is critical to and in demand due to the green energy transition, given its use, for example, in electric vehicles, power grids, and solar energy turbines.

The base metal now, according to Citi analysts, is in a bull market, its second in the 21st century, CNBC reported in an April 10 article.

Accordingly, copper prices are going up, Bogner pointed out. Since early February, copper futures prices rose 13%, to US$9,560 per ton from US$8,483.

"As having broken the resistance recently, a longer-term upward trend is anticipated," he wrote.

Of the same belief, Morgan Stanley just increased its forecast for the copper price by 12%, now expecting it to hit US$10,500 per ton by Q4/24, according to an April 10 article.

The near-term supply-demand imbalance is what is driving up copper prices, according to the investment bank. Disruptions from weather and power generation continue to hamper new copper supply, and reduced production at Chinese smelters is anticipated to likely decrease supplies of refined copper. Consequently, mined copper output in 2024 will be 0.7% lower than last year, resulting in a 700,000-ton undersupply, estimated Morgan Stanley.

Beyond this year, Citi analysts indicated in a research note they expect copper prices to keep climbing, as high as US$12,000 in 2026, noted CNBC.

"Explosive price upside is possible over the next two to three years too, if a strong cyclical recovery occurs at any time, with prices potentially rising more than two-thirds to US$15,000-plus per ton in this, our bull case scenario," the analysts wrote.

The Catalyst: Field Program

The next potential stock-moving event for NevGold is the completion of the next steps of its robust field program at Zeus, preparations for which are now in progress.

NevGold intends to carry out comprehensive surface geochemical sampling in addition to geophysics, such as magnetics, gravity, electromagnetic, controlled source audio-frequency magnetotellurics, or induced polarization. Should any potential targets be identified through these efforts, the company will then rapidly advance to drill them.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE)

It plans to start the work next month, in May, "as the snow melts and the conditions improve," Unger said. "The main focus now is rapidly advancing the project over the coming weeks and months."

Ownership and Share Structure

According to NevGold, its strength is "a financial groundwork that supports exploration success," including strong insider ownership, a tight capital structure, and a strong balance sheet.

About 37% of the company is now held by strategic investors, including GoldMining Inc., which now holds 29.4% of the company on an undiluted basis, and McEwen Mining Inc.

The company said about 30% is held by management and insiders. According to Reuters, these include Non-Executive Chairman Giulio T. Bonifacio with 7.3%, CEO Brandon Bonifacio with 6.7%, Independent Director Gregory French with 1.62%, and Independent Director Timothy Dyhr with 1.37%, Reuters said.

About 10% is held by institutions, and the rest is in retail.

As for its share structure, NevGold has 93.91M outstanding shares and 30M free float traded shares.

The company's market cap is CA$31.21 million. Its 52-week trading range is CA$0.24−CA$0.50 per share.

| Want to be the first to know about interesting Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- NevGold Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.