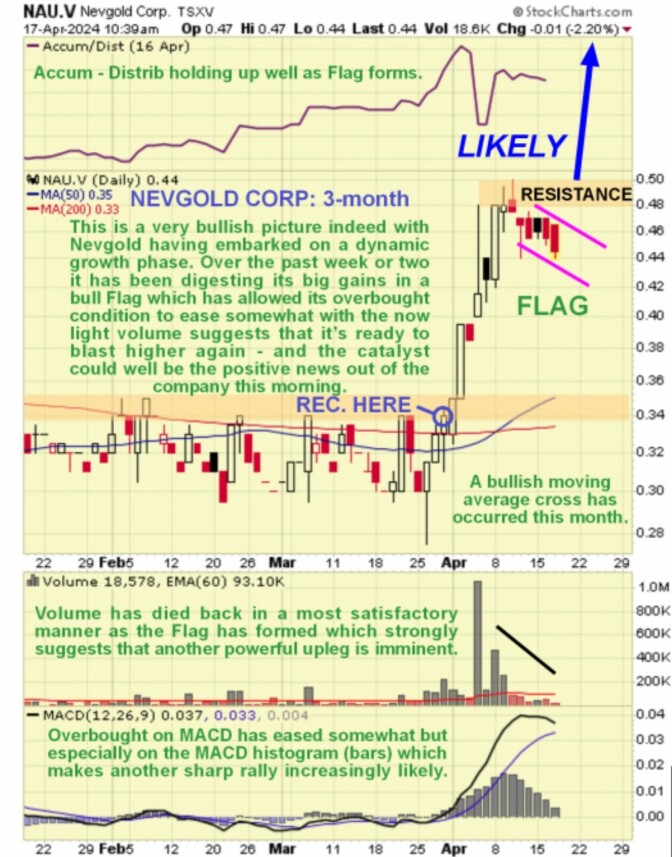

NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) has done very well since it was first recommended for purchase on April 1, blasting almost vertically higher from a price of CA$0.34 to hit CA$0.50 on its first upleg. It was recommended again on April 4 on the news of its staking the Zeus claims. Since then, as we can see on its latest 3-month chart below, it has been consolidating in a fairly tight bull Flag with strongly positive volume indications.

This is a sign that it is readying to blast almost vertically higher again in a second upwave that is likely to be similar in character and magnitude to the first upwave, and with volume having dwindled to become light, this could happen immediately, and the catalyst for it may well be the very positive news out of the company this morning NevGold ANNOUNCES POSITIVE COPPER PORPHYRY POTENTIAL AT THE ZEUS COPPER PROJECT IN THE HERCULES COPPER DISTRICT, IDAHO.

If you read the original article, you may recall that we alluded in no uncertain terms to the great potential of the company's Zeus Project and the high probability of its being of similar stature to nearby Hercules Silver's big copper find, and this news out of the company greatly increases the probability that this is indeed the case.

So now we will briefly review the latest stock chart for NevGold to see how this news is likely to impact the share price. For this purpose, since NevGold is now in a dynamic growth phase, we only need to look at a 3-month chart.

On the 3-month chart, we can see where it was recommended right before it broke out of a large trading range at the start of the month, with the breakout triggering a dramatic vertical ascent. Upon hitting CA$0.50, it stopped consolidating into what can now clearly be seen as a bull flag.

This Flag has allowed time for the heavily overbought condition to partially unwind, setting it for renewed advance, and with volume having shriveled to a low level in recent days, it now looks ready to embark on another strong upleg that, as mentioned above, is likely to be similar to the upwave preceding the Flag.

A general point and highly positive background factor that should be mentioned here is that copper itself is commencing a massive bull market in the face of a severe supply shortfall that will last for years, which clearly should act as a big driver for all copper stocks but especially those that are positioned to deliver big, as NevGold now is.

We, therefore, stay long, and NevGold is rated an Immediate Strong Buy for all timeframes.

NevGold's website.

NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) closed at CA$0.46, US$0.32 on April 17 24.

Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- NevGold Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.