NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) completed a geological review and model update of its newly staked Zeus project in southwestern Idaho's emerging Hercules Copper District, results of which are favorable and encouraging, the company announced in a news release.

"All of the geological signatures that we encountered through our geological review and after many months in the field solidify our view that Zeus is some of the best ground in the district and has very strong copper porphyry potential," President and Chief Executive Officer Brandon Bonifacio said in the release.

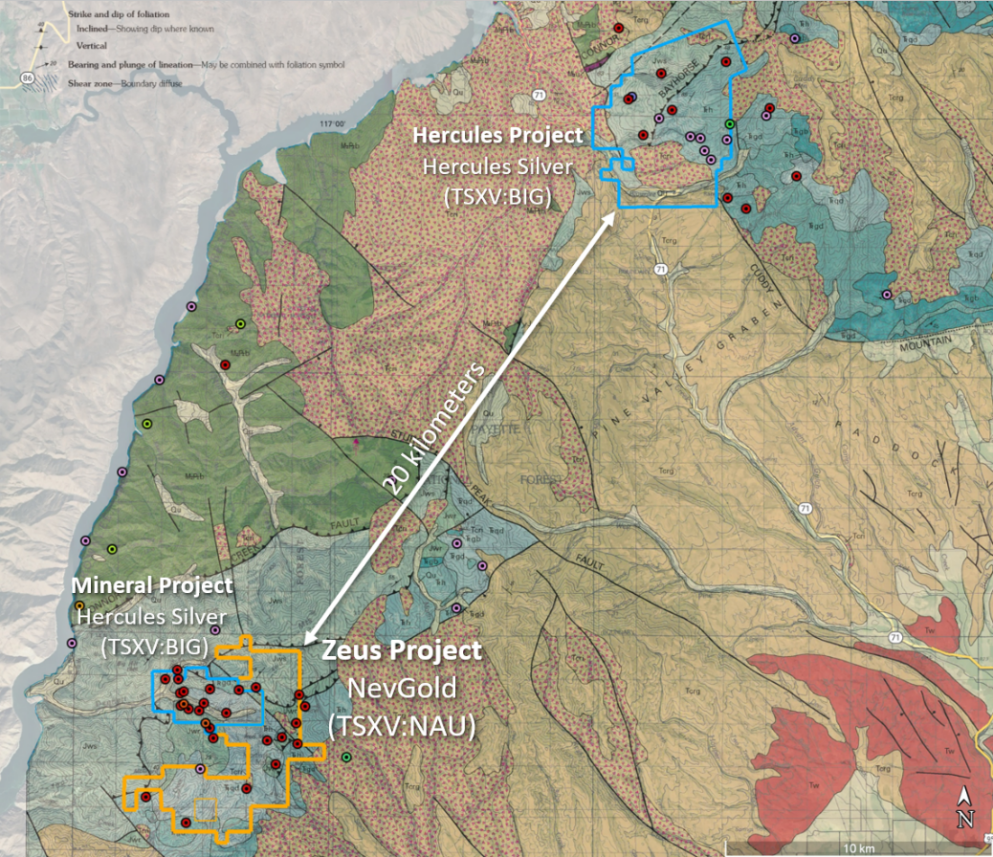

Zeus, spanning about 2,000 hectares (2,000 ha), shares the same geological characteristics as Hercules Silver Corp.'s (BIG:TSX.V; BADEF:OTCMKTS) Hercules copper porphyry discovery 20 kilometers to the northeast, the release noted. These similarities include XXXX.

"One of the most important rules with copper porphyries is that where there is one, there are others," Carlisle Kane, editor/publisher of The Equedia Letter, wrote in an April 4 article on NevGold.

Hercules District Geology Map and Zeus Project

(Map Legend – Light Green: Jurassic Geological Unit, Light Blue: Triassic Geological Unit, Black Lines: Fault Structures, Various Colored Dots: Historical Mineral Occurrences or Drillholes)

The company's recent dive into Zeus included reviewing historical records and geological maps a well as analyzing results of its new surface mapping and sampling, over a six month period. Simultaneously, NevGold staked the claims at the project.

"This has provided a major advantage in being able to rapidly advance the project," Vice President of Exploration Derick Unger said in the release.

Zeus is about 120 km northwest of its capital Boise, in an area with existing road, water and power infrastructure but limited modern exploration, described Stephan Bogner of Rockstone Research in a March 18 initiation report. The project is in a historically copper-producing district in the top mining jurisdiction of Idaho, known for its geological potential, low geopolitical risk and favorable mining regulation, taxation and political support.

Strong Upside, Resource Growth Potential

Based in Vancouver, British Columbia, NevGold is a mining explorer-developer targeting large-scale mineral systems in mining districts in Idaho, Nevada and British Columbia. Along with Zeus, the company owns three "near-surface, heap-leachable gold projects with significant resource growth upside," Bogner wrote.

One of them, 40 kilometers southeast of Zeus, also in Idaho, is Nutmeg Mountain, a low-sulphidation epithermal gold deposit spanning 1,724 ha. It has a current mineral resource, updated last June, of 1,000,000 ounces of 0.61 grams per ton (0.61 g/t) gold in the Indicated category and 275,000 ounces of 0.48 g/t gold in the Inferred category. As well, the company said, Nutmeg Mountain offers significant exploration upside.

"The asset has attractive scale," Bogner wrote in an April 4 research report.

NevGold also owns 100% of Limousine Butte, a Carlin-style gold deposit in Nevada, another top-tier mining jurisdiction. The 6,650 ha project boasts historical resources and recent intercepts on drilling of 2.19 g/t gold oxide over 61.6 meters (61.6m) and 0.86 g/t gold oxide over 175.2m, Bogner reported. Last year, NevGold created a new geological model of the project and identified a series of high-priority drill targets, including Resurrection Ridge, Cadillac Valley, West Cadillac and Coffee Mug.

About 300 km south-southeast of Limousine Butte is Cedar Wash, the company's other asset in Nevada. Spanning 3,904 ha, this high-potential project, as described by Bogner, hosts both Carlin-style gold and gold-bearing quartz-calcite veins.

Lastly, NevGold owns Ptarmigan, a 9,900 ha project in British Columbia, known to contain silver-gold-copper massive pyrite manto-type deposits and high grade copper-silver-gold veins, the company said. Last year, surface samples showed silver grades up to 3,188 g/t over 140m, Mugglehead Magazine reported. The copper surface anomaly extended over 9 km, nearly the entire length of the property.

Advancing all of these projects is a group of well-qualified and skilled professionals, the company said. Together, they have 175 years of broad experience and success in the mining industry, including progressing properties from exploration to construction.

Copper on Upward Trajectory

Copper is one of the metals that is critical to and in demand due to the green energy transition, given its use, for example, in electric vehicles, power grids and solar energy turbines.

The base metal now, according to Citi analysts, is in a bull market, its second in the 21st century, CNBC reported in an April 10 article.

Accordingly, copper prices are going up, Bogner pointed out. Since early February, copper futures prices rose 13%, to US$9,560 per ton from US$8,483.

"As having broken the resistance recently, a longer-term upward trend is anticipated," he wrote.

Of the same belief, Morgan Stanley just increased its forecast for the copper price by 12%, now expecting it to hit US$10,500 per ton by Q4/24, according to an April 10 article.

The near-term supply-demand imbalance is what is driving up copper prices, according to the investment bank. Disruptions from weather and power generation continue to hamper new copper supply, and reduced production at Chinese smelters is anticipated to likely decrease supplies of refined copper. Consequently, mined copper output in 2024 will be 0.7% lower than last year, resulting in a 700,000 ton undersupply, estimated Morgan Stanley.

Beyond this year, Citi analysts indicated in a research note they expect copper prices to keep climbing, as high as $12,000 in 2026, noted CNBC.

"Explosive price upside is possible over the next two to three years too, if a strong cyclical recovery occurs at any time, with prices potentially rising more than two-thirds to $15,000-plus per ton in this, our bull case scenario," the analysts wrote.

The Catalyst: Field Program

The next potential stock moving events for NevGold are completion of the next steps of its robust field program at Zeus, preparations for which are now in progress.

NevGold intends to carry out comprehensive surface geochemical sampling in addition to geophysics, such as magnetics, gravity, electromagnetic, controlled source audiofrequency magnetotellurics or induced polarization. Should any potential targets be identified through these efforts, the company will likely then drill them.

It plans to start the work next month, in May, "as the snow melts and the conditions improve," Unger said. "The main focus now is rapidly advancing the project over the coming weeks and months."

Ownership and Share Structure

According to NevGold, its strength is "a financial groundwork that supports exploration success," including strong insider ownership, a tight capital structure and a strong balance sheet.

Nine strategic entities own 42.92%, or 40.3 million (40.3M) shares, of the Canadian explorer-developer, Reuters reports. From most to least interest owned, the Top 5 investors are GoldMining Inc. (GOLD:TSX; GLDG:NYSE.American) with 28.4% or 26.67M shares, Chair Giulio Bonifacio with 5.26% or 4.94M shares, President, CEO and Director Brandon Bonifacio with 4.83% or 4.54M shares, Director Gregory French with 1.17% or 1.1M shares and Director Timothy Dyhr with 1.02% or 0.96M shares.

Retail investors own the remaining 57.08%. There are no institutional investors at this time.

As for its share structure, NevGold has 93.91M outstanding shares and 53.6M free float traded shares.

The company's market cap is CA$31.21 million. Its 52-week trading range is CA$0.24−CA$0.50 per share.

| Want to be the first to know about interesting Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |