Freeport Resources Inc. (FRI:TSX.V; FEERF:OTCQB; 4XH:FSE) launched an internal project optimization review of its 100%-owned Yandera copper-gold-molybdenum project in Papua New Guinea's prolific PNG Orogenic belt ahead of a definitive feasibility study, the company announced in a news release. Also, it plans to carry out a private placement for up to CA$5 million (CA$5M) in gross proceeds.

The aim of the review is to determine how best to improve the economics and maximize the value of Yandera, as explained in the release. According to Freeport Resources, Yandera is now "significantly undervalued based on historical expenditures, current copper prices, and the potential for resource expansion." According to the 2017 pre-feasibility study completed by Worley Parsons, the Yandera Copper Project is a large, high-grade asset with a resource estimate of 727 million tonnes of measured and indicated resources, that average 0.39% copper equivalent.

Already Yandera is garnering interest from prospective strategic partners, but optimization of the project would increase its attractiveness, Gord Friesen, president and chief executive officer, noted in the release.

"Further improvements in the project's economics would be a win-win for all parties, including shareholders," added Friesen.

One potential way to lower Yandera's capital and operating costs is by employing one of the new direct leaching technologies to produce a final copper cathode product. These breakthrough sulfide copper heap leaching technologies may be done right at the mine site versus elsewhere, thus eliminating the need to use a concentrator, which is expensive to buy and operate, and transportation costs.

Goldman Sachs equity research analysts wrote in a research report they identified ten copper leaching breakthrough technologies currently being developed by copper companies, both majors and smaller independents, including Rio Tinto, BHP, Jetti, AngloAmerican, and Codelco. Each company wants a more affordable method that will "improve recoveries from harder-to-leach, lower-grade primary sulfide ores and [will] utilize spare cathode capacity, therefore squeezing more production from existing assets."

When Freeport Resources completes its internal optimization review of Yandera and releases its findings and conclusions, this could catalyze the company's share price.

The analysts explained that these new technologies do not use sulfuric acid as a leaching agent as has been done traditionally. Instead, they employ types of chemicals that either function as oxidants or help break down the passivation layer: chlorides, nitrates, and catalysts.

Freeport Resources' Senior Vice-President of Operations, Dr. Nathan Chutas, who helped manage the PFS, will lead the project optimization review.

Regarding the company's other news, its non-brokered private placement will consist of up to 100,000,000 (100M) units sold at CA$0.05 apiece. Each unit will comprise one common Freeport Resources share plus one-half of a share purchase warrant. Each whole warrant will entitle the holder to acquire one additional common share for CA$0.25 during a specified 24-month period.

Freeport Resources said it will use the proceeds to continue advancing Yandera and for general working capital purposes.

Superlative Asset in Ideal Location

Headquartered in Vancouver, British Columbia, Freeport Resources is a copper-focused prefeasibility-stage company with one of the world's largest undeveloped copper assets, the 245-square-kilometer Yandera project. More than US$200M has been spent on the exploration and development of this property since 2005.

Yandera boasts a prime location in Papua New Guinea's PNG Orogenic Belt, home to several robust copper and gold deposits, including Grasberg, Frieda River, Porgera, Lihir, Wafi-Golpu and Kainantu. In this country, Yandera is of strategic national interest as it could become one of its most significant copper mines, the company said.

Also, the project's close proximity to Asia, the world's top copper consumer and refiner, nicely positions Yandera as a possible long-term supply source of the commodity. According to Richard Mills, editor/publisher of Ahead of the Herd, China is the world's largest producer and biggest consumer of copper; last year, the country produced 47% of the global supply.

On the heels of successfully renewing the project's license through November 19, 2025, Freeport Resources began having discussions with a number of potential strategic partners to advance Yandera to a definitive feasibility study and mine development.

Copper Market is Tightening

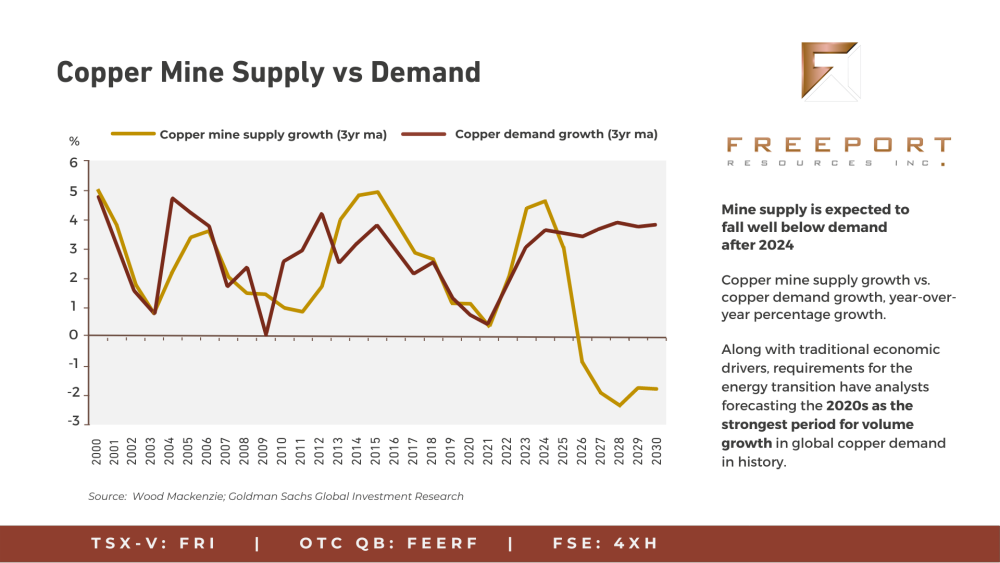

Research analysts at Goldman Sachs predict that during this decade, volume growth in global copper demand will be the strongest in history thanks to the amount of the red metal needed for the green energy transition.

Analysts estimate that as soon as 2025, the increased demand and shortage of new mined copper supply coming online, will push copper supply into a structural deficit, with the widest supply-demand gap forecast to happen in about 2028.

"The looming copper supply deficit our commodities team forecasts is driven not only by a lack of new greenfield mine developments and declining head grades but also falling cathode production at larger mature operations as oxide resources are depleted," the analysts wrote in a research report.

At the start of this year, analysts purported that the copper price would surge over 75% to record highs in 2025, CNBC reported, and big movement is already happening. Earlier this week, the copper price jumped to US$9,380 per ton, "having climbed to two-year highs," reported Mike Beck of Regent Advisors LLC, in light of better manufacturing data and persisting supply constraints. Beck also noted that 13 major copper smelters proposed cutting smelter capacity by 5–10% because of "overcapacity and dwindling concentrate availability.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Freeport Resources Inc. (FRI:TSX.V;OTCQB:FEERF;FSE: 4XH )

When Freeport Resources completes its internal optimization review of Yandera and releases its findings and conclusions, this could catalyze the company's share price, the company noted.

Ownership and Share Structure

According to Reuters, Freeport Resources currently has one insider investor, Chief Financial Officer and Director Scott Davis, who owns 0.83%, or 1.3 million (1.3M) shares.

Retail investors own the remaining 99.17%. There are no institutional investors at this time.

As for its share structure, Freeport has 147.33M outstanding shares and 156.03M free float traded shares.

The company has a market cap of CA$7.56M and has traded in the past 52 weeks between CA$0.02 and CA$0.08 per share.

| Want to be the first to know about interesting Base Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Freeport Resources Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.