NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) is an exploration and development company targeting large-scale mineral systems in the proven districts of Nevada, Idaho, and British Columbia. NevGold owns a 100% interest in the Limousine Butte and Cedar Wash gold projects in Nevada and the Ptarmigan silver-polymetallic project in Southeast BC and has an option to acquire 100% of the Nutmeg Mountain gold project in Idaho, so we can say that it is primarily a gold exploration and development company which is certainly a good spot to be in going forward with gold now embarking on its biggest bull market ever.

The stock is regarded as the most attractive for investors here and is going forward for several very important reasons. The first is the emerging major bull market in gold that has already begun and promises to be of unprecedented magnitude due to the collapse of the current monetary system, which is already in its death throes.

Related to this is that NevGold is, as its name implies, heavily into gold and actively exploring to expand its gold resources at its Nutmeg Mountain Project in Idaho and its Limousine Butte property in Nevada, with Summer drilling programs starting or soon to start at both. The third reason is that the stock is still at a very good price as it has not — so far — responded much to gold's gathering strength, but for reasons we will see on its charts, it looks set to soon, and the gains should be amplified by the relatively low number of free trading Nevgold shares on the market.

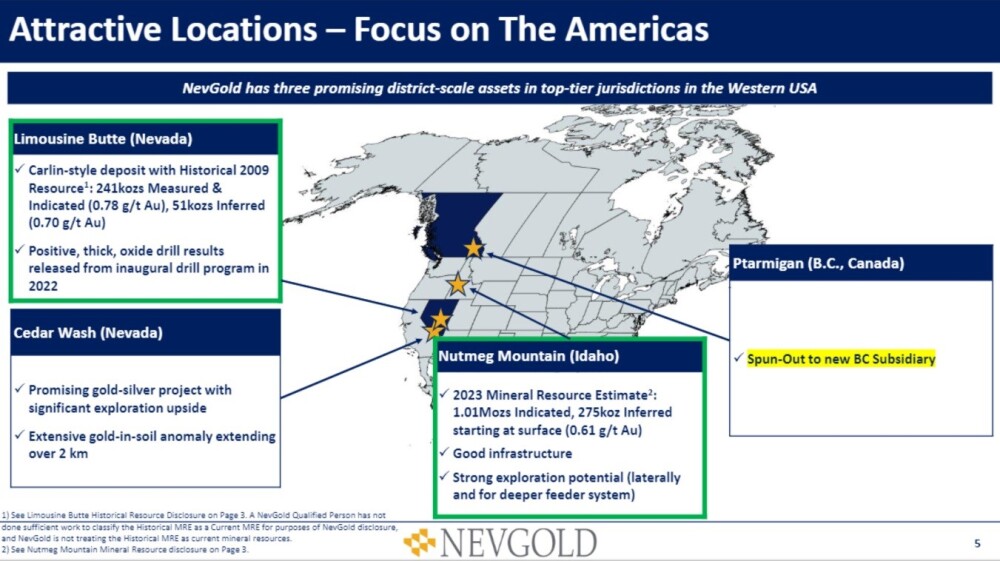

The following slide, lifted from the company's latest investor deck, shows its properties all located in western North America.

Note that Cedar Wash, not mentioned above, is a promising gold-silver project with significant exploration upside.

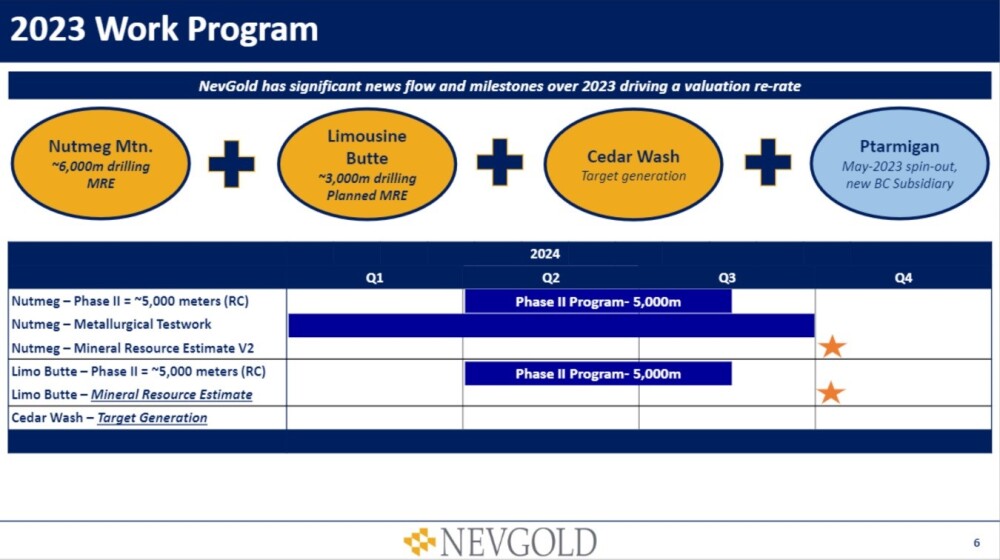

The following slide shows that important Phase 2 Summer drilling programs have now begun or will soon be at both the Nutmeg Mountain and Limousine Butte properties.

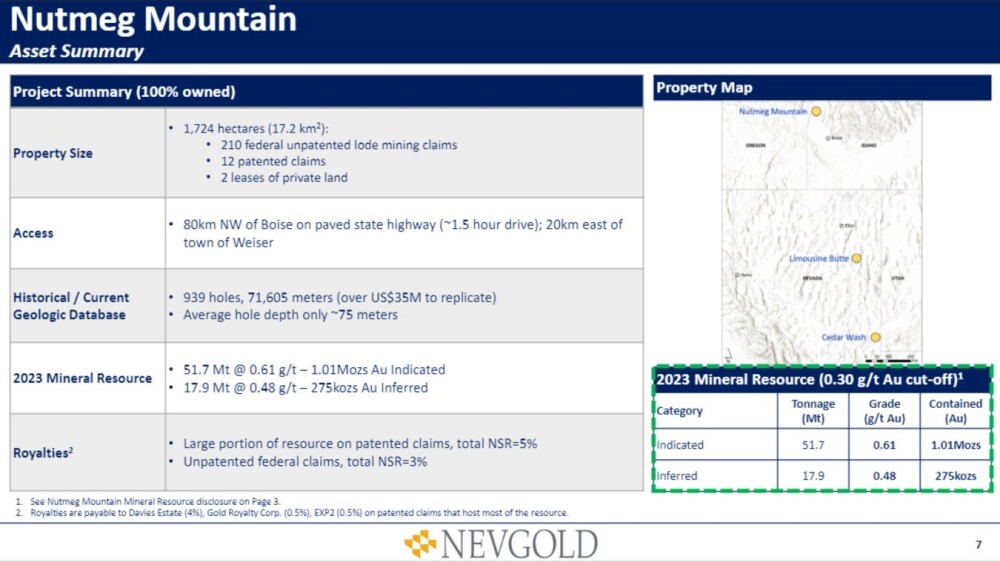

This slide shows an asset summary of the Nutmeg Mountain property in Idaho and, on the right, its position relative to both the Limousine Butte and Cedar Wash properties in adjacent Nevada to the south.

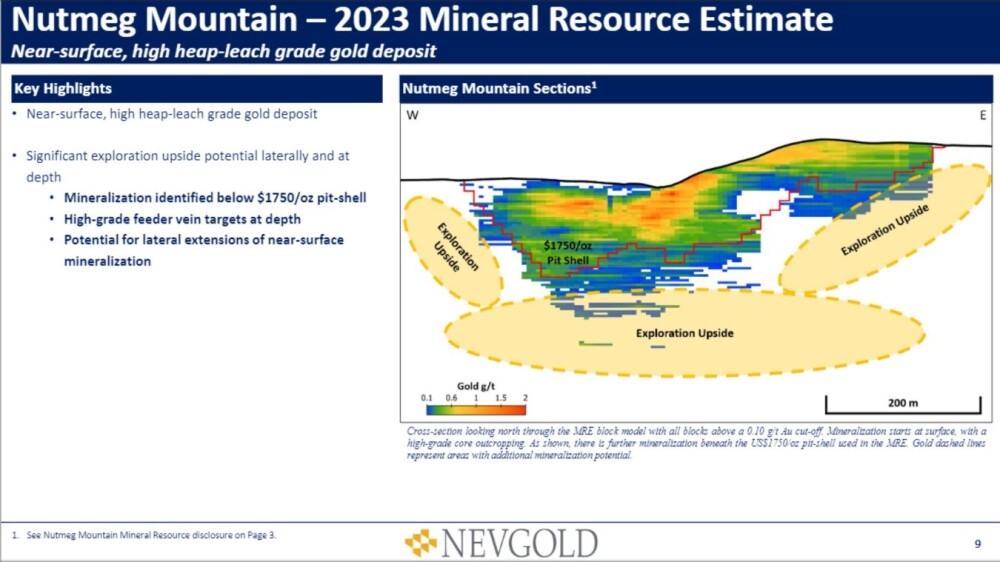

This slide includes a simplified cross-section of the Nutmeg Mountain property, which makes clear that mining this resource should be relatively low cost because it is near-surface and, therefore, can be exploited by the open pit method.

At the same time, it reveals that there is plenty of exploration potential by driving deeper later and into the flanks as there is evidence the resource extends further down and to the sides.

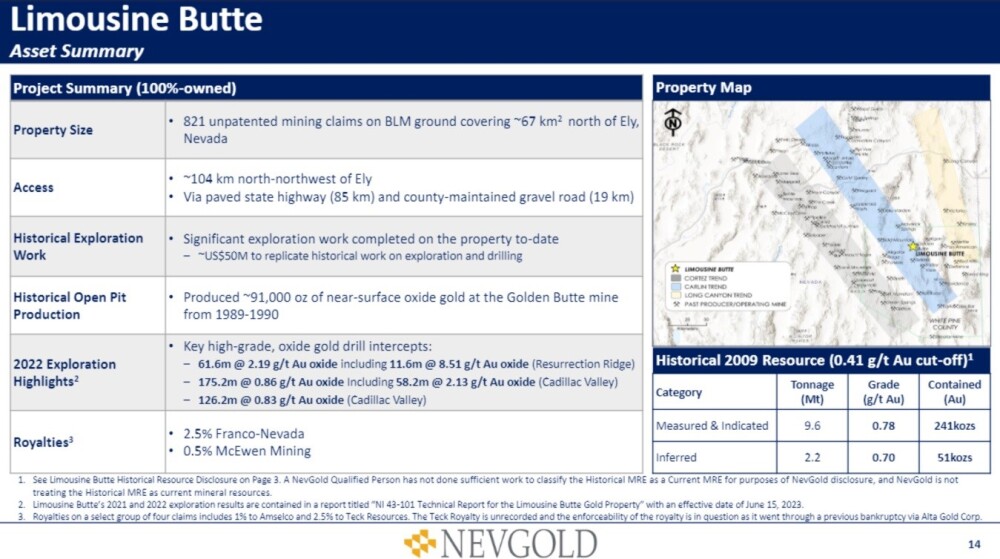

The following slide presents an asset summary of the Limousine Butte property on which we see on the map at the right that it is situated in the famous and prolific Carlin Trend, which certainly bodes well, and this slide also details Royalties due to Franco-Nevada of 2.5% and McEwen Mining of 0.5%.

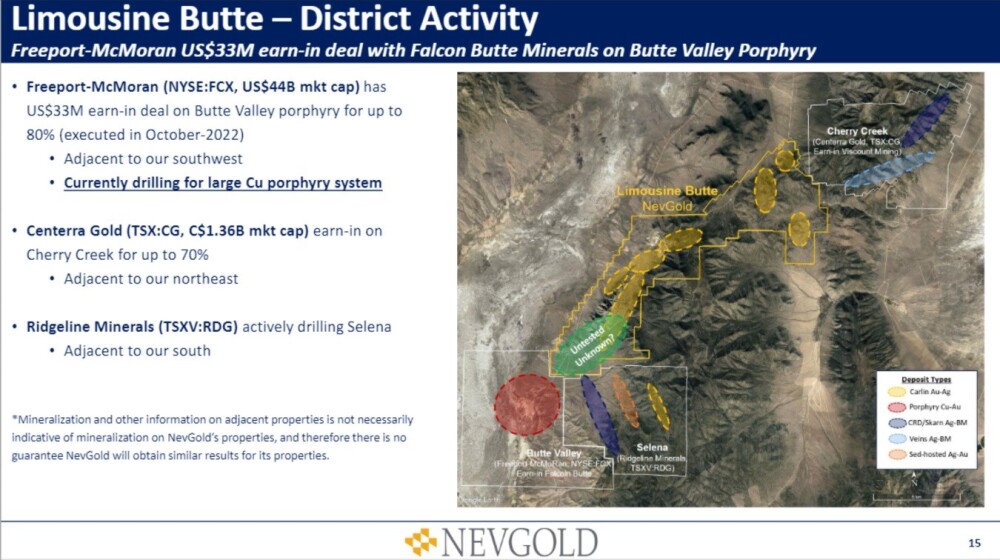

NO SMOKE WITHOUT FIRE — the following slide shows that Nevgold has some prestigious neighbors active on its flanks at Limousine Butte, and they wouldn't be there without good reason.

This clearly augurs well for good drilling results for NevGold at this property.

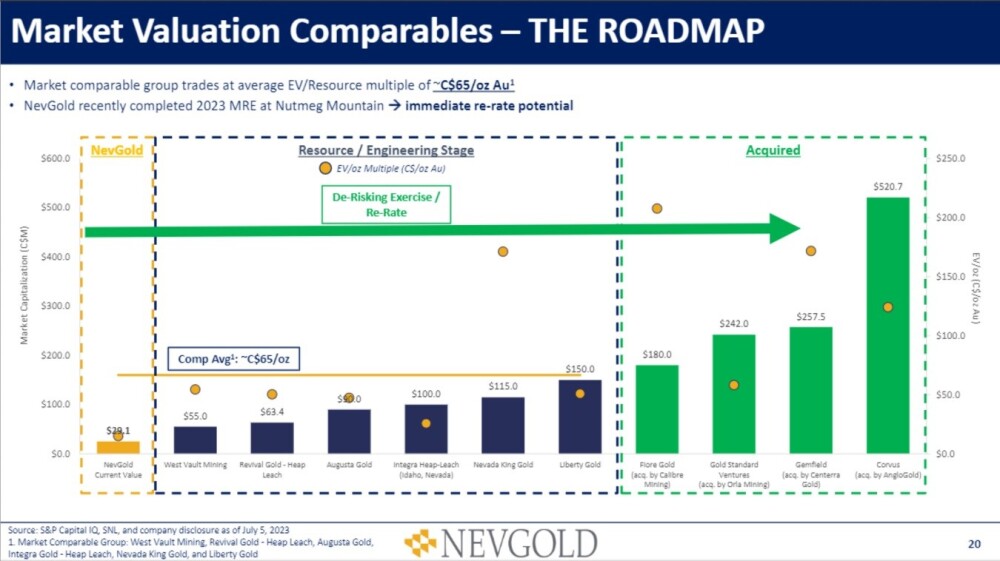

The following slide is most interesting as it shows Nevgold's current modest valuation relative to its peers and its big potential to be re-rated.

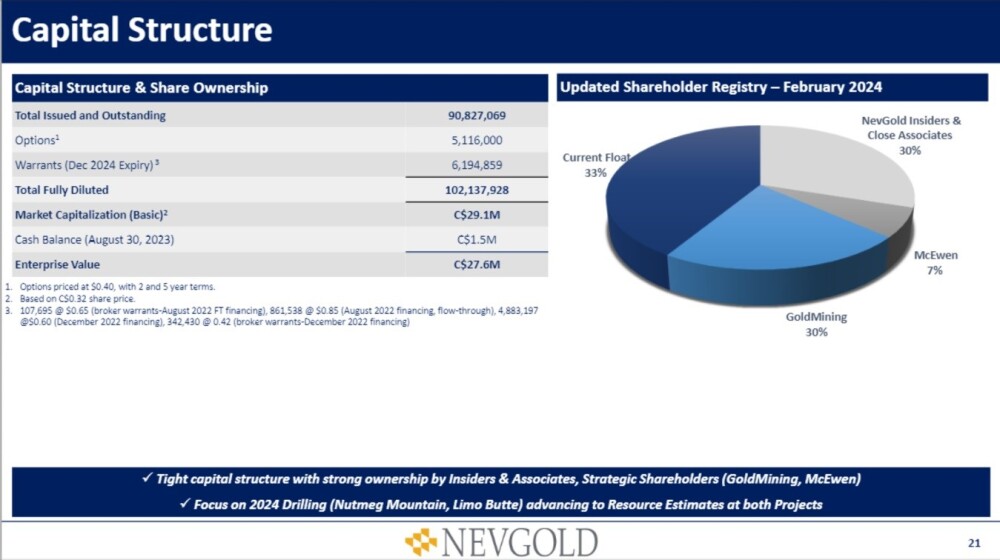

The next slide is also most interesting to would-be buyers of the stock as it shows that of the 90.8 million shares in issue, only 33%, or one-third, are free trading, with NevGold insiders and close associates holding 30%, with a further 30% being owned by GoldMining and 7% being owned by McEwen Mining, leaving a modest 30.3 million approx. shares in the float.

This means that any significant increase in demand for the stock will quickly translate into a higher share price.

Of note is that Beacon Securities' Michael Curran put NevGold on his Updated Watchlist Report dated March 26, so just a few days ago.

Now, we will proceed to review the latest charts for Nevgold's stock.

Nevgold is looking most attractive for investors here as it is believed to be on the verge of beginning a new bull market, and it is still at an excellent entry point. On its 3-year chart, we can see that the bear market in force from mid-2021 has run its course, with the downtrend having slowly fizzled out so that in recent months, it has morphed into a base pattern.

The strong Accumulation line, which has shown positive divergence for many months with upside acceleration in recent weeks, strongly suggests upside resolution of the current standoff, meaning an upside breakout into a new bull market, with this being made still more likely by gold's gathering bull market.

Zooming in on recent action by means of the 7-month chart, we can see that the downtrend ended with a Double Bottom late last year, whose first low was in September, with the second being in December. The price actually broke out of this Double Bottom in December on good volume but couldn't quite hold the breakout and has slipped back into pattern to do more work before a sustainable uptrend can become established.

The mild downtrend from early January ended with a prominent bull hammer a few days back, which signified its end and we have seen upside volume build very noticeably as the price has risen in recent days to challenge the resistance at the upper boundary of the current trading range with momentum (MACD) swinging positive and the Accumulation line soaring. This strongly implies that it is powering up to break out above the resistance, which would lead to a swift move to the next resistance at the CA$0.40 level that the long-term chart shows us is the boundary of the earlier major downtrend, so once it breaks out above the CA$0.40 level it will mark the start of a new bull market, and this looks set to happen soon.

NevGold is therefore rated an Immediate Strong Buy for all timeframes.

Nevgold's website.

NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) closed at CA$0.34, $0.246 on March 28 24.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- NevGold Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.