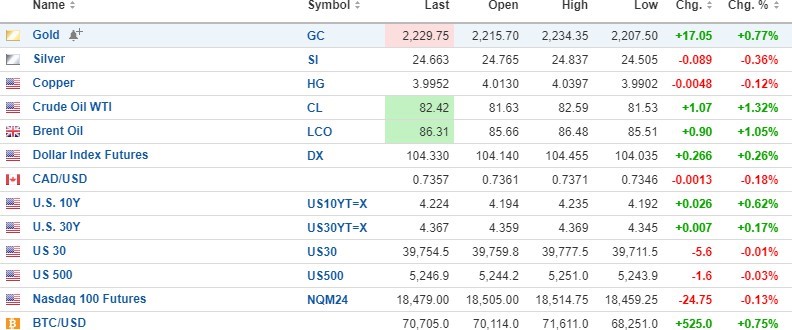

The big news this morning is the $20 move in gold (+.92%) against a stronger USD Index and weak silver (-.19%) and copper (-.26%). Oil has resumed its uptrend and is the clear winner so far up $1.21/bbl. (+1.49%). Stock futures are mixed.

Yesterday, I took a 25 contract position in the puts on the assumption that weak oil, copper, and silver would drag gold lower. Well, that did happen briefly but ended the day marginally higher.

Ø Bought 25 GLD June $200 puts @ $2.40

Yesterday, I wrote: “If they trade down through $2.00, then I am wrong and I will throw them overboard in a flash” but since silver and copper are not confirming the move in gold, I want to give this trade until this afternoon to see if the sellers knock it back. To repeat again, I have rarely seen a gold advance that lasted against a rising USD and weak silver, copper, and oil.

Getchell Gold Corp.

There has been no announcement yet but it is my understanding that the metallurgical study designed to clarify the recovery rates for the Fondaway Canyon ore is well in progress. This will put to rest any of the rumours regarding “refractory gold” or “metallurgical issues” that were thrown at me by a few of the investment bankers and analysts that use “bar talk” as an excuse for “due diligence”. I knew that Barrick conducted metallurgical assessment back in 1980 and had arrived at 90%-plus recovery rates but since that is old news and not 43101-compliant, it

was never included in any of the marketing materials.

Once completed, they will produce a Preliminary Economic Assessment that will include an update Mineral Resource Estimate that will include twelve drill holes that were excluded from the Q1/2023 MRE due to their late arrival in 2022. With the new data, I see an increase in the indicated and inferred resource to something north of 2,500,000 ounces. (That is my estimate, not Getchell’s.)

It has been my opinion since late 2022 that the only event that needed to happen to propel GTCH to higher prices was a breakout in the price of gold above $2,100. From August 2020 when gold and the HUI peaked to about a month ago, nothing could move the needle for junior gold developer/explorer issuers. The portfolio managers out their avoided the Seniors and the Juniors like the plague with particular revulsion for the penny stock developers and explorers. I surmised that there was no sense in blowing the treasury apart by drilling holes if the market was going to yawn at spectacular results, such as Getchell’s 25 metres of 10.4 g/t Au from the North Fork Zone. In any other market environment prior to the 2020-2024 period, the stock price would have moved sharply higher. With the recent breakout in gold, markets are once again moving ever-so-slowly to what I call a “gold-friendly” environment where spectacular drill results will be rewarded with rising share prices and ample funding offers.

With the PEA set to arrive by June along with the new Mineral Resource Estimate, Getchell’s share price will be directly correlated to the direction and amplitude of the gold price. It is my opinion that 2024 will be a year that gold tops $2,500 and with that event, force the generalist portfolio managers to begin to allocate portions of their assets under management to the precious metals sector. When all of those investment dollars begins to migrate to gold miners, it will be akin to forcing the water behind the Hoover Dam out through a garden hose. As the rules of economics dictate, rising demand running into finite supply can only create rising prices. There will be a trickle-down effect where they bid the Barricks and Newmonts up into the rafters then turn to the Alamos’ and Fortuna’s and as these large capital flows cascade down the valuation waterfall, they will ultimately find the junior developers with large resources that can be expanded through drilling. That is precisely the point where value-per- ounce for Getchell moves from $14.33/ounce to $50-100/ounce as jurisdiction and expandability take precedence.

This why one can reflect back on the timeliness of the Getchell debenture offering. To be sure, there was 43 million shares of dilution through the 10-cent warrants but that also puts CAD

$4.3 million into Getchell’s treasury as they get exercised which paves the way for an aggressive drill program to expand Fondaway to Tier Two status (3mm ounces).

With gold trading above $2,200 this morning, I wanted all subscribers to understand just how ridiculously cheap the junior gold developers are and why Getchell is an ideal proxy for rising gold prices.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |