The decline in Atlas Lithium Corp. (ATLX:NASDAQ) stock price this year, which appears to have been a delayed reaction to the heavy drop in the lithium price last year occasioned by a glut in supply coupled with lower-than-expected demand for EVs, is viewed as a classic case of "throwing out the baby with the bath water."

Why?

For reasons we will review in this article as succinctly as possible, the company is set to be in a vastly superior position to many of its competitors.

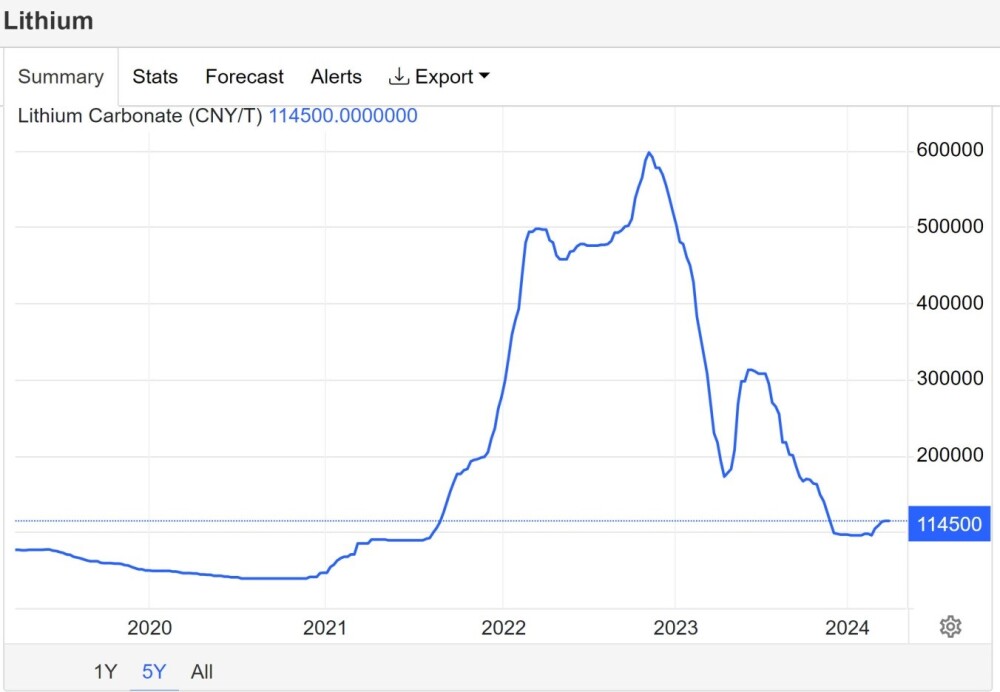

We will start by taking a brief look at a 5-year chart for lithium itself, which obviously provides a crucial backdrop for all lithium producers. This chart shows the severe bear market decline in lithium last year, which took the form of a classic 3-wave decline, implying that a new bull market will commence after the current basing process at a low level has ended.

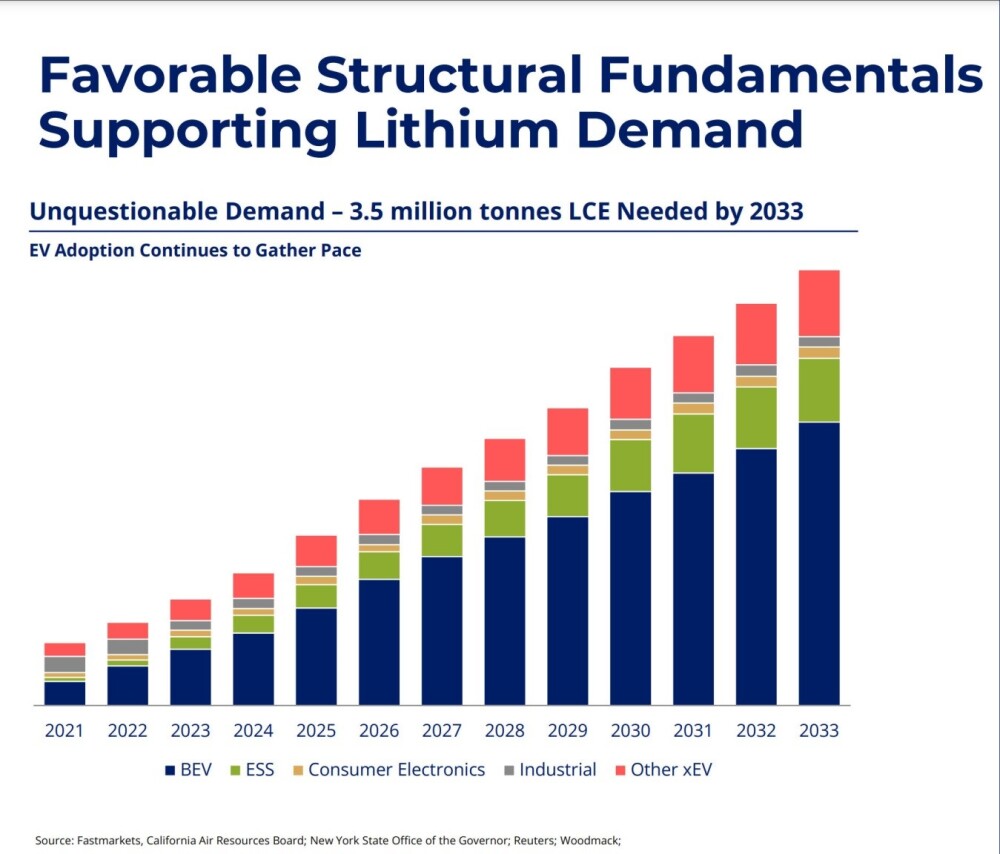

The first point to make is that despite the slump in the price of lithium last year, the worldwide lithium battery market is expected to grow by a factor of five to ten over the next decade, so this is a big growth market.

The relatively low lithium prices in the recent past will be self-correcting as they will force weaker, less competitive producers "to the wall" and thus cause prices to stabilize and probably advance anew in response to rising demand.

Prices already look like they are stabilizing here.

The second very important point is that Atlas Lithium is set to be a hard rock lithium producer, meaning that they are going to mine it, not sit around waiting for evaporation ponds to do their thing. Compared to lithium extraction from brine, hard rock lithium mining offers several advantages.

Firstly, hard rock lithium deposits, such as spodumene, typically have higher lithium concentrations, allowing for more efficient extraction. Secondly, the processing time for hard rock lithium is generally shorter than that of brine, which can take years to extract through evaporation.

Additionally, hard rock lithium mining is less dependent on weather conditions and can be conducted year-round, whereas brine evaporation is subject to seasonal variations. Finally, hard rock methods are much more ESG-friendly, with significantly less water usage or environmental impact overall.

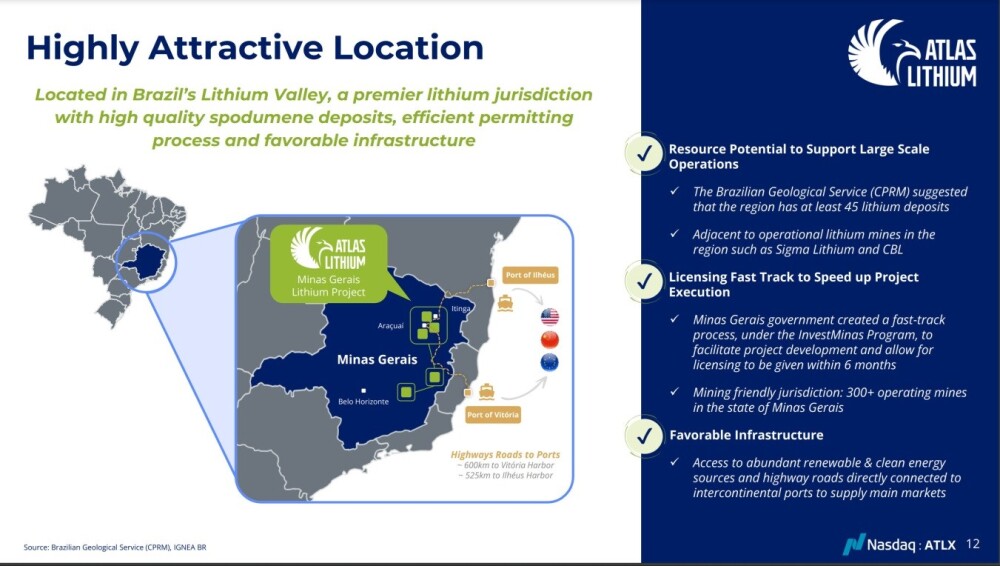

Atlas' hard rock lithium projects are situated in the state of Minas Gerais, Brazil, known as Brazil's Lithium Valley.

Atlas has the largest lithium exploration portfolio in Brazil's Lithium Valley, a premier lithium jurisdiction with high-quality spodumene deposits, an efficient permitting process, and favorable infrastructure.

In the region of Brazil where Atlas projects are situated, it has an adjacent neighbor, Sigma Lithium Corp (SGML:NASDAQ), which is a US$1.5 billion producer, so it is interesting to make comparisons; Atlas has similar quality of lithium to Sigma’s which was confirmed by several metallurgical studies, it has a greater land area in the Lithium Valley at 240 square km, as against Sigma's 191 square km, and by mid-2025 Atlas plans to be producing lithium in annualized quantity that is similar to the current production by Sigma, which kind of makes it intriguing that Sigma's current market valuation is 9X that of Atlas and this strongly suggests that this gap could narrow substantially, most likely through appreciation of Atlas' stock.

With respect to operational challenges and costs, Atlas has a great advantage because its deposits are close to surface, which means that they can be mined by the open pit method, which, of course, vastly reduces costs and accelerates the developmental timeline. The open pit approach and modular DMS technology developed by a team of DMS experts will allow for a manageable CAPEX of only US$49.5 million in production, which is already fully funded, as announced by Atlas in December 2023.

The key point is that Atlas is the only Brazilian lithium company with pre-ordained buyers waiting for its product as set out in the following, which is lifted from the December 4th news release on the company's website entitled "Atlas Lithium Fully Funded to First Production in 2024."

- Direct investment at a premium into Atlas Lithium and offtake agreements for Phase 1 of Atlas Lithium's battery-grade spodumene concentrate production have been executed with two top lithium chemical companies, Chengxin Lithium Group and Yahua Industrial Group, suppliers of lithium hydroxide to Tesla, BYD, and LG, among others. Goldman Sachs served as financial advisor to Atlas Lithium in these transactions.

- Chengxin and Yahua have committed an aggregate of US$50 million to Atlas Lithium with US$10 million as equity at US$29.77 per share (a 10% premium to recent VWAP) and US$40 million as non-dilutive prepayment in exchange for 80% of Atlas Lithium's Phase 1 lithium concentrate production.

It is noteworthy that both Chengxin and Yahua, who are two of the world's largest lithium chemical producers, as mentioned above, have each purchased US$5 million of Atlas stock at a premium, having paid US$29.77.

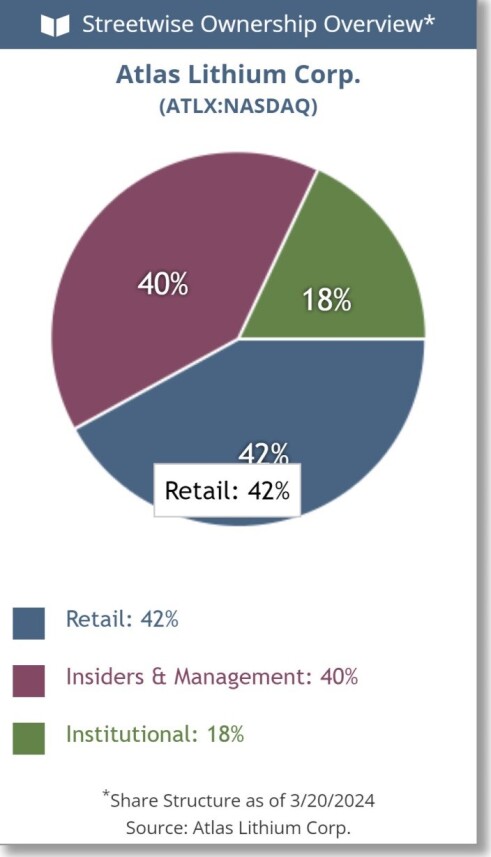

With respect to the financials of the company, it only has 12.7 million shares in issue, of which 40% are owned by management, with a further 18% owned by institutions, leaving only 42% for retail investors, as the following pie chart makes plain.

So, with less than 6 million shares available to retail investors, it is clear that any significant increase in investor interest could drive a big rally in the stock market. At its recent price, the company has a valuation of about US$150 million. Warrants outstanding are negligible when compared to the overall OS number.

The company has another advantage, which is that it is one of the few hard rock lithium companies whose stock is listed on the NASDAQ exchange, which provides enhanced liquidity and heightened investor interest.

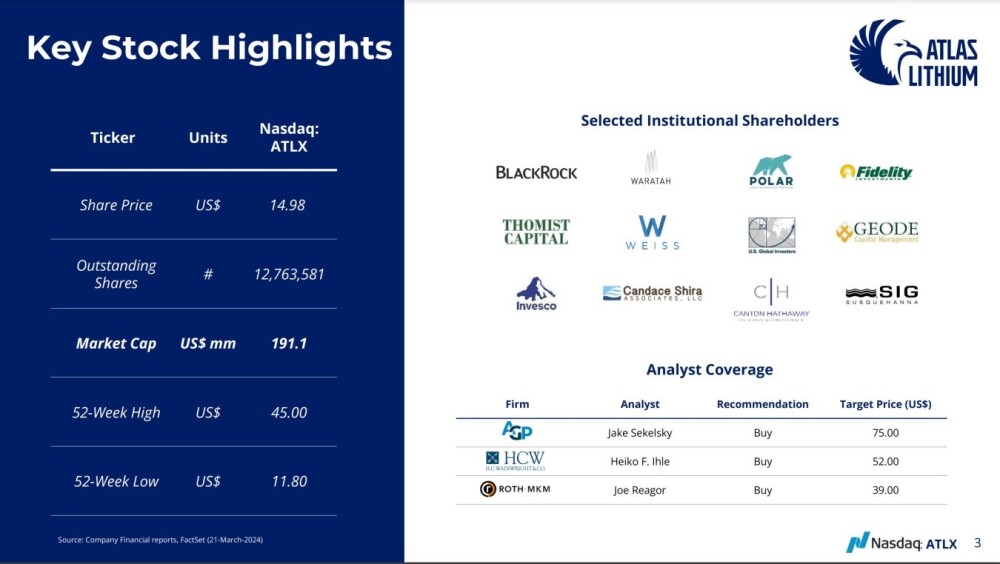

This slide shows key stock highlights.

It is most encouraging to note that on the above slide at the bottom right, the analyst's price targets for the stock are US$39, US52, and US$75, with even the lowest of these projections being way above the current price.

Only a few days ago, the company announced that renowned lithium expert Brian Talbot is to join the company as Chief Operating Officer and a member of the board of directors, effective April 1.

Now, we will examine the stock charts for Atlas Lithium, which will make very clear why it looks like an extraordinary bargain here for investors. On its latest 6-month chart, we see that the severe downtrend from its December 28 high when it hit US$34 through to the 18th of this month, when it is believed to have hit a final low at US$12, has erased almost two-thirds of the company's value in less than three months.

This selloff appears to have been a delayed reaction to the heavy drop in the lithium price last year due to the combination of a glut and weaker-than-expected demand for EVs. For the fundamental reasons discussed above, not only has the selling been way overdone, but the stock should soon reverse into a bull market and will probably not hang around making much of a base pattern first.

There are several strongly bullish factors to observe in this chart. The first is that the price has already broken out of the steep downtrend with the big white candle that appeared on the chart in good volume some days back on the 20th. The second bullish factor is that the turnaround of recent days has been on strong volume that has driven up the Accumulation line.

The third is that the latest low on the 18th of this month was not confirmed by momentum (MACD), which did not make a new low by a wide margin — this shows diminishing selling pressure.

Lastly, the persistent downtrend this year has opened up a large gap with the 200-day moving average, which is a measure of how oversold it now is and, in so doing, has created "snapback" potential.

Zooming out by using a 16-month chart, not only can we see again the large gap with the 200-day moving average creating recovery potential, but we can also see clearly why the price would want to reverse to the upside here, for it has fallen into a zone of quite strong support arising from several lows in this price area during the Spring of last year and also from the upper reaches of the earlier trading range.

Thus, this is a good position from which to start higher again.

Zooming out again, the 5-year chart is most interesting as it reveals that Atlas is being shepherded higher by a giant and broad parabolic uptrend channel that kicked off with an extraordinary spike early in 2021, which was followed by a violent reaction that led into a long slump which found support at the lower parabolic boundary, which is exactly what it is doing right now and a very important point to note is that even though the parabolic uptrend channel shows a gradual acceleration, within it, the price has the potential to accelerate dramatically and make huge gains within a short space of time, as it has done on several occasions already because this channel is so broad.

With it being significantly oversold now and close to the lower channel boundary, it certainly looks like it is at a great entry point here.

Lastly, we will take a brief look at the very long-term 16-year chart to get an overview of the entire history of the stock, this time period being selected to get the price out from under the writing at the top left of the chart.

Whilst this chart is of limited use technically, it shows that (adjusted for splits) Atlas was trading at far higher levels back in 2013 (Prior to the October 2022 name change, the company was called Brazil Minerals.) and also that, after the severest of bear markets into early 2015, it has essentially been scuttling along sideways ever since, although within what looks like a giant low base pattern on this chart, it has made some huge percentage gains at times as it was coming off such a low level.

The conclusion is that Atlas Lithium is at a great price here on both fundamental and technical grounds. It has big growth potential and is rated a Strong Buy for all timeframes.

Atlas Lithium's website.

Atlas Lithium Corp. (ATLX:NASDAQ) closed at US$13.98 on March 25, 2024.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Atlas Lithium Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Atlas Lithium Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.