A non-medical college student relied on Treatment.com AI Inc.'s (TRUE:CSE; TREIF:OTCMKTS) Treatment mobile app when taking the Objective Structured Clinical Examination (OSCE) and scored 92%, the company announced in a news release. The app utilizes the company's artificial intelligence (AI)-powered medical information support platform.

"The ability of the AI software to identify the pertinent positives and negatives, together with physical exam findings, and turn them into a precise description and reasoned differential diagnoses was remarkable. This is an AI tool that any medical professional can use in their pocket," Treatment.com Chief Medical Officer Dr. Kevin Peterson said in the release.

The OSCE is a standard clinical exam given at medical and nursing schools to assess students' diagnostic aptitude. It involves examining and assessing 12 simulated patients, the release explained. With the app, the student questioned each patient, summarized the findings, and indicated the most likely diagnosis. The student got 11 of the 12 most likely diagnoses correct, among them colon cancer, appendicitis, acute myocardial infarction, diabetes, and patellar tendonitis.

A suite of AI-Backed Medical Software

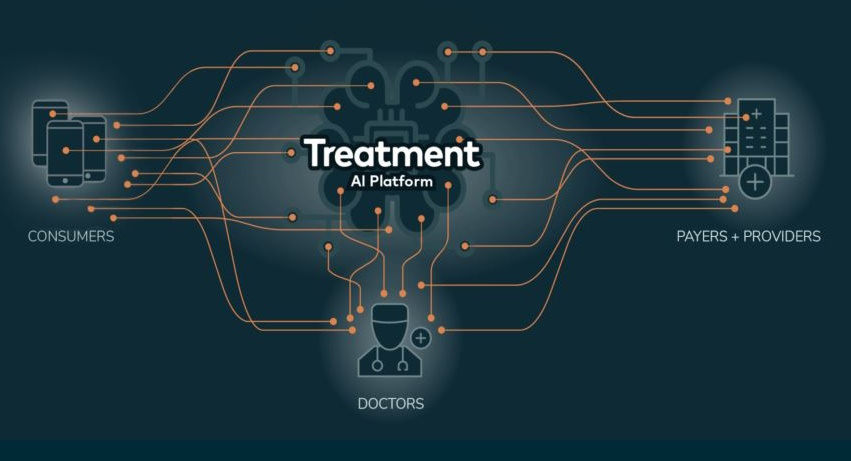

With a mission to "dramatically disrupt how healthcare is delivered worldwide," Treatment.com AI develops and provides medical software solutions.

"Treatment.com AI's platform is powered by its proprietary Global Library of Medicine (GLM), which incorporates AI machine learning and has been trained by hundreds of physician experts across the globe," wrote Technical Analyst Clive Maund in a February 16 report. "The company is already in partnership with the Mayo Clinic and the University of Minnesota Medical School and is in discussion with another 52 organizations."

Currently, the Vancouver, British Columbia-based firm offers an array of solutions utilizing the GLM. The Medical Education Suite (MES) delivers case-based clinical decision-making testing, grading, and remedial action support for the next generation of healthcare professionals. Treatment’s Enterprise Solution offers healthcare organizations the ability to integrate with the GLM through an application programming interface (API). This enables organizations to access the GLM to improve both clinical accuracy and efficiency of their processes, from back-office tasks to patient intake and care (including writing a medical note, providing a differential diagnosis with probabilities, and suggesting recommended treatments, testing, and billing codes to a healthcare professional).

High-Growth Sector

The overall AI healthcare market is projected to grow at a 37% CAGR between 2022 and 2030, by which time it will reach an estimated value of US$187 billion (US$187B), according to Statista. Roughly three years ago, in 2021, this market was valued at US$11B.

"The growth potential of this industry is enormous," Maund wrote. "With Treatment.com AI having already developed its own platform, it is centrally placed to be a part of this."

According to MarketsAndMarkets, the global AI in medical diagnostics market is expected to reach US$3.7B in value, up from US$1.3B, between 2023 and 2028, increasing at a 23.2% compound annual growth rate (CAGR).

The Catalyst: New Software Debut

The company plans to launch additional products in the healthcare marketplace this year, the company said, and any of those could boost the stock.

Maund, who conducted a technical analysis of Treatment.com AI last month, wrote in a report that the company's pattern of movement indicated a breakout from the base pattern looked likely to happen soon. He recommended the stock as a Strong Buy for all time frames.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS)

"Treatment.com AI is a company that should have a very bright future," Maund added.

Ownership and Share Structure

According to Reuters, two insiders own 13.12%, or 4.87 million (4.87M) shares, of Treatment.com AI. They are Chief Medical Officer, Chairman and Director Dr. Kevin Peterson with 10.35% or 3.84M shares and John Fraser with 2.76% or 1.03M shares.

Retail investors own the remaining 86.88%. There are no institutional investors currently.

The company has 37.11M outstanding shares and 32.24M free float traded shares.

Its market cap is CA$17.33 million, and its 52-week trading range is CA$0.10−1.20 per share.

| Want to be the first to know about interesting Life Sciences Tools & Diagnostics investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Treatment.com AI Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Treatment.com AI Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Contributing Author Disclosures

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor.