It would be easy to infer from the current low share price that the outlook for Silver North Resources Ltd. (SNAG:CVE;TARSF:OTCMKTS) is bleak, but as we will see, such is not the case.

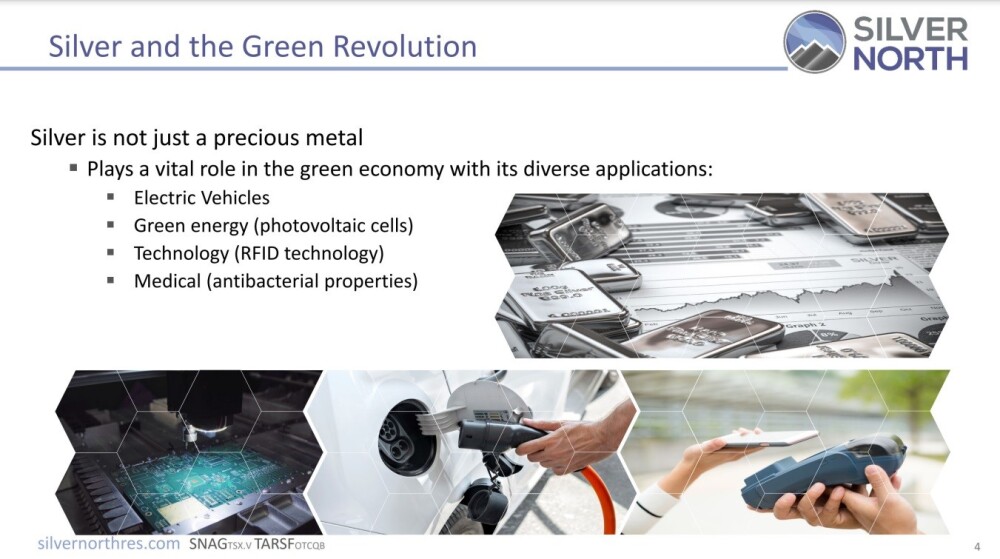

The company is set to move ahead with its two main silver projects in the Yukon this summer when drill programs will be undertaken at a time when the outlook for the silver price is better than it has been for many years, with the prospect of robust gains in the silver price and an important general point made early on in the company's investor deck is that silver is not only a precious metal but plays an increasingly vital role in the so-called green revolution as set out on the following slide lifted from the company's latest investor deck.

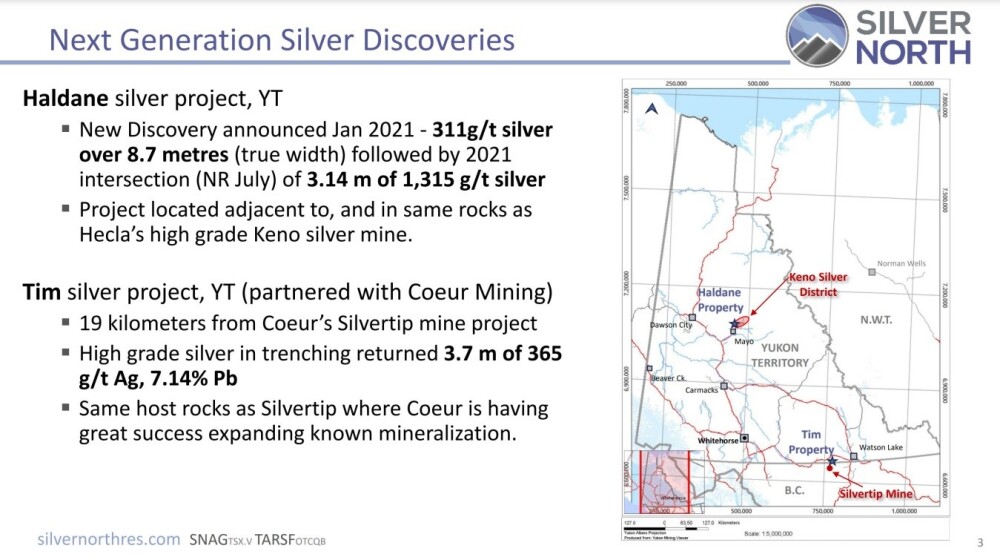

The company's assets consist primarily of two important and highly prospective silver properties in the Yukon. One is the Haldane Silver Project, where drilling is set to be undertaken in July and August, subject to financing, and the other is the Tim Silver Project close to the BC border, where the company is in cooperation with Coeur Mining, with which the property is optioned, to advance the project and Coeur is set to implement a drill program there in June and July.

The location of the Haldane and Tim properties and some details of these projects are set out on the following slide.

Apart from these two main properties, the company has a portfolio of other mainly early-stage properties, mostly in the Yukon but also as far afield as Colorado, Nevada, Peru, and also some Royalties, which it plans to adjust this year by disposing of some and acquiring others.

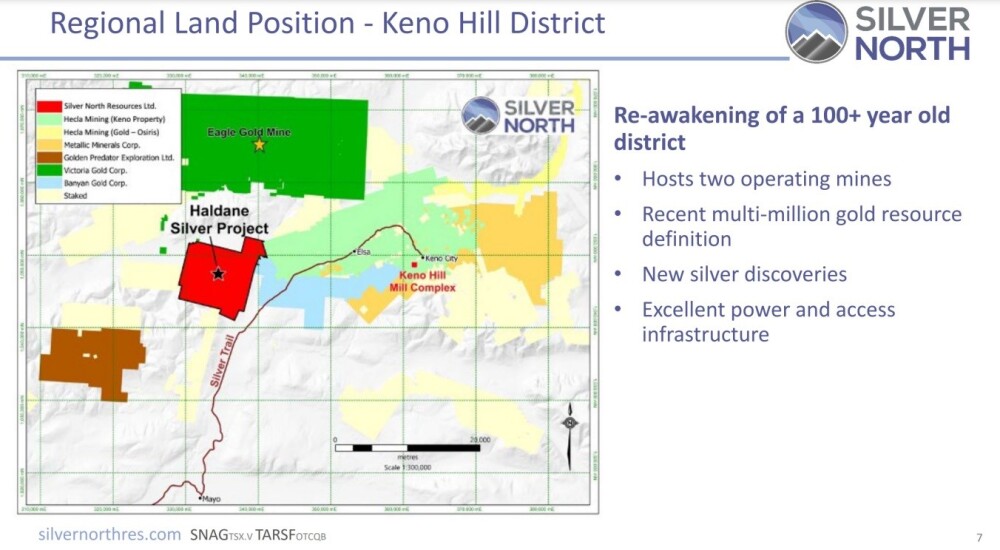

As the following slide shows, the Haldane property is in a very prospective location, being as it is adjacent to Banyan Gold, Hecla Mining's Keno property and very close to Victoria Gold's Eagle Gold Mine and also close to properties of Golden Predator and Metallic Minerals.

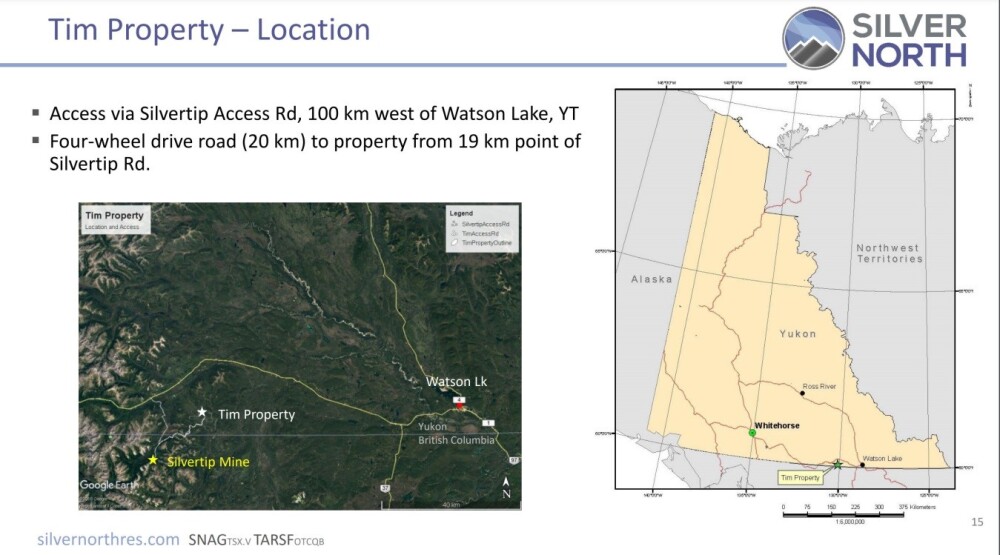

The Tim property's location is shown on the following slide which makes clear its proximity to Coeur's Silvertip Mine, just over the border in BC.

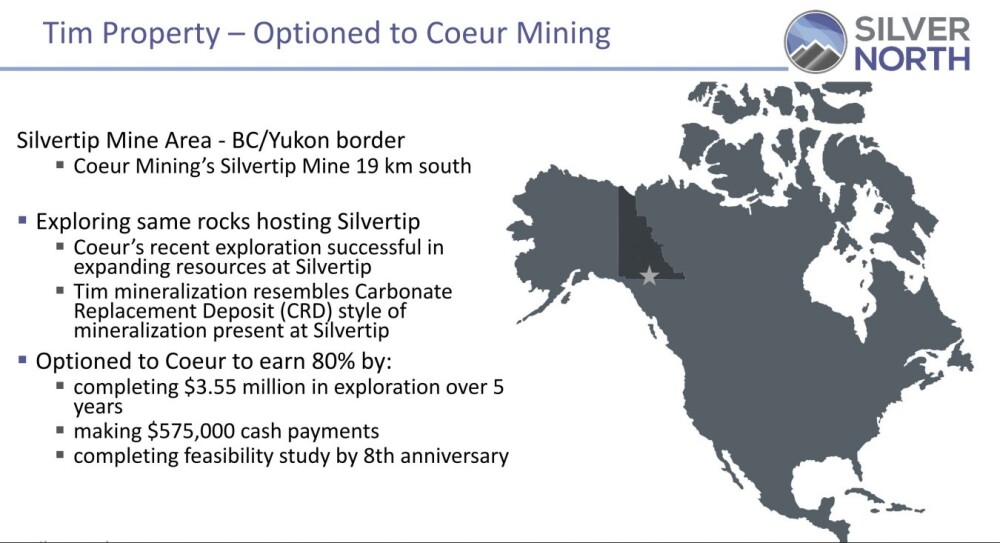

Some details regarding Coeur's involvement in the development of the Tim property are set out on the following slide.

Now, we will look at the stock charts for Silver North to see what they have to say about the outlook.

We will start with the very long-term 20-year chart, which gives an overview of the entire history of the stock. This immediately reveals that Silver North has seen much, much better days — it briefly got as high as CA$47.50 at the start of 2011, after which a plunge marked the start of a particularly brutal bear market that by the time it had run its course had rendered the stock virtually worthless.

Since late 2015, it has been bumping along the bottom, marking out a long base pattern. Whilst it would be unrealistic to expect the stock to climb back to its former lofty heights achieved in 2007 and 2011, it could have a serious go at it, given that the company still has a relatively modest 36.8 million shares in issue even after all this time and that we are right now beginning a gold and silver bullmarket that could easily eclipse that of the 2000s due to collapse of the debt markets and currencies trending towards worthlessness, ultimately including the dollar.

Moving on, we will now open out the latter part of the base pattern by means of a 5-year chart, which initially shows that, even within what looks like a low flat base on the 20-year chart, there have been some big percentage swings. This chart reveals that a severe bear market has unfolded from the peak above CA$1.20 at the start of 2021, which is believed to have finally ended a couple of weeks ago when the stock marginally hit a new low towards the end of February.

Even though it just made a new low, it actually broke out of the downtrend back last July on strong volume, which was a positive sign when it is believed that some savvy investors understood that the company was "turning the corner" and that better times lay ahead.

Nevertheless, it takes time for the fundamentals to improve, which is why the stock has since drifted back down, skating along above the upper rail of the downtrend to make a Triple Bottom with its earlier lows of November 22 and then from March through July of 23. Nevertheless, those who bought back last July and presumably others evidently believe they are on to something and have persisted in furtively buying the stock even as its price has drifted lower, which is why the Accumulation line has continued to advance in a vigorous manner even as the price continued to fall. This marked divergence is viewed as very bullish.

Zooming in again, the 2-year chart shows the area of the Triple Bottom in detail, enabling us to see exactly what has been going on in the more recent past. The dip back to form the third low of the Triple Bottom, the last part of which was partly due to the announcement of the current small financing at 12 cents that is expected to be closed in April, has taken the form of a bullish Falling Wedge that promises a reversal to the upside.

The breach of the clear line of support at 10 cents that occurred late last month and may have been concerning to some is viewed as a "head fake" or false breakdown, especially as the upside volume buildup of the past couple of weeks has driven the Accumulation line still higher strongly suggests that the stock is building up to break out into a new bull market and with a major new silver bull market on the verge of starting it should "have the wind at its back" as its ascent gains more and more traction. The MACD indicator shows plenty of upside potential, and in the sort of positive environment for the sector that we are moving into, the resistance shown on the chart should not prove to be much of an obstacle.

Lastly, the 6-month chart enables us to see recent action in still more detail and emphasizes again the enormous positive divergence of the Accumulation line relative to price, and further shows that the stock is significantly oversold relative to its 200-day moving average, and we can also see more clearly the upside volume buildup of recent weeks.

Catalysts that will help get the stock moving as the year unfolds are as follows…

- March: Details of the drill plan will be announced in the next couple of weeks, set by Coeur, the Tim Property, which is 19 kms from their Silver Tip Mine, and $700k funded by Coeur.

- April: The company will close the small financing that was just announced on Thursday.

- April/May: The addition of one or two new silver property acquisitions to the key property list is likely to be announced. Other properties may be sold during this period.

- June/July: Drilling at the Tim Property.

- July/August: Drilling at the Haldane property — financing dependent.

- August/September/October: Drill results out from both the Tim Property and the Haldane property.

Also, during the summer months, the announcement of early-stage work programs on the newly acquired properties.

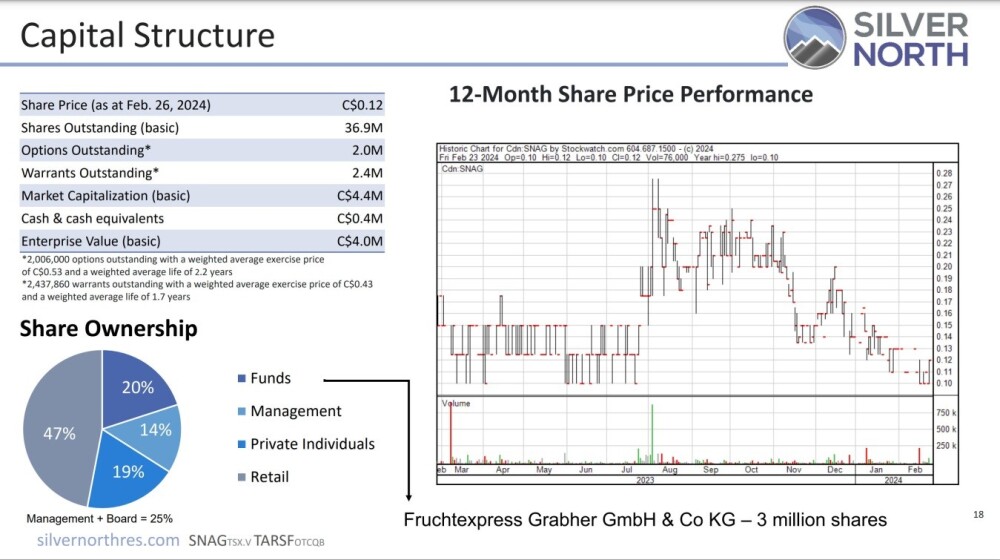

Lastly, the following slide shows the capital structure; of the 37 million shares in issue, only 47% are in the float, or less than half, meaning that not more than 18 million are publicly traded. So any significant increase in demand will quickly move the price.

The conclusion is that Silver North is a stock that only has upside, and that upside is relatively unlimited and likely to result in very large percentage gains for anyone buying the stock in this area.

Note that the price may remain in this area for a few more weeks until notification is received that the small financing is closed.

Silver North Resources Ltd. (SNAG:CVE;TARSF:OTCMKTS) closed at CA$0.10, $0.083 on March 15, 2024.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.