World Copper Ltd. (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA), a Top Pick, was among Fundamental Research Corp.'s (FRC) Top 5 performers of the week, the equity research firm reported in its March 4 note.

The Canadian company with advanced-stage porphyry copper projects, Zonia in Arizona and Escalones in Chile, took the fifth spot with a week over week (WOW) return of 17%.

In other news, the copper explorer-developer is arranging a CA$4 million financing, FRC reported. Further, the Chilean government recently designed an area encompassing Escalones as a sanctuary, and World Copper's management is "reviewing its options."

Week in review

In its Analyst Ideas Of The Week report, FRC highlighted the performance of certain commodities and reported key events that happened, during last week, ended March 1.

"We believe these developments should encourage higher investor risk tolerance, prompting increased capital allocation to small-cap stocks, which have significantly trailed the performance of large-cap stocks in the past year," FRC wrote.

Global equity markets were up 1.3% on average, a slightly better performance compared to its 1.2% increase the week before. FRC attribute the most recent week's change to slower-than-anticipated gross domestic product growth in the U.S. and slowing inflation in Europe.

Standout metals

In its report, FRC addressed gold, nickel and lithium specifically.

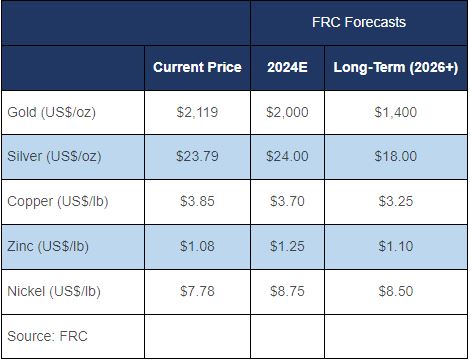

About metals overall, however, it noted metal prices were up 2.9% last week versus 0.1% the prior week. FRC maintained its metal price forecasts.

Gold near record highs

As for gold, it was up 5% and trading near record highs, having surpassed US$2,100 per ounce (US$2,100/oz), reported FRC. The research firm maintained its bullish outlook on gold and still expects its price to reach US$2,200/oz this year.

Also up last week were the valuations of gold producers, by 2%. This was an improvement over the previous week, when they were down 8%.

"On average, gold producer valuations are 27% lower compared to the past three instances when gold surpassed US$2,000/oz," FRC wrote.

Base metal producers were up 4% last week, continuing the trend of the previous week when they were up 6%.

Nickel on the upswing

As for nickel, it hit US$7.78 per pound (US$7.78/lb), up 10% since FRC predicted, in January, it was about to rise, the firm reported. FRC reiterated its bullish stance on the nickel price and its forecasted 2024 high of US$8.75/lb.

Lithium E&D outperforms

Lithium was in the spotlight during the week, as FRC's best performing Top Pick under coverage was Noram Lithium, a Canadian company with a large high-grade project in Nevada. Noram's stock was up 41.9% WOW.

Also in lithium news, Mitsubishi Corp. announced it is acquiring a 7.5% interest in Frontier Lithium Inc. for US$25M, with an option to increase its interest to 25%. This coincided with FRC's thesis that mergers and acquisitions are going to pick up in the electric vehicle sector. Frontier has a lithium project in Ontario, Canada that is high grade and large tonnage.

"The transaction price reflects a 67% premium over Frontier Lithium's last closing price," added FRC.

Cryptocurrencies do well

Like gold, bitcoin (BTC) was up last week and trading near its all-time high, noted FRC. BTC rose 7% while the Standard & Poor's 500 creeped up 1%.

"Our models suggest that the current fair value of BTC is US$49,100 (previously US$46,500), indicating 27% downside potential from the current price," FRC wrote.

The global hash rate of BTC was up 1% WOW, to 569 exahashes per second (EH/s), and up 3% month over month (MOM).

"The increase in hash rates is negative for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates," FRC explained.

Also up last week were the prices of mainstream/popular cryptos, by 10% on average, versus 3% the week before. The global market cap of cryptos was $2.5 trillion, up 48% MOM and 138% year over year.

Companies operating in the crypto space traded at an average enterprise value:revenue of 10.6x, up from 9.6x previously.

| Want to be the first to know about interesting Base Metals, Gold, Cryptocurrency / Blockchain and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |