Finally, gold breaks out as it has been very frustrating for precious metal investors.

Oil also went over my $80 target this week but could not close above $80. Nevertheless, the chart shows a solid up trend (blue) with resistance at that $80 level and a breakthrough that would mean a test of $85.

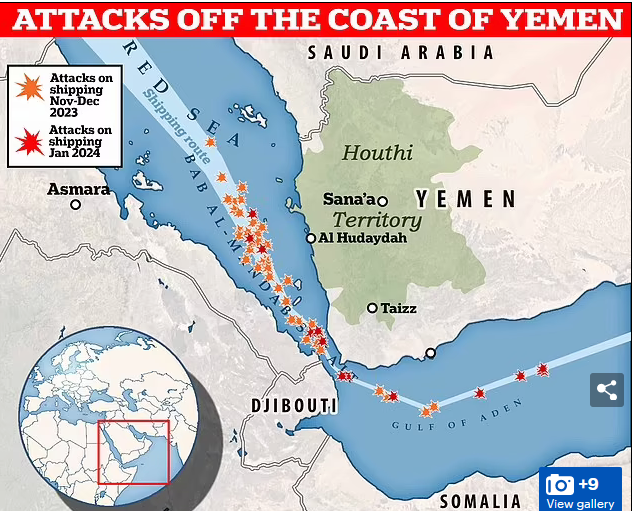

The near-term bearish factor for oil would be a ceasefire in the Israel war. It would not mean any real difference for oil, but the market would have a knee-jerk reaction or excuse to take profits with that news. With a ceasefire, I really doubt the Houthis would stop attacking ships.

The latest attack this week on a Commercial ship, the True Confidence, was the first fatal one killing three crew members and critically injuring more.

Brigadier General Yahya Saree, a Houthi military spokesman, said the rebels' attacks would only stop when the 'siege on the Palestinian people in Gaza is lifted.'

This morning, The DailyMail in the UK showed an excellent map of recent attacks, and there is a lot more than you usually hear in the press.

Gold Prices

Now for the news I have and most of us have been waiting for is the break out in gold prices. I have stuck my neck out for months and have been calling for a strong rally in gold for 2024. I had commented numerous times that we needed to see a solid higher high closing price, and I was looking for $2150 or higher to signal a strong breakout. On Wednesday, we got that for a close of $2158.

A lot of market commentary is saying that gold is reacting to a Fed pivot in June. I don't think so because the market has been talking up and hoping for such a pivot for over a year now. There is actually a handful of reasons that gold is finally reacting as I have been expecting:

- An inflation hedge, January inflation numbers were higher than expected and those rising energy prices and higher shipping costs signal more inflation. Union wage increases of about 7% will add inflation pressure as well;

- Government spending and debt remain out of control, adding to inflation pressure plus adding to market uncertainty. Gold does well with uncertainty;

- U.S. government and, recently, Janet Yellen have been harping about confiscating the frozen Russian assets and giving the money to Ukraine. Many other countries, especially BRICS, see this as the dollar being used as a weapon, not a good reserve currency anymore, gold is better;

- In 2023 gold became a Tier I asset class, the same as holding dollars, euros, and treasury bonds for the banks. Therefore, Central Banks are diversifying their asset base;

- U.S. economic data is not as good as the headlines suggest. I have been commenting for a long time that the pivot will come because an economy going into recession, not tamed inflation;

- Central Banks have been buying gold at record amounts, taking a lot of it off the market;

- Gold is way under-owned with just 1% of Assets Under Management allocated to gold vs. 8% in 1980. Only the 1998 to 2003 bottom saw lower allocation. The 2011 peak saw this increase to about 1.5%. It will not take much with the massive amount of money floating around.

There are a few other bullish fundamentals for gold, but above are most of them. It is an election year, and I believe we will see a Fed pivot. It might not be June, but not long after. They will want to signal interest rates are coming down to help Biden's chances.

This will happen because of a weak economy, even though they may continue to show decent job numbers. Goldilocks would have less inflation, lower interest rates, and still job growth.

That will be the narrative; reality is probably different. With every past Fed pivot, gold and gold stocks have soared. With the gold miners gaining between 200% and 400% on average after the last three pivots or easing. Instead of a Comex gold chart, I am going to show a chart of the 'GLD' etf. I will point out, though, on the futures market, Managed Money is only 56,000 contracts long and 5-year historically that can increase three to four fold from here.

Still way under-invested.

No matter what chart you use, the breakout high is obvious. However, look at the low volume so far. Hardly any buying has come into gold so far.

I predicted gold bottomed in October 2022, and we are now up +31%, so this is no doubt a bull market. What I did not predict is that gold stocks would not respond to this move. However, I have been following this strange development and acknowledge this strange market, and my theory was a strong break to new highs would be needed to kick the gold stocks in the butt.

I predicted this for 2024, and now it is becoming a reality. So, what have gold stocks done in the past week or so? My last update showed the unprecedented performance gap between the stocks and gold. So far, the HUI index has moved up just over 10%, and the gold stocks are still cheap, cheap, cheap. Just to get back to the 2022 high when gold hit about $1980, we would see over a +50% move to 330.

We hit bull market status around 240, but we really need to see a higher high above 255. We have had short bull runs in the last 1 and 1/2 years, but the stocks have come right back down. This was very frustrating as hopes would be raised only to be squashed. This is one of the reasons retail investors will not be buyers for quite a while yet.

This time we are at the start of a major bull run, what we have been waiting for.

Because of false starts and typical bull beginning, this first move will be driven by institutional money coming back into gold. We can watch the TSX Venture index for signals that retail money is coming back in. It will also go into ETFs, but it is hard to tell in the ETFs if it is retail or institutions. On the TSX Venture, the shorts have been running that market for the last two years. We need to see a good break out, a close at 660 or higher. The key thing to watch is volume.

We have to see a strong move from the 20 million shares per day back to around 75 million. That is what will wrestle control away from the shorts, and maybe they will go long.

We are probably several months away from getting volume back in, but you never know; it could depend on how fast gold moves.

PDAC Curse

The PDAC is the biggest annual mining conference in the world. In most years, the mining stocks would rally ahead of the conference only to come back down. It got nicknamed by some as the 'PDAC Curse'.

This year, the opposite is happening as the stocks did nothing ahead of the conference but were in rally mode during the conference and still are.

This is perhaps a good sign.

Argonaut Gold AR:TSX

Recent Price - $0.30

Stopped out at $0.43

Argonaut Gold Inc. (AR:TSX) ended 2023 at $0.47, but we got stopped out on the Selection List at $0.43 in January. The main reason was their expansion, bringing the Magino mine on stream, which has been a financial disaster in a very poor market.

The company got fleeced on financing, had to sell some assets, and sold a NSR on the new mine to help finance rising construction costs with inflation. For example, the stock was heavily shorted in October/November, driving the price down from about 55 cents to 38 cents.

There were about 60 million shorts by the end of November. They covered into a 220 million share financing at $0.38 in mid-December. Their financing costs created a lot of dilution, and new debt on the balance sheet ate some profits.

It was not a total disaster, but instead of Magino being a game changer with much higher production and lower costs, it has only been moderately positive.

That all said, the stock is way over sold and beat up, so worth buying and owning.

Gold production is expected to be up about +20% in 2024, but costs will be about the same because of higher sustaining costs at Magino. The company has a good plan to manage costs and production going forward. A big factor is that a higher gold price fixes a lot of problems for any miner.

They had an operating cash flow of $67 million in 2023, and I expect this will improve in 2024 with a full year production at Magino and higher gold prices. The stock is trading at six times 2023 cash flow, which is in the range of five to ten times where a lot of gold stocks are trading now. However, their All-In-Sustaining-Cost was high in 2023 and about $1,800 per ounce in Q4 2023. That is higher than most, but higher-cost gold companies get way more leverage to rising gold prices. For example, with some round numbers:

Assuming gold prices stay up here and or go higher, Argonaut will see a big increase in cash flow for 2024.

The gap down in late February was on the news their production would only increase 13% to 25% in 2024, and costs would be about the same. I think all the bad news is priced into the stock at this point.

Aztec Minerals AZT:TSXV

Recent Price - $0.1

Entry Price - $0.40

Opinion – hold

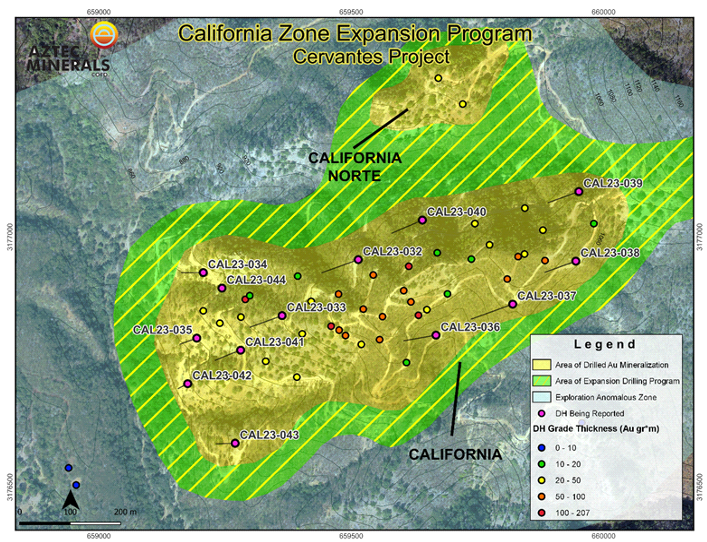

Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) has reported all results of their 2023 drilling at their Cervantes project, Mexico, and did a summary update today.

The drill program comprised 1,646 meters in 13 RC drill holes testing the California porphyry gold target. Total drilling by Aztec Minerals on the Cervantes project since 2016 now totals 67 drill holes and 12,134m.

All drill holes intersected oxidized Au mineralization, and the California target continues to be open. The California target now has an area of 1,000 m by 300m drill demonstrated.

There was a lot of info in the news release, so a picture is 1,000 words.

The deposit is running around 0.4 to 1.0 g/t gold with some copper. Most of it is near surface or starts right on surface, so this could be very economical.

Aztec closed a $1.1 million financing in February, so it will be able to do more drilling. This time we could be in a much better gold market for the juniors and be well worth buying on drill speculation this go around.

Let's see how things unfold in the months ahead.

| Want to be the first to know about interesting Gold and Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Argonaut Gold and Aztec Minerals. My company has a financial relationship with: Aztec Minerals is a paid advertiser at playstocks.net. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.