Regardless of whether you believe the climate to be changing or not, and if it is, regardless of whether you believe climate change to be natural or man-made, what Aisix Solutions Inc. (AISX:TSX.V; AISXF:OTCQB) is doing is of huge and central importance going forward.

What the company does, in a nutshell, is to make sense of the ever-changing ocean of climate and weather data using AI-driven analytics to provide actionable insights for governments, businesses and every kind of organization. This is achieved using its "Climate Genius" AI tool, which is, as the company says, the "answer to the market's need for precise, auditable, explainable, defensible and most importantly actionable climate risk assessments and mitigation strategies." Amongst the company's usable tools is Wildfire 2.0 Canada, which facilitates analysis and assessment of the risk of wildfires at any location across Canada.

The ability to predict and prepare for various climate and weather events and possibly emergencies in real time and for different timeframes is of paramount importance for governments and various agencies who are obliged to plan ahead and also for individual businesses and private citizens.

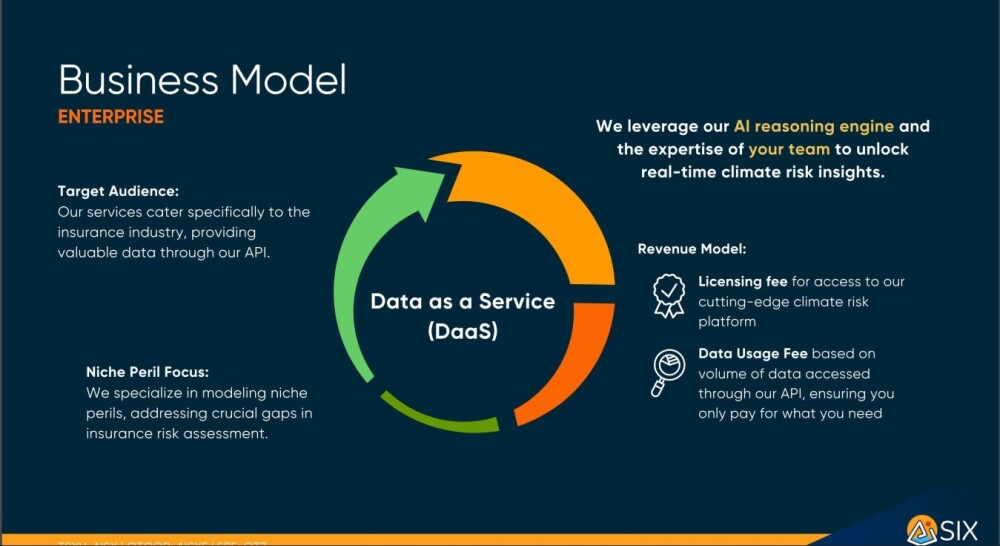

Aisix provides solutions for every industry, including accounting and auditing, agriculture, construction, healthcare, insurance, investments, supply chains, transportation, and utilities, a prime example is the insurance industry, where it is vital to assess risk and determine appropriate insurance premiums accurately. So, the Enterprise Business Model for the insurance industry is as presented on the following slide lifted from the company's investor deck.

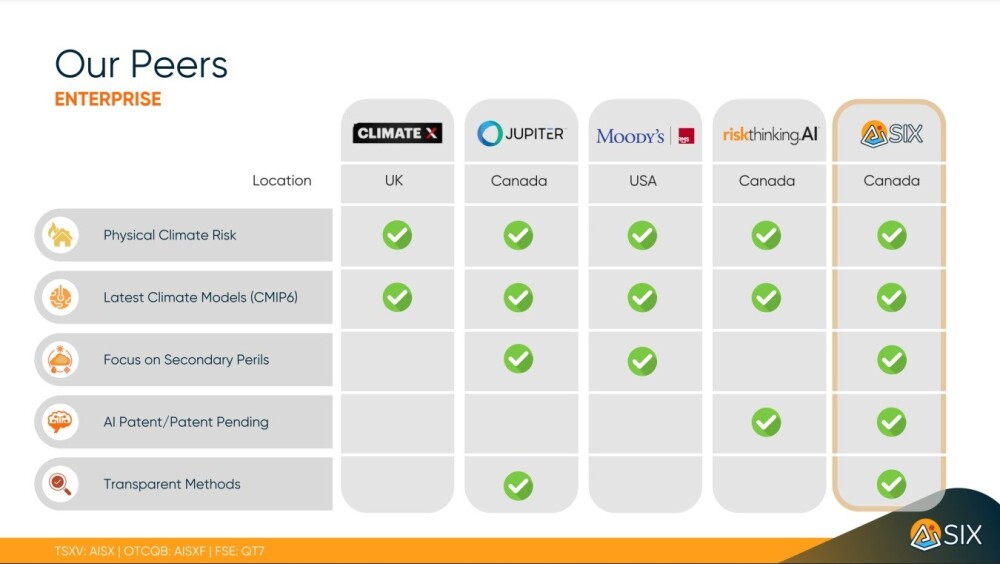

The following slide shows the company's peers in this field, and as we see, Aisix checks all the boxes.

An important development is that Aisix is to develop AI software for IFRS S1, S2 compliance.

These new reporting standards came into effect in January, and the company plans to augment its existing AI-powered (artificial intelligence) climate risk data sets and launch an enterprise-level AI solution tailored to ensure compliance with the newly introduced IFRS S1 and S2 reporting standards, assisting businesses in managing the complexities associated with environmental and climate-related financial disclosures.

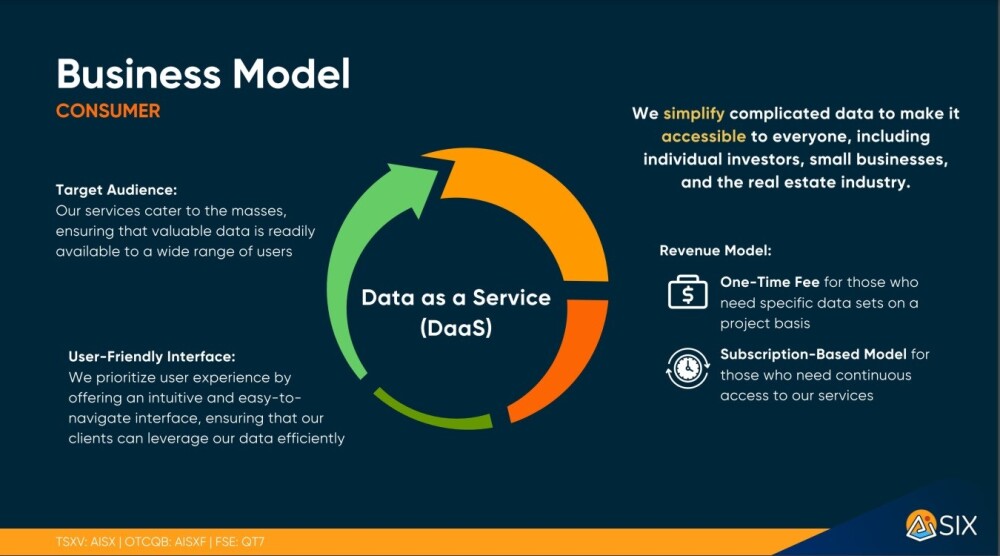

With regards to the private citizen, the Consumer Business Model is as follows:

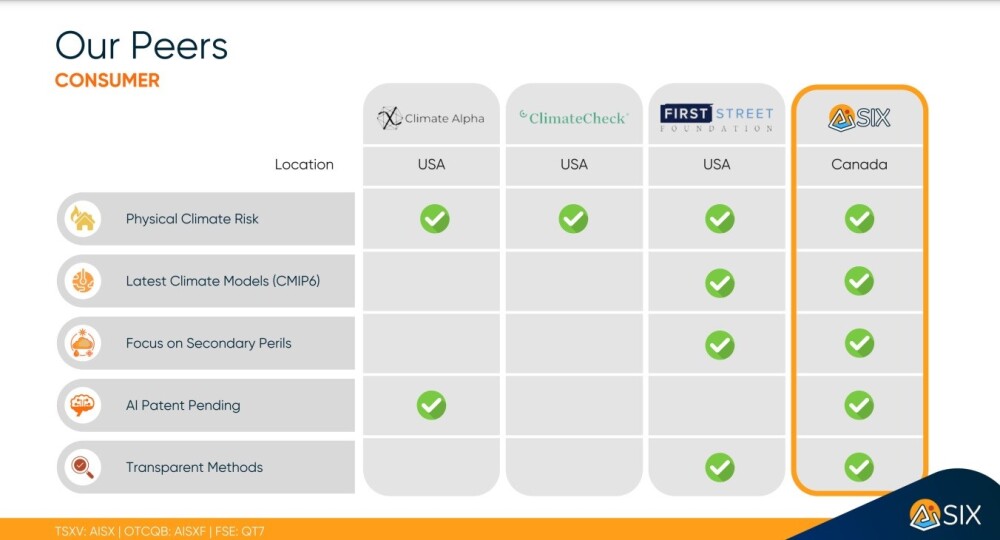

The following side shows the company's peers in the broad consumer field, and again, Aisix checks all the boxes.

The company already has a range of partners and clients.

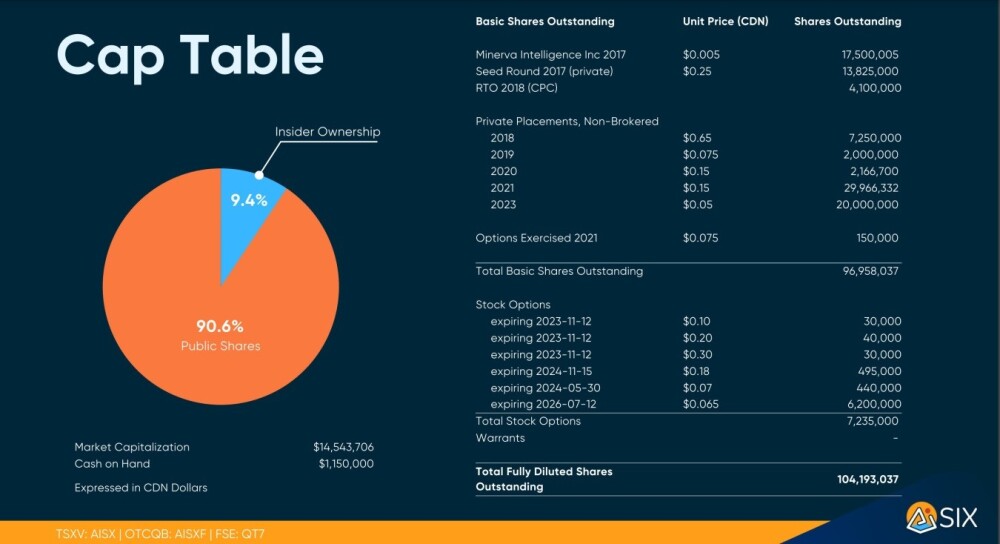

The following cap table shows the share structure, ownership, cash on hand, etc.

Since coming to market a little over six years ago, Aisix stock has been subject to wild swings, with its overall trend being slightly lower up to now, as we can see on its latest 6-year chart below.

However, although it was still far from hitting its final low, by early 2022, it had started a basing process that has continued right up to the present. The severe bear market from its early 2021 spike peak had erased almost all of the stock's value by the time it hit bottom at the lowly price of just C$0.015 at the end of November 2022.

The good news is that since then, it has gone on to complete a fine Cup and Handle base, and we know that this is a genuine example of such a pattern as there was persistent high volume on the rally to complete the right side of the Cup part of the pattern and we are seeing high upside volume again so far this year as the price starts what should turn out to be a "breakout drive" out of the entire base pattern.

We can see the Cup and Handle base pattern to advantage on a 28-month chart, this rather odd time period being selected to enable us to see the entire Cup and Handle base in detail and the action that immediately preceded it. The market psychology that builds such a pattern is this — after a long period of difficulty, a company "turns the corner" and "sees the light at the end of the tunnel," and so do investors who rejoice by piling into the stock and driving a big rally on strong volume.

This is what forms the steep right side of the Cup. The problem is that they overdo it and get ahead of themselves. It takes a while for the improving fundamentals on the ground to catch up, and many investors get bored with this and take profits, driving a self-feeding reaction. This is what forms the Handle of the pattern — and this, too, gets overdone, especially given the fact that the fundamentals of the company are often steadily improving even as investors continue to sell the stock down, as is believed to be the case with Aisix.

This then clearly creates a major opportunity for investors who understand what is going on to buy the stock at a very low level before it breaks out of the entire base pattern and takes off strongly higher into a new bull market.

Because the Handle of the Cup and Handle base in Aisix is rather "droopy," it means that we have an even better entry point than might otherwise be the case because the price is not very far above the lows of the Cup part of the pattern, with a big difference now being that when it takes off this time, it should be for real, meaning that it should head higher and stay higher.

A key point for investors to note is that Aisix looks to be very close now to breaking out of the Handle part of the pattern, which should soon lead to a breakout from the entire base pattern, and by the time it succeeds in doing this it will be almost three times higher than the current price since it won't have achieved such a breakout until it gets above the resistance shown that marks the upper boundary of the pattern which is at the 13 – 14 cent level.

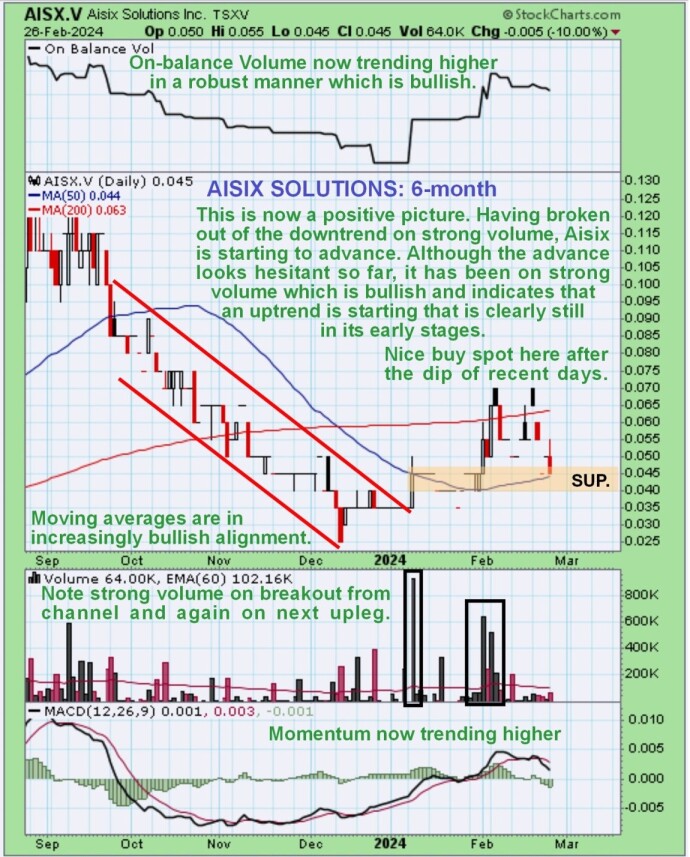

Zooming in again using a 6-month chart, we see that most of the Handle of the pattern has consisted of an orderly downtrend whose boundaries drawn on the chart we know are valid from the heavy volume that occurred on the day it broke out of it early in January.

Following the breakout from the downtrend, the price has paused to consolidate and allow the moving averages to swing into better alignment, which they have now about done, and while this has been going on, the volume pattern has remained strongly bullish with the upleg of late January – early February being again on robust volume.

So this, then, is viewed as a very favorable setup on all of the charts shown here, and the "cherry on the cake" for buyers now is that the price of the stock has dipped back from 7 cents over the past week or so to the current 4.5 cents (at the time of writing) to provide an excellent entry point.

Yesterday, after the close, came positive news that may get the stock moving, which is that AISIX ANNOUNCED A STRATEGIC ALLIANCE WITH LEADING CANADIAN BUSINESS CONSULTING FIRM TO ADVANCE CLIMATE RISK MANAGEMENT.

Mihalis Belantis, Chief Executive Officer of Aisix, sums it up thus: "This collaboration brings together Aisix's expertise in climate modeling technologies and the consulting firm's vast network, offering an unparalleled approach to sustainable business strategies."

Aisix Solutions is therefore rated a Strong Buy for all timeframes.

Aisix Solutions's website.

Aisix Solutions Inc. closed at CA$0.045, $0.03 on March 4, 2024.

| Want to be the first to know about interesting Special Situations and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Aisix Solutions Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.