Lithos Group Ltd. (LITS:CBOE.CA;LITSF:OTCQB;FSE:YU8;WKN:A3ES4Q), whose proprietary technology AcQUA™ allows lithium to be extracted from brine without using water-intensive, environment-damaging evaporation ponds, forecasts a year chock-full of catalysts, the company said.

Currently, LiTHOS is working with "four tier-1 lithium companies and two supermajor energy companies in North and South America to help display the commercial viability of its technology," Beacon Analyst Ahmad Shaath wrote in a January research report.

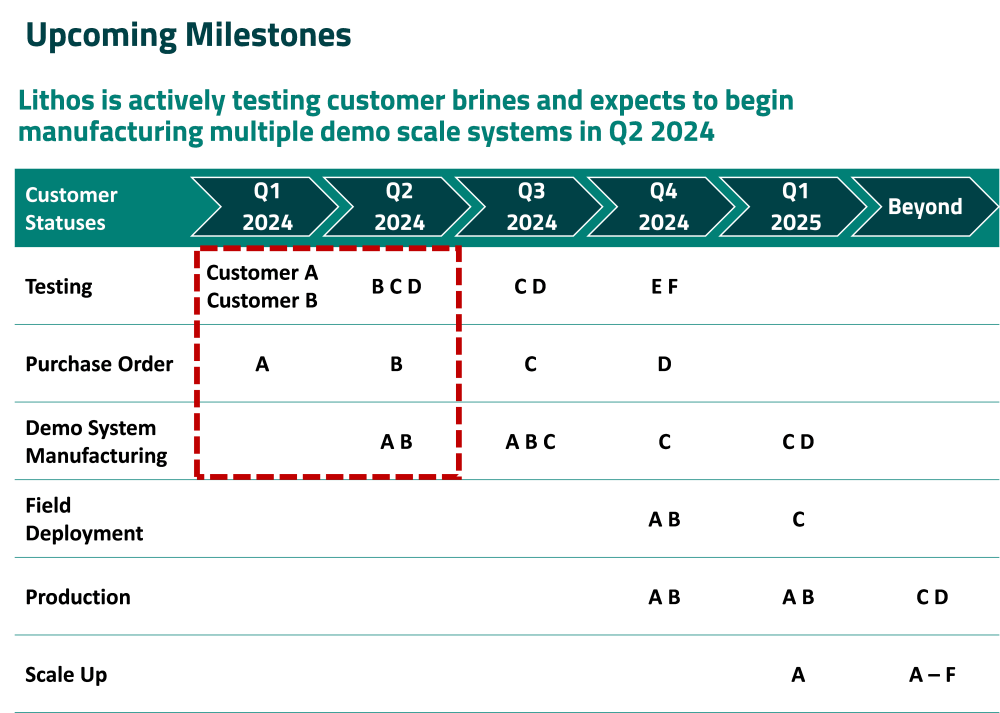

Getting each existing customer to and beyond lithium production using AcQUA™ involves a sequence of steps: brine testing, purchase order receipt, manufacturing a demo system, deployment in field, production, and scale-up. Completion of any of these steps for a customer constitutes a milestone.

Earlier this year, after landing its first purchase orders from Customers A and B, LiTHOS finished testing its brines and is about to give them the results.

"We are working with these customers with a clear, mutually defined goal to deliver demonstration-scale AcQUA™ field units in Q4/24," LiTHOS said in the release.

As for Customer C, its field brines are being shipped to LiTHOS' Alabama lithium processing facility, receipt of which is expected in April. Also, for six strategic mineral resource owners, LiTHOS is processing their brines from the largest Salars in Chile and Argentina and the Smackover reservoir in the southeastern U.S. and is developing commercial proposals for paid pilot projects.

This graphic shows a timeline of the milestones LiTHOS expects to reach in the near term:

The Goal: Sustainable Lithium Production

Headquartered in Vancouver, British Columbia, LiTHOS Group aims to "become the global standard in economically efficient, sustainable lithium production," the company said. Its patented-pending AcQUA™ technology spans the whole value chain from the conditioning and pretreatment of raw brines, the primary bottleneck, through the direct lithium extraction (DLE) phase to the polishing and purification of battery-grade lithium feedstock. About 70% of global lithium resources are hosted in brine.

Beacon Analyst Ahmad Shaath explained in a January research report, "The technology enables lithium brine resource operators to deploy field-ready extraction solutions that will substantially reduce water consumption by recycling 98.5% of the input brine water, reduce capex by greater than 50% compared to evaporation ponds, curtails the use of toxic chemicals, cuts processing time by more than 90% and substantially eliminate the use of evaporation ponds in the pretreatment and concentration phases of production."

As for DLE, it could nearly double the production of lithium from brine, Goldman Sachs analysts wrote in a research note. It could boost recoveries to 70−90% from 40−60%, thereby improving project returns.

LiTHOS has two fully operational facilities, a 4,000-square-foot laboratory in Denver, Colo., and a 55,000-square-foot complex, permitted to produce pilot-scale lithium hydroxide, in Bessemer, Ala. In January, LiTHOS subsidiary, Aqueous Resources, applied for a follow-on US$30 million (US$30M) grant from the U.S. Department of Energy (DOE) to expand its Alabama facility. Awardees will be announced this May. No other company has operated such a facility with any throughput consistency, the company said.

Previously, the company received a US$1.3M grant from the DOE and a US$250,000 grant from the state of Colorado to fund acceleration of pilot demonstration testing.

LiTHOS is also involved in the exploration and development of mineral properties, Rhodes Marsh in Nevada and PacMan in Arizona, in which it owns a stake, Shaath reported.

Technical Analyst Clive Maund, in a January report, recommended Lithos as an immediate Strong Buy as he highlighted the stock was about to break out in a significant way. He predicted breakouts from the pennant formation, the third fan line of the fan correction, and the nearby strong resistance level.

"[The breakout] will thus have great technical significance and should mark the start of a major bull market in the stock," he wrote.

In a March 5 update, Maund reiterated his rating, saying, "With another significant upleg looking imminent, Lithos Energy is rated an Immediate Strong Buy here, and this is a good point for existing owners of the stock to add to positions."

Beacon has Lithos on its Watchlist.

Increasing Demand Driving Sector Growth

Demand for lithium has been rising steadily since 2020 and is expected to continue this trend to at least 2035, Statista data show. Projections indicate that by then, demand will have reached 3,829,000 metric tons of lithium carbonate equivalent, a 317.5% increase from 917,000 metric tons in 2023.

Similarly, the lithium market is projected to continue growing to US$6.4 billion (US$6.4B) in value by 2028 from US$2.5B in 2023, according to Markets and Markets. This change reflects a 20.4% compound annual growth rate.

"The market has observed stable growth throughout the study period and is expected to continue with the same trend during the forecast period," the report said.

Katusa Research purported the lithium market could have a major breakout this year. It cited demand for use in electric vehicles and storage batteries as key drivers.

"The opportunity in lithium is more electric than ever," Katusa wrote.

Ownership and Share Structure

About 53% of Lithos is held by insiders and management, the company said. According to Reuters, this includes CEO Taylor with nearly 15% or 12 million shares, Independent Director Michael Westlake with 0.73% or 600,000 shares, and Independent Director Kevin McKenna with 0.05% or 40,000 shares.

About 16% of the company is held by strategic entities. The rest is retail.

Lithos has a market cap of CA$63.76 million with about 81.7 million shares outstanding. It trades in a 52-week range of CA$0.98 and CA$0.485.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |