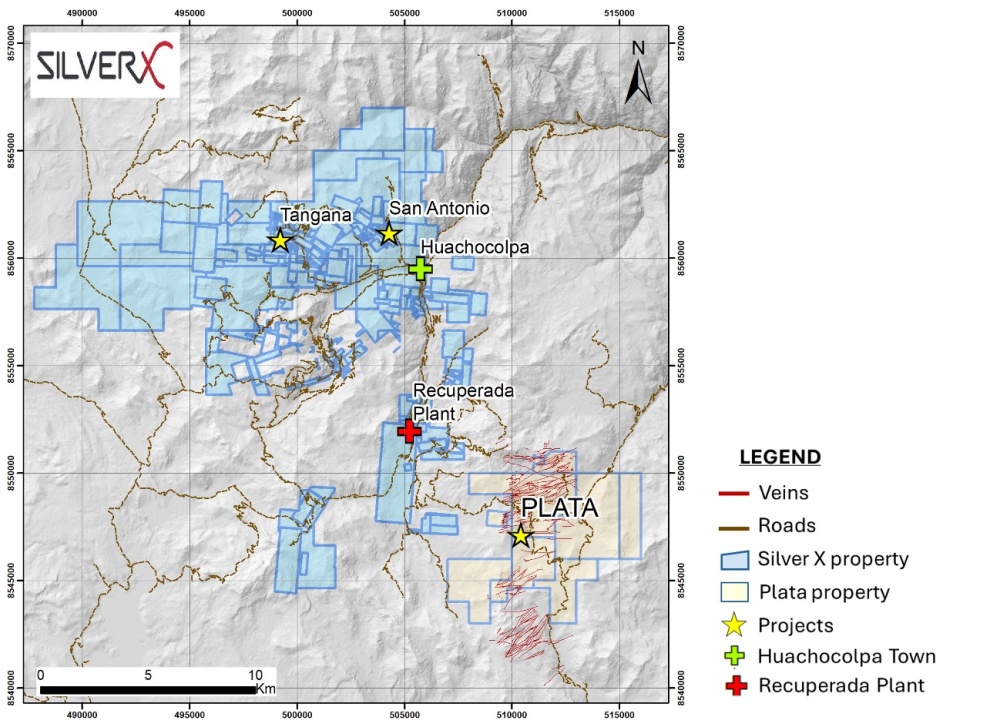

Silver X Mining Corp.'s (AGX:TSX.V) next target for growth is the development and possible expansion of the past-producing Plata unit at its Nueva Recuperada district-scale property in central Peru, the company announced in a news release.

"A former producing area of the project with abundant veins that have been only lightly exploited, Plata has strong exploration potential to increase overall production," the release noted.

Plata boasts a high-grade system with 17 surface-exposed veins containing silver, lead, and zinc mineralization. The project spans 3,829 hectares (3,829 ha) and is 10 kilometers south of the Nueva Recuperada plant.

The current Inferred resource at Plata is 448,812 tons of 220.81 grams per ton silver, 2.55% lead, and 4.58% zinc. This was calculated based on historical exploration work and included in the 2022 Nueva Recuperada preliminary economic assessment.

Additionally, Silver X pointed out in its 2024 corporate presentation, "Evidence from historical sampling and development work indicates the existence of higher-grade mineralization at depths below 4,460 meters (4,460m) above sea level, highlighting untapped exploration potential."

Robust Growth Pipeline

Silver X, headquartered in Vancouver, British Columbia, consolidates and develops undervalued assets with which it creates value by expanding resources and increasing production. The company owns two properties in Peru: Nueva Recuperada and Coriorcco.

Its flagship, Nueva Recuperada, covers 230 mining concessions over 20,000 ha in a tier 1 mining jurisdiction. Along with Plata, Nueva Recuperada comprises two other mining units, Tangana, the producing silver, gold, lead, zinc, and copper project, and Red Silver.

Coriorcco is a 2,000-ha, exploration-stage gold property in Ayacucho, southeast of Nueva Recuperada, with the potential for standalone development. It has known gold-silver mineralization at surface with vein widths ranging from 1−2.5m in width.

Both properties offer significant exploration potential, the company said.

Silver In Bull Market Uptrend

Silver In Bull Market Uptrend

The global demand for silver is forecast to reach 1,200,000,000 ounces in 2024, the second highest level recorded, according to The Silver Institute.

Factors behind this 1% increase over 2023 are continued strength in industrial applications of the metal and a returned desire for jewelry and silverware.

At the same time, the supply of the white metal continues to be in a deficit, wrote Rich Checkan, president and chief operating officer of Asset Strategies International, in a recent note. He predicts the silver price will "move above and sustain levels above previous all-time highs."

Mary Anne and Pamela Aden, editors of The Aden Forecast, agree. Silver, "a sleeping giant," they wrote on February 23, 2024, is holding quietly in a bull market uptrend, should continue its bullish momentum in 2024, and is poised to rise a lot further.

"Silver has great potential going forward in technology and in green energy," the Adens added. "Silver is a Buy and hold for several years."

Technical Analyst Clive Maund wrote earlier this month that the medium and long-term outlook for silver "could scarcely be better as [the metal] is considered to be probably the most undervalued asset in the world."

The Catalysts: Progress on Two Fronts

Silver X plans to carry out drilling and mine preparation at Plata this year, and related news could move up its share price.

"2024 will be a year of resource definition, and we hope we can be in production or [have] the first cash flows in 2025," President and CEO Jose M. Garcia said in a video.

Also, at Tangana, the company intends to ramp up processing, aiming to eventually reach 2,220 tons per day from the current 720.

In a recent report, Technical Analyst Clive Maund recommended Silver X as a Buy for "all time frames."

Overall, Silver X is working toward completing two goals at Nueva Recuperada by 2026, the company said.

One is expanding the project's current Measured and Indicated resource by four times. The second is tripling its current production to about 6,000,000 ounces of silver equivalent.

Analyst sentiment toward the Canadian silver producer is positive.

In a recent report, Maund recommended Silver X as a Buy for "all time frames." He wrote the stock was "at a very low price and close to strong support," and the company's fundamental prospects were improving quickly. The price then was CA$0.21 per share; now, it is hovering around CA$0.1750.

Red Cloud Securities Analyst Timothy Lee and Echelon Wealth Partners Analyst Gabriel Gonzalez also have a Buy rating on Silver X.

The company is an option for investors looking to get into or add to their position in silver, experts said, particularly at this juncture as Silver X is pursuing and achieving growth.

Ownership and Share Structure

According to Reuters, Silver X has 166.58 million (166.58M) shares outstanding and 119.53M free float traded shares.

Silver X said management and insiders own approximately 17% of the company. According to Reuters, President and CEO Jimenez Jose Maria Garcia owns 8.40% of the company, Vice President Sebastian Wahl owns 7.85%, Executive Chairman Luis Zapata owns 0.50%, Director Michael Hoffman owns 0.24%, and CFO Ronald Anibal Marino Sanchez owns 0.06%.

The company said institutional investors own 23%. Some listed by Reuters include Baker Steel Resources Trust Ltd. owns 11.71%s, US Global Investors Inc. owns 4.8%, Earth Resource Investment Group owns 1.05%, and Sprott Asset Management LP owns 1.11%.

Retail investors own the remaining.

Silver X has a market cap of CA$20.97 million and a 52-week trading range of CA$0.165−0.47 per share.

| Want to be the first to know about interesting Silver and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver X Mining Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver X Mining Corp.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Contributing Writer Disclosures:

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.