This Sunday, the 93rd annual convention of the Prospector and Developers' Association unfolds in lovely downtown Toronto within the walls of the massive Metro Convention Centre where every year, thousands of mining industry executives gather along with the investment crowd, including analysts, investment bankers, and, of course, the retail investors all converging on the booth of the hottest junior miner or, in the case of the 1980s, the booth of the hottest newsletter writer which was always Jim Dines.

The reason for the popularity of the Dines booth was always the two 6'-tall twin platinum blonde bombshells nattily attired in low-cut evening gowns loaded with sparkles resembling diamonds. Due to the dominance of male attendees back in the day, the power of the pen, when combined with the power of cleavage, resulted in large congestion zones around the Dines booth where not a man was listening to a word Dines was saying because their attention was riveted to the two stunning twins that were handing out subscription forms to anyone within eye contact.

If gold prices rally another $1,000 per ounce by the end of 2024, the NEM management will be seen as "visionaries" for having levered up.

The finest of the junior mining letter writers was Robert (Bob) Bishop, who would have a trail of Vancouver promoters following him around the convention floor so closely that if Bob stopped to talk with someone, there was a multiple-person pile-up with pitch sheets and briefcases flying asunder. Bob had so much power that the investor relations boys would pay money to get his hotel room number and then camp out next to it, waiting for his arrival in the late evening.

I attended PDAC from 1981 until I left the securities industry in 2014, but by the time 2009 had arrived, I was pretty much chagrined by the manner in which the marketing people had altered the very fiber of the convention, taking it from an information-exchanging venue to a carnival sideshow complete with clowns doing cartwheels and fishbowl draws for the rights to own warrants in a "penny dreadful," the other name for a junior mining explorer. Newmont Corp. (NEM:NYSE)

Newmont Corp.

However, events at the end of this week were delivered, I am sure, by the two goddesses of the junior mining universe — Lady Luck and Mother Nature — who delivered a $40 advance in gold and a 50-cent pop in silver as a letter-perfect lead-in to the convention.

It could not have arrived at a better point in time for the gold miners as the month of February saw some pretty brutal results delivered by the world's premier gold producer, Newmont Corp. (NEM:NYSE), prompting TF Metals guy Craig Hemke to send out a tweet to his 66,000 followers: "F***ing Newmont is such a f***ing piece of s**t. Down 20% YTD, while gold is down 2%. New 50-year lows in price while gold is 50% higher over the same time period. A s*itty business with s*itty management and s*itty execution."

Tell us how you really feel, Craig.

If there could ever be a moment in which one tweet from a prominent newsletter/podcaster /Sprott luminary could be seen as the precise moment of gold stock capitulation, that was it. He went on the defensive quickly thereafter, claiming to have simply reallocated capital to the other miners, but that was low for Newmont.

And that is exactly how markets bottom. A seminal event, seemingly innocent, totally justified, and above all, totally human in his response to a company whose management failed to secure a crystal ball when they started taking over other companies with both reserves and/or production.

I put out this chart in an Email Alert on February 26: I called Newmont "a contrarian Buy," but in my tweet, I said it was a "Screaming Buy Signal." As fate would have it, I was right.

Newmont is a company that is under huge pressure from the "activist" fund managers who think that management is too heavy. If gold prices rally another $1,000 per ounce by the end of 2024, the NEM management will be seen as "visionaries" for having levered up. It is astounding how, at bear market bottoms, everyone becomes an "I-told-you-so" expert enjoying a few fleeting weeks of sunlight and rookie-trader adulation until the turn comes. Then, and only then, does the narrative shift. That is where I think we are with Newmont. The recent purchases by Stan Druckemiller, reallocating capital from sales of Amazon, Alphabet, and Microsoft, give me further confidence that Newmont is more a "Buy" than a "Sell."

Bear markets bring out the "Mr. Hyde" in many people formerly believed to be "Dr. Jekyll," but such is the lot of the junior mining or precious metals speculators. It is a tough, tough business.

There has been a great deal of rumbling around social media feeds today about the move in gold (up $40 to $2,094), with one notable podcaster tweeting: " CNBC is so fixated on the sideshow going on with Bitcoin and the new ETF's that they haven't even reported on today's $43 rise in the price of gold or the new record high in the gold ETF GLD."

Getchell Gold Corp.

To clarify, GLD:US is not at an all-time high. The old high was registered on August 6, 2020, at $194.45, so with the intraday high today at $193.40, gold prices need another $13 increase or about $1.30 in the GLD:US to get there.

However, to really get the gold mining stocks going, I need at least a two-day close above the old highs and then a run through the old futures highs from December 3 of last year at $2,152.30 for another two-day close before the real fireworks begin.

It is certainly nice to see my top gold pick — Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) — finally gaining traction with the 18.52% move on the day when the TSX Venture Exchange is up a modest 2.38%.

Also contributing to the bullish narrative today is silver's 2.48% move (versus gold's 1.91% advance), and I know you are all well-schooled on the significance of silver outperforming gold as a confirmation of bullish advances.

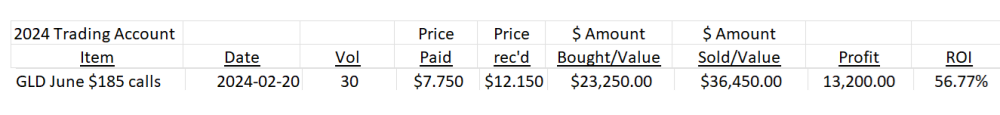

I am 60% long the position in the GLD June $185 calls at $7.75, looking for $20 by the June expiry.

That translates to $205 for GLD:US and an April Gold close around $2,215 per ounce, a clear breakout.

Copper, Uranium, and Lithium

Meanwhile, the calls have traded up to $12.15 today and are ahead 56.77% in eight days. I will need follow-through next week to allow my chest to remain puffed out, and based upon the last few attempts; I will definitely be holding my breath, saying ten "Hail Marys" and throwing salt over my left shoulder.

I usually fall asleep every night to an audiobook or a podcast from the hundreds of content providers" that are all lavishing praise on their guests while reciting the cue-card evidence of exactly why they are seen as "experts." The man who invented the process of interviewing financial wizards is Grant Williams.

Grant has an enviable habit of making sure that every guest he interviews is capable of offering what I call "actionable content," and by that, I mean whether it is Luke Gromen or Felix Zulauf, you come away with an idea that you think might make your portfolio perform better. Unfortunately, the world of social media and YouTube podcasting has become inundated with pretenders to the Grant Willams throne.

There is now far too much "financial content" offered up as "altruistic advice" when, in reality, it is largely "click-bait" designed to attract the interest of the big advertisers that depend on click traffic in order to survive. It seems that the vast majority of podcasters are more interested in sensationalist gimmickry in order to gather those all-important "likes" and "subscribers" that are the lifeblood of the podcasting business model.

The content is always based on either an Armageddon-type or a Nirvana-type outlook on the human condition. Rarely is there a balanced, middle-of-the-road discussion of possible or probable outcomes. In the final analysis, all we want to read or hear are ideas. Give us ideas upon which we have the capacity to act.

As many of my followers know, I have been recommending two metals with nauseating tenacity and frequency for most of the past six months. Copper and gold are the two metals whose fundamentals are the most compelling to me relative to the value of the companies that produce them. Nuclear energy has the most compelling story relative to the underlying commodity (uranium), but the stocks had all been hyped-up to nosebleed valuation levels where I decided to "Exit, Stage Left," after which my big Cameco Corp. (CCO:TSX; CCJ:NYSE) position proceeded to plunge 21% in a month.

However, copper stocks are still undervalued based on the underlying commodity, which has yet to confirm the bullish narrative. If you go back and revisit some of the missives I was writing in 2019 on uranium, I accurately predicted the upturn based purely on the demand-supply characteristics of the uranium markets, where a supply glut was being gradually eliminated by low prices (sub-economic pricing structure).

Once supply began to shrink, the elasticity of demand started to kick in, and as soon as the kiddies discovered the insanity of relying on solar and wind to heat homes and drive industrial production, the politicians were dragged kicking and screaming into the pro-nuclear camp to the extent where even the largest tree-hugging, Greenpeace-following contingent of Birkenstock-wearing environmentalist picture-splashing vote-grabbers fell into line.

In the same vein, the copper market has all of the same characteristics as lithium in 2021 and uranium in 2022 in terms of its tensile set-up. Unlike uranium and lithium, which have very narrow avenues in which demand can attract the masses, copper is universal. Copper is used everywhere. Copper needs no educational primers for the kiddies to "get it." If you want to minimize fossil fuels, expand the grid with more copper wiring and then pump all the nuclear-generated electricity through it. It is really quite that simple.

The problem is that there is a looming shortage of supply in the copper market. Bank of America says that it will go "red line" this year, meaning that demand is going to outstrip supply by the end of 2024. Copper demand is strong on every continent and in every country on the planet. When supply constraints are finally perceived by the investment bankers, they will quickly forget about "yesterday's deals" like lithium and cobalt and magnesium sulphide and launch themselves into funding the next generation of copper developers and producers. And that, my friends, is exactly how new bull manias are formed.

Executives like Mark Bristow (Barrick) and Tim Price (Teck) have made it abundantly clear that copper (as well as gold) is going to be a stalwart in their portfolio of operations around the globe. The BMO Global Metals, Mining, and Critical Minerals conference wound up last week, and it was concluded that battery metals such as lithium, nickel, and cobalt were still months, if not years, away from finding a bottom while the #1 metal for 2024 was copper with the #2 metal being gold. I swear that I had no knowledge of anything the gents over at BMO Capital Markets were thinking, but that is completely in line with what I have been writing since Q3/2023.

Bob Bass

I had a discussion with Getchell Gold's newly-appointed Chairman, Robert (Bob) Bass, this evening about the course of action required for the company in order to free it from the shackles of disdain brought about largely due to its inability to deliver adequate shareholder returns since first introduced back in 2020 (for my subscribers) but since 2011 for Mr. Bass, when he wrote his first cheque for shares in the predecessor company, Buena Vista Gold Corp.

If you want to talk about a long-term commitment to a deal, you need to look no further than Bob Bass. Without going into a long quasi-emotional diatribe about the reasons, it boils down to a multi-year and generational aversion to gold miners brought about by the rise of competing products such as crypto and technology stocks. As an example, my daughters used to waddle into my office when they were toddlers and ask, "How are the diamonds doing?" (in reference to the big pass I made on diamonds deals in the 1990s) and now they send their toddler children (my grandchildren) into my office to ask "How is Bitcoin doing?" As always, I digress.

Bob asked me whether she should write another (huge) cheque to Getchell, and I responded with the comment, "Do you want my unbiased investment advice, or do you want my biased Getchell shareholder advice?"

Like me, Bob Bass is a huge believer in the future of Getchell Gold. Without going into detail, all that mattered to the new Getchell Chairman was that I was onside with "all things Getchell" and that he wanted to ensure that the working capital position was where it should be. In the seven years since I first became a shareholder and in the four years since launching the newsletter, I have never been as confident in the outlook for this company as I am now. Notwithstanding the fact that I am a large shareholder, I keep staring in the most unenviable, slack-jawed pose at the 2,059,900 ounces of gold in the best jurisdiction for mining in the entire continental U.S., aghast at the $10 million valuation for in-ground ounces worth over $4 billion. I think that the ultimate revaluation of those ounces is what Bob Bass and I both share as a vision.

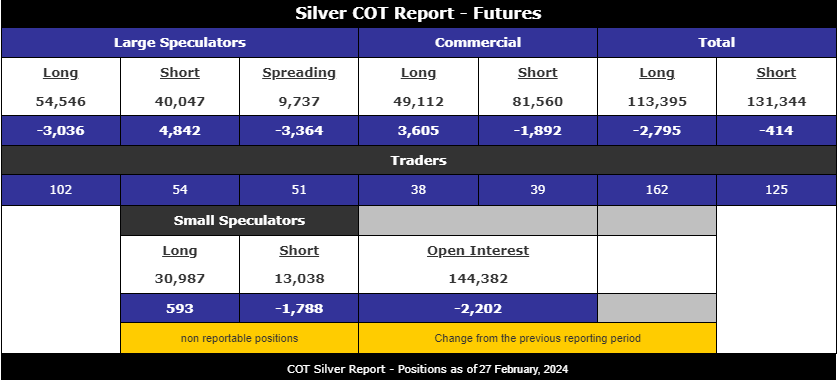

Next week is going to be a crucial week for the bulls but even more so for the bears. Those that are short gold are in a world of hurt right now, but nothing compared to the silver shorts that saw them get very aggressive late last week and into the Tuesday COT cut-off point. As I have stated consistently since 2021, I am not a player in the silver market because I find it very difficult to trade. That said, I get the sense that a trap is being set. If the bullion banks really want to snare in the Bitcoin kiddies and take ALL of their newly found cash, there is no better way than to trash Bitcoin and vault silver. The rotation out of crypto into silver will create the illusion that the bullion banks are "weak," and that will invite a pile-on effect that will send the kiddies into orgasmic excitement.

Large speculators dump 3,036 longs and add 4,842 new shorts for an aggregate increase in their short position of 7,878 contracts, representing 39,390,000 ounces of silver worth $920,544,300. Small Speculators cover 1,788 shorts and add 593 longs, representing 2,381 contracts or 11,905,000 ounces or $278,219,985. Commercial traders cover 1,892 shorts and ADD 3,605 new longs for a net increase of 5,497 contracts representing 27,485,000 ounces or $642,324,445. In the three days after the COT report, silver is up over $.80/ounce.

I have no trading positions in silver, but if it can find a bid and get above $26.50 over a two-day close, it will set up a run to $30. Once there, my opinion changed completely. Until then, I stood aside and simply watched it for confirmation that gold and gold miners were in good shape.

To those who care, keep your collective chins raised up. We are very close to a precious metals bull. I think it is quite close, but I just need a tad more confirmation. When it arrives, your capital appreciation will be nothing short of obscene.

| Want to be the first to know about interesting Base Metals, Cobalt / Lithium / Manganese, Uranium, Critical Metals, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp. and Getchell Gold Corp.

- Michael Ballnger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.