Gold is still holding on, but sentiment is very poor.

Will it hold above US$2000 for another monthly close in February?

Keypoints

Gold

- Another monthly close above US$2000 would be very positive

- Market sentiment is very poor

- Bulls giving up

Gold Stocks

- XAU at a critical level

- Gold stocks vs gold at major long-term support

Currencies

- US$ still holding on

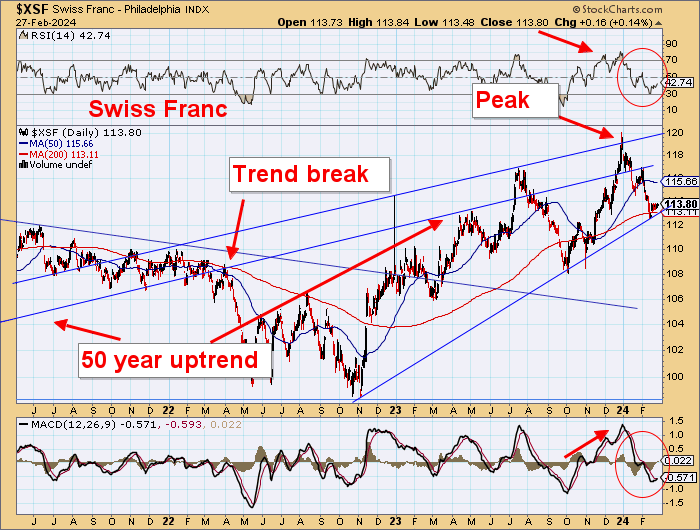

- Swiss Franc about to crack?

Bonds

- Yields still likely to head lower

Stocks

- S&P 500 overextended but not negative

- Silver vs. S&P 500

Metals and Mining

- Metals and Mining ETF is looking very positive

It seems the warmongers are thinking of heading into Ukraine and also using F15s to hit targets inside Russia.

Stupidity.

But it could be the issue that sends gold through this consolidation phase and much higher.

The Euro, Pound, and Swiss France are teetering on technicals that might see sharp falls and might be suggesting Eurosuicide.

Gold is here, holding within a narrow range.

And this looks constructive.

Gold Stocks

The XAU here is at a critical level.

A very strong 2-month downtrend could be broken in the next couple of days.

And this is certainly at an extreme.

Hard to believe gold is near all-time highs, and the market sentiment is so poor.

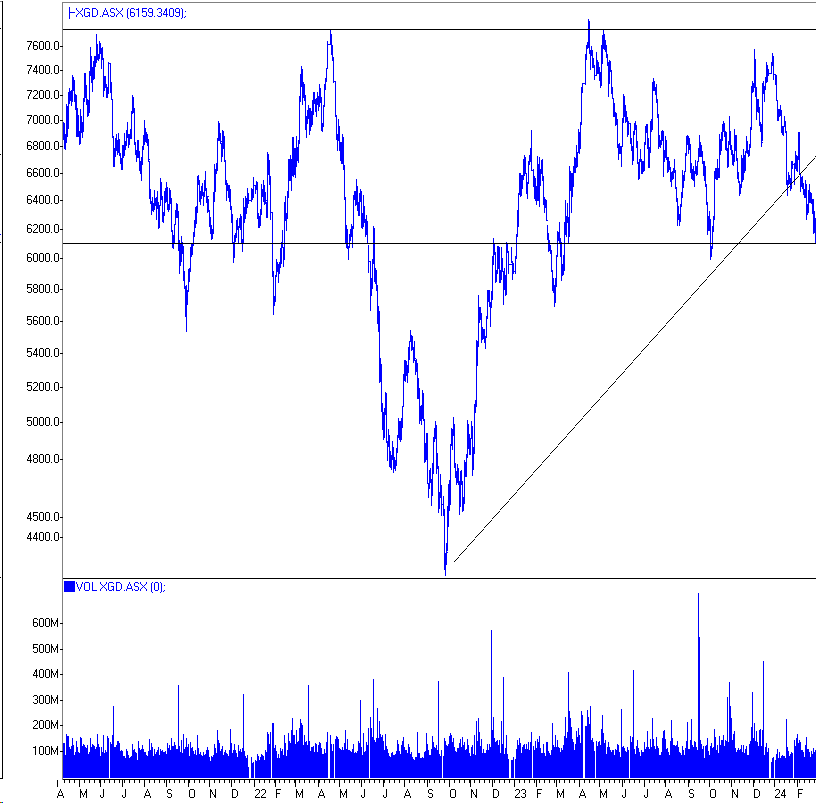

ASX Gold Stocks

The XGD has broken the uptrend, but it is still filling out the RHS.

Gold in AU$ is still heading parabolically higher.

And in Yuan.

Currencies

Swiss Franc looking to crack lower here.

Stocks

Is it time now?

Bonds

Yields heading lower.

Metals and Mining

Looking constructive.

Heed the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.