Silver X Mining Corp.'s (AGX:TSX.V) next target for growth is development and possible expansion of the past-producing Plata unit at its Nueva Recuperada district-scale property in central Peru, the company announced in a news release.

"A former producing area of the project with abundant veins that have been only lightly exploited, Plata has strong exploration potential to increase overall production," the release noted.

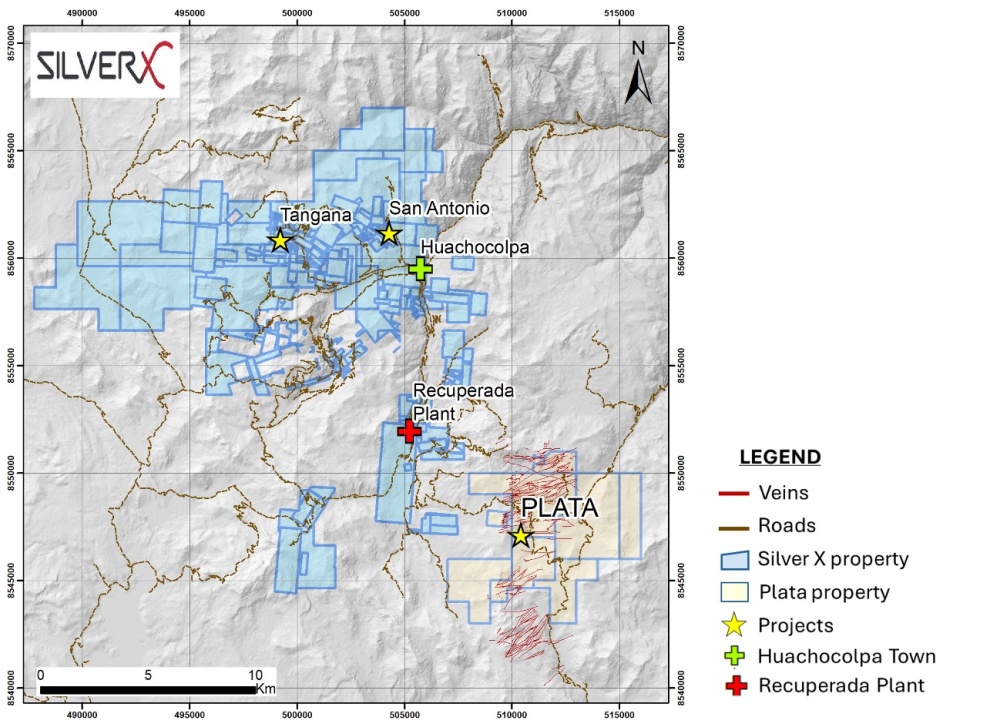

Plata boasts a high-grade system with 17 surface-exposed veins containing silver, lead and zinc mineralization. The project spans 3,829 hectares (3,829 ha) and is 10 kilometers south of the Nueva Recuperada plant.

The current Inferred resource at Plata is 448,812 tons of 220.81 grams per ton silver, 2.55% lead and 4.58% zinc. This was calculated based on historical exploration work and included in the 2022 Nueva Recuperada preliminary economic assessment.

Additionally, Silver X pointed out in its 2024 corporate presentation, "evidence from historical sampling and development work indicates the existence of higher-grade mineralization at depths below 4,460 meters (4,460m) above sea level, highlighting untapped exploration potential."

Robust Growth Pipeline

Silver X, headquartered in Vancouver, British Columbia, consolidates and develops undervalued assets with which it creates value by expanding resources and increasing production. The company owns two properties in Peru: Nueva Recuperada and Coriorcco.

Its flagship, Nueva Recuperada, covers 230 mining concessions over 20,000 ha in a tier 1 mining jurisdiction. Along with Plata, Nueva Recuperada comprises two other mining units, Tangana, the producing silver, gold, lead, zinc and copper project, and Red Silver.

Coriorcco is a 2,000 ha, exploration-stage gold property in Ayacucho, southeast of Nueva Recuperada, with potential for standalone development. It has known gold-silver mineralization at surface with vein widths ranging from 1−2.5m in width.

Both properties offer significant exploration potential, the company said.

Silver In Bull Market Uptrend

Silver In Bull Market Uptrend

The global demand for silver is forecast to reach 1,200,000,000 ounces in 2024, the second highest level recorded, according to The Silver Institute, Factors behind this 1% increase over 2023 are continued strength in industrial applications of the metal and a returned desire for jewelry and silverware.

At the same time, the supply of the white metal continues to be in a deficit, wrote Rich Checkan, president and chief operating officer of Asset Strategies International, in a recent note. He predicts the silver price will "move above and sustain levels above previous all-time highs."

Mary Anne and Pamela Aden, editors of The Aden Forecast, agree. Silver, "a sleeping giant," they wrote on Feb. 23, 2024, is holding quietly in a bull market uptrend, should continue its bullish momentum in 2024 and is poised to rise a lot further.

"Silver has great potential going forward in technology and in green energy," the Adens added. "Silver is a buy and hold for several years."

Technical Analyst Clive Maund wrote, earlier this month, the medium and long-term outlook for silver "could scarcely be better as [the metal] is considered to be probably the most undervalued asset in the world."

The Catalysts: Progress on Two Fronts

Silver X plans to carry out drilling and mine preparation at Plata this year, and related news could move up its share price.

"2024 will be a year of resource definition, and we hope we can be in production or [have] the first cash flows in 2025," President and CEO Jose M. Garcia said in a video.

Also, at Tangana, the company intends to ramp up processing, aiming to eventually reach 2,220 tons per day from the current 720.

Overall, Silver X is working toward completing two goals at Nueva Recuperada by 2026, the company said. One is expanding the project's current Measured and Indicated resource by four times. The second is tripling its current production, to about 6,000,000 ounces of silver equivalent.

Analyst sentiment toward the Canadian silver producer is positive.

In a recent report, Maund recommended Silver X as a Buy for "all time frames." He wrote the stock was "at a very low price and close to strong support" and the company's fundamental prospects were improving quickly. The price then was CA$0.21 per share; now it is hovering around CA$0.1750.

Red Cloud Securities Analyst Timothy Lee and Echelon Wealth Partners Analyst Gabriel Gonzalez also have a Buy rating on Silver X.

The company is an option for investors looking to get in to or add to their position in silver, experts said, particularly at this juncture as Silver X is pursuing and achieving growth.

Ownership and Share Structure

According to Reuters, Silver X has 166.58 million (166.58M) shares outstanding and 119.53M free float traded shares.

Insiders own 28.24% of the company. These investors, from greatest to least stake held, are Baker Steel Resources Trust Ltd. with 11.71% or 19.5M shares, Silver X's Garcia with 8.4% or 13.99M shares, Silver X Vice President of Corporate Development and Director Sebastian Wahl with 7.83% or 13.05M shares, Michael Hoffman with 0.24% or 0.4M shares and Ronald Marino Sanchez with 0.06% or 0.1M shares.

Institutional ownership is 7.32%, comprised of one corporation and three funds. The corporation is Sprott Asset Management LP, with 1.11% or 1.85M shares.

The funds, listed from most to least shares held, are U.S. Global Investors Gold and Precious Metals Fund with 4.8% or 8M shares, Ninepoint Silver Equities Class with 1.11% or 1.85M shares and Earth Gold Fund UI with 0.29% or 0.49M shares. Total fund ownership is 6.21%.

Retail investors own the remaining 64.44%.

Silver X has a market cap of CA$20.97 million and a 52-week trading range of CA$0.165−0.47 per share.

| Want to be the first to know about interesting Silver and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |