Gold is setting up for a move very soon

Technicals at key pressure points

NST is a global leader.

Key Points

Gold

- Getting ready to move higher

- Technicals tight

- Look at all of the time scales

- AU$ gold looking to rise

- Gold vs. T Bonds is about to rise

Gold Stocks

- XAU could jump higher this week.

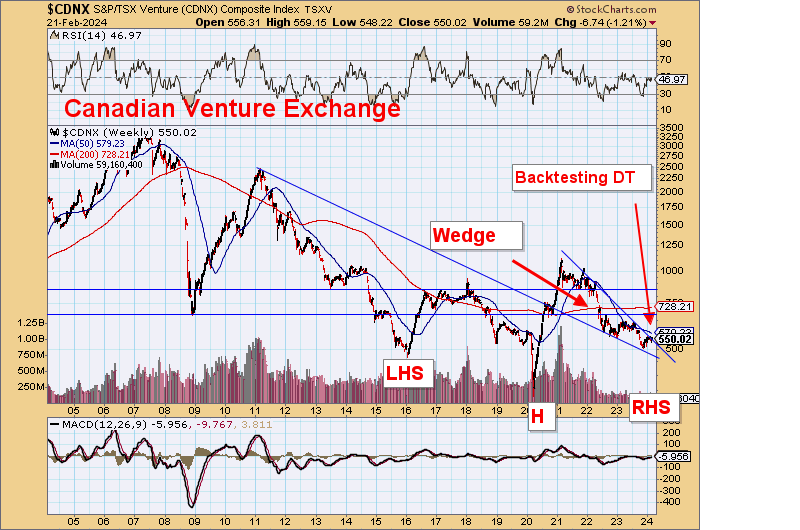

- TSX-V is wedging and about to break the downtrend

ASX Gold Stocks

- XGD Index holding on

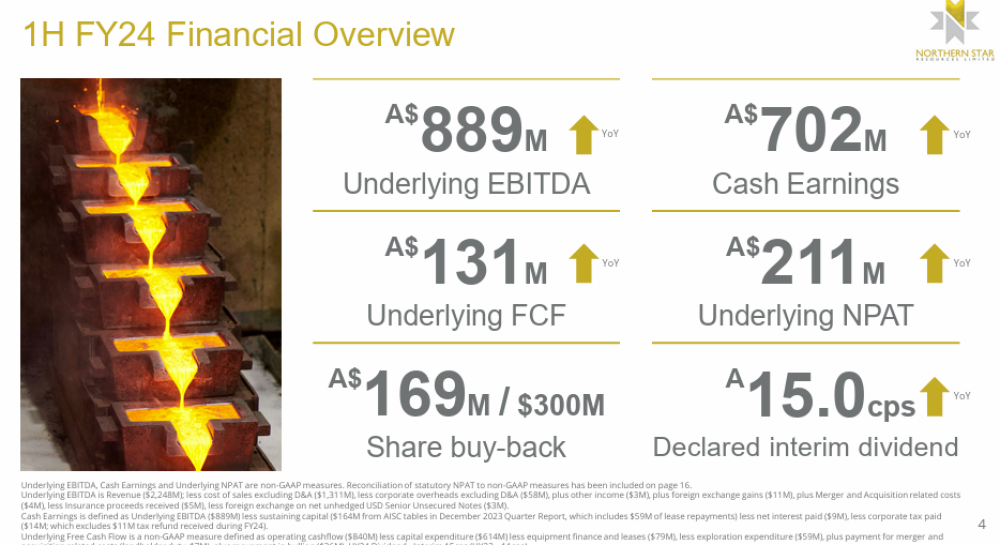

- NST earnings

- 41% increase in EBITDA!

- 50% increase in Cash Earnings!

- 36% increase in interim dividend

Gold stock investors and speculators have been ground into a pulp over the past few years, but there is still hope for a better future.

Many technicals are suggesting a breakout is at hand. And it still could be February.

Asia will be back from Spring Festival in full for next week. Gold here is quiet.

But Gold here has jumped above the downtrend.

Looks constructive.

Note that there is a wedge here that should be broken quite soon.

Hopefully higher.

This just gets closer to resolution each day.

And the big picture just says higher prices are coming.

Gold is ready to break higher against bonds.

Can't be much longer to go now.

Stronger gold or weaker bonds?

Stronger gold and strong bonds.

Gold in AU$ has broken and has backtested the downtrend.

Should start moving up again.

Gold Stocks

This is oversold, pushing against a downtrend, bouncing off the underlying parabola, and ready to rise.

This shows that a resolution is required.

Gold stock sentiment is close to a bottom.

I think there was capitulation in the past week.

Should be ready to rally soon now.

Note this, though. A16-year bear market here.

Supporting on downtrend line and ready to break through wedge. Completing that RHS.

A very bullish pattern.

ASX Gold Stocks

The indeck is hanging on.

And then there is one!

Global Leader Northern Star Resources Ltd. (NESRF:OTCMKTS)

41% increase in EBITDA!

50% increase in Cash Earnings!

36% increase in interim dividend!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.