Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) announced in a press release that it’s partner, Valor Resources Ltd.. (VAL:ASX) has completed the necessary requirements to earn 80% interest in the Saskatchewan-based Hook Lake uranium project.

The Hook Lake project is a 25,847m project that hosts 16 claims that have returned grades of 68% uranium mineralization (U3O8) in sampling programs. The company has continued to conduct geological surveys of the property, with significant potential remaining, as the source of the mineralization has yet to be discovered.

The company reports that it made the last of three payments, worth CA$75,000 and totaling CA$250,000 over three years (with a total exploration expenditure commitment of CA$3.5 million), and issued Skyharbour 31.75 million shares with a total of 295,083,33 shares.

George Bauk, the Executive Chairman of Valor, commented, “We are pleased to have completed this significant earn-in milestone at Hook Lake, which delivers Valor 80% ownership of a very attractive uranium asset located in one of the most prospective uranium exploration addresses in the world right now, thanks to the recent Gemini/92 Energy and ACKIO/Baselode Energy discoveries, located 30 kilometers north of Hook Lake.”

Jordan Trimble, the CEO of Skyharbour, also commented, “Skyharbour continues to add value to its project base in the Athabasca basin through focused exploration and drilling at its co-flagship Russell and Moore uranium projects, as well as utilizing the prospect generator model to advance its secondary projects with strategic partners. We are excited to have the opportunity to work with Valor as a joint-venture partner at Hook Lake going forward and will benefit from any upside at the project with our retained interest in the property and equity position in Valor. We are confident that the work carried out by Valor in recent years has advanced the project sufficiently to a stage where a new discovery could be on the horizon with future drilling.”

Hot Demand for Uranium

Uranium is in demand as countries around the world attempt to step up their nuclear power production. On February 7, 2024, Katusa Research highlighted uranium’s rise to CA$106 per pound, calling the mineral “the poster child for dramatic market shifts.”

As Dominic Frisby of The Flying Frisby puts it, “The world needs nuclear power, yet it hasn’t invested enough in uranium, there are supply shortages and these are made even worse by the fact that the world’s largest producer, Kazakhstan, surrounded by Russia, is struggling to get its production to market.” According to the report, Kazatomprom and Cameco have both struggled to meet production goals, setting the world up for a uranium shortage.

Potential 119% Return

Gwen Preston of The Maven Letter commented on February 7, "My rationale for buying Skyharbour Resources Ltd. is both for its particular appeal (near term discovery potential, close working relationship with Denison) and its position as a larger but still small uranium company. I think this segment will be the next to go."

In November of 2023, David Talbot with Red Cloud Securities rated Skyharbour Resources as a “Buy” with a share target of CA$0.85 and a potential return on investment of 57%. Siddharth Rajeev with Fundamental Research Corp. increased this estimate to 119% with a target price of CA$0.53 and agreed with the company’s “Buy” rating a month later in December. For both analysts, the hot uranium market was a compelling catalyst for the company, as well as drill plans on the part of Skyharbour and its partners.

On February 12, 2024, David Talbot commented, "One of our top uranium picks is Skyharbour Resources Ltd. . .we believe the company to be one of the more successful project generators in the industry given the extent of incoming cash and third party shares into its treasury and the abundance of exploration spending required for its partners to option its various projects."

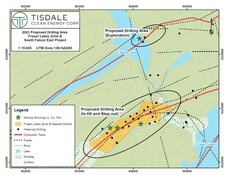

Michael Ballanger with GGM Advisory Inc. included Skyharbour in a list of stocks to keep an eye on as uranium prices continue to rise. The report identified Skyharbour’s successful partnership with Tisdale Clean Energy Corp. as a major source of upside for the company, especially if Tisdale meets the necessary requirements to earn 75% from the South Falcon East project.

On January 17, 2024, Technical Analyst Clive Maund reviewed the company positively, commenting that the company has “taken off strongly higher” after buying it during a correction.

The company's investor presentation reported a number of catalysts, including a 5,000m planned drill program on the Russell Lake project and a 3,000m program planned for the Moore uranium project.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

Refinitiv provided a breakdown of the company’s ownership and share structure, where management and insiders own approximately 2.47% of the company. According to Refinitiv, President and CEO Jordan P. Trimble owns 1.54% of the company with 2.79 million shares, Director David Daniel Cates owns 0.70% of the company with 1.27 million shares, and Chairman James Gaydon Pettit owns 0.23% of the company with 0.42 million shares.

Refinitiv reports that institutions own approximately 18.33%, as Alps Advisors, Inc. owns 8.68% of the company with 15.72 million shares, Mirae Asset Global Investments (U.S.A.) L.L.C. owns 4.92% of the company with 8.91 million shares, Sprott Asset Management L.P. owns 2.49% of the company with 4.52 million shares, Incrementum A.G. owns 1.30% of the company with 2.36 million shares, Vident Investment Advisory, L.L.C. owns 0.34% of the company with 0.61 million shares, D.W.S. Investment GmbH owns 0.33% of the company with 0.60 million shares, and BetaShares Capital Ltd. owns 0.27% of the company with 0.50 million shares.

According to Refinitiv, there are 181.16 million shares outstanding with 176.36 million free float traded shares, while the company has a market cap of CA$64.59 million and trades in the 52-week period between CA$0.32 and CA$0.64.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources Ltd.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.