The "Drive for Five" (as in FIVE thousand for the S&P 500) is now complete.

With a 29.6% allocation comprised of the "Magnificent Seven" mega-cap stocks that have led the advance since late October, the S&P 500 has used that extraordinary rocket fuel to blast through 5,000 with nary as much as a wince. Over a 45-year career trying to carve out a living in the financial markets, I have seen a number of seesaw battles at the round numbers for the S&P.

It always seemed to take a few runs at those levels, like the 500 level in March 1995 the 1,500 level in April 2000, and again in late 2007. In 2018-2020, it took three failed breakouts before a tsunami of fiscal and monetary stimulus finally propelled it through 2,500 in a once-and-for-all vanquishing of that psychological level after touching 2,191 only a couple of weeks earlier. My point here is that markets normally do not move above these milestone levels as if they are non-existent; they usually run into resistance brought about by either valuation extremes or overbought conditions, both of which are glaringly prevalent in today's market environment.

While nothing should surprise me these days after the torrent of profligate fiscal and monetary insanity that we all witnessed in 2020, I must confess that I am indeed confused and confounded by the ease with which the S&P scaled 5,000 with only a modicum of celebratory fanfare. No horns blared; no ceremonies on the floor of the NYSE; no tears of joys from Jim Cramer or Bob Pisani. In fact, there was a trace of insolent smugness in the deportment and wink-wink-nudge-nudge acknowledgment as if the CNBC Talking Heads were almost embarrassed to be party to an event that was 100% the result of government spending — fiscal stimulus — from which the bulk of the GDP figures are derived.

The bears (or shall I say, "cautious investors") out there would point to the imminency of the "lag effect" of the interest rate shocks that besieged the financial horizon through most of 2022 and at least half of 2023 as a timed-tested reason to expect a "hard landing" while the legions of fuzzy-cheeks bulls out there (that have never experienced a bear market EVER) give glorified and erudite explanations that never use Mr. Templeton's "most expensive four words" but when translated in the language of the common investor, they sound very much like "it's different this time."

They point to consumers and their "deep pockets" and corporate earnings while ignoring the trillions of dollars of deficit spending that is the "gift that keeps on giving" while forgetting that the inflated cost of goods and services is a major component of the earnings increases. In the end, however, all markets correct, and they do so when the masses least expect it. The woes of late October of last year with the S&P at 4,103 seem like a generation ago all because the Fed gave the impression that a full-blown "pivot" was in the cards, sending bond yields plummeting and stock prices soaring. While the Fed has tamped back the pivot rhetoric in the last few weeks, the stock junkies could care less because the bull market is back with a vengeance, and nothing can stop it. Well, it will get stopped, and it will come without the benefit of a gong being sounded or an alarm bell going off. Bear markets come like thieves in the night; it is only in the morning that you awake and find everything of value has simply vanished.

Lithium Mania

A great example of that was the lithium mania of last summer. By the time the summer of 2023 arrived, the newbies to the lithium trade could recite the ten major reasons that lithium was going to triple in price. These novices to the world of junior resource investing that could not tell you how to SPELL lithium, let alone cite its uses a year earlier, could, by the summer of '23, rhyme off the top five lithium producers on the planet and the lithium content in any one of Elon Musk's electric time bombs disguised as automobiles. When the top finally rolled in, the next ninety days was tweet after podcast after sub-stack rationalizing why the Bagholders — er, investors —should Hold their precious lithium investments rather than bite the bullet and take the loss.

Here in the winter of 2024, the lithium mania has been replaced by the uranium mania, and now the kiddies can recite the ten reasons why Kazatomprom's production guidance is bullish for their junior uranium explorer that staked a claim 48 kilometers from a ballistic missile launch silo in order to have "close-ology" to anything "nuclear." To make me go even more ballistic, I read about a Vancouver explorer this week who underwent a name change last year to include "Battery Metals," where the word "Resources" once stood. This week, they announce yet another pivot by staking ground within a hundred kilometers of a known uranium discovery, and I will wager dollars to donuts that on their immediate agenda will be a name-change to "Uranium" something.

That is symptomatic of the stresses in the Canadian junior resource sector where the speculative capital that used to create enormous wealth through new discoveries has all but vanished. There are pools of spec capital that migrate from cannabis to crypto to lithium and uranium but that is distinctly different than prior junior resource bulls.

In the mammoth discovery decade of the 1990s (and to a lesser degree, the 2001-2011 period), the sheer volume of capital made available to the juniors was staggering such that by way of sheer "dollars spent" on drilling and metallurgy and staking, there were many world-class discoveries but across all metal groups and locales. In today's marketplace, the dismal performance of the TSX Venture Exchange has caused problems for many of brokerage firms, such as Canaccord, which made an astounding move to rebrand itself as a "wealth manager" as opposed to a "transactional broker."

Back in the 1990s, Canaccord was run by Vancouver bon vivant and scallywag entrepreneur Peter Brown, arguably the most charming gentleman to ever work in the securities industry. I recall Peter calling me up one afternoon after Mountain Province had made the mighty AK-47 kimberlite discovery in Canada's NWT, demanding that I "tell management that they MUST merge with Aber Resources or else"! The Canaccord of 1995 was a monster dealmaker that funded a great many major discoveries around the world as well as even greater number that were not. However, thanks to the smaller boutiques like Canaccord, C.M. Oliver, and McDermid St. Lawrence Chisholm, a lot of money was raised in what then was an extremely robust junior resource workplace.

However, as always, I digress.

Copper

UGH!

One week ago, I posted a chart that was absolutely beautiful with a "Golden Cross," a bullish MACD crossover, and an MFI "buy signal" for copper and walked — no — strutted away with the cockiness of a teenaged porn star. I had a serious "swing" going on, fully expecting that I was witnessing a developing major breakout in copper prices, and then WHAM!

Copper got walloped from $3.94 to $3.68 in seven — count them — SEVEN trading sessions. If I did not know better, I would have thought the chart was that of gold or, even better — SILVER — but neither gold, silver, nor copper could get out of the way of the disinflationary juggernaut that is the USD.

As I approach my 71st birthday, I reflect back on the moments in my life when crying is most common. It occurs when you are a helpless infant and continues on and off in varying frequencies and intensities until you reach puberty and then gradually recedes until your first girlfriend gives you the boot, at which point you are three-years-old once again, wailing uncontrollably as your heart shatters on the floor, screaming for mummy to make the pain go away.

Once recovered, the average mature male seldom cries over the next forty years (with the exception being deaths in the family and tax audits) until he reaches the stage in life where the tear-preventing testosterone begins to dissipate, leaving the rapidly-aging stallion no defence.

Watching the copper price do a seven-day non-stop dive like this is pure agony. It actually makes me CRY. No amount of equine majesty can remove the pain of watching the U.S. dollar manipulators as they direct prices to a political objective.

Since the last election, the Biden Administration has orchestrated the price of oil from $130/bbl. to under $70/bbl. by emptying the SPR in an attempt to sabotage the Russian economy, which has NOT happened. They need inflation to remain "contained" in order to control interest rates, so they instruct the futures traders at the NY Fed to "MAKE DAMN SURE" that there are no adverse movements in ANY of "THEM DAMN METALS." Traders like me get up from our vibrating, stress-resilient chairs and stare at our quote screens and blather incoherently as we watch stocks like NVidia gap higher day upon day upon day and try upon try to understand what it is that we are missing.

The answer while elusive lies in the graphic posted to the left. The "Thundering Herd" is alive and well on Wall Street, and NO ONE is going to stop them. It is said that "Bull markets never end with a "BANG;" they end with a "WHIMPER."

If you are a fireworks fan (as am I) and you love to watch the trajectory of a lit rocket ascend into the night sky (especially over Lake Rosseau in 1997), you cannot help but notice the moment when it is the brightest and the loudest which is the precise moment of its last hurrah and the moment where the nitrates fizzle out and the propellant leaves the projectile. It then stops the upward ascent; it pauses; it rolls over; and then it disappears in its mortal descent to the ground where it simply lands with a "THUD" and with no honour, dignity, or respect. That final flare-out is how all markets top out.

Copper has had nothing "mania-like" since the run in 2022 when it briefly got through $5.00/lb. only to get blasted back under $4.00/lb. It has garnered zero love from the investment community for as much as a nanosecond despite the fact that the legendary Robert Friedland is pumping its tires left, right, and center.

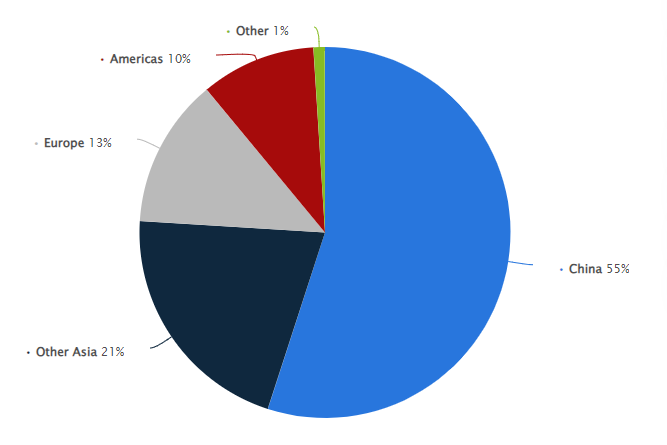

The price of copper has been tracking the Shanghai Stock Exchange nearly tick for tick for the past five years. The chart below would suggest that only recently has copper stabilized despite Shanghai losing 46.8% in the last nine months. The pie chart shown below is an awe-inspiring illustration of China's complete dominance of the global copper market in terms of consumption.

It is also the reason why copper prices are so closely tied to the Shanghai Stock Exchange. In order for copper to rally, it either needs to decouple from China or react to a massive stimulus program recently announced in Beijing designed to shore up their stock market.

From TradingEconomics.com: "Copper futures in the US fell to under $3.7 per pound in February, the lowest in nearly three months and sinking more than 5% since the start of the month amid a strong US dollar and pessimistic industrial sentiment in China. Persistent macroeconomic headwinds in China, the world's top consumer, continued to hamper the outlook for base metals. Deflation in the country unexpectedly rose to a 14-year high, while the official manufacturing PMI pointed to the fourth consecutive contraction in January. The developments were consistent with a persistent decline in the Yangshan copper premium as factories refrained from purchasing the metal, while inventories in major Chinese warehouses soared by over 120% year-to-date to nearly 70,000 tonnes."

That summary basically ties the outlook for a copper rally directly with the Chinese manufacturing PMI (Purchasing Manager Intentions) because only an improvement in Chinese demand will be able to work off those excess inventories.

While Chinese economic trends govern the demand side of the equation, it is the global production shortfalls brought on by mine closures and reserve depletion that will act as an offset. The $64,000 question is whether or not production shortfalls will be severe enough to counterbalance the weakness in China. The bulls (like Friedland) point to Chinese industries like military hardware and technology taking up the space that housing and EV's did in 2022. The bears will argue that there is nothing the Chinese leadership can do to solve the problem in the real estate sector, where developers like Evergrande are being liquidated for pennies on the dollar. The bulls have a case, and the bears have a case when it comes to China.

Only time will tell how Beijing deals with its economic issues, but if there is one thing that the leaders cannot abide by, it is unemployment and/or deflation. There are too many people and far too much domestic debt for them to allow either to move in the wrong direction. Chinese leaders know the history of rebellions in their country and it all revolves around keeping 1.4 billion citizens employed and fed. I suspect that a "shock-and-awe" stimulus event will be launched in the next quarter that should take the SSEC back up and rekindle manufacturing activity. That will eliminate the inventory build-up and rebalance the copper market to the point where the supply issues will have an impact on price.

Looking out to the balance of the decade, it is the modernization of the Third World that will accelerate non-Chinese demand, and is at this point that the structural deficits in global copper production are going to ignite prices. The long-term bullish case for copper and the need for new mines and accelerated exploration can only get stronger, and that has nothing to do with the global electrification movement.

Now, add in electrification, and you have to imagine what happens when those 58 new nuclear reactors finish construction (with twenty-two of them in China). They turn on a switch, and suddenly, a mountain of new electrical current is leaving for homes, offices, and factories in distant locations.

How does the new electricity get transmitted to the outer regions of China, India, and Africa?

Copper.

Kilometer after kilometer of heavy gauge copper wiring will be needed to support the infrastructure requirements brought about by the move to nuclear. The bull case for uranium prices and for uranium producers and explorers is, by default, the exact bull case for copper prices and copper producers and explorers, but copper is magnified greatly due to the distances that power must travel.

The same case can be made when the lithium bulls start chortling about how global EV demand is about to dwarf supply, but that argument breaks down when one considers that every lithium-ion battery currently in operation will need to be recycled within five to seven years. In fact, secondary or scrap supplies of lithium are expected to explode by the end of the decade as all these EV's get turned in for scrap. That is not the case for the enormous transmission towers and lines with all that copper wiring that have been in place for years and years and rarely get recycled for scrap.

The recent weakness in copper is, in my view, and aberration and a short-term one at that. Subscribers should be accumulating quality copper names like Freeport-McMoRan Inc. (FCX:NYSE) and juniors Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) and American Eagle Gold Corp. (AE:TSXV) for some added leverage. The two copper ETF's (COPX:US and COPJ:US) provide exposure to baskets of senior and junior copper names. The same mania that has gripped the other two electrification metals — lithium and uranium — is coming to a copper stock near you. You want to be ready for it.

GLD:US

GLD:US is doing what it always seems to do; it is locked in a battle between the forces of darkness and the forces of light. One day, it looks as though it wants to test the upper bounds around $193, and the next day (like last Friday), it looks like it wants to correct back to the 200-dma around $182.46. I am flat all option positions looking for an entry point, but for the life of me, I cannot find a more boring market out there.

Silver is about as unexciting as a Chicago Blackhawks-Ottawa Senators hockey game. The Canadian gold and silver miners ETF's are trading within a few percentage points of their 52-week lows. The VanEck Senior Gold Miners ETF (GDX:US) is a mere 5% above its 53-week low at $25.62. The Junior Gold ETF (GDXJ:US) is not doing quite as badly, trading a mere 7.1% above its 52-week low at $30.46. These are absolutely ghastly performances, given that gold has now been trading above $2,000 for 58 straight sessions.

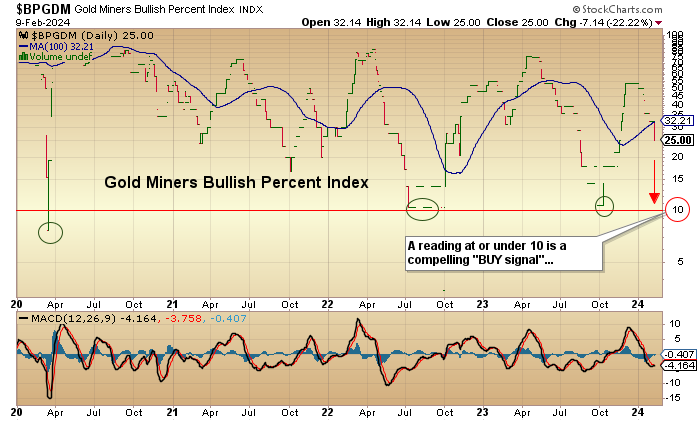

The Gold Miners Bullish Percent Index ($BPGDM) is normally a fairly reliable indicator but even with the miners this depressed, the 25 reading is still too high to constitute a solid "BUY signal."

At the lows in March 2020, the indicator was at 7.5, and we all remember what an unbelievable buying opportunity that was. I am not sure that I will get a sub-10 reading this time because the MACD looks ready to get a bullish crossover, but I will still refrain from trying to bottom-fish this market but instead look for a solid, two-day closing price above $2,150 before taking a position.

As for the junior gold miners, all one needs to do is surf around the Twitter feeds for an hour or two to see how absolutely dour sentiment has become. Companies that sported $100 million market caps one year ago are now whittled down to under $20 million as investors take their losses and move on to the areas that are treating them better (which is virtually anywhere). I take no pleasure in reading some of the tweets from the obvious newbies to the junior resource space with particular empathy for the latecomers to the lithium space. They are absolutely shellshocked at the drawdowns in some of the names.

Alas, while the junior gold developers and explorers are having a tough time raising money, Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) pulled a rabbit out of a hat wearing a four-leaf clover with a leprechaun on its back by completing a $3.8mm debenture funding in January which secured 100% interest in the Fondaway Canyon gold project where they have a 43101-compliant resource of 2,059,900 ounces of gold (indicated and inferred) that is wide open to depth and along strike in all directions.

The company has a goal of moving the resource to Tier 1 status through drilling starting in 2024, but only if market conditions begin to reward the junior golds for their progress. Markets are rewarding juniors like Hercules Silver (BADEF:OTCMKTS;BIG:TSXV) and American Eagle Gold, but not for silver or gold discoveries but for copper discoveries made in 2023. I want to see GTCH come with another big intercept like they pulled in April 2022, which was 25 meters of 10.4 g/t Au at their newly-discovered North Fork zone. A world-class intercept by any measure, the sickly gold market simply yawned at the results. Similar drill holes by many other companies since then have suffered the same fates.

I see that all changing with a sustained move in gold above $2,150. Until then, two-day prayer sessions at the local church along with intense sessions with my Haitian voodoo lady who sticks pins into puppets dressed up like central bankers and CNBC commentators. While it has yet to yield results, she swears that it will work of I keep the cash rolling, which I consider as "the cost of doing business."

| Want to be the first to know about interesting Gold, Cobalt / Lithium / Manganese, Uranium, Base Metals, Silver and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc., American Eagle Gold Corp., and Getchell Gold Corp..

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.