Goldshore Resources Inc. (TSX.V:GSHR; OTCQB:GSHRF; FWB:8X00) has released an updated mineral resource estimate for the company's 100%-owned Moss Lake project that has analysts reevaluating the company. The Moss Gold project is fully funded through 2025.

Goldshore now believes that the project, located in Ontario, Canada, holds an indicated 1,535,000 ounces of gold (Au) at grades of 1.23 grams per tonne (g/t).

The company closed a private placement deal worth CA$3,750,000. The company intends to use this to support several initiatives, including a new preliminary economic assessment.

In a discussion with Streetwise Reports, CEO Brett Richards stated, "I think the takeaway from the MRE is quite simple: 23% of our resource is now indicated, so a quarter of our resource is at a much higher confidence level."

The project is believed to host an additional indicated 5,198,000 ounces of gold at 1.11 g/t Au. Together, these two adjustments in the indicated resource amount to an overall grade increase of approximately 11%, painting a picture of a higher quality resource on Moss Lake than previously thought.

Goldshore also claims to have a clearer picture of the shear structures that host most of the gold on Moss Lake. The company now believes that 94% of the indicated gold tonnes and ounces are contained within these mineralization structures. The updated MRE also indicated that the site has greater potential for greater pit depth and the expansion of all the mineralized zones on the project.

Looking forward, Goldshore hopes to use this updated MRE as a launching point for a push towards Tier 1 status and a new Preliminary Economic Assessment. Brett Richards stated that the company was going to start heap leach testing, which only requires a rate of 50% recovery to be economically successful.

He commented, "I'm optimistic and pretty confident heap leach is going to work."

Pricey to Pricier

Mining Discovery reported on January 23, 2024, that gold is expected to find support from central banks, which have bought the commodity as a hedge against the falling U.S. dollar. Gold may be a solid bet for institutions hoping to protect against hard times.

As Mining Discovery noted, "An economic downturn accompanied by more rate cuts than currently expected might send gold to new record highs."

Eric Fry with Investor Place also highlighted gold as a safe-haven investment and believes that it will do well for the same reason central banks seem to think it will do well: a weakening American dollar, rate cuts by the Federal Reserve, and rising global conflicts. Fry encouraged investors to buy in now before prices rise and said, "I'm expecting gold stock valuations to move from pricey to pricier as the year progresses."

Comparable Companies

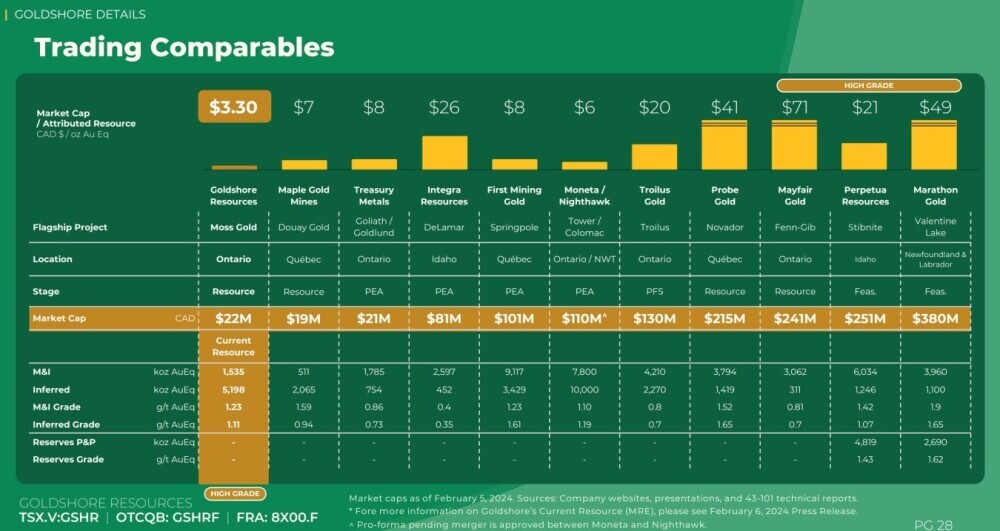

Goldshore is comparable to a number of other projects in the area shown in the chart below, with Marathon Gold Corp. (MOZ:TSX; MGDPF:OTCMKTS ) being the one with the largest market cap, a company currently trading at US$0.59 a share.

Marthan has some of the highest grades out of this list as well, sitting right next to Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ), US$2.78 a share, and Mayfair Gold (MFGCF:OTCMKTS), US$1.65 a share.

While Goldshore has the smallest market cap attributed to its resource, its current resource has shown high grades, with an even larger inferred amount of gold equivalent at 5,198 thousand ounces, higher than all but one on this table.

Goldshore Rated "Outperform"

Technical Analyst Clive Maund rated the company as a "Strong Buy for all timeframes" on February 8, 2024, and continued that the company's stock "is equally attractive for investors or speculators at this juncture."

Maund believes that Goldshore is on the brink of a big breakout and that the recent dip may present an opportunity for investors to break into the stock before things really build momentum. Maund commented, "The point to grasp here is that this post-breakout dip has afforded would-be buyers the perfect opportunity to swoop in and pick up the stock at a very low price before the expected bull market gets going in earnest."

Velocity Trade Capital Research Commentary reviewed Goldshore recently and gave the company an "Outperform" rating with a share target of CA$0.33. The report seemed enthusiastic about the recent adjustment in the company's indicated resource as a catalyst.

The company's investor presentation revealed a number of very interesting catalysts, including that it expects to begin discovery and drilling on new targets in Q2 of 2024, as well as resource development in H1 of 2025. Additionally, Goldshore anticipates finishing up with metallurgical studies in Q2 of 2024, beginning target generation, and then beginning another round of both in H1 of 2025. The company has an updated resource estimate expected in H2 of 2025 and an ongoing environmental baseline that it expects to continue through 2025.

Additionally, Goldshore brought in a new strategic investor in its most recent round of financing, SAF Group, which is now the largest shareholder.

Ownership and Share Structure

The company provided a breakdown of its ownership, where 26% of Goldshore is held by management and insiders.

According to Refinitiv, Director Brian Alexander Paes-Braga owns 18.08% of the company with 31.28 million shares, while CEO Brett Allan Richards owns 3.78% of the company with 6.54 million shares, Chairman Galen Stuart Mcnamara owns 2.36% of the company with 4.09 million shares, Director Victor Cantore owns 1.57% of the company with 2.71 million shares, Director Shawn Khunkhun owns 0.60% of the company with 1.04 million shares, Director Kyle Jonathan Hickey owns 0.58% of the company with 1.00 million shares, and Vice President of Exploration Peter Alan Flindell owns 0.35% of the company with 0.60 million shares.

Institutions own approximately 29% of the company, as Sprott Asset Management L.P. owns 7.93% of the company with 13.72 million shares, and U.S. Global Investors, Inc. owns 0.58% of the company with 1.00 million shares.

Strategic investor SAF currently holds 11.9%, with 31 million shares.

Refinitiv reports that there are 173.02 million shares outstanding with 105.85 million free float traded shares, while the company has a market cap of CA$14.06 million and trades in the 52-week period between CA$0.09 and CA$0.33.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Goldshore Resources Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.