Goldshore Resources Inc. (TSX.V:GSHR; OTCQB:GSHRF; FWB:8X00) ("Goldshore" or the "Company") has released an updated MRE for the company's 100%-owned Moss Gold project that has analysts re-evaluating the company. The Moss Gold Project is fully funded through 2025, with CA$4 million in treasury at the time of this article.

Goldshore has just published that the project, located in Ontario, Canada, holds an Indicated 1,535,000 ounces of gold ("Au") at grades of 1.23 grams per tonne (g/t) and 5,198,000 ounces of Au at grades of 1.11 g/t. An NI 43-101 technical report will be forthcoming March 2024, supporting the announcement.

The Company closed a private placement deal worth CA$3,750,000 in November 2023 and is well positioned with working capital for the next 24 months. The Company intends to use this working to support several initiatives, including metallurgical test work to validate heap leachability of the deposit, to be then followed by a new preliminary economic assessment ("PEA").

In a discussion with Streetwise Reports, CEO Brett Richards stated, "I think the takeaway from the MRE is quite simple: 23% of our resource is now indicated, so a quarter of our resource is at a much higher confidence level, which is advancing the project through its stages of development in quality and quantity, as we have communicated over the past few years."

The project also hosts an additional 5,198,000 ounces of Au at 1.11 g/t in the Inferred category. Together, these two adjustments in the overall global resource amount to a combined grade increase of approximately 11%, painting a picture of a higher quality resource on the Moss Gold Project than the previous MRE in 2023.

Goldshore also claims to have a clearer picture of the shear structures that host most of the gold on the project. As a result of utilizing implicit modelling techniques, the Company now believes that 94% of the tonnes and ounces are contained within these mineralized shear structures. The updated MRE also indicated that the site has greater potential for greater pit depth as the depth is currently model constrained – meaning there is significant potential to increase all of the pits at depth, in addition to their being long term upside for underground development on the project.

Looking forward, Goldshore hopes to use this updated MRE as a launching point for a push towards an industry beacon of Tier 1 status and a new Preliminary Economic Assessment. The Company CEO, Brett Richards stated that the Company was currently conducting metallurgical test work to validate heap leachability of the low-grade material in the deposit, and the economic viability of recovery is apx. 50% recovery in a dump leach or heap leach environment.

He commented, "Given the preliminary met test work we have done to date (course bottle rolls), I'm optimistic and pretty confident heap leach is going to work, and we will be able to determine to what extent when we get the test results back (expected in May and June 2024)."

Pricey to Pricier

Mining Discovery reported on January 23, 2024, that gold is expected to find support from central banks, which have bought the commodity as a hedge against the falling U.S. dollar. Gold may be a solid bet for institutions hoping to protect against hard times.

As Mining Discovery noted, "An economic downturn accompanied by more rate cuts than currently expected might send gold to new record highs."

Eric Fry with Investor Place also highlighted gold as a safe-haven investment and believes that it will do well for the same reason central banks seem to think it will do well: a weakening American dollar, rate cuts by the Federal Reserve, and rising global conflicts. Fry encouraged investors to buy in now before prices rise and said, "I'm expecting gold stock valuations to move from pricey to pricier as the year progresses."

Comparable Companies

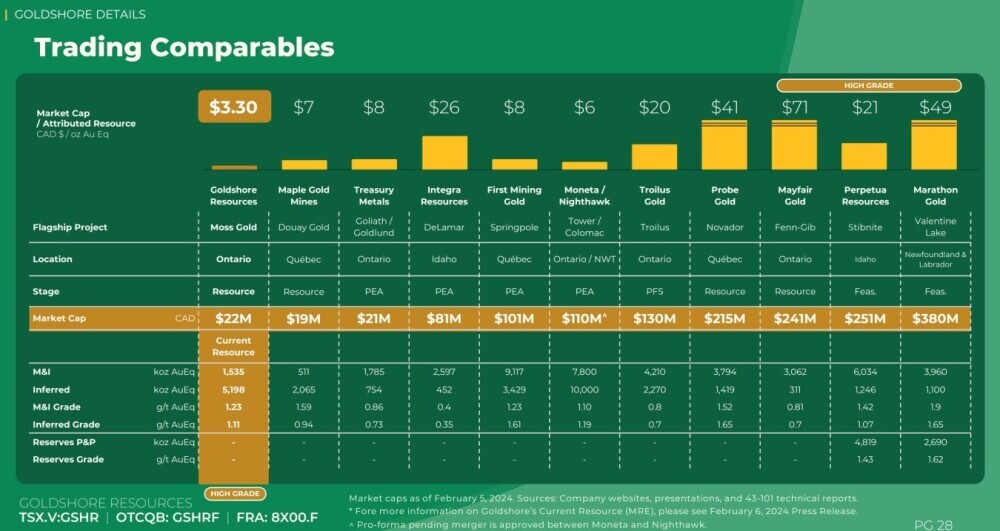

Goldshore is comparable to a number of other projects in the area shown in the chart below, with Marathon Gold Corp. (MOZ:TSX; MGDPF:OTCMKTS ) being the one with the largest market cap, a company currently trading at US$0.59 a share.

Marathon has some of the highest grades out of this list as well, sitting right next to Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ), US$2.78 a share, and Mayfair Gold (MFGCF:OTCMKTS), US$1.65 a share.

While Goldshore has the smallest market cap attributed to its resource, its current resource has shown high grades, with an even larger Inferred amount of gold equivalent at 5,198 thousand ounces, higher than all but one on this table.

Goldshore Rated "Outperform"

Technical Analyst Clive Maund rated the company as a "Strong Buy for all timeframes" on February 8, 2024, and continued that the Company's stock "is equally attractive for investors or speculators at this juncture."

Maund believes that Goldshore is on the brink of a big breakout and that the recent dip may present an opportunity for investors to break into the stock before things really build momentum. Maund commented, "The point to grasp here is that this post-breakout dip has afforded would-be buyers the perfect opportunity to swoop in and pick up the stock at a very low price before the expected bull market gets going in earnest."

Velocity Trade Capital Research Commentary reviewed Goldshore recently and gave the company an "Outperform" rating with a share target of CA$0.33. The report seemed enthusiastic about the recent adjustment in the Company's indicated resource as a catalyst.

The Company's current investor presentation revealed several very interesting catalysts. Goldshore expects to begin discovery drilling on new targets in Q2 of 2024, initially at Vanguard as part of its earn-in obligations to Thunder Gold. The Company will also commence with resource development drilling (market willing) H2 2024 or in H1 of 2025, all subject to its market cap / share price and state of the junior mining capital markets for raising capital. Additionally, Goldshore anticipates finishing up with metallurgical studies in Q2 of 2024, and will begin these drilling initiatives thereafter. The Company has an updated resource estimate expected in H2 of 2025 and an ongoing environmental baseline studies through 2024 and 2025 that it expects to continue through to permitting and Pre-Feasibility Study.

Additionally, Goldshore brought in a new strategic partner in Q4 2023 – SAF Group, whereby several principals of the organization funded $3,000,000 of the $3,750,000 raised; with the CEO and other members of the Board picking up the balance. One of the principals of SAF Group is now the single largest shareholder with 31M shares or 11.6% of the Company.

Ownership and Share Structure

The company provided a breakdown of its ownership, where 26% of Goldshore is held by management and insiders.

According to Refinitiv, Director Brian Alexander Paes-Braga owns 11.91% of the company with 31.28 million shares, while CEO Brett Allan Richards owns 3.78% of the company with 6.54 million shares, Chairman Galen Stuart McNamara owns 2.36% of the company with 4.09 million shares, former Director Victor Cantore owns 1.57% of the company with 2.71 million shares, Director Shawn Khunkhun owns 0.60% of the company with 1.04 million shares, Director Kyle Jonathan Hickey owns 0.58% of the company with 1.00 million shares, and Vice President of Exploration Peter Alan Flindell owns 0.35% of the company with 0.60 million shares.

Institutions own approximately 29% of the company, as Sprott Asset Management L.P. owns 7.93% of the company with 13.72 million shares, and U.S. Global Investors, Inc. owns 0.58% of the company with 1.00 million shares.

The SAF Group has committed to support the Company in future financings, to raise capital for drilling campaigns – if and when the Company’s share price and market conditions warrant a capital raise.

Refinitiv reports that there are 247.22 million shares outstanding with apx. 195.85 million free float traded shares, while the Company has a market cap of CA$22.34 million and trades in the 52-week period between CA$0.09 and CA$0.33.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Goldshore Resources Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.