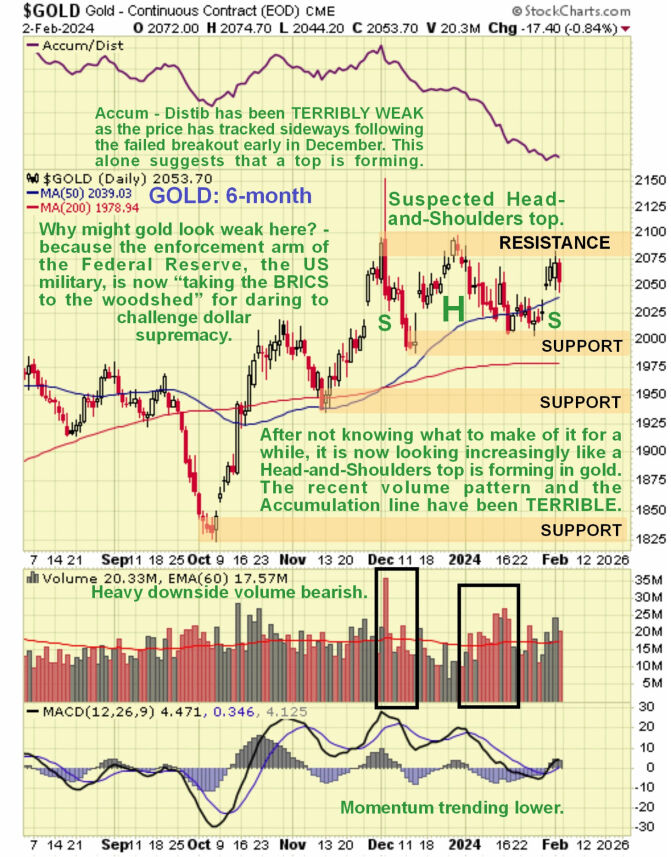

I haven't written much about gold in the recent past — since the failed breakout attempt early in December — simply because I haven't known what to make of it, and that indecisiveness has been reflected in the market itself, where we have seen gold stuck in a fairly narrow trading range, but now things are starting to become a lot clearer both fundamentally and technically, and as we will proceed to see, it's not a pretty picture.

On gold's latest 6-month chart, we can see the trading range that has built out since early December, and it is now becoming clear that the pattern that has formed is a Head-and-Shoulders top that also has the characteristics of a Double or Triple Top or a Symmetrical Triangle and right now it is on the point of backing off from the Right Shoulder peak of the pattern.

We can be a lot more sure that this is what it is from the volume pattern that, from early December, has been very bearish, with heavy downside volume, which is why the Accumulation line has been in severe decline. This pattern portends a breach of the support and a drop, and at the time of writing, Monday morning (charts made yesterday), gold is down quite hard.

If gold is set to drop then what about PM stocks?

The answer is that they will drop more. Now, I know about the valid argument that the gold stocks to gold ratio is already at a low level that is traditionally bullish and leads to a reversal to the upside and a new bullmarket, but that won't prevent a possible flush out first.

The latest 6-month chart for GDX shows what I believe will happen to PM stocks if gold breaks down as soon as it looks set to. Such a drop would really lead to many diehard PM stockholders throwing in the towel in disgust, and the correct way for existing holders of PM stocks to handle this right now (with the exception of a few special situations) is either to hedge or to step aside and buy back once the dust has settled after another drop.

Alright, if the PM sector is set to drop hard soon, then what will be the cause of it?

The answer is a rally in the dollar. So now let's take a look at the latest dollar index chart, and we will sharpen this by then taking a look at a dollar proxy where we have the benefit of being able to see the volume pattern.

On the 6-month dollar index chart we can see that, while our suspected Head-and-Shoulders top has been building out in gold, the inverse pattern, a Head-and-Shoulders bottom, has been building out on the dollar, which is hardly surprising.

The dollar rallied well in January, up from the low of the Head of the H&S bottom, and after a big up day last Friday is now on the point of breaking out of this potential base pattern. Breakout will be signaled by it breaking clear above the resistance marking the upper boundary of the pattern. Momentum has been improving rapidly, and moving averages are steadily swinging into much better alignment.

It is helpful to also look at a dollar index proxy, in this case, the Invesco DB Dollar Index Bullish Fund, where we can find additional clues regarding what is going on, especially in the volume pattern. This is very illuminating for on this chart we see that UUP already had a volume breakout last Wednesday and a price breakout from its parallel H&S bottom pattern on Friday, again on strong volume, So "the writing is on the wall" with respect to the immediate outlook for both the dollar and the Precious Metals.

After Reading This Article, Are You Thinking About Investing In Gold?

Here Are Some Companies You May Be Interested In Reading AboutThis chart looks strong with a bullish volume pattern and the Accumulation line uptrending since late November, momentum rapidly improving and now positive and moving averages swinging into decidedly bullish alignment.

The longer-term outlook for gold and silver could not be better with continued money creation and resulting inflation, meaning their prices must rise to compensate.

Banks are known to be buying gold at record rates and short positions in gold and silver are being closed out, creating a potentially explosively bullish setup for the Precious Metals, so the expected short to medium-term drop in the metals resulting from temporary dollar strength will provide a final opportunity to buy at good prices.

Tactics now are, therefore, to hedge or step aside here and be ready to move back in once this last drop has run its course, and we will, of course, be looking out for this.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.