Canada-based uranium exploration and development company Tisdale Clean Energy Corp. (TCEC:CSE) announced it has closed on a larger second tranche of its private placement after the first was oversubscribed and prices of the element hit 16-year highs.

The company, which saw a 2024 high of CA$0.195 per share this week, has issued a further 6,362,216 units at a price of CA$0.18 per unit for gross proceeds of CA$1.145 million.

In December, it announced a first tranche of 4,305,556 units at CA$0.18 per unit for gross proceeds of CA$775,000.

Technical Analyst Clive Maund on Tuesday wrote, "It's seldom that you come across a stock setup as bullish as that which currently exists in Tisdale Clean Energy Corp."

Technical Analyst Clive Maund wrote, "It's seldom that you come across a stock setup as bullish as that which currently exists in Tisdale Clean Energy Corp."

He said the company has "the wind at its back" because it's in a strong growth sector, uranium, and it has a low number of shares on issue.

"If the stock attracts more attention from the investing public, it is clear that its upside potential from here is great," wrote Maund, who rated the stock a "Strong Buy for all timeframes."

Each unit of both tranches consists of one common share of the company and one share purchase warrant exercisable at CA$0.30 per share until December 22, 2025, for the first tranche and Feb. 1, 2026, for the second.

In combination with the first tranche, the company has raised gross proceeds of CA$1.92 million by issuing 10,667,772 units.

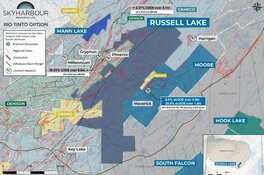

The company said the money would be used for general working capital and to carry out exploration programs at its South Falcon East uranium project.

The Catalyst: New Bull Market for Co. Coming?

The company has been covered extensively by analysts who believe it could be a profitable option for investors looking to get in on green energy as governments ramp up efforts to replace fossil fuels.

"The uranium ducks are quacking loudly," newsletter writer Michael Ballanger wrote last week, as he mentioned some larger companies that he "began taking profits on."

"The uranium ducks are quacking loudly," newsletter writer Michael Ballanger wrote last week,

"The correct strategy is to reallocate . . . funds into the junior exploration space," Ballanger noted. "While remaining in the uranium space, moving to a micro-cap explorer like Tisdale Clean Energy Corp. takes me out of the CA$90 million market cap of WUC/WSTRF [Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX)] and into a CA$2.9 million market cap in TCEC, a 30-times differential."

Ballanger said he does "not want to miss what could easily be a flood of excitement into the little junior uranium exploration" space.

CEO Steadily Adding to Position

Maund noted that the company's chief executive officer, Alex Klenman, "has demonstrated his confidence in the company by steadily buying the stock," adding 704,000 shares since November.

Maund noted that the company's chief executive officer, Alex Klenman, "has demonstrated his confidence in the company by steadily buying the stock," adding 704,000 shares since November.

And as John Dorfman, a contributor for Forbes, noted in December, "When chief executives buy their own companies' shares, it's often worth considering the stock."

"Company insiders achieve better capital gains, on average, than the typical investor does," Dorfman wrote. "The effect is especially strong for chief executive officers (CEOs) and chief financial officers (CFOs)."

Maund said TCEC's 1-year logarithmic chart started "a basing process" last summer and needs to break above the "resistance marking the upper boundary of the entire base pattern" for a "major new bull market" to officially begin.

"This looks likely to happen soon," Maund noted. "Huge gains from here are certainly very possible."

Demand for Element Climbing Steadily

According to the World Nuclear Association, demand for uranium for nuclear reactors is expected to climb 28% by 2030 and nearly double by 2040 as governments work toward meeting zero-carbon targets.

"From the beginning of the next decade, planned mines and prospective mines, in addition to increasing quantities of unspecified supply, will need to be brought into production," the report said.

In general, global nuclear power-generating capacity is expected to rise 82% to 792 gigawatts by 2050 as the world transitions from fossil fuels, the International Atomic Agency said.

"Uranium is the one energy source that could satisfy every Millennial and Gen-Xer on the planet; zero pollutive impact anywhere and a reliable, cost-effective means of heating the planet and recharging Elon Musk's vehicles," newsletter writer Ballanger has written. "Handled properly, nuclear power is truly the alternative for coal and oil and natural gas."

The uranium market has hit 16-year highs so far this year as it deals with demand consistently outpacing supply.

"This comes after an extended bear market defined by decades-long low prices," Kitco reported. "The new surge has been attributed to a structural deficit where the global consumption of uranium, at 200 million pounds annually, far outstrips the production of only 145 million pounds."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Tisdale Clean Energy Corp. (TCEC:CSE)

Uranium from mining is used primarily as fuel for nuclear fission in power plants, but it is also used in the medicine, food production, and space industries. There are currently about 440 nuclear reactors operating worldwide, with about 60 under construction and a further 430 planned or proposed, according to the World Nuclear Association. In 2022, they provided about 10% of the world's electricity.

Nuclear power plants produce carbon-free baseload energy 24/7, which is essential for achieving emission-reduction targets. Investors are hoping nuclear power will have a resurgence as governments attempt to turn away from fossil fuels.

Ownership and Share Structure

Reuters reported CEO and Director Alex Klenman as the primary investor in the company, with 2.5% in the company and 704,000 shares. The rest is retail.

The company has 28 million shares outstanding and a market cap of CA$3.29 million. It trades in the 52-week period between CA$0.14 and CA$0.57.

| Want to be the first to know about interesting Uranium, Clean Energy and Alternative - Cleantech investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Tisdale Clean Energy Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tisdale Clean Energy Corp. and Western Uranium & Vanadium Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.