The disparity between the current lithium product prices and the current and projected costs of production of future capacity is unsustainable.

Lithium stocks globally have been trashed but it is supply and demand that are important, particularly for spodumene.

China and Europe are the key markets for lithium — certainly, for EVs.

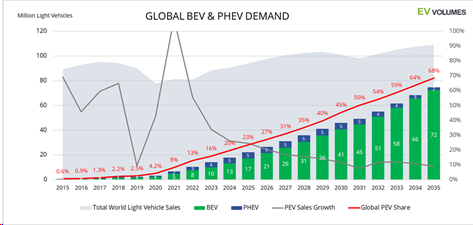

EV demand is being driven by China (8.35mpa units - 65% of EV sales) and Europe (3.1m pa units – 24% of EV sales) which is almost 90% of global demand.

And also for lithium.

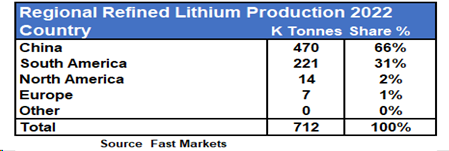

China produces 66% of refined lithium, but Europe produces just 1%.

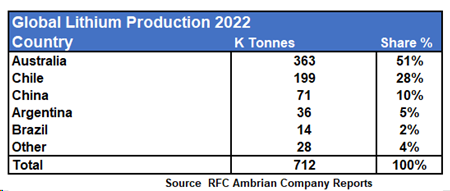

China produces 66% of lithium products but mines only 10% of primary lithium.

And from ores with less than 20% being spodumene the rest being brines and from lithium micas.

Europe produces none.

A big mismatch here, so spodumene from WA is very important.

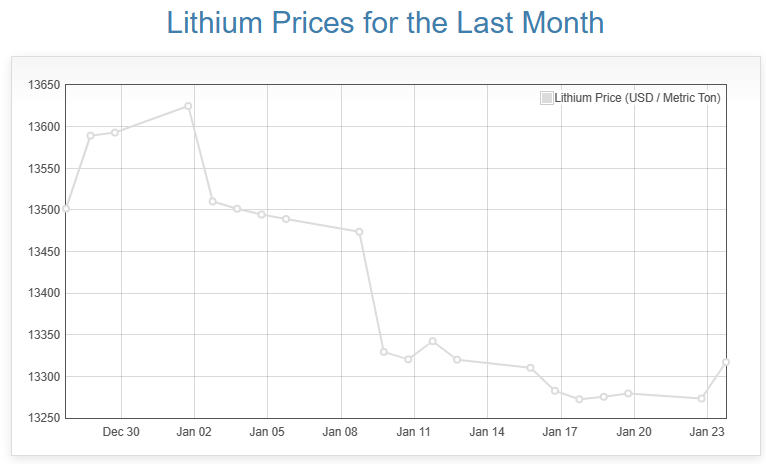

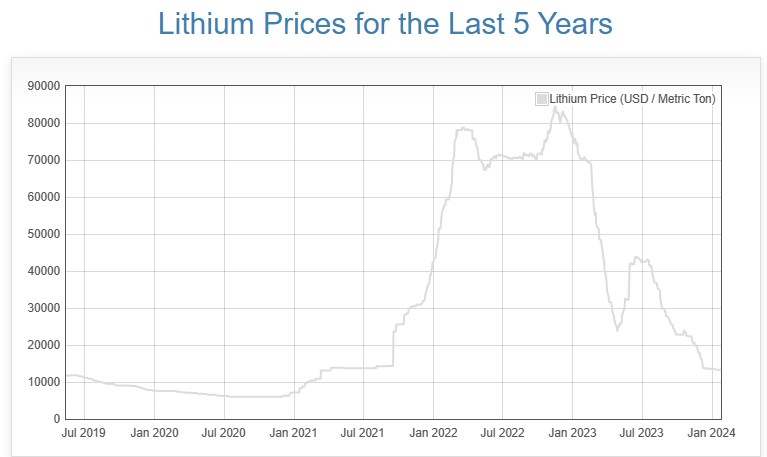

The lithium price looks as if it might be bottoming at previous highs.

First price uptick in a long while!

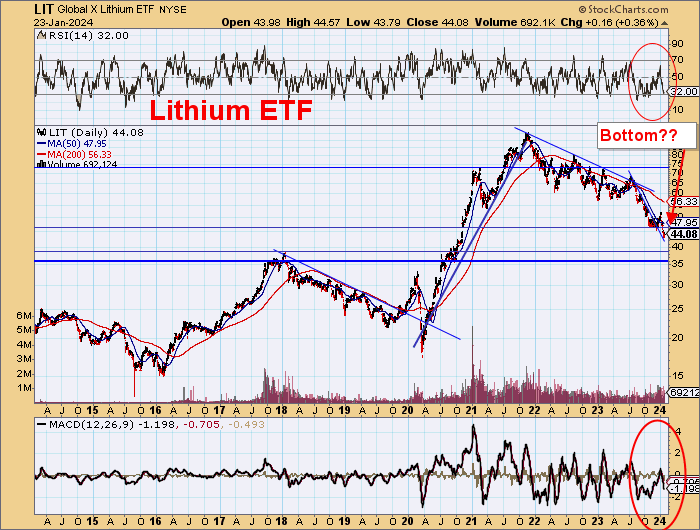

Lithium ETF oversold and could be bottoming, too.

ASX lithium stocks have fallen disastrously but are now bottoming.

It is buying time now, especially better placed explorers where the timeline to discovery is short.

Head the markets, not the commentators.

Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.